PM Svanidhi Yojana Online Application Form 2024 | प्रधानमंत्री स्वनिधि योजना | PM Street Vendor’s Atmanirbhar Nidhi Loan Scheme | PM Svanidhi List of Beneficiaries | pmsvanidhi.mohua.gov.in Apply Online Process.

PM SVANidhi Yojana or Pradhan Mantri Street Vendor’s Atmanirbhar Nidhi (PM SVANidhi) Scheme 2024 is a new scheme launched earlier on 1 June 2020 by Central government to provide short term loans to street vendors (rehdi / patri valas / phereewala). PM Svanidhi yojana online applications are being invited through the official website of the scheme at pmsvanidhi.mohua.gov.in.

PM Svanidhi Yojana applications can also be made offline at banks or Common Service Centers to avail a loan. Eligible street vendors can also check their name in the PM Svanidhi Yojana list of beneficiaries through street vendor survey search facility at the official portal.

PM SVANidhi Yojana Online Application Form 2024

The apply online process for street vendor self reliant scheme had been specified earlier on 29 June 2020. Below is the complete process to apply by filling PM SVANidhi online application / registration form.

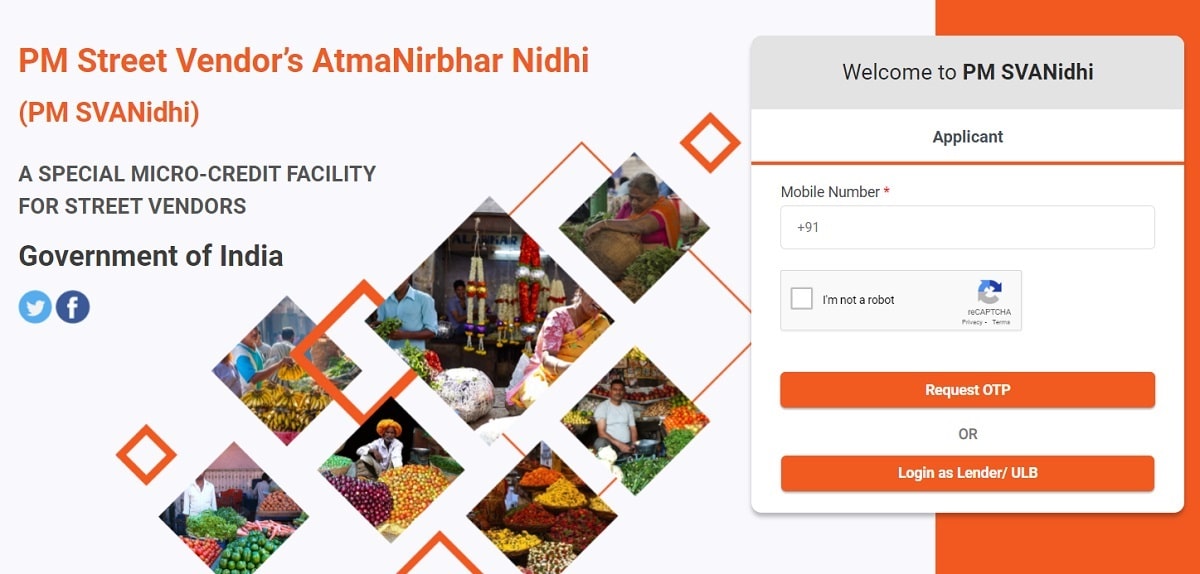

STEP 1: Visit official website – Firstly visit the official website at http://pmsvanidhi.mohua.gov.in/

STEP 2: Apply for loan online – At the homepage, click at the “Apply Loan 10K” tab or “Login as applicant” as shown in the figure below or directly click https://pmsvanidhi.mohua.gov.in/Login

STEP 3: Login using mobile number – In the new login window, street vendors can apply online for PM SVANidhi loan by logging in using mobile number. Enter the mobile no. and click at the “Request OTP” button to get one time password on that mobile phone. Afterwards, enter received OTP and click at “Verify OTP” button.

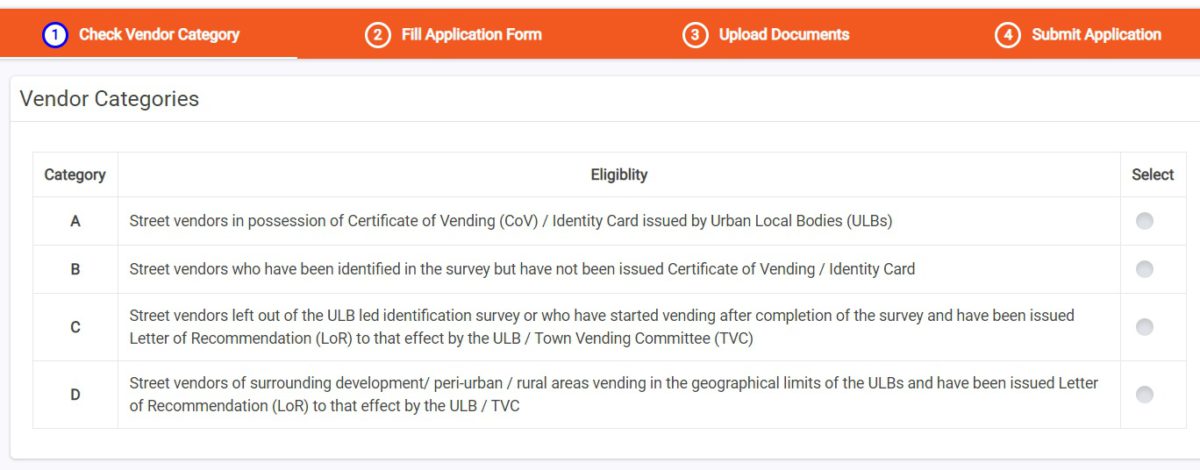

STEP 4: Check Vendor Category – Here applicants can check vendor category from the following 4 options.

1. First are those street vendors in possession of Certificate of Vending (CoV) / Identity Card issued by Urban Local Bodies (ULBs).

