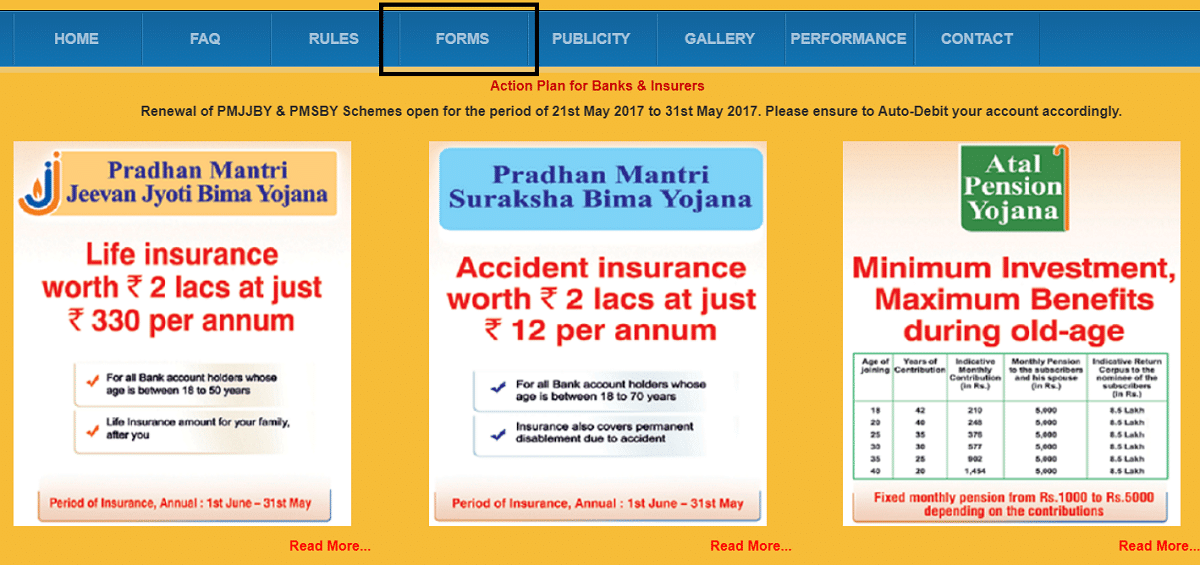

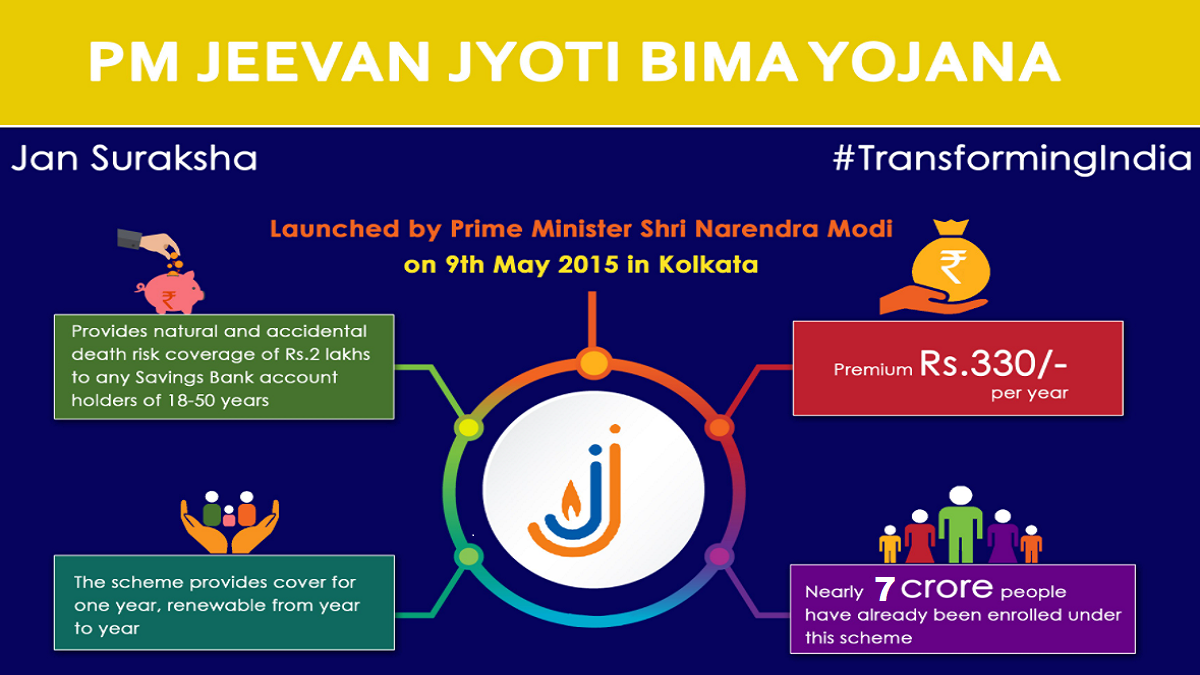

PM Jeevan Jyoti Bima Yojana (PMJJBY) Form PDF 2024 available to download at jansuraksha.gov.in through online mode. Pradhan Mantri Jeevan Jyoti Bima Yojana 2024 is an insurance scheme by central government aiming to increase the adoption of life insurance cover by Indians. Launched along with PM Suraksha Bima Yojana and Atal Pension Yojana, the scheme has also seen a tremendous response with almost 12.77 crore people getting covered (from 9 May 2015 to 1 June 2022).

The PMJJBY is available to people in the age group of 18 to 50 years having a bank account who give their consent to join / enable auto-debit. Aadhar would be the primary KYC for the bank account. The life cover of Rs. 2 lakhs shall be for the one year period stretching from 1st June to 31st May and will be renewable. Risk coverage under this scheme is for Rs. 2 Lakh in case of death of the insured, due to any reason.

The premium is Rs. 436 per annum (w.e.f 1 June 2022) which is to be auto-debited in one installment from the subscriber’s bank account as per the option given by him on or before 31st May of each annual coverage period under the scheme. The earlier premium amount was Rs. 330 per annum which has now been increased to Rs. 436 p.a. The scheme is being offered by Life Insurance Corporation and all other life insurers who are willing to offer the product on similar terms with necessary approvals and tie up with banks for this purpose.

