Atmanirbhar Bharat Abhiyan 2024 Portal Registration / Login available at aatmanirbharbharat.mygov.in. Aatmanirbhar Bharat Abhiyan aims to make India self reliant and doesn’t advocate a self centered system. PM Narendra Modi led central government mentioned that in India’s self reliance, there is a concern for the whole world’s happiness, cooperation and peace. In this article, we will tell you about the complete schemes list for MSMEs, Education, Health and Agriculture sector.

What is Atmanirbhar Bharat Abhiyan 2024 – Complete Details

PM Narendra Modi in his address to the nation on 12 May 2020 had announced a new Atmanirbhar Bharat Abhiyan. In this Self Reliant India Campaign, the central govt. will lay special emphasis on economy growth, local production of goods, strengthening supply chain and raising demand of products . To make India a self reliant (आत्मनिर्भर) country, central govt. had announced an economic package of Rs. 20 lakh crore to aid our country out of the Coronavirus crisis (by making us self-reliant). People can now check list of schemes for MSMEs, Education, Health, Agriculture & other sectors.

This section covers all the relevant Infographics, Videos, PDFs and certain Policy reform initiatives based on the announcements made by Honourable Finance Minister covering the “AatmaNirbharBharatAbhiyaan”, in 5 tranches from 13th May till 17th May, 2020. People can even check schemes list in Atmanirbhar Bharat Abhiyan 3.0 as well as those announced on 12 November 2020.

Atmanirbhar Bharat Abhiyan 2024 Portal Registration / Login

Below is the complete procedure to make Atmanirbhar Bharat Abhiyan portal registration 2024 & login:-

STEP 1: Firstly visit the Aatma Nirbhar Bharat Abhiyan official website at https://aatmanirbharbharat.mygov.in/

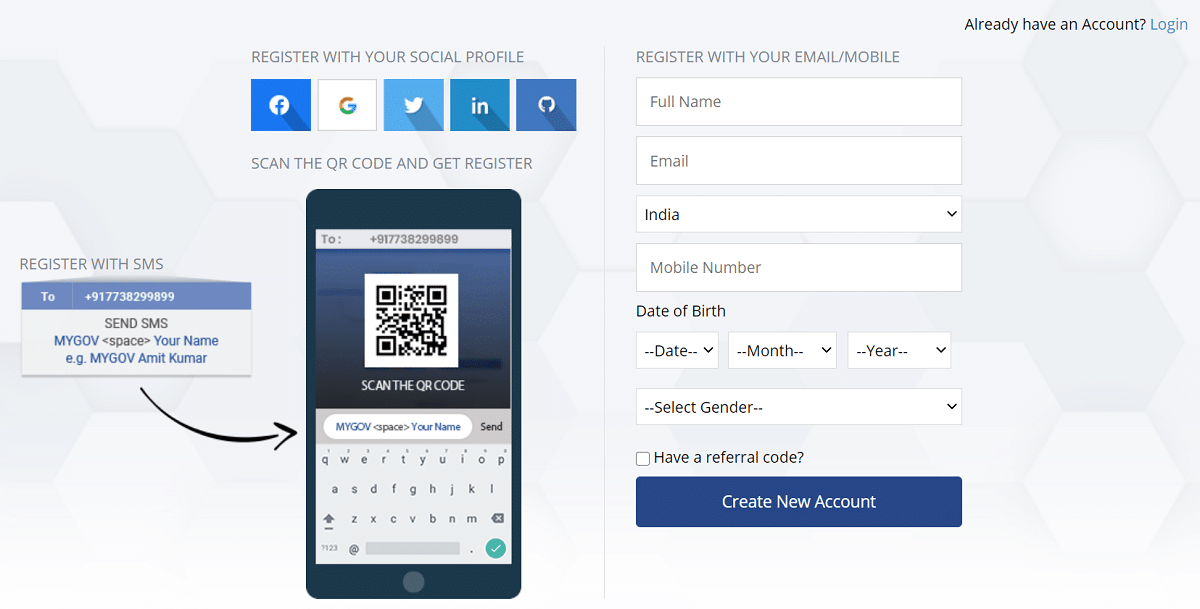

STEP 2: At the homepage, click at the “Register” link present in the main menu to open the Atmanirbhar Bharat Abhiyan Portal registration page:-

STEP 3: Here candidates can enter their name, e-mail ID, mobile number, date of birth, select gender and then click at “Create New Account” tab. Candidates can even register with their social profile such as through accounts on facebook, google, twitter, linkedin. Moreover, candidates can even Send SMS at MYGOV<space>Your Name eg- MYGOV Amit Kumar to +917738299899.

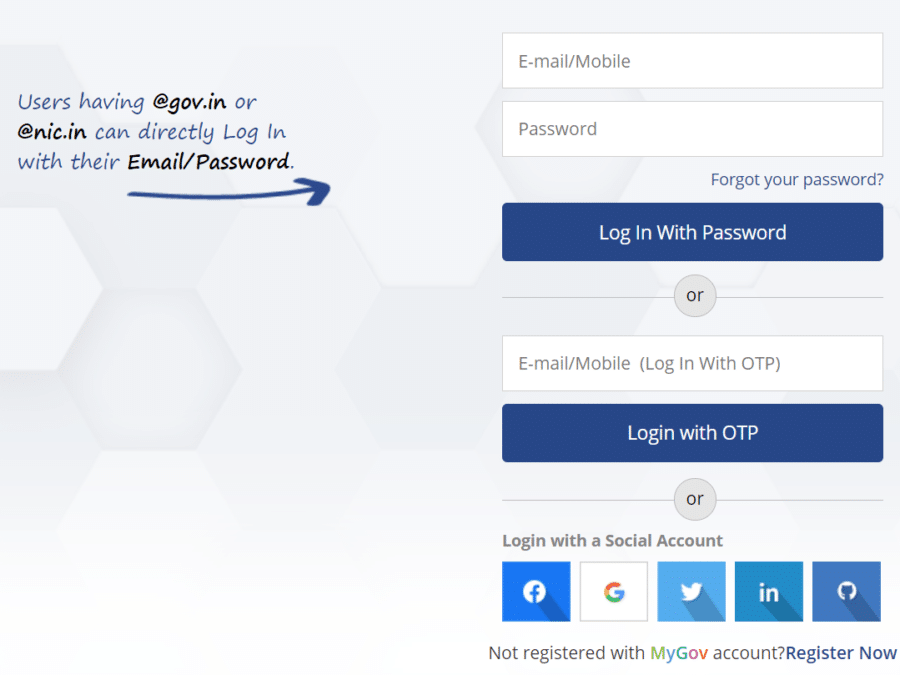

STEP 4: Afterwards, candidates can hit at “Login” tab present on the Aatmanirbhar Bharat Abhiyan Portal homepage to open the page as below:-

STEP 5: Upon successful registration and login at Aatm Nirbhar Bharat Abhiyan Portal, candidates can get involved by participating in AatmaNirbhar Bharat Online Activities and can even share their stories.

India’s Atmanirbhar Bharat Abhiyan Schemes List 2024

Prime Minister Modi had earlier announced that the central govt. is providing Rs. 20 lakh crore in 2020 (20 Lakh Crore in 20-20). This Atmanirbhar Bharat Abhiyan package was inclusive of the already announced 1.7 lakh crore PM Garib Kalyan Yojana and 1.7 lakh crore package by the RBI. The main focus of Atmanirbhar Bharat Abhiyan will be on making India a manufacturing hub as the country has youngest workforce. This Aatmanirbhar Bharat Abhiyan 2020 package was approx. 10% of the total Gross Domestic Product (GDP) of India. Now we are going to provide you the details of the self reliant India campaign such as 4 L’s factors, beneficiaries, sectors to benefit etc.

This economic package of Rs. 20 lakh crore under Atmanirbhar Bharat Abhiyan had several features. This package was announced in 5 tranche economic doses on 13th, 14th, 15th, 16th and 17th May 2020. Some schemes were announced on 12 November 2020 and the Aatm Nirbhar Bharat Abhiyan 3.0 was announced on 13 November 2020 (Here we will describe the 12 Nov and 13 Nov 2020 schemes in one section). Now check the details of each of the economic doses. ***Language of Writing is as on Update Date***

1st Economic Dose under Atmanirbhar Bharat Abhiyan (13 May 2020)

Check out the PM Vision of 20 lakh crore for Businesses including MSMEs. There are 15 different measures to realize the PM Modi’s vision of Rs. 20 lakh crore. This includes 6 measures for micro, small and medium enterprises (MSMEs), 2 for Employee Provident Fund (EPF), 2 for HFCs / MFIs / NBFCs, 1 for power sector, 1 for real state, 1 for contractors, 2 as direct tax measures:-

For MSMEs (6 measures)

- 3 lakh crore for MSME Sector – The central govt. will provide collateral free loans to facilitate MSMEs. These loans will have 4 years tenure and will get moratorium of 12 months. Approx. 12 crore workers would be benefited.