2. Second are those street vendors who have been identified in the survey but have not been issued Certificate of Vending / Identity Card.

3. Third are those street vendors left out of the ULB led identification survey or who have started vending after completion of the survey and have been issued Letter of Recommendation (LoR) to that effect by the ULB / Town Vending Committee (TVC).

4. Fourth are those street vendors of surrounding development/ peri-urban / rural areas vending in the geographical limits of the ULBs and have been issued Letter of Recommendation (LoR) to that effect by the ULB / TVC.

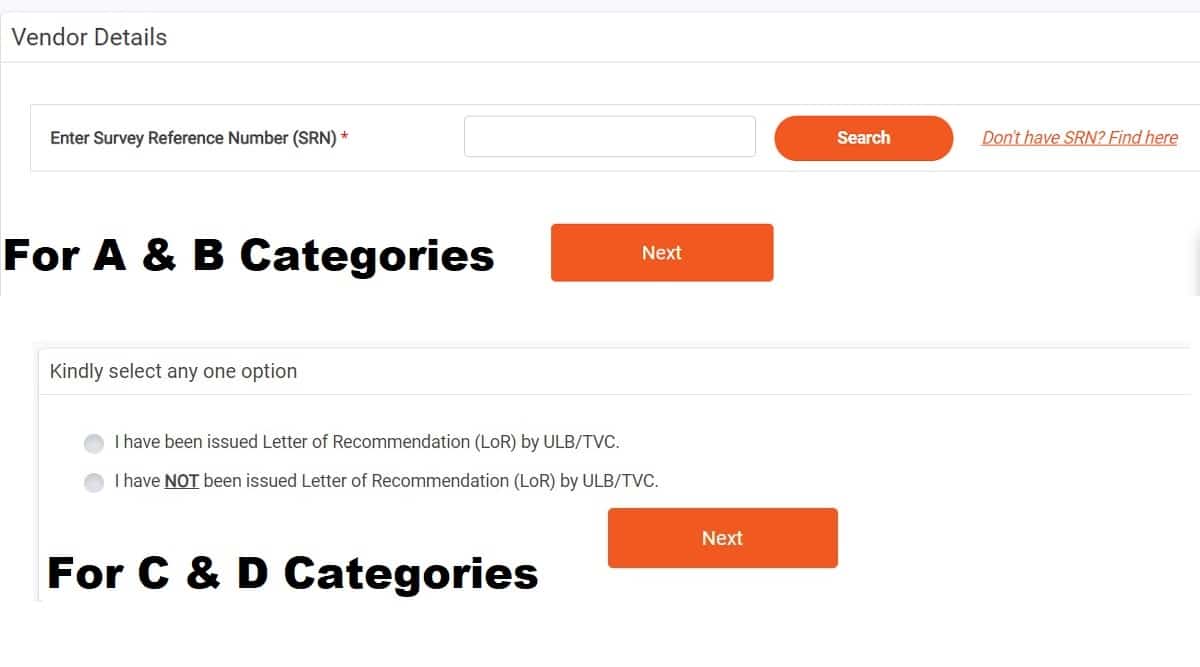

STEP 5: Select appropriate vendor category to proceed further – Applicant Street Vendors can choose any of the above given categories to proceed further to fill PM Svanidhi Scheme online application form. The selection of categories would result in Vendor’s details as per chosen vendors categories as shown below.

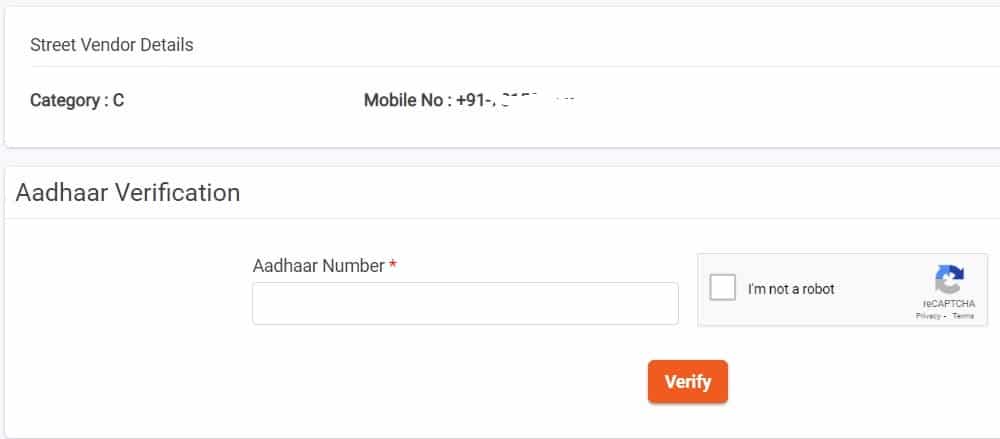

STEP 6: Registration using Aadhar number – Afterwards, street vendors can make registration using Aadhar verification as shown below. Upon entering aadhaar number and clicking at “Verify” button, you will get an OTP on mobile number which is registered in Aadhar card.