What is Pradhan Mantri Jeevan Jyoti Bima Yojana?

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a one year life insurance scheme being offered by the LIC (Life Insurance Corporation) of India and other private insurance companies through the Public and Private Sector banks. The scheme offers a life cover of Rs. 2 Lakh life cover in case of loss of life due to any reason up to the age of 55 years. With the launch of the scheme, government aimed at creating a social security system, targeted especially for the poor and under-privileged category of society.

How to Download PM Jeevan Jyoti Bima Yojana Application Form PDF

Here is the complete process of how to download PM Jeevan Jyoti Bima Yojana Application Form in PDF format:-

STEP 1: Firstly visit the official PM Jeevan Jyoti Bima Yojana Portal or Jan-Dhan Se Jan Suraksha website at https://jansuraksha.gov.in/

STEP 2: At the homepage, click at the “Forms” tab present in the main menu as shown here or directly click https://jansuraksha.gov.in/Forms.aspx

STEP 3: Then in the new window, click at the “Pradhan Mantri Jeevan Jyoti Bima Yojana” sub-section under “Forms” section or directly click https://jansuraksha.gov.in/Forms-PMJJBY.aspx

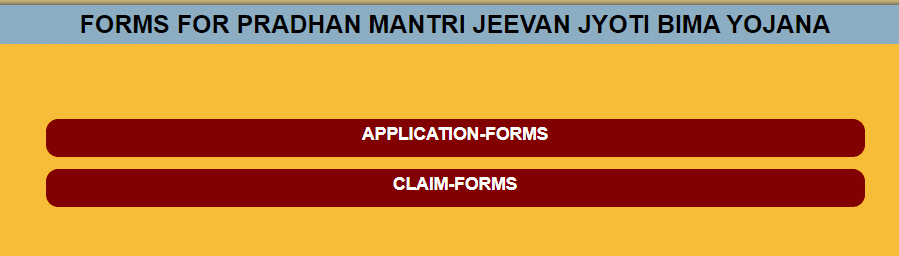

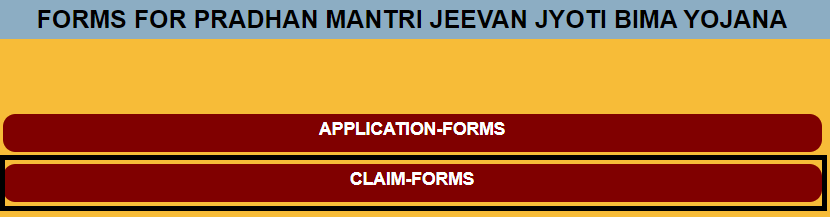

STEP 4: In the new window of Forms for Pradhan Mantri Jeevan Jyoti Bima Yojana, click at the “Application Forms” link.