- Subordinate Debt based scheme – Rs. 20,000 Crore for Stressed and NPA MSMEs. Around 2 lakh stressed and NPA MSMEs to benefit.

- Fund of Funds – Rs. 50,000 crore of equity infusion into those who have potential and doing viable business.

- A change in the definition of MSMEs – Investment limit for MSMEs is revised upward (investment size), additional criteria i.e turnover (turnover size) would be taken into consideration. Moreover, the differentiation b/w manufacturing and service MSME will be removed.

- Global Tender to be Disallowed upto Rs. 200 cr – Govt. procurement tenders upto 200 crore will no longer be on global tender group.

- Other Interventions for MSMEs – E-market linkage would be provided across the board in absence of trade fairs to promote e-commerce. Within 45 days, CPSEs and Govt. of India will clear their receivables.

Employee Provident Fund (EPF) (2 Measures)

- Companies having upto 100 employees & 90% having less than 15,000 salary – Liquidity support for all EPF establishements would be paid by the central government. This means that govt. will now provide 12% which was to be paid by employer as well as 12% which was to be paid by employee. Govt. of India expands this contribution for June, July and August 2020. Liquidity relief of Rs. 2500 crore EPF support for businesses and workers for 3 months to benefit 72.22 lakh employees.

- For companies with more number of employees – For the next 3 months, employers and employees will have to pay 10% (earlier 12%). For Public Sector Enterprises (PSEs) and Public Sector Undertaking (PSUs), govt. will pay full employer contribution while govt. employees can pay only 10% for next 3 months. For this purpose, govt. will provide Rs. 6750 crore.

Housing Finance Corporation & Micro Finance & NBFCs (2 Measures)

- Rs. 30,000 cr Liquidity Facility for NBFC / HCs / MFIs – Rs. 30,000 Liquidity investment facility will made in primary and secondary sectors of NBFCs, MFIs and HCs. This would be done through taking and buying debt papers (not of high quality) of NBFCs, MFIs and HFCs which would be fully guaranteed by Indian government.

- Rs. 45,000 cr Partial Credit Guarantee Scheme 2.0 – The central govt. will start Partial Credit Guarantee Scheme 2.0 with an amount of Rs. 45,000 crore for NBFC. The first 20% loss would be borne by the govt. of India.

Power Sector (1 Measure)

- Rs. 90k crore Liquidity injection for DISCOMs – The govt. will provide an Emergency Liquidity Injection of Rs. 90,000 for DISCOMs.

Contractors (1 Measure)

- Relief to Contractors – All govt. of India agencies such as railways, roadways can now give upto 6 months extension to contractors to comply with contract conditions. Concessional period extended for next 6 months. Govt. agencies will partially release bank guarantee on partial completion of projects.

Real Estate (1 Measure)

- Extension of Registration and Completion Date of Real Estate Projects under RERA – The suo moto registration and completion date of all the real estate projects under RERA would be extended by 6 months. This includes even those projects whose expiry date was 25 March 2020.

Tax Measures (3 Measures)

- Rs 50,000 crore Liquidity through TDS / TCS Reduction – From 14 May 2020 to 31 March 2021, TDS / TCS rate are reduced by 25% for all purposes. This initiative will give Rs. 50,000 crore liquidity through TDS / TCS reductions.

- Direct Tax Measures – All pending refund to charitable, professional, partnerships, LLPs, proprietor will be given immediately. The due date of all income tax returns are now being extended from to 30 November 2020 and tax receipts to 31 October 2020. The date of assessment getting barred as on 30 Sept 2020 is now being extended to 31 December 2020. Those getting barred on 31 March 2021 will now be moving to 31 Sept 2021. Without any additional amount, Vivad Se Vishwas Scheme is extended to 31 December 2020.

For more details on Atmanirbhar Bharat Abhiyan for Businesses including MSMEs, download the PDF:-

http://164.100.117.97/WriteReadData/userfiles/Aatmanirbhar%20Presentation%20Part-1%20Business%20including%20MSMEs%2013-5-2020.pdf

Economy Booster Dose 2 under Atmanirbhar Bharat Abhiyan (14 May 2020)

In this phase, the main focus is on migrant workers, street vendors, small traders, small farmers and self employed persons. There are 9 steps as a part of economy booster dose 2 under Atmanirbhar Bharat Abhiyan. There are 9 steps including 3 for migrant workers, 1 for shishu loan within mudra, 1 for street vendors, 1 for housing, 1 for employment of people in tribal areas and tribal pockets and 2 measures are related to farmers. The complete details are given here:-

Migrant Workers (3 Measures)

- Free food grains supply to all migrants for next 2 months – All non ration card holders not covered in National Food Security Act (NFSA) or whose name is not in state ration card list will now get 5 kg wheat or 5 kg rice per person. In addition to this, 1 kg chana per family would be given. Around 8 crore migrants will benefit from this free food supply scheme for non ration card holders with an outlay of Rs. 3500 crore.

- One Nation One Ration Card Scheme – To ensure national portability of ration to benefit migrant workers, central govt. will start One Nation One Ration Card Scheme. From August 2020, 67 crore migrant workers in 23 states would benefit from this scheme which is around 83% of total PDS beneficiaries. 100% beneficiaries coverage under 1 Nation 1 Ration Card Scheme to be achieved till 31 March 2020.

- Affordable Rental Accommodation for Migrant Labourers & Urban Poor under PMAY – The govt. will start a new rental housing scheme for migrant workers and urban poor under Pradhan Mantri Awas Yojana. In this PMAY Rental housing scheme, all the migrant workers will get houses on lesser rent in the area of their working. This would be done by converting govt funded houses in major cities into affordable rental housing accommodations or complexes through PPP mode. Moreover, govt. will provide incentives business companies, state govt’s, agencies, associations to provide low rent housing facility to its workers.

Migrant workers are being given 3 meals per day in shelter homes. For urban poor in just last 2 months during covid period, the central govt. has permitted state govt’s to utilize state disaster management fund to provide shelter, food water to workers which costs roughly around Rs. 11000 crore.

Nearly 12000 SHGs have already produced 3 crore masks and 1.02 lakh litres sanitizers. The central govt. also provide access to revolving funds to SHGs at PAiSA portal to raise their capacity building. Around 7200 new SHG groups have been formed for urban poor from 15 March 2020.

Shishu Loans under Mudra Yojana (1 Measure)

- Modi govt. will provide interest subvention incentive of 2% on prompt repayment of shishu loans for next 12 months after moratorium period ends. Around 3 crore beneficiaries to benefit with this scheme with an outlay of Rs. 1500 crore.

Street Vendors (1 Measure)

- Special credit facility of Rs. 5000 crore to street vendors would be provided by the Indian government. Within 1 month duration, central govt. to launch special scheme for street vendors to provide them easy access to credit. Around 50 lakh street vendors to benefit and mostly of them will now get initial working capital of upto Rs. 10,000.

Housing (1 Measure)

- The lowest strata of middle income group who earns 6 to 18 lakh per annum, PMAY CLSS scheme which was started in May 2017 and which ends on 31 March 2020 has now been extended till March 2021. Around 3.3 lakh families have already been benefited till now from PMAY CLSS scheme. Now another 2.5 lakh MIG group people will benefit from PMAY CLSS scheme in the next 1 year. This scheme will result in immediate job creation and will also raise demand for construction material such as steel, cement and other house construction materials.

Employment Generation for Adivasis (1 Measure)

- Rs. 6,000 crore has been allocated for employment generation for people in tribal areas (adivasi).

Farmers (2 Measures)

Till date, about 3 cr farmers have availed 63 lakh agricultural loans given to them in concessional rates. Farmers already availed loans which worth over Rs. 4.22 lakh crores. Now the interest subvention for prompt repayment of loans is extended from 1 March 2020 to 31 May 2020.