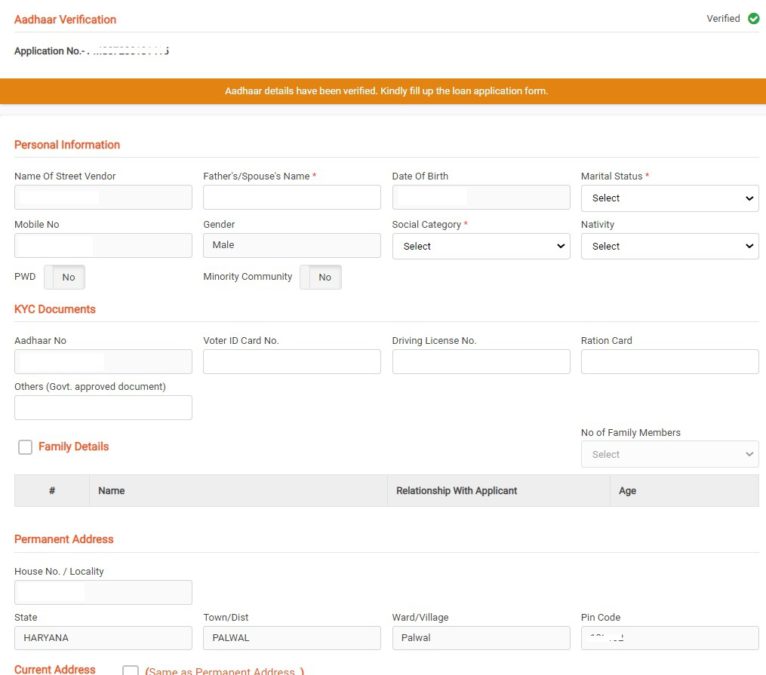

STEP 7: Fill online application form – Accordingly on verification of Aadhar OTP, the PM Svanidhi online application form will appear.

STEP 8: In this opened application form, street vendors can fill in all the details to complete the PM Svanidhi apply online process.

PM SVANidhi Yojana Online Application Process – The detailed procedure of how to apply online for PM Svanidhi Yojana is also available in PDF format at this link.

Extension of PM Svanidhi Yojna till Dec 2024

Central govt. on 27 April 2022 approved the continuation of flagship scheme to provide subsidized collateral free loans to street vendors under PM Street Vendor’s Atmanirbhar Nidhi (PM Svanidhi) scheme till December 2024. The scheme launched after the surge of COVID-19 aims to provide quick loans to street vendors to restart their business. The scheme was originally planned till March 2022.

Through the scheme, affordable collateral-free loans are being facilitated to the street vendors. The scheme had envisaged to facilitate loans amount of Rs. 5,000 crore. Today’s approval has increased the amount to Rs. 8,100 crore. The budget for promotion of digital payments, including cashback to vendors, has also been enhanced. It is likely to benefit 1.2 crore people, the government said.

Apply for SVANidhi Yojana Letter of Recommendation

The street vendors who do not have any identity card or certificate to prove their status as vendors can now apply online for the “Letter of Recommendation” which will help them avail a loan under the PM SVANidhi Yojana.

How to Apply for LoR:

- In Order to apply online for the letter of recommendation, interested candidates can visit this link. And, enter theri mobile number which is attached to Aadhar Number, and enter and verify the OTP on the next screen.

- On the next page, enter your Aadhar number and again verify the OTP and verify it.

- After verifying the Aadhar number, you will see the loan application form, fill all the required details and select “Yes” in the Request for Local enquiry report by the TVC/ULB (Request letter to the ULB) dropdown under the “Documents” section and click “Submit” button.

You can also apply offline for Letter of Recommendation with the Urban Local Body through a simple application on white paper to conduct local inquiry to ascertain the genuineness of the claim as vendor. ULBs will have to dispose of the request for issue of LoR within a period of 15 days.

After the vendors gets the LoR, they will be issued certificate of vending or identity card within a period of 30 days.

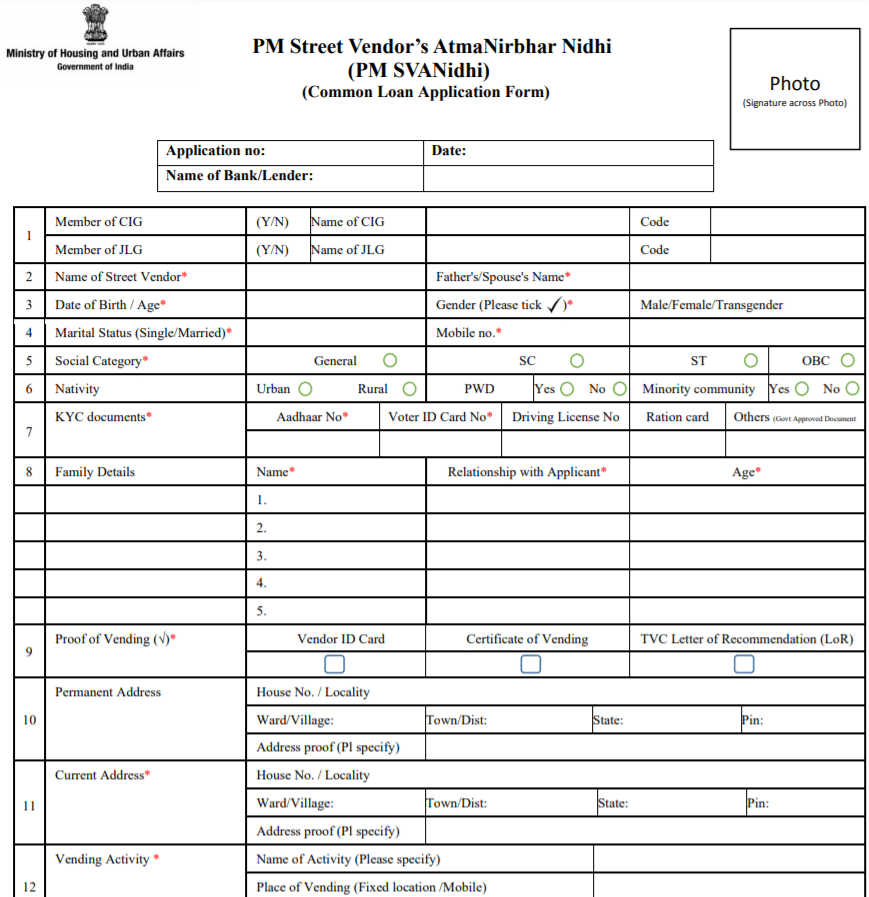

PM Svanidhi Loan Application Form PDF

To download PM Svanidhi Yojana Loan Application Form in PDF format, visit the same official PM SVANIDHI Scheme Portal at http://pmsvanidhi.mohua.gov.in/. At this page, go to “Planning to Apply for Loan” section, follow 3 steps before applying online. These 3 steps are Understand the Loan Application requirements, make sure your mobile no is linked to your Aadhaar, check your eligibility status as per scheme Rules and then click at “View More” button.