STEP 5: This will open the application forms section into various languages where one can easily download PM Jeevan Jyoti Bima Yojana Form PDF in their desired language. Here we are selecting the English language to tell you about the apply format of PMJJBY Scheme which can even be checked using this link

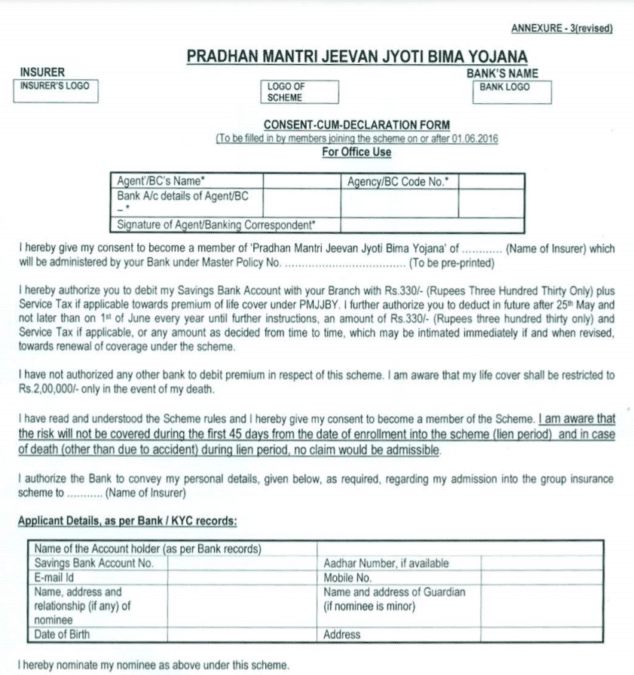

STEP 6: Then the PM Jeevan Jyoti Bima Yojana Application Form PDF will appear online as shown below which can be downloaded.

Applicants who wants to avail Rs. 2 lakh life cover can download this form and submit it at the bank.

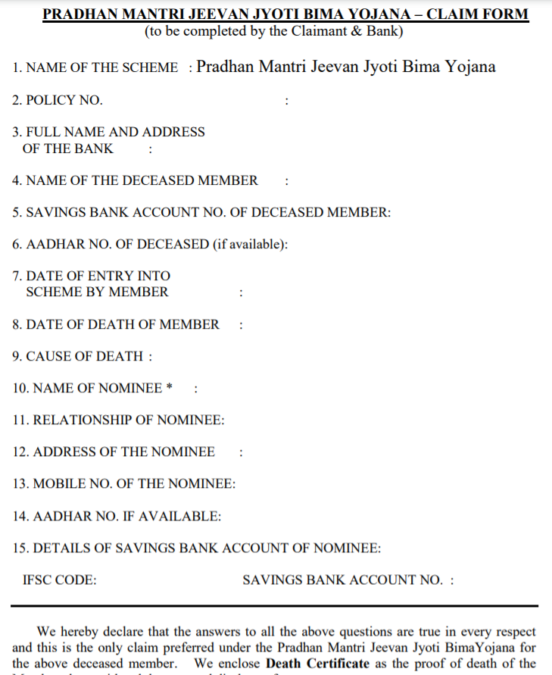

PM Jeevan Jyoti Bima Yojana Claim Form Download Online

Below is the complete process to download PM Jeevan Jyoti Bima Yojana Claim Form online:-

STEP 1: As mentioned above, the first 3 steps for downloading PMJJBY claim form through online mode are same or directly click https://jansuraksha.gov.in/Forms-PMJJBY.aspx.

STEP 2: In the window of Forms for PMJJBY Scheme, click at the “Claim Forms” link similar to the Step 4 above as shown here.

STEP 3: This will extend the claim forms section into various languages where one can easily download PM Jeevan Jyoti Bima Yojana Claim Form PDF in their desired language. Here we are selecting the English language to tell you about the apply format of PMJJBY Scheme which can even be checked using this link

STEP 4: Then the PM Jeevan Jyoti Bima Yojana Claim Form PDF will appear online as shown below which can be downloaded.

Applicants can download this PMJJBY Claim Form in PDF format through online mode and can submit it to avail Jeevan Jyoti Bima Yojana scheme benefits of life insurance coverage.

The premium of Pradhan Mantri Jeevan Jyoti Bima Yojana can be affordable by people belonging to almost all income groups including EWS and BPL. It is just Rs. 436 per annum which will be auto-debited from the saving account of subscriber in the month of May every year. The insurance cover will commence from 1st June of the same year and will stretch to 31st May of the next year.

Total Premium: Rs. 436/- per annum per member

The period of the insurance would be same as before, i.e. 1st June to 31st May.

Eligibility for the Pradhan Mantri Jeevan Jyoti Bima Yojana

- Any Indian resident within the age group of 18-50 years can join the scheme.

- The aspirant should have an active saving bank account.

- The subscriber should give a written consent to the bank for auto debit of premium amount.

- The subscriber will have to maintain required balance in the bank account at the time of auto debit on or before 31st May every year.

- The applicants will have to give a self certification of good health at the time of subscribing for the insurance cover.

- The subscriber will have to make a self declaration at the time of availing the scheme that he/she is not suffered from any acute or critical illness.