- Rs. 30,000 crore additional emergency working capital fund through NABARD – Annually, NABARD provides Rs. 90,000 crore for refinance purposes. Now an additional Rs. 30,000 crore additional emergency working capital fund through NABARD (refinance) would be released immediately. Around 3 crore small and marginal farmers to get benefit for their Rabi post harvest work. Rural cooperative banks (state cooperative banks, district cooperative banks) and RRBs to get this immediate assistance on tap based lending.

- Around Rs. 2 lakh crore concessional credit would be extended for KCC – Rs. 2 lakh concessional credit would be extended for Kisan Credit Card. Around 2.5 crore farmers to benefit from this KCC scheme. Fisheries and animal husbandry farmers will be included in KCC Scheme.

Around 25 lakh new KCC holders have been given loans given loans of Rs. 25000 crore. Liquidity support of 86,600 crore for farmers is given in the month of March-April. NABARD has refinanced 29,500 crore through Rural Cooperative Banks & Regional Rural Banks (RRBs) in March. Around Rs. 4200 crore support is provided for rural infrastructure development. State govt’s are also get working capital assistance of Rs. 6,700 to procure agricultural produce.

Works in Pipeline for Workers to make India Aatm Nirbhar

Here is the complete list of works which are in pipeline for the government to make India Aatm Nirbhar:-

- Right to minimum wage to all workers.

- National Floor Wage implementation across the country to remove regional disparity in minimum wage.

- Appointment letters to workers to make them formal.

- Health benefits for all (atleast 1 health checkup)

- New definition for interstate migrant workers to benefit them.

- Portablity of welfare benefits for migrant workers.

- Extension of ESIC benefits to all establishments (no restriction of number of employees).

- Mandatory ESIC coverage to all those working in hazardous activities. (occupational safety and health)

- Social security benefits extension to all workers.

- Re-skilling of all workers.

- All occupation should be open for women even in nights along with their safety measures.

The central govt. has already increased average wage rate of workers from Rs. 182 to Rs. 202 under MGNREGA. Moreover, govt. has already generated 14.62 crore person days of work till 13 May 2020. The annual expenditure is 10,000 crore as work is offered to 2.33 crore workers in 1.87 lakh gram panchayats (40% to 50% more workers enrolled). Furthermore, central govt. has issued directions to state govt’s to provide enrollment and provide employment under MGNREGA to workers in their own states.

For more details on 2nd tranche of Atmanirbhar Bharat Abhiyan, please click the link below:-

http://164.100.117.97/WriteReadData/userfiles/Aatma%20Nirbhar%20Bharat%20presentation%20Part-2%2014-5-2020.pdf

3rd Economic Dose of Atmanirbhar Bharat Abhiyan (15 May 2020)

This 3rd economic dose of Atmanirbhar Bharat Abhiyan is basically focused on agriculture and allied activities, govt and administrative reforms. The first 8 measures are for welfare for fisheries, dairy, animal husbandry, food processing and farmers while last 3 are government reforms in system to benefit agriculture sector.

Agriculture and Allied Activities (8 measures)

The first 8 measures are for agriculture and allied activities which are for strengthening of infrastructure, logistics, capacity and storage capabilities for farmers:-

- Farm Based Infrastructure (Rs. 1 lakh crore) – The central govt. has allocated Rs. 1 lakh crore for aggregators, farmer production organizations (FPOs), primary agriculture cooperative societies and krishi udyami to strengthen farm gate infrastructure. This amount would be spent for strengthening of cold chain, post harvest infrastructure, storage centers, yards etc.

- Micro Food enterprises (Rs. 10,000 crore) – This initiative is for food enterprises which are micro in size. The central govt. will implement Rs. 10,000 crore scheme with cluster based approach to emphasise on “vocal for local” initiative. Around 2 lakh micro enterprises to benefit from this marketing and branding scheme. For eg- clusters can be made for makhana of Bihar, mango of UP, ragi and coarse grains of Karnataka, kesar of Kashmir, turmeric of Telangana has turmeric, chillies of Andhra Pradesh. Van sampada clusters would also be formed.

- PM Matsya Sampada Yojana (Rs. 20,000 crore) – This Rs. 20,000 crore for PM Matsya Sampada Yojana includes activities related to fisheries and aquaculture. In this scheme, govt. will provide employment to 55 lakh people. New krishi vessels can be given and new krishi harbours can be built. Moreover, insurance of persons related to fisheries and their personal boats would be done. This would result in an additional fish production of 17 lakh tonnes. The main objective is to empower people by providing them resources. In this scheme, Rs. 11000 crore would be given for aquaculture, 9000 crore for vessels and harbours.

- FMD Livestock Disease Control Scheme (Rs. 13,000 cr) – To eliminate foot and mouth disease, 100% vaccination of cattles, buffaloes, sheep, goat would be done. India has 53 crore livestock which is largest in the world. From January 2020, around 1.5 crore cows and buffaloes have been vaccinated. In green zones, vaccination is going to be started soon. To achieve 100% vaccination of livestock, govt. will spend Rs. 13,343 crore.

- Animal Husbandry Infrastructure Development Fund (Rs. 15000 crore) – The central govt. will spend Rs. 15k crore for dairy infrastructure development fund. In this initiative, private investment can be done. The govt. will provide incentives for exporting of milk, cheese, ghee and to produce cattle feed.

- Promotion of herbal cultivation (Rs. 4000 crore) – Upto 10 lakh hectares (25 lakh acres) of land would be used for herbal cultivation. This initiative would result in an additional Rs. 5000 crore of income for farmers. On both the banks of ganga, herbal plants can be grown. Around 800 hectares of area of ganga corridor would be given for cultivation of herbal and medicinal plants.

- Promotion of Bee keeping (Rs. 500 crore) – The central govt. will spend Rs. 500 crore on bee-keeping initiatives to benenfit 2 lakh beekeepers. This will ensure better standards of living for bee keepers and people will get better honey. Moreover, wax for medicinal and other purposes is imported till now, so honeybee keeping will help in meeting wax requirement of India locally and there is potential to become its exporter.

- Operation Greens (additional Rs. 500 crore) – Govt. has already launched Operation Green to take care of onion, tomato, potato (OTP) crops. Now farmers producing these perishable items would get 50% subvention on transportation and 50% on storage. This scheme will be extended and expanded for other perishable food items such as fruits and vegetables with an additional amount of Rs. 500 crore.

Government and Administrative Reforms (3 measures)

- Amendment in Essential Commodities Act 1955 – This Essential Commodities Act came into force in FY 1955 to reduce food shortage. Now as India is producing food items in abundance, govt. is going to make ammendment in Essential Commodities Act 1955. From now onward, cereals, oilseeds, onion, potato, pulses, edible oils will be deregulated. No such stock limit shall apply for food processors subject to installed capacities. However, there are certain provisions in which govt. can take steps on these crops in case of price hike or natural calamities.

- Central law for farmers to sell their produce at attractive prices – Now govt. will frame a central law in which farmers will get leverage to sell their agricultural produce at attractive prices. There would be no barriers in interstate selling of agricultural products and e-trade would also be allowed for farmers.

- Facilitative legal framework – A new standardized mechanism would be framed in collaboration with large retailers, exporters, aggregators and farmers to ascertain them with the price of sowing and selling, other information at the start of each season.

Support System Established for Farmers during COVID-19 lockdown

In India, around 85% of the operational landholdings are with small and marginal farmers. Farmers works in adverse conditions, endured a lot and made India reach global level. India is largest producer of milk, jute, pulp, second largest in production of sugarcane, cotton, fruits, vegetables and third largest in production of cereals. In the past 2 months, take a look at the support system established during COVID-19 lockdown. The central govt. has performed MSP purchase to an extent of Rs. 74,300 crore. In addition to this, Rs. 18,700 transferred to account under PM Kisan Samman Nidhi Yojana.

The claim payment of Rs. 6,400 crore under Pradhan Mantri Fasal bima Yojana has been cleared. Around 560 lakh litres of milk per day was procured by the government. In total 111 crore litre of milk was procured and for this purpose, govt. has paid Rs. 4100 crore to dairy cooperative farmers. Furthermore, govt. is providing an interest subvention of 2% for dairy cooperatives and an additional 2% on prompt repayment. This has resulted in Rs. 5000 crore additional liquidity for farmers and benefited around 2 crore farmers.