At the new page, click at the “View / Download Form” link and the PM Svanidhi Common Loan Application Form will appear as shown below:

PM Svanidhi Application Form PDF: Download Now

Fill all the asked details accurately and submit it will along with the necessary documents to the concerned officials / bank branch. The PM Svanidhi Portal has started accepting online loan application from 2 July 2020 onward.

PM SVANidhi – Eligible Street Vendors List

Vegetables, fruits, ready-to-eat street food, tea, pakodas, breads, eggs, textile, artisan products, books/ stationery sellers are among others who are considered eligible under the PM SVANidhi Yojana.

Barbershops, cobblers, pan shops, laundry services are also included in the street vendors category and can avail loan of Rs. 10,000/- under this scheme.

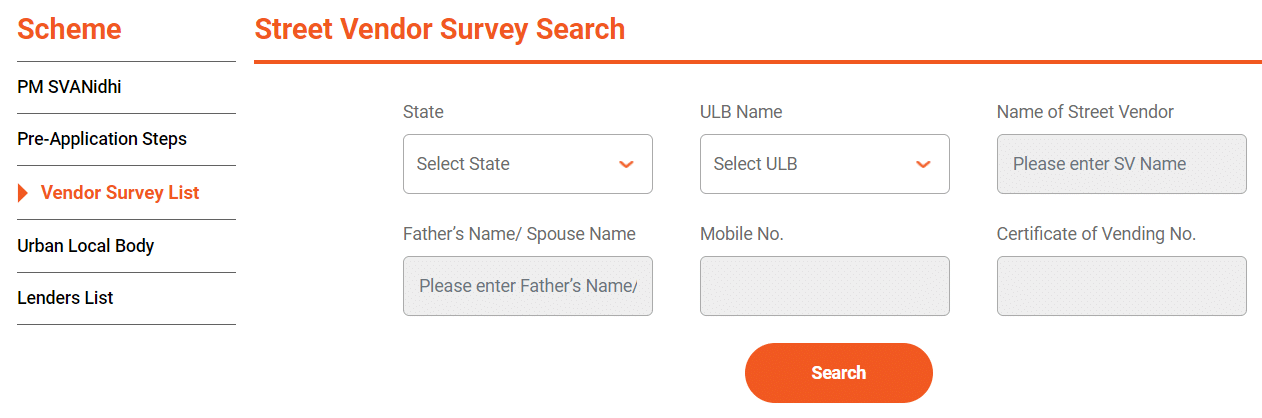

Check your Survey Status / Street Vendor Survey Search

People can now check their survey status whether they have been covered in the survey carried out by Urban Local Bodies(ULB) / Municipalities or not and can save your Survey Reference Number(SRN) for future Reference. Here is the direct link to check Street Vendor Survey Search – https://pmsvanidhi.mohua.gov.in/Schemes/SearchVendor

The page for PM Svanidhi Street Vendor Survey Search will appear as shown below:-

Here applicants will have to enter state, ULB name, name of street vendor, father / spouse name, mobile number, certificate of vending no. and then click at the “Search” button to check Survey Status.

Beneficiaries List of PM SVANidhi Scheme

As per the initial data collected from state governments, around 50 lakh street vendors would be benefited from PM Street Vendor Atmanirbhar (PM SVANidhi) Scheme. The central govt. will extend a credit flow of Rs. 5,000 crore to this sector. Moreover, those street vendors who makes use of digital payments and timely repayments would be incentivized through monetary rewards.

It is important to mention that only a fraction of those 50 lakh phereevaala may have credit history with commercial banks as banks didn’t had a product designed for this sector. The major objective is to make street vendors self reliant and not fall in debt trap of lenders for such small amount.