Features of Pradhan Mantri Jeevan Jyoti Bima Yojana

- Yearly basis life insurance cover of Rs. 2 Lakh at a premium of just Rs. 436.

- Easy to join, maintain, exit and re-join.

- Available for all Indian citizens within age group of 18-50 years.

- PMJJBY is being offered by LIC of India and other private insurance companies while the participating bank remaining the Master policy holder.

- It covers death due to any cause even including murder or suicide.

- Auto debit facility for the premium amount, no need to manually deposit the premium every year.

How to Join Pradhan Mantri Jeevan Jyoti Bima Yojana

STEP 1: The insurance scheme can be joined by presenting the dually filled application forms from official website of PMJJBY.

STEP 2: Fill the application form and go to the bank where you have an active saving bank account. Make sure you have the enough balance in the account to pay the premium.

STEP 3: Give declaration of good health and a signed consent of joining the scheme and auto-debit of premium amount. The consent document is attached along with the download application form.

Termination of Pradhan Mantri Jeevan Jyoti Bima Yojana

The insurance cover will terminate in any of the following events and no benefit will become payable there under.

- Upon attaining the age of 55 years subject to annual renewal up to that date (entry, however, will not be possible beyond the age of 50 years).

- Closure of the saving bank account or the insufficiency of the balance at the time of renewal.

- In case the applicant is found to be covered under more than one saving bank account, only one will remain active, rest will be terminated and the premium will be forfeited.

- The subscriber can himself/herself can exit the scheme any time in any particular year and can re-join by paying the full premium from the succeeding year.

How to Claim Jeevan Jyoti Bima Yojana Cover Amount

In case of claim the nominees/heirs of the insured person have to contact respective bank branch where the

insured person was having bank account. A death certificate and simple claim form is required to submit and the claim amount will be transferred to nominees account. The complete PM Jeevan Jyoti Bima Yojana scheme details can be checked using the direct link here – https://jansuraksha.gov.in/Files/PMJJBY/English/Rules.pdf

The Jeevan Jyoti Bima Yojana claim forms can be download from the link https://jansuraksha.gov.in/Forms.aspx

Sir I want to change my PMJJBY scheme from IDBI bank to other bank how it can be done

sir kya me pmjjy se atal penctio yojna me badalna chahta hoo to kya esa ho sakta h kya

Sir m kaise pmjjy se jur skta h kripya btaye

very nice

bank me jane se acha hota ki online hi kar sake.

“The scheme offers a life cover of Rs. 2 Lakh in case of loss of life due to any reason up to the age of 55 years.”

HERE THEYA RE MENTIONING THE GOVT WILL PAY Rs. 2 lac for the loss of life till the age of 55.

But Under the scheme you are eligible to apply when you are between age of 18-50.

so my question is if as soon as one cross the age of 50. he will be disqualify for the scheme. in that case how i can get claim if he dies under the age of 55.

If onebody have answere of my question pls reply.

Thanks

sir, i have my PMJJBY certificate

as per installment Rs.330/- deduct from seving account Axis Bank ,

but not yet receive my policy number & that policy certificate

so, please guide

which is the procedure for Certificate hard copy PMJJBY

Pmjjby is very well

Hi sir,

This is indu plz give me a correct information regarding pmjjby. I too want to invest.is there any options for online registration. Plz inform me sir. Yearly we have to pay 330.it is only for accidently bima

Hello Sir I am poor boy I have many problems In my home no light . I have not much money. Sir my village name is Rampur kala Machhali shahar jaunpur. 7052655153 no.

sIr,

I have Bank A/c in IOB. I did not recd any PMJJY/PMSBY policy certificates from bank or LIC.Last 2 years already deducted amount on my accounts. Pls advice, how can i get or download.

Hey sar

mera bank me s/b a/c tha,aur mane PMJJBY Schemes me samti diya tha fir bhi bank ne amuont debat nahi kiya aur meri mata ke death huva .muje amount nahi mel rahe hai ..me ka karu?

Anurag modi says sir Mera khata SBI jiska branch code 15828 Hai Maine branch manager Sir se bola sir mujhe pmjjby and atal pension yonna Lena Hai to bole sarkari yojna kejhamele mei na pado suno hamari bank ki yojnaye le lo mujhe sure mujhe Khali hath lautna pada 09455842580

Muniya Anilrajkumar

Pradip kumar

baibaha

bidhoona

auraiya

Strange to see no responce of above any queries raised by investers ?

are we just distributing this amount to M yojna without any acknowledgement . we should imm stop this deposition of small amount if doesnot worth to continew

anita

Hi I am ziaul Haque

Dear sir

hi sir i am paying last 6 years i am not haveing policy document from union bank of india .how many years paying amount present i am leaveing company please give my policy details my mobile number 9848742039