For more details on 3rd tranche of Atmanirbhar Bharat Abhiyan Package, click the link below:-

http://164.100.117.97/WriteReadData/userfiles/Aatma%20Nirbhar%20Bharat%20Presentation%20Part-3%20Agriculture%2015-5-2020%20revised.pdf

4th Economic Dose under Atmanirbhar Bharat Abhiyan (16 May 2020)

In the 4th tranche of Atmanirbhar Bharat Abhiyan, the central govt. is focusing on structural reforms in 8 sectors. These are Coal, Minerals mining, Defense production, Civil Aviation (airspace management, PPP and airports, MRO Hubs), Power distribution sector, Social Infrastructure Projects, Space and Atomic energy sectors. Now lets study the structural reforms made in each of these sectors.

Coal Sector

- Earlier coal was a product with monopoly of the central govt. but to promote commercial mining in coal sector, govt. monopoly is removed. It will lead to more coal availability at market prices and liberalized entities allowed to participate.

- India has 3rd largest valued coal in uncapped mines and we still import coal. So regulations are required. Now the govt. will provide incentives on coal gasification to prevent environment and coal extraction beds would be auctioned. Govt. will spend Rs. 50,000 crore for creating evacuation infrastructure.

Mineral Mining Sector

- A seamless composite exploration cum mining cum production meachanism would be setup. Around 500 new mining blocks would be auctioned.

- The central govt. will remove distinction b/w captive and non-captive mining.

- In addition to this, govt. is in the process of development of mineral index.

- Rationalization of stamp duty would be done while providing mining leases.

Defence Sector

- The govt. will notify a list of weapons which are not allowed to import. Every year list will be increased.

- Central govt. will focus on indigenisation of imported spares. Separate budget provision would be made for domestic capital procurement.

- The 3rd step is to provide autonomy and accountability to ordinance factories. Corporatization (not privatization) of ordinance factories board would be done.

- Foreign Direcct Investment (FDI) limits are raised from 49% to 74%. The central govt. will also give priority to time bound defence procurement system.

Civil Aviation (Airspace management, PPP and airports, MRO Hub)

- For Airspace management, around 60% of airspace is only available for civil flights due to military restrictions. So from now onward, govt. will focus on optimum utilization of airspace. This will save fuel requirement, less price tickets and reduce time of travel and will save around Rs. 1000 crore.

- For PPP and airports, 6 more airports would be brought in by the central govt. for auction. Airport Authority of India (AAI) will do this on PPP basis. The govt. is seeking additional investment to provide high quality facilities at airports. The govt. has already received Rs. 13,000 crore investment in 1st and 2nd round of 12 airports. Now with these 6 airports, more investment is expected to come.

- Maintenance, Repair and Overall (MRO) Hubs will be setup in India to perform maintenance, repair, service and other works related to civil aeroplanes and defense aircrafts.

Power Sector

- Power distribution companies in all Union Territories would be privatized in line with tarriff policy. Moreover, private players will get open access as well as incentives on timely payments. This will ensure power distribution to be sustainable.

- The DISCOMs will ensure adequate power, less load shedding to provide adequate power supply to consumers. For consumers, smart prepaid meters would be installed while DBT process will be started for electricity bills directly in bank accounts of consumers.

Social Infrastructure Project Sector

- To enable setting up of more schools, hospitals and other social infrastructure projects, govt. will start providing increased Viability Gap Funding (VGF) for private players with an outlay of Rs. 8100 crore. This raised VGF will boost private investment in health and education sector.

Space Sector

- Private sector will get access to ISRO assets. The central govt. will bring predictable policy for private players to get access to space area.

- The govt. is going to provide a level playing field for private companies which means that private companies can now participate in planterary exploration, outer space exploration, launching satellites and other space activities.

- Moreover, govt. will provide access to remote sensing data to private startups.

Atomic Energy Sector

- Research reactor would be established in public private partnership (PPP) mode for production of medical isotopes for cancer.

- The govt. is also focusing on establishing facilities in PPP mode to use irradiation technology to prevent perishable crops to get rotten.

- In addition to this, the central govt. will setup various Technology cum Incubation Centres.

Reforms made by Modi Government from 2014-2020

The following are the reforms which are made by the Modi led Indian government in past 6 years:-

1) Direct Benefit Transfer (DBT)

2) Goods and Services Tax (GST)

3) Insolvency Bankruptcy Code (IBC)

4) Starting of UPI platforms

5) Ease of Doing Business Reforms

6) Public Sector Bank reforms

7) Direct Taxation reforms

8) Power sector reforms

9) Coal sector reforms

10) Empowered group of Secretaries Constituted

11) Budget development cell to be constituted

Various policy reforms had been made by the central government to fastrack investment such as ranking of states on investment attraction, promotion of champion sector such as solar PV, advance battery manufacturing cells among others. The Make In India initiative was launched to promote local production of goods. Govt. had also focused on upgradation of industrial infrastructure, 3376 industrial parks which are setup in 5 lakh hectares would now be mapped. The govt. will ease down the process of providing land passes to industries as all industrial parks would be mapped. The issue of connectivity would be resolved and common infrastructure development would be improved.

For more details on 4th tranche of Atmanirbhar Bharat Abhiyan Package, click the link below:-

http://164.100.117.97/WriteReadData/userfiles/AatmaNirbhar%20Bharat%20Full%20Presentation%20Part%204%2016-5-2020.pdf

5th Economic Dose under Atmanirbhar Bharat Abhiyan (17 May 2020)

FM Nirmala Sitharaman has announced the 5th economic dose under Atmanirbhar Bharat Abhiyan on 17 May 2020. Check out the complete details here:-

Health Related Steps for COVID-19

Till date, govt. has announced various health related steps of around Rs. 15,000 crore for COVID-19 containment.

- Already announced (Rs. 15,000 crore) – Out of this 15k crore, around 4113 cr have been released to states, essential items have been purchased worth Rs. 3750 cr, testing lans and kits worth Rs. 550 crore. Moreover, govt. has provided Insurance cover of Rs. 50 lakhs per person for health professionals under the flagship Pradhan Mantri Garib Kalyan Yojana.

- Use of Information Technology – In order to leverage IT, govt. has roll out e-Sanjeevani Tele Consultation Services. To ensure capacity building, iGOT platform has been launched. Moreover, Aarogya Setu App and Aarogya Setu Mitr website has also been launched to prevent Indian citizens from Coronavirus.

- Protection to Health Workers – The central govt. has made amendment in Epidemic Diseases Act, adequate provisions for PPEs. There are now more than 300 domestic manufactures (from 0 earlier). Govt. has already supplied 51 lakh PPEs, 87 lakhs N95 masks, 11.08 Cr HCQ tablets.

Health Reforms & Initiatives

Now there would be increased investments in Public Health sector and public expenditure on health will be increased.

- There would be more investments in grass root health institutions and govt. will ramp up health and wellness centres in rural and urban areas.

- To prepare India for any future pandemics, govt. will setup Infectious Diseases Hospital Blocks in all districts.

- Lab network and surveillance would be strengthened. There would be Integrated Public Health Labs in all districts & block level

Labs & Public Health Unit to manage pandemics. - Moreover, govt. will encourage research by creating National Institutional Platform for One health by ICMR.

- The central govt. will start Implementation of National Digital Health Blueprint under National Digital Health Mission.

Online Education for Students during COVID-19

Here is the list of various technology driven systems for online education during Coronavirus (COVID-19) lockdown:-

- 12 More SWAYAM PRABHA DTH channels – In order to support and reach those who do not have access to the internet, govt. started 3 SWAYAM PRABHA DTH channels for school education. Now another 12 SWAYAM PRABHA DTH channels (1 for each class) to be added.

- The govt. has made provision for telecast of live interactive sessions on these channels with experts from home through Skype.

- Govt. also tied up with private DTH operators like Tata Sky & Airtel to air educational video content to enhance the reach of these

channels. Central govt. has made coordination with states of India to share air time (4 hrs daily) on the SWAYAM PRABHA channels to telecast their education related contents. - Till date, DIKSHA platform has had 61 crore hits from 24th March 2020 till date. More 200 new textbooks added to e-Paathshaala.

PM eVIDYA / DIKSHA / Manodarpan Initiatives for Education Post COVID-19

After COVID-19, govt. will focus on technology driven education system with equity. For this purpose, the following measures are announced:-

- PM eVIDYA – A programme for multi-mode access to digital/online education to be launched immediately. This PM E-Vidya Scheme will comprise of the following measures:-

- One Nation One Digital Platform – DIKSHA for school education in states/UTs. E-content and QR coded Energized Textbooks for all grades.