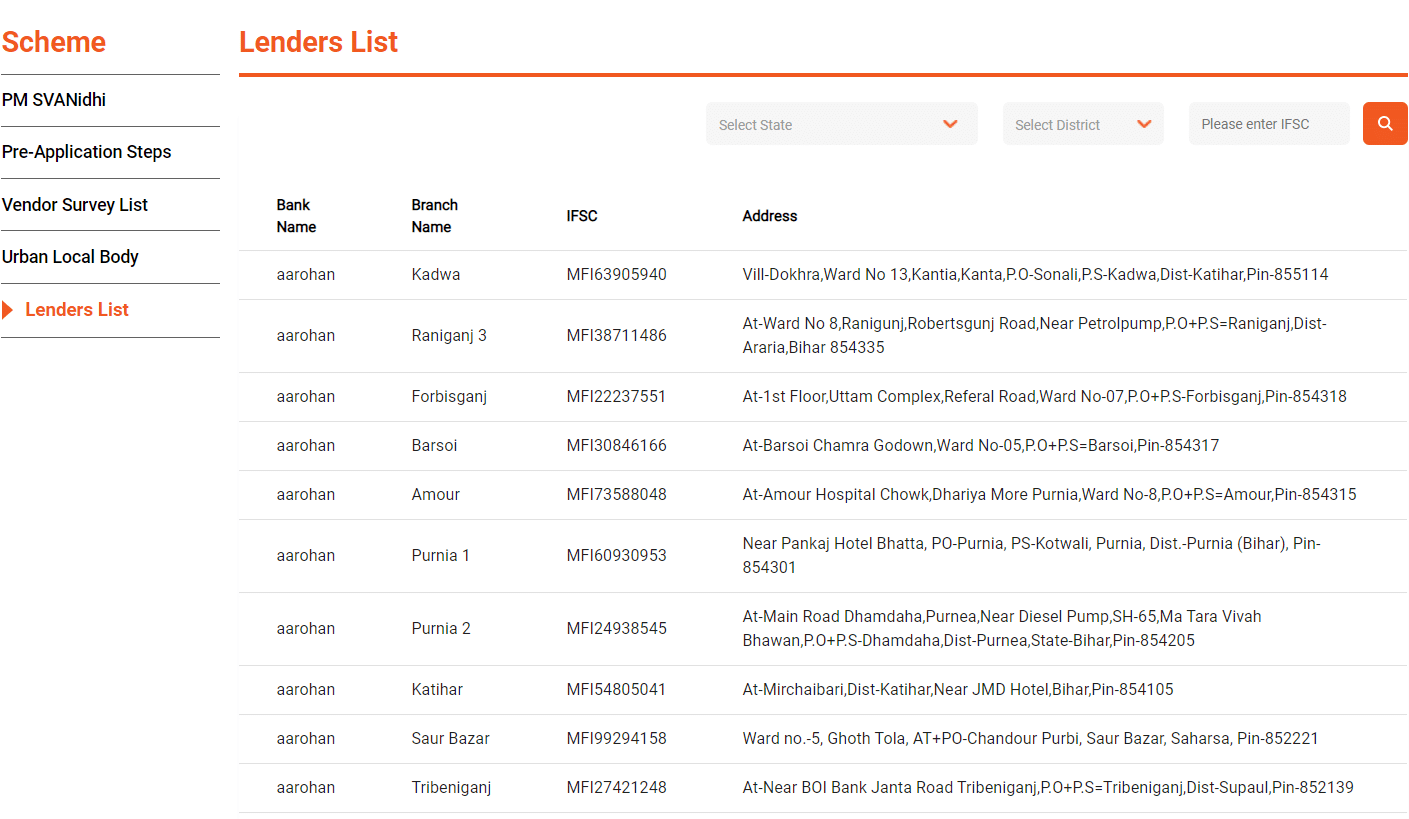

Lenders List for PM SVANidhi Yojana

Here is the direct link to check lenders link for PM SVANidhi Yojana 2024:-

http://pmsvanidhi.mohua.gov.in/Schemes/LenderList

Upon clicking this link, the complete list of lenders will appear on your screen as shown below:-

You can then find the appropriate lender for you which is located near you and can avail loan benefits easily.

PM SVANidhi Yojana Guidelines

The detailed guidelines of PM SVANidhi Scheme can be download in PDF format in English and Hindi using the below links.

English Guidelines

Street Vendors Scheme – State Wise Guidelines

| Sr. No. | State / UT | SVANidhi Scheme |

|---|---|---|

| 1 | Andaman & Nicobar Islands | View | Download |

| 2 | Andhra Pradesh | View | Download |

| 3 | Arunachal Pradesh | View | Download |

| 4 | Assam | View | Download |

| 5 | Bihar | View | Download |

| 6 | Chandigarh | View | Download |

| 7 | Chhattisgarh | View | Download |

| 8 | Dadra & Nagar Haveli | View | Download |

| 9 | Daman & Diu | View | Download |

| 10 | Delhi | View | Download |

| 11 | Goa | View | Download |

| 12 | Gujarat | View | Download |

| 13 | Haryana | View | Download |

| 14 | Himachal Pradesh | View | Download |

| 15 | Jharkhand | View | Download |

| 16 | Karnataka | View | Download |

| 17 | Kerala | View | Download |

| 18 | Madhya Pradesh | View | Download |

| 19 | Maharashtra | View | Download |

| 20 | Manipur | View | Download |

| 21 | Meghalaya | View | Download |

| 22 | Mizoram | View | Download |

| 23 | Nagaland | View | Download |

| 24 | Odisha | View | Download |

| 25 | Puducherry | View | Download |

| 26 | Punjab | View | Download |

| 27 | Rajasthan | View | Download |

| 28 | Tamil Nadu | View | Download |

| 29 | Telangana | View | Download |

| 30 | Tripura | View | Download |

| 31 | Uttar Pradesh | View | Download |

| 32 | Uttarakhand | View | Download |

| 33 | West Bengal | View | Download |

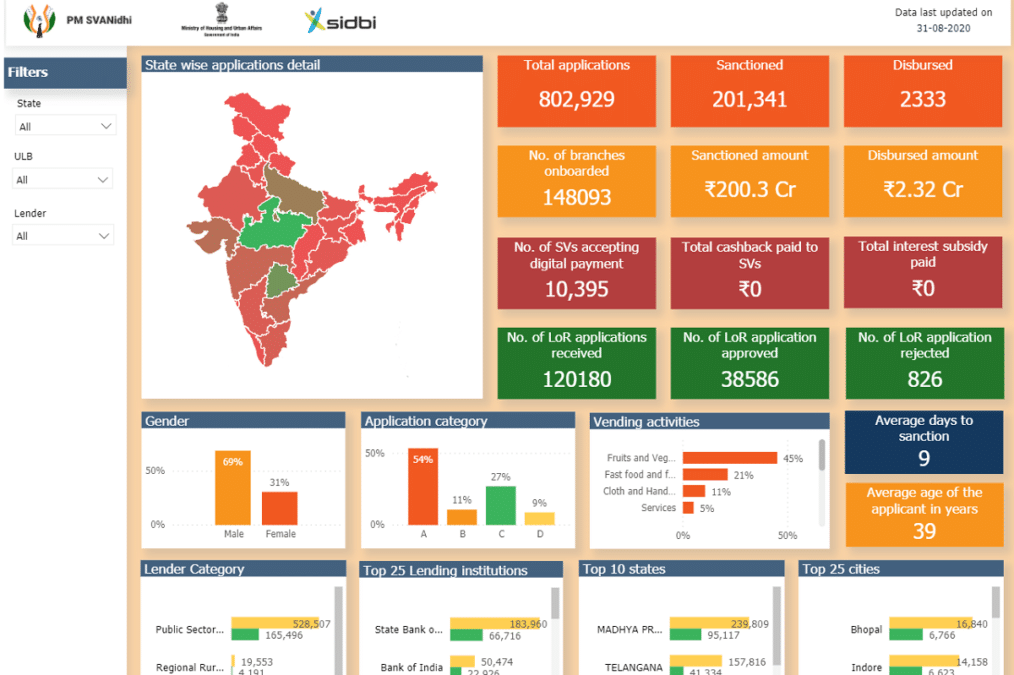

PM Svanidhi Scheme Dashboard Online

PM Svanidhi online dashboard is dynamic, interactive and would provide a one stop solution to all stakeholders looking for information and tracking monitoring of progress of PM SVANidhi up to city level. The direct link to check PMS Dashboard is given here – https://pmsvanidhi.mohua.gov.in/Home/PMSDashboard