- One Class One Channel – One earmarked TV channel per class from 1 to 12.

- Extensive use of Radio, Community radio and Podcasts

- Special e-content for visually and hearing impaired.

- Top 100 universities will be permitted to automatically start online courses by 30th May, 2020.

- Manodarpan – An initiative for psychosocial support of students, teachers and families for mental health and emotional well-being to be launched immediately.

- New National Curriculum and Pedagogical framework for school, early childhood and teachers will be launched. This would be integrated with global and 21st century skill requirements.

- National Foundational Literacy and Numeracy Mission for ensuring that every child attains Learning levels and outcomes in grade 5 by 2025 will be launched by December 2020.

Reforming Governance for Ease of Doing Business

Globally, all the potential investors look at a country’s Doing Business Report (DBR) ranking. To improve DBR ratings of India, the govt. has taken various measures:-

- The govt. has taken sustainable measures which have resulted in steadily improving India’s position in World Bank’s DBR rank from 142 in 2014 to 63 in 2019.

- To get better DBR rating, govt. has streamlined processes such as granting of permits and clearance, self-certification and third party certification etc.

- Government is working on a mission mode on the next phase of Ease of Doing Business Reforms. These includes measures relating to easy registration of property, fast disposal of commercial disputes and simpler tax regime for making India one of the easiest places to do business.

Recent Corporate Law measures for Ease of Doing Business

The following Corporate Law measures are now taken to boost Measures for Ease of Doing Business:-

- Decriminalization of Company Law Defaults 2018 (1st Phase) – In the first phase of decriminalization of Company Law defaults in 2018, 16 compoundable offences were shifted to an in-house adjudication & penalty mechanism.

- Integrated Web based Incorporation Form – A new and simplified proforma for Incorporating Company Electronically Plus (SPICe+) introduced which extends 10 services of different Ministries and one State Government through a single form.

- Databank of Independent Directors launched

- Withdrawal of more than 14,000 prosecutions under the Companies Act, 2013.

- Rationalization of Related Party Transaction related provisions.

- Timely Action during COVID–19 to reduce compliance burden under various provisions of the Companies Act 2013 as well as enable Companies conduct Board Meetings, EGMs & AGMs, Rights issue by leveraging the strengths of Digital India.

- In 221 resolved cases, 44% Recovery has been achieved since inception of IBC, 2016. This includes admitted claims amount to Rs. 4.13 lakh crores while realizable amount is Rs. 1.84 Lakh crores. Under IBC, 13,566 cases involving a total amount of Rs. 5.01 lakh crores (approx.) have been withdrawn before admission under provisions of IBC till 29th Feb 2020.

Rs. 40,000 Cr Increase in MGNREGA Allocation for Employment Boost

The central govt. will now allocate an additional amount of Rs. 40,000 crore under MGNREGS Scheme:-

- This will help in generating nearly 300 crore person days in total under Mahatma Gandhi National Rural Employment Guarantee Act.

- The govt. is addressing the need for more work including returning migrant workers in Monsoon season as well.

- Creation of larger number of durable and livelihood assets including water conservation assets to boost rural economy through higher production.

Decriminalisation of Companies Act Defaults

Decriminalization of Companies Act violations involving minor technical and procedural defaults (shortcomings in CSR reporting, inadequacies in board report, filing defaults, delay in holding AGM). The following measures would also be taken:-

- Majority of the compoundable offences sections to be shifted to internal adjudication mechanism (IAM) and powers of RD for

compounding enhanced (58 sections to be dealt with under IAM as compared to 18 earlier). - The Amendments will de-clog the criminal courts and NCLT.

- 7 compoundable offences altogether dropped and 5 to be dealt with under alternative framework.

Other measures includes Ease of Doing Business for Corporates, Public Sector Enterprise Policy for a New and Self-reliant India, Supporting State Governments & promoting state level reforms and further enhancement of Ease of Doing business through IBC related measures. For more details on 5th tranche of Atmanirbhar Bharat Abhiyan Package, click the link below:-

http://164.100.117.97/WriteReadData/userfiles/Aatma%20Nirbhar%20Bharat%20%20Presentation%20Part%205%2017-5-2020.pdf

Atmanirbhar Bharat Abhiyan 3.0 (Update As on 13 November 2020)

Finance Minister Nirmala Sitharaman has announced new measures in the series of stimulus announcements the government has been doing since the onset of the coronavirus crisis in the country. While addressing the press briefing Sitharaman said that the country is showing good signs of a strong recovery from the downtrend in the economy. Atmanirbhar Bharat Abhiyan 3.0 which is the 3rd tranche under the Aatm Nirbhar Bharat Economic Package has been launched. The size of the stimulus being provided by the government, as part of the 12 announcements made today under Aatmanirbhar Bharat 3.0, amounts to Rs 2.65 lakh crores. This equals to 15% of national GDP as stimulus takeaway whose important points are as follows:-

- Rs. 900 crores provided for COVID Suraksha Mission for research and development of the Indian COVID vaccine to the Department of Biotechnology.

- Rs. 3,000 crores will be released to EXIM Bank for promotion of project exports through Lines of Credit under IDEAS Scheme. Supported projects cover Railways, power, transmission, road and transport, auto and auto components, sugar projects etc.

- An additional outlay of Rs 10,000 crores will be provided for PM Garib Kalyan Rozgar Yojana in the current financial year, to boost rural employment.

- 10 new Champion sectors will now be covered under the Production Linked Incentives Scheme to boost the competitiveness of domestic manufacturing. It is expected to give a significant boost to economic growth and domestic employment.

- Central govt. is launching a credit guarantee support scheme for the healthcare sector and 26 sectors stressed due to COVID19. Entities will get additional credit up to 20% of outstanding credit, repayment can be done in five years’ time (1-year moratorium + 4 years repayment).

- If new employees of a requisite number are recruited from October 1, 2020, to June 30, 2021, the establishments will be covered for the next two years.

- The existing Emergency Credit Line Guarantee Scheme extended till 31st March 2021.

- Aatmanirbhar Bharat Rozgar Yojana being launched to incentivise the creation of new employment opportunities during COVID19 recovery.

- Every EPFO registered organisations – if they take in new employees or those who had lost jobs b/1 March 1 & Sept 30 – these employees will get benefits.

- ‘Atmanirbhar Bharat Rozgar Yojana’ has been introduced as a new stimulus measure to create new employment opportunities in the country during COVID recovery phase’.

- SBI Utsav cards being distributed, under the festival advance scheme announced on 12th Oct. 11 states sanctioned Rs 3,621 crores as an interest-free loan towards capital expenditure.

- Under the Emergency Credit Liquidity Guarantee Scheme, a total amount of Rs 2.05 lakh crores has been sanctioned to 61 lakh borrowers, out of which Rs 1.52 lakh crores has been disbursed.

Markets are on a record-high and India’s foreign exchange reserves are at USD 560 billion. India has made a strong comeback economically. RBI has said that India will do better in Q4. So the mood in the country, as well as Moody’s rating for India, has improved.

Beneficiaries of Aatmanirbhar Bharat Abhiyan

The following are the major beneficiaries of Aatmanirbhar Bharat Abhiyan 2024:-

- Shramik (Labourers / Workers)

- Kisan (Farmers)

- Daily Wage Earners

- People who works for development of the country

- Middle Class people who pay income tax to the government

- Upper class people who gives strength to the economy

5 Pillars of Growth under Aatma Nirbhar Bharat Abhiyan

There are 5 basic pillars for the growth of the Aatma Nirbhar Bharat Abhiyan 2024:-

1) Economy (Quantum Jump in Economy)

2) Infrastructure

3) Our System (21st century Technology Driven System)

4) Demography

5) Demand and Supply Chain

Sectors to Benefit from Aatmanirbhar Bharat Abhiyan 2024

The following sectors would be immensely benefited from the Aatm Nirbhar Bharat Abhiyan 2024:-

- Primary Sector: Agriculture Sector, Mining Sector, Fishing Sector

- Secondary Sector: Construction Sector, Manufacturing and Utilities, MSME (Micro, Small & Medium Enterprises), Cottage Industries etc.

- Service / Tertiary Sector: Retail, Tourism, Banking, Real Estate, Entertainment, Communication, Hospitality & leisure, IT services etc.

- Quaternary Sector: Public sector, Education, Research and development.

4 L Factors of Self Reliant India Campaign 2024

Here are the key factors which would be kept in mind to make 21st century of India. The main focus will be on the following four key factors (4 L’s):-

- Land

- Labour

- Liquidity

- Laws

The global value chain integration would be done to turn local brands into global brand.

Govt. Initiatives in Past 6 years for Aatm Nirbhar Bharat

The central govt. had already taken various initiatives to make India self reliant in the past 7 years which are as follows:-

- Poor People – Various schemes like Swachh Bharat Abhiyan, Ayushman Bharat Yojana, DBT based reforms, Jan Dhan Accounts, Micro insurance schemes, PM Awas Yojana, PM Ujjwala Yojana.

- Farmers – PM Fasal Bima Yojana, PM-Kisan Yojana, Creating new Fisheries department, PM Krishi Sinchai Yojana.

- Businesses – Public sector bank recapitalization, PSB merging, FDI, Ease of busineess reforms, GST reforms.

- National Reforms – Airport privatization, Power sector reforms, 175 GW of Solar targets, Cleaning up of mining sector.

Total Allocation for Atmanirbhar Bharat Abhiyan

Here is the total allocation of money under the flagship Atmanirbhar Bharat Abhiyan 2024:-

| Description | Cost in Crores |

|---|---|

| Reserve Bank of India (RBI) Measures | 8,01,603 |

| Tax Concessions from 22 March 2020 | 7,800 |

| Pradhan Mantri Garib Kalyan Yojana | 1,70,000 |

| PM Modi’s Announcement for Health Sector | 15,000 |

| Emergency W/C facility for businesses including MSMEs | 3,00,000 |

| Subordinate debt for stressed MSMEs | 20,000 |

| Fund of Funds for MSMEs | 50,000 |

| EPF Support for Business and Workers | 2,800 |

| Reduction in EPF Rates | 6,750 |

| Special Liquidity Scheme for NBFC / HFC / MFI | 30,000 |

| Partial Credit Guarantee Scheme 2.0 for liabilities of NBFCs / MFIs | 45,000 |

| Liquidity Injection for DISCOMs | 90,000 |

| Reduction in TDS / TCS Rates | 50,000 |

| Free food grain supply to stranded migrant workers for 2 months | 3,500 |

| Interest subvention for MUDRA Shishu loans | 1,500 |

| Special credit facility to street vendors | 5,000 |

| Housing CLSS-MIG | 70,000 |

| Additional Emergency Working Capital through NABARD | 30,000 |

| Additional Credit through KCC | 2,00,000 |

| Food Micro Enterprises | 10,000 |

| Pradhan Mantri Matsya Sampada Yojana | 20,000 |

| TOP to Total: Operation Greens | 500 |

| Agri Infrastructure Fund | 1,00,000 |

| Animal Husbandry Infrastructure Development Fund | 15,000 |

| Promotion of herbal cultivation | 4,000 |

| Beekeeping Initiative | 500 |

| Viability Gap Funding | 8,100 |

| Additional MGNREGS Allocation | 40,000 |

| Total Allocation | 20,97,053 |

Frequently Asked Questions (FAQ’s)

1) What is Aatma Nirbhar Bharat Abhiyan?

Aatma Nirbhar Bharat Abhiyan or Self Reliant India campaign is a new initiative of the Modi led Union government of India to make India self dependent. The main objective is to make India a manufacturing hub which is enable to meet its own requirements and produce it for others also. In simple words, India must become major exporter of goods and services rather than importer of things.

2) What are the main factors to be considered?

In this initiative, the govt. will focus on economy growth, infrastructure development, improvement in system, demography and demand-supply chain.

3) What is the assistance amount provided by the Modi govt.?

For this Aatmanirbhar Bharat Abhiyan, Indian govt. will provide assistance amount of Rs. 20 lakh crore for various sectors. This amount is approx. 10% of the total India’s GDP.

4) What is the need to start this Self Reliant India Campaign?

As the coronavirus pandemic crisis is ongoing, the world’s economy including India is on a slowdown and has witnessed great downfall. Major countries across the world are in lockdown to tackle COVID-19 spread. Indian government has also imposed a nation-wide lockdown in which all the industries, factories, shops are closed and so economy is on downfall. So to revive Indian economy amid COVID-19 crisis, govt. has decided to provide assistance under Self Reliant India campaign.

5) Is there any particular sector to benefit the most?

All the sectors as mentioned above would be benefited so that the entire Indian economy could get a boost. The main focus would be on improvement in land issues, labour, liquidity support and laws. This Atmanirbhar Bharat Campaign will put India’s economy back on track and would also lessen the risk of job loss.

6) Who are the major beneficiaries of Aatma Nirbhar Bharat Abhiyan?

The farmers, labourers, construction workers, middle class people, public sector workers, upper class people and all those who works hard for growth of economy would be the major beneficiaries.

Here is complete list of government schemes and initiatives taken by central govt. & state govt’s to tackle Coronavirus (COVID 19) pandemic, check state wise list of yojana and steps taken by various state governments as PM Modi announced complete lockdown in India. Coronavirus or COVID 19 is a pandemic declared by World Health Organization (WHO) which is taking lives of so many people and is originated from Wuhan, China. PM Modi led central govt. and respective state governments are declaring government schemes and initiatives for tackling Coronavirus (COVID 19).

People can now check the complete list of Government Schemes and Initiatives to fight Coronavirus in state wise manner. CM’s of various states have announced Lockdown and announced various initiatives to prevent worsening of this situation. In this post, we will give you the detailed information of how various state govt. along with central govt. are taking measures to prevent this Novel Coronavirus outbreak.

Central Government

PM Garib Kalyan Yojana Package of Rs. 1.7 Lakh Cr – FM Nirmala Sitharaman has announced Pradhan Mantri Garib Kalyan Yojana Package of Rs. 1.70 lakh crore. This initiative will cover a new PM Garib Kalyan Ann Yojana as well as other initiatives for farmers, Rs. 500 per month to women Jan Dhan Account holders, poor people, loans to Women SHGs, ex-gratia to widow / old-age / disabled pensioners, MGNREGA workers, PM Ujjwala Yojana beneficiaries. The details of the scheme can be checked using the link – Pradhan Mantri Garib Kalyan Yojana

SBI to provide lifeline emergency credit to coronavirus-hit borrowers – State Bank of India (SBI) will provide emergency loans to fexisting borrowers whose operations are impacted by Coronavirus 2019 (COVID 19) at 7.25% p.a fixed rate of interest. This ad-hoc loan facility is named as COVID 19 Emergency Credit Line (CECL) to meet temporary liquidity mismatch arising out of covid-19. The scheme will be in force upto June 30, 2020 and max loan amount is Rs. 200 crore. All standard accounts as on March 16, 2020 and till the date of sanction are eligible. However, standard accounts classified as Special Mention Accounts – SMA 1 (overdue between 30-60 days) and SMA2 (overdue between 61-90 days) are not eligible for availing credit facility. This loan facility shall be made available as Fund Based Limits only. The loans will be repayable in six equated monthly installments after a moratorium period of six months from the date of disbursement of the loan.

DBT to PM Kisan Beneficiaries – The central govt. has transferred Rs. 5,125 crore amount through Direct Benefit Transfer to bank accounts of 8 cr PM Kisan Samman Nidhi Yojana beneficiaries.

Production Linked Incentive (PLI) Scheme for Promotion of Domestic Manufacturing – Central govt. approves sum of Rs. 6,940 crore for PLI scheme. This scheme will boost domestic manufacturing and attract large investments in mobile phone manufacturing and specified electronic components including Assembly, Testing, Marking and Packaging (ATMP) units. PLI Scheme is going to raise incremental sales of Rs. 46,400 crore and significant additional employment generation over 8 years.

Scheme to Boost Manufacturing of APIs & Medical Devices in India – The central govt. approved package to tackle Coronavirus with an outlay of Rs. 13,760 crore. This scheme will boost domestic production of bulk drugs (9,940 cr) and medical devices (3,820) in the country as well as exports.

Scheme on Promotion of Bulk Drug Parks – Cabinet approves Rs. 3,000 crore for next 5 years for Scheme on Promotion of Bulk Drug Parks to finance common infrastructure facilities in 3 bulk drug parks.

Vivad Se Vishwas Scheme Interest / Penalty Waived – The government has extended the deadline for settling tax disputes under the Vivad se Vishwaas scheme without paying any interest and penalty to 30 June 2020 from March 31, 2020.

Aadhar-PAN Linking Date Extended – The central govt. has extended the last date for linking of aadhaar card with PAN Card till 30 June 2020.