What is PM Svanidhi Yojana 2024

The main objective of PM Svanidhi Yojana is to ensure that daily wage earners like vegetable seller, fruits seller earns their livelihood. These short term assistance will enable small street vendors to start their work which is badly hit due to any reason. This scheme was earlier announced by FM Nirmala Sitharaman in the Rs. 20 lakh crore Atmanirbhar Bharat Abhiyan Package.

Online Dashboard for PM Svanidhi Scheme has been launched. Earlier , Letter of Recommendation module was launched for the street vendors who don’t have identity cards or certificate of vending. The PM Street Vendor Atmanirbhar Nidhi or PM SVANidhi Scheme will provide initial working capital required to purchase items for selling. Now check the PMSVA scheme guidelines, implementation, reviews by experts and complete details here.

The new PM Street Vendor’s Atmanirbhar Nidhi Scheme targets to benefit over 50 lakh Street Vendors who had been vending on or before 24 March, 2020 in urban areas including those from surrounding peri-urban/ rural areas. Under the PM Svanidhi Scheme, the vendors can avail a working capital loan, which is repayable in monthly installments in the tenure of 1 year.

On timely or early repayment of the loan, an interest subsidy at the rate of 7% per annum will be credited to the bank accounts of beneficiaries. This interest subsidy on loans under PM SVANidhi Scheme would be credited through Direct Benefit Transfer (DBT) mode on a quarterly basis. There will be no penalty on early repayment of loan.

The PM Svanidhi Scheme promotes digital transactions through cash back incentives up to an amount of Rs. 100 per month. Moreover, the vendors can achieve their ambition of going up on the economic ladder by availing the facility of enhancement of the credit limit on timely or early repayment of loan.

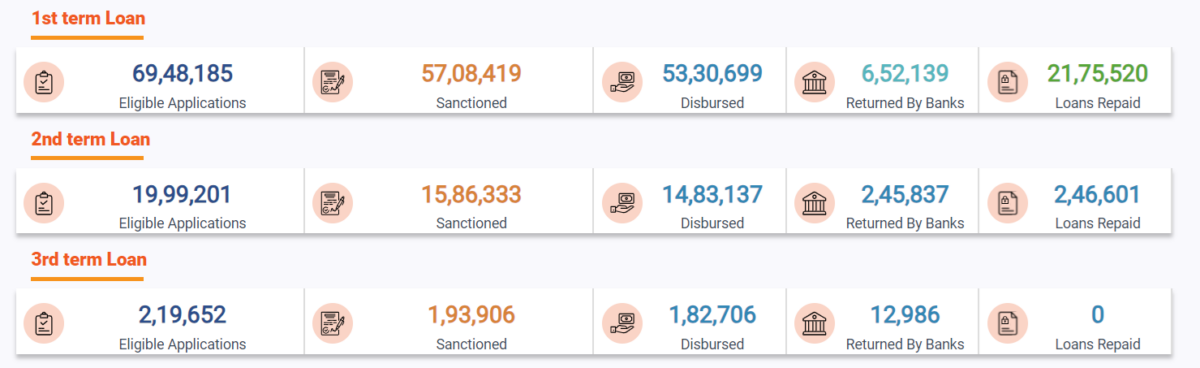

PM Svanidhi Yojana Loan Amount

Any street vendor can apply for the following loan amount under PM Svanidhi Scheme:-

- Rs. 10,000 Loan (First Term Loan) – For this, click “Apply 10K Loan” at the official website.

- Rs. 20,000 Loan (Second Term Loan) – For this, click “Apply 20K Loan” at the official website.

- Rs. 50,000 Loan (Third Term Loan) – For this, click “Apply 50K Loan” at the official website.

Svanidhi Se Samriddhi Scheme Launched by MoHUA

Housing and Urban Affairs Ministry launched ‘SVANidhi se Samriddhi’ program in additional 126 cities across 14 States and Union Territories on 12th April 2022. With the expansion of scheme, 28 lakh street vendors and their families will be benefited. The Ministry said, SVANidhi se Samriddhi, an additional program of PM-SVANidhi was launched in January 2022 in 125 cities in Phase one, covering approximately 35 lakh street vendors and their families.

Considering the success of Phase one, the Housing and Urban Affairs Ministry has launched the program in additional cities with a total target of 20 lakh scheme sanctions for this fiscal year. The Ministry has been implementing Prime Minister Street Vendors AtmaNirbhar Nidhi scheme since June 2020.

Progress of PM Svanidhi Yojana

****The progress is upto 25 October 2023.

PM Svanidhi Yojana App Download at Google Play Store

PM Street Vendor’s Atmanirbhar Nidhi (PM SVANidhi) App had been launched by Ministry of Housing and Urban Affairs of Central Government on 17 July 2020. People can now download & install PM Svanidhi Mobile App on their smartphones from google play store through the direct link. This new PM SVANidhi mobile application aims to provide a user-friendly digital interface for lending institutions (LIs) and their field functionaries. The new app is developed for sourcing and processing loan applications of street vendors. All the applicant street vendors can now apply online for loans, perform vendor search, do e-kyc under PM Street Vendors Aatmanirbhar Nidhi Scheme through this app or through the previously launched pmsvanidhi.mohua.gov.in

PM SVANidhi App by MoHUA is a step towards boosting the use of digital technology. This PM Svanidhi app will facilitate field functionaries of LIs like Banking Correspondents (BCs) and Agents of Non-Banking Financial Companies (NBFCs) / Micro-Finance Institutions (MFIs), who have proximity with the street vendors, to ensure maximum coverage of the Pradhan Mantri Street Vendor Atmanirbhar Scheme.

The launch of PM Svanidhi app will provide boost to the implementation strategy of the scheme besides promoting paper-less digital accessing of micro-credit facilities by the Street Vendors.

PM Svanidhi Mobile App Download Link for Android Users

The Ministry of Housing & Urban Affairs has already launched the http://pmsvanidhi.mohua.gov.in/ website on 29 June 2020. Now the MoHUA has launched PM Svanidhi mobile app which has all similar features as compared to the PM SVANidhi web portal. The direct link to download PM Svanidhi Mobile App from Google Play Store is given here – https://play.google.com/store/apps/details?id=com.mohua.pmsvanidhi&hl=en_IN&gl=US. The official PM Svanidhi App download from google play store for android users will appear as shown below:-

PM SVANidhi – Official Mobile Application provides end-to-end solution to facilitate Lending Institutions – Banks/ NBFCs/ MFIs etc. to process loan applications of beneficiaries through their field agents. The new official PM Sva Nidhi App is 4.4 MB in size, with current version of 1.0.9 and requires android version of 4.4 and up for installation.

MoHUA had, on June 01, 2020, launched ‘PM Street Vendor’s AtmaNirbhar Nidhi (PM-SVANidhi)’, to facilitate collateral free Working Capital loan up to ₹10,000, of 1 year tenure, to approximately 50 lakh Street Vendors, to resume their businesses. Incentives in form of interest subsidy (@7% per annum) and cash-back (up to ₹100 per month) are being provided to promote good repayment behavior and digital transactions.

Scheme entails enhanced next tranche of loan on early or timely repayment. Besides banks, for the first time NBFCs and MFIs have been included as Lending Institutions (LIs) for maximizing Scheme’s reach. A Graded Guarantee Cover is being provided through CGTMSE to these LIs, on portfolio basis, to encourage lending. The duration of the scheme is till March 2022.

Features of PM SVANidhi App

The PM SvaNidhi App has the features which are described below:-

- Vendor search in the survey data

- E-KYC of applicants

- Processing of Loan applications

- Real-time monitoring

Who Should download PM SVANidhi App

The PM SVANidhi app can be downloaded from the Google Play store for use by the LIs and their field functionaries. After the start of lending process under PM SVANidhi scheme on 2 July 2020, more than 1.54 lakh street vendors have applied for working capital loan across States/ UTs. Out of these loan applications received from street vendors, more than 48,000 have already been sanctioned loans under PM Street Vendor’s Atmanirbhar Nidhi Scheme.

PM SVANidhi was launched by the Ministry of Housing and Urban Affairs (MoHUA) on 1 June 2020. More details of Scheme may be accessed at https://pmsvanidhi.mohua.gov.in/Home/Schemes

PM SVANidhi Yojana – FAQ’s

Here are the most frequently asked questions (FAQ’s) about PM Svanidhi Yojana.

✔️ What is PM SVANidhi Yojana

PM SVANidhi Yojana is a short term loan or micro finance scheme for street vendors across the country under which they can avail a loan of Rs. 10,000 (1st Term Loan), Rs. 20,000 (2nd Term Loan) or Rs. 5000 (3rd Term Loan)

✔️ Who are Street Vendors / Hawkers

Any person who works in vending of articles, goods, wares, food items or merchandise of daily use or offering services to the general public in the street, footpath, pavement etc. from either a temporary built-up structure or by moving from one place to another.

✔️ How to Apply for PM SVANidhi Yojana Loan

Street vendors can apply online at pmsvanidhi.mohua.gov.in portal for the loan.

✔️ What is the Interest Subsidy under Svanidhi Yojana

Interest subsidy of 7% would be provided on timely / early repayment of the loan.

✔️ Who are beneficiaries of PM SVANidhi Yojana

Over 50 lakh street vendors who had been vending on or before 24 March 2020 in urban areas across the country would be the beneficiaries of the scheme.

✔️ What is the tenure of the loan under PM SVANidhi Yojana

The loan will be provided for 1 year

✔️ Which bank will provide the loan

Major Scheduled Commercial Banks, Regional Rural Banks, Small Finance Banks, Cooperative Banks, Non-Banking Financial Companies (NBFCs), Micro Finance institutions and Self Help Group banks.

✔️ How to Apply without Identity Card / Certificate of Vending

The government has started “Letter of Recommendation” module for such street vendors, apply for LoR online or at the Urban Local Body.

✔️ How to Check Name in the Beneficiary List

You can check the survey list at official website pmsvanidhi.mohua.gov.in

✔️ What are the documents required for SVANidhi loan application

Any one of the Aadhaar Card, PAN Card, Driving License, MGNREGA card, Voter ID Card for KYC purpose and any one of the Certificate of Vending / Identity Card or Letter of recommendation from urban local body or any other govt. issued document which verifies you as a street vendor.

✔️ What is the security required for the loan

No security is required to avail the loan under SVANidhi yojana

✔️ Is there any incentive for timely / early repayment of loan

Yes, on timely / early repayment of loan, a vendor becomes eligible to avail a higher tranche of loan in next cycle.

✔️ Is there any penalty for repayment of loan

No

✔️ Will I get Identity Card for use

Yes, you will be issued Provisional Identity Card on approval of loan and permanent CoV/ID will be issued within 30 days.

✔️ How long it will take to get the loan approved

The complete process should take less than 30 days.

Erecksa Lena h

1lac ka lone Lena h

Sir kirpya mera lone pass kar wa do

Phone no 9309390690

I have own land. I m interested in fruits and vegetables production, storage and marketing. But i have not able for it financially. So i want loan, plz regards me.