Filing Income Tax Return (ITR) Deadline Extended – The government has also extended the deadlines for filing income tax return (ITR) for FY 2018-19 to June 30, 2020 from current 31 March 2020 deadline. For FY 2018-19, delayed payment for tax payments have been reduced from 12% to 9%. No extension, for delayed TDS deposit has been reduced from 18% to 9%.

No Minimum Balance for Bank Account – In order to avoid mass gatherings at bank, govt. has announced that people are not required to maintain any minimum balance in their bank accounts. This decision would be applicable to all banks in India. In case a person does not have minimum balance in their bank accounts, then no interest would be charged for this period.

Unlimited Transactions from Other Bank ATMs – People can now withdraw money from nearby ATMs without any hassle irrespective of banks. There is no charge levied on transactions from other bank ATMs.

Interest Subsidy on Crop Loans for Farmers – In order to ensure that farmers do not have to face the situation of paying penal interest and they can continue getting the benefit of short term crop loans at a 4% interest rate. The central government has decided to further to continuity the availability of 2% interest subvention to banks and 3% prompt repayment incentive to farmers.

Odisha

Odisha to Provide Rice to 5 Lakh Poor People – Food Supply and Coronavirus welfare department approves inclusion of 5 lakh new beneficiaries under Odisha Food Security Scheme. In this scheme, govt. will provide rice at subsidized price of Rs. 1 per Kg to poor people.

Odisha Accommodation / Food / Medical Care initiative – The state govt. will develop quarantine facilities and arrange temporary accommodation, food and medical care for the people sheltered in quarantine camps. Odisha govt. will also setup additional testing labs and procure essential equipment to deal with the situation.

Dry Ration To Students – School and Mass Education department announced that dry ration will be given to students of Class 1st to 8th of government and government aided schools for next 90 days. For Class 1st to 5th, dry ration of 3 kg rice per month would be given. For Class 6th to 8th, dry ration of 4.5 kg rice would be given through Fair Price Shops / PDS outlets. For this purpose, headmaster of each school will give a coupon to parents/ guardians certifying that the student is a bonafide student of the school.

Bihar

Old Age / Widow / Disabled Pension for Next 3 months in advance – CM Nitish Kumar announced that all pension holders covered under schemes like Mukhyamantri Vridhjan Pension (Old Age), Divyang Pension (Persons with Disabilities) and Vidhwa (Widow) Pension Scheme would be paid pension amount of next 3 months in advance.

Incentives to Govt. Doctors & Health Employees – All the government doctors and health employees will be paid an incentive equivalent to their one month’s basic pay.

Rs. 1,000 to All Ration Card Holder Families – All ration card holder families will get one month’s ration free of cost. Rs. 1,000 per family will be given to all ration card holder families residing in all lockdown areas. This amount will be transferred through the Direct Benefit Transfer (DBT) Scheme.

Bihar Corona Tatkal Sahayata App – All those Biharis who are stuck outside the state in other parts of the country will now get Rs. 1,000. For this purpose, people needs to make registration at Bihar Corona Tatkal Sahayata App. Accordingly, govt. will transfer the amount into their bank accounts through DBT mode from CM Relief Fund.

Delhi

Free Ration for PDS Beneficiaries – All beneficiaries under public distribution system (PDS) will get free and additional ration for one month. Around 18 lakh families will be covered under the scheme.

Free Ration to Delhi Ration Scheme Beneficiaries – Delhi govt. will provide 50% more quantity i.e 7.5 kg instead of fixed quota of 5 kg free rations to 72 lakh beneficiaries attached to Delhi Ration Scheme for 1 month. The ration will be provided free of cost. Delhi govt. has started transporting 7.5 kg of extra ration for the city’s 7.2 million beneficiaries through its fair price shops. Till date, around 1,000 fair price shops have been covered while remaining 2,300 fair price shops would be covered soon (expected till 31 March 2020).

2 Times Free Food to Homeless at Night Shelters – The state government will also provide free food twice a day to homeless at night shelters. This offer would not be restricted to occupants of those facilities. Free Lunch and Dinner would be given at 220 night shelters for each person.

Widow / Disabled / Old Age Pension Amount Doubled – The state govt. has doubled the pension amount for widow, old age and disability pension scheme. Delhi government on 28 March 2020 started disbursing old-age pensions for nearly half-a-million beneficiaries at twice the usual rate for the current month. For people above 65 years age, who are entitled a monthly pension of around Rs. 2, 250 under a government scheme, the amount had been doubled to around Rs. 4,500 for the present month.

Rs. 5,000 to Construction Workers – The state govt. of Delhi will now provide Rs. 5,000 to each construction worker to enable them to sustain their livelihood.

Kerala

Medical Assistance to SC / ST Person – In case any SC / ST person is put under surveillance, essential medical assistance will be given through district administration or local self-governments.

Protein Rich Food Kits to Senior Citizens in Tribal Areas – All the individuals in tribal settlements who are above 60 years of age, will be given special protein-rich food kits. The kit will contain 500 grams of beans, 500 grams Bengal grams, 500 grams jaggery, 500 grams coconut oil and 2 kilograms of wheat. Those who lose their jobs will be ensured jobs under the MGNREGA Scheme.

Free Ration Scheme – The state govt. has provided free ration to 14.5 lakh beneficiaries on first day (2 April 2020) of ration distribution. The total quantity of rice distributed on a single day equals 21,472 metric tons. Health workers and representatives in local bodies intervened effectively in this process. Free ration distribution to continue till 20 April 2020. Strict action will be taken if there is any non-congruence in the quantity of rice supplied. Arrangements have been made to deliver rice at the homes of Endosulfan victims.

Uttar Pradesh

Cash Transfer for MGNREGA workers – UP govt. has transferred Rs. 611 crore into 27.5 lakh bank accounts of MGNREGA workers on 30 March 2020.

Rs. 1,000 p.m to Daily Wage Workers – Rs. 1000 each will be given to 15 lakh daily wage labourers and 20.37 lakh construction workers to help them meet their daily needs in UP. This financial aid would be provided to 35 lakh daily wage workers under Shramik Bharan-Poshan Yojana.

Free Ration to Antyodaya Scheme Beneficiaries – Free ration which includes 20 kg of wheat and 15 kg of rice is to be provided to more than 1.65 crore beneficiaries of Antyodaya Scheme.

Disbursement of Quarterly Pension to Old Age / Widow / Disabled – The state govt. of UP will start disbursement of quarterly pension to 83.83 lakh old age, widow and persons with disabilities.

Gujarat

Free Ration – Around 60 lakh ration card holders in Gujarat will now get free food items to ensure poor people not remain hungry during COVID-19 lockdown.

Tamil Nadu

Rs. 1,000, Free Rice, Sugar to All Ration Card Holders – The state govt. will provide Rs. 1000 to all ration card holders, free rice, sugar and other essential commodities. In order to avoid long queues, all the commodities will be issued on a token basis as announced by Tamilnadu CM Edappadi K Palaniswami.

1 Month Extra Salary – TN govt. will provide 1 month extra salary to doctors, nurses and all those who attend to Coronavirus patients.

COVID Relief and Development Scheme – This scheme will benefit around 2,000 MSME units who have availed loans from the Tamil Nadu Industrial Investment Corporation (TIIC). The scheme would be implemented with a fund of Rs. 200 crore.

Moratorium for Crop / House Loans – Moreover, CM has also announced 3 month moratorium (till June 30) for repayment of installments for crop loans, house loans etc. and payment of certain charges for the following categories:

- Payment of wealth tax, water tax to local bodies

- Repayment of instalments for the crop loans availed from cooperative institutions

- Repayment of instalments for cooperative housing societies and Tamil Nadu Housing Board

- Repayment of instalments for the loans availed from all fishermen cooperative societies and handloom cooperative societies

- Repayment of loans availed by MSME units from Tamil Nadu Industrial Investment Corporation

- Repayment of soft loans availed by industrial units from SIPCOT

- Payment of Maintenance Charge by industrial units which function in SIPCOT Industrial Parks

- Renewal of Licence and FC for Vehicles

- Renewal of licences under Weights and Measures Act, TN Shops and Establishment Act and Dangerous and Offence Act

Chhattisgarh

2 Months Free Rice to All Ration Card Holders – CG govt. has decided to provide 2 months free rice to all ration card holders. Each family will get 35-35 kg rice absolutely free of cost to sustain their life during “complete lockdown” in India till 14 April 2020.