छोटा बिजनेस लोन सूरत

Kaise lon le ham kaha jana pade ha lon le ne k liye ham logo ko

बैंक में जाना पड़ेगा लेकिन अभी सरकार की तरफ से कोई जानकारी नहीं आई है

Sir ham log beank me vhi jata ho Etna mangta he ki de nahi shkta pesa yek benk ka staff bola ki 15 din me loan karba dunga pesa JMA karo 25000 hjar par do sal ho chuka he yavhi tak loan nhi Mila Mera number he 7294884977

लोन कैसे मिलेगा कोइ प्रकिया तो बताओ And कंहा से मिलेगा

मुझे चाहिए मै ठेला लगाता hu ब्रेड पकोडे का मुझे बहोत जरूरत hai लोन की किर्पया मुझे बताये 🙏🙏🙏

सरकार जल्द ही इस योजना के लिए आवेदन प्रक्रिया के बारे में जानकारी देगी

लोन कैसे मिलेगा कोइ प्रकिया तो बताओ And कंहा से मिलेगा

मुझे चाहिए मै ठेला लगाता hu ब्रेड पकोडे का मुझे बहोत जरूरत hai लोन की किर्पया मुझे बताये 🙏🙏🙏

Loan kaise le sir please batao.

is scheme me online apply kab kar sakte hai… or isko apply kon karega…mean kisi csc wala ya hum khud bhi aplly kar sakte hai???

Pm svanidhi loan ka apply kaise kare? Koi website app ya link hai toh batiyega please.

Aatamnirbhar bharat

Ashok kr Awasthi

Pm svanidhi loan ka apply kaise kare? Koi website app ya link hai toh batiyega please.

pmsvanidhi.mohua.gov.in

aai ki chungi zikriyabad GLI.no(8) saharanpur

लोन कहाँ से मिलेगा मुझे बताये क्या प्रक्रिया है पूरा जानकारी दे प्लीज

इस योजना के तहत लोन लेने के लिए सम्पूर्ण प्रक्रिया अभी सरकार द्वारा जारी नहीं की गई है, जैसे ही इसके बारे में कोई जानकारी मिलती है हम इस पेज पर अपडेट कर देंगे

10000

Teri wala

Bikram kumar

10000 help me lone

Mai sashi bhusan kumar mai rehari lagata hu kirpaya mujhe btaye kaise mai 10000 rupay prapt kar sakta hu mera mobile number hai – 9625355370

HOW TO APPLY THIS LONE

You can go to the nearest bank to avail these loans

1) No Online Form Available.

2) Banks do not have any information. I have personally visited State Bank of India and Bank Of Baroda at Nipania branch , Indore.

3) I want to avail this benefit.

Please guide and assist me.

Regards

Rahul Chandratre

+919579792121

Indore

Madhya Pradesh.

Rahul Chandratre, We understand your problem, don’t worry as it is a new scheme, here is the solution. You can show the bank officials the official notification which can be downloaded through the link here – http://mohua.gov.in/pm_svandhi/guidelines.pdf. At this link, the official guidelines as present at the official website of Ministry of Housing and Urban Affairs of Central government. For further assistance, check frequently asked questions about PM SVANidhi Scheme through the link – http://mohua.gov.in/pm_svandhi/FAQ.pdf

हमको। सब्जी।बेचने।कामन।है।इस।लिए।कुछ।लोन।कि।जरुरत।है

You can get loan from banks under PM Atmanirbhar Svanidhi Scheme as you would be eligible for the loan upto Rs. 10,000.

[email protected]

Main Chhoti Moti ki lagata hun mujhe loan chahie

Sauravjain, you can take loan of upto Rs. 10,000 from nearest bank under PM SVANidhi Scheme.

Thanks

Thanks

10000mujhe loan chahiye

आप स्वनिधि योजना की वैबसाइट पर ऑनलाइन अप्लाई करें जैसा कि आर्टिक्ल में बताया गया है।

IHAVE A SHOP SINCE 2007 BUT NOT REGISTERD FOR VENDING NEW SHOP CAN ELIGBLE FOR LOAN BUT OLD SHOP NOT RECOGNIGED BY PURI MUNICIPALTY MY AGE 52 BUT NOT VENDIG REGISTRATION KINDLY HELP ME TO ENTRY MY NUMBER PH 8093938937 PLEASE GIVE ME SOME REPLY

You can apply for letter of recommendation through the official portal

PM swanidhi yojana ka labh Jo mahila Ghar sambhal ker mess ka Kam karti hi unko bhi loan Milna chahiye 10,000 loan mujhe chahiye mobile no :7744853105

how to change bank account number in submitted applicaiton.

Call the helpline

Mujhe bhi loan chaiye me ek tralor hu mujhe lone ki bhut jarurat hai please🙏🙏🙏

Lone kaise milega mujhe bhut jarurat hai pleace puri informashion chaiye me ek trailar hu me rode me silai krta huu

लोन कहाँ से मिलेगा मुझे बताये क्या प्रक्रिया है पूरा जानकारी दे प्लीज

apply online for PM Svanidhi Yojana at the official website at pmsvanidhi.mohua.gov.in

“It is a very progressive move by the government by launching such apps and saying that this is an economic strategy to some extent.

Such types of applications will be beneficial for small businesses, and it will be convenient as well; this application is also available on the google play store, which is easy to download and free of cost.”

Lone kese milega hum nehi pehe changed

I am glad to see the government is taking such initiatives to help the poor and needy. This is a great way to help them get the help they need and deserve.

Sir mujhe pahele 10000 ka loan mila tha ab wo khatam ho gaya hai mujhe 2nd loan ki zarurat hai please mujhe loan Dene me meri madad kijiye

Sir mujhe pahele 10000 ka loan mila tha ab wo khatam ho gaya hai maherbani krke mujhe dusra loan dijiey mujhe bahot zarurat hai pahele aap ne meri madad kiye the mere karobar ko or aage badhane me abhi bhi meri madad kijiye

Phone number 8329852501

9373962390

Hame loan chahiye

Phone number 8329852501

9373962390

10000 ka lon sir sanctioned par he abhi lon aaya nahi he khuch madada karo please

Sir mereko pesha ki bahut jarurat he please m.9313267571