Jharkhand

CM Kitchen Scheme – Jharkhand CM Hemant Soren starts CM Kitchen Scheme in Ranchi. In this scheme, govt. will serve food to 5,000 people every day. Meals would be transported from the city to villages in trains.

West Bengal

Rs. 1000 for Daily Wage Labourers – The state govt. is going to provide Rs. 1,000 for daily wage workers to sustain their life during lockdown period.

Maharashtra

Cash Transfer to Daily Wage Workers – The Maharashtra government plans to provide cash transfers to labourers earning wages daily to reduce the economic harm that lockdowns will inflict on the force. Sources said that a proposal to provide direct bank transfers for construction workers and financial package for industries is being reviewed.

Meals to Poor People – The state govt. will now provide meals thali under Shiv Bhojan Yojana at just Rs. 5 for 1 lakh people daily for the next 3 months.

COVID-19 Treatment for Poor – The treatment for COVID-19 (Coronavirus) would be covered under the Mahatma Jyotiba Phule Jan Arogya Yojana (MJPJAY).

Relief Package for Dairy Farmers – Maharashtra govt. announced Rs. 200 crore relief package for dairy farmers who are facing losses with most dairies cut down on collected by 25% to 30%. The govt. will buy 10 lakh litres of surplus milk from farmers at Rs. 25 / litre. This procured milk will be converted into skimmed milk powder or ghee to be sold in the market.

Karnataka

2 Months Social Security Pension in Advance – The state govt. of Karnataka will provide social security pension of two months in advance for the poor people.

Additional Working Days Payment under MGNREGA – Karnataka govt. will release additional working days amount in advance under MNREGA scheme and two months ration will be supplied immediately.

2 Months Ration Supply for Poor – Poor people can now avail 2 months ration which would be supplied immediately to all ration card holders.

Rs. 1,000 for Construction Workers – The state govt. will provide Rs. 1,000 per person to around 21 lakh construction workers.

Loan Waiver under Badavara Bandhu Scheme – In Badavara Bandhu (interest-free loan to roadside vendors) scheme, govt. has decided to waive Rs 13.20 crore loans. This includes Rs. 9.10 crore in 2018-19 to benefit 15,120 people and Rs 5.16 crore in 2019-20 to benefit 6,500 people.

Mizoram

Free Ration – Mizoram govt. has announced to provide free ration to all the economically underprivileged families.

Haryana

Salary of Health Workers Doubled – The state govt. has doubled the salary of all health workers such as doctors, paramedical staff and asha workers.

Rs. 4,000 to MMPSY beneficiaries – The state govt. has transferred Rs. 4000 to 12.56 lakh families registered under the Mukhyamantri Parivar Samriddhi Yojana. Rs. 211.62 crore have been received under MMPSY scheme.

Madhya Pradesh

Free Ration Scheme – All those families whose name is not present in National Food Security Scheme beneficiaries will be given free ration. For this purpose, poor people who does not have ration card but comes in 25 categories of Samagra will be given 5 Kg ration absolutely free of cost.

The central govt. helpline number for corona-virus is +91-11-23978046. The state wise list of helpline numbers of states and UT’s to tackle Coronavirus are mentioned in the table below:-

| Name of the State | Helpline Nos. |

|---|---|

| Andhra Pradesh | 0866-2410978 |

| Arunachal Pradesh | 9436055743 |

| Assam | 6913347770 |

| Bihar | 104 |

| Chhattisgarh | 104 |

| Goa | 104 |

| Gujarat | 104 |

| Haryana | 8558893911 |

| Himachal Pradesh | 104 |

| Jharkhand | 104 |

| Karnataka | 104 |

| Kerala | 0471-2552056 |

| Madhya Pradesh | 0755-2527177 |

| Maharashtra | 020-26127394 |

| Manipur | 3852411668 |

| Meghalaya | 108 |

| Mizoram | 102 |

| Nagaland | 7005539653 |

| Odisha | 9439994859 |

| Punjab | 104 |

| Rajasthan | 0141-2225624 |

| Sikkim | 104 |

| Tamil Nadu | 044-29510500 |

| Telangana | 104 |

| Tripura | 0381-2315879 |

| Uttarakhand | 104 |

| Uttar Pradesh | 18001805145 |

| West Bengal | 1800313444222, 03323412600 |

| Andaman and Nicobar Islands | 03192-232102 |

| Chandigarh | 9779558282 |

| Dadra and Nagar Haveli and Daman & Diu | 104 |

| Delhi | 011-22307145 |

| Jammu & Kashmir | 01912520982, 0194-2440283 |

| Ladakh | 01982256462 |

| Lakshadweep | 104 |

| Puducherry | 104 |

For more details, please visit the official website of Ministry of Health and Family Welfare at https://mohfw.gov.in/

we also

My name is Randhir Kumar choudhary I am event Photoghepar how benefit my business to do this facility get

अभी इतनी डिटेल्स आई नहीं हैं जैसे ही इस अभियान की डिटेल्स आती हैं, हम इस पेज पर अपडेट करते रहेंगे

Main ek motor line ka worker hu mujhe iska labh kaise milega.

इसका लाभ प्रत्यक्ष और अप्रत्यक्ष रूप से सभी को मिलेगा

How can we apply for atmanirbhar loan for online because I can not found the online form please help me for this

There is no form as of yet

My name is bhavesh and I am barber can I get the loan

Yes, everyone subject to the eligibility and document requirement can take the loan

Rachna Sarovar

I am new to your audience and hit this article as my first visit, I would say you are doing fantastic work, and of course, this would be super useful.

Thank You

Widow yojana in covid Maharashtra

Good Sir

HOW IT IS GOOD, DID YOU GET THE MONEY TO REESTABLISHMENT OF YOUR BUSINESS, PLEASE CONFIRM ME ON 880883239.

OR ITS JUST FOR CHATUKARITA PURPOSE.

I am not getting befits of Govt. scheme.

whenever I am trying but it doesn’t work

where exactly should I apply for loan.

Main Ek restaurant sanchalak hun mujhe Se Kya Labh mil sakta hai

aap aone restaurant ke vistaar ke liye loan le sakte hein, MUDRA yojana ke tahat

Randheer kumar yadav

Chhattisgarh main ham log railway hai

detailing about construction labour

detailing about construction labour, what provision made by govt of india for construction labours

Labourer to get free ration for next 2 months, loan scheme would be there very soon.

me State Bank of India, Branch code 10637, Rajasthan High Court Jaipur me loan ke liya gaya. Me typist Hoon, mujhe laptop, scanner and Zerox machine ke liya loan chahiye tha. Bank ke employee Mr. khan ne yaha kahakar mana kar diya ki loan sirf sarkari nokri walo ko milta he. Now what can I do.

Nahi aisa kuch nahi hai, aap MUDRA Loan ke baare m pata kijiye… You can also apply online, details here https://sarkariyojana.com/pradhan-mantri-mudra-yojana/

can i take atam nirbhar loan , i m running confectionery shop

Gram seoni tola post mohgaon kachi teshll Lakhnadon jila seoni madhyprdeshKanahiya

hello main ek computer centre ka owner hu mujhe kis suvidha ke tahat labh mil sakta hai

Aap MUDRA Loan ke tahat apne business ke vistaar ke liye loan le sakte hain

Maine agarbatti company ke liya ek baar loan liya hai, aur one year ho chuka hai kya mai dubra le sakta hu. Mujhe loan ki bahut jarurat hai

Touch with me always

i apply for lone

I am khalid iam kerela kannur i have small scle bussiness improve bussnss forr fund pleas hlp me my mob no .919526943750

need to know about death due to covid

,what is the compensation given by company .

How to apply for aatma nirbhar loan

I want to start new setups.

Proposal: production of recombinant antigen and monoclonel antibody.

Scope: active pharmaceuticals ingredients of diagnostic industry.

Tha same platform for vaccination.

Investment: 4 to 6 crore

Competitor: 4 companies in foreign countries.

Import: more than 100cr per year.

Each product require 3 molecules to manufacture one product and there are hundreds of products belong to this category. Same platform is involved. So ,no risk involved

I WANT A LOAN TO BUILD A FARM FOR FARMING, WHAT NEEDS TO BE DONE FOR THAT

i will started my new business fish aquaculture. so i need this lone scheme.

how to try for his lone scheme

can we apply for atmanirbhar loan for online because I can not found the online form please help me for this