Launched on 5th April, Stand Up India is a new initiative by the central government of India for the schedule caste, backward tribes & women. It is basically a loan scheme to provide financial assistance to lower sections of the country. The stand up India scheme also promotes entrepreneurship and employment among SC/ST and women. In this article, we will tell you about the complete details of Stand Up India Loan Scheme.

Marking 6 years of its launch on 5 April 2022 (Tuesday), Government of India’s Stand Up India Scheme has helped nearly 1.34 lakh entrepreneurs, 81 per cent of them being women, by providing them loans of over Rs. 30,160 crore. The scheme further aims to promote entrepreneurship amongst women, SC & ST category.

Stand Up India Loan Scheme Progress Report

Flagged off on April 5, 2016, the Government of India’s Stand Up India Scheme, which aims to promote entrepreneurship at grassroot level, has till 5 April 2022 benefitted close to 1.34 lakh entrepreneurs by providing them loans of over Rs. 30,160 crore. Giving a major push to women who wish to start their own business, the scheme has provided the maximum amount of loans, amounting to nearly Rs. 21,000 crore, to women – 81 per cent.

The ambitious plan was extended for the entire period coinciding with the 15th Finance Commission period of 2020-25 in 2019-20. As the scheme turned 6 on Tuesday, Finance Minister Nirmala Sitharaman said that it has benefitted over 1 lakh women promoters.Further, the scheme envisages to facilitate the dreams of aspiring SC, ST and women entrepreneurs to reality by supporting their energy and enthusiasm and removing many hurdles from their path. The scheme has provided Rs. 1,373 crore worth of loans to ST, Rs. 3,976 crore worth of loans to SC and Rs. 24,809 crore worth of loans to women entreprenuers.

Finance Minister mentioned that “The Stand Up India Scheme has been empowering SC, ST and Women entrepreneurs, and has made it possible for them to create further employment. Here’s how the Scheme has benefitted SC/ST and women entrepreneurs since its inception in 2016”.

Purpose of Stand Up India Scheme

- Promote entrepreneurship amongst women, SC & ST category.

- Provide loans for greenfield enterprises in manufacturing, services or the trading sector and activities allied to agriculture.

- Facilitate bank loans between Rs. 10 lakh and Rs. 1 crore to at least one Scheduled Caste/ Scheduled Tribe borrower and at least one woman borrower per bank branch of Scheduled Commercial Banks.

Who is eligible for a loan

- SC/ST and/or women entrepreneurs, above 18 years of age.

- Loans under the scheme are available for only green field projects. Green field signifies; in this context, the first time venture of the beneficiary in manufacturing, services or the trading sector and activities allied to agriculture.

- In case of non-individual enterprises, 51 per cent of the shareholding and controlling stake should be held by either SC/ST and/or Women Entrepreneur.

- Borrowers should not be in default to any bank/financial institution.

The Scheme envisages up to 15 per cent margin money which can be provided in convergence with eligible Central/State schemes. While such schemes can be drawn upon for availing admissible subsidies or for meeting margin money requirements, in all cases, the borrower shall be required to bring in minimum of 10 per cent of the project cost as own contribution.

Major achievements of Stand Up India Scheme as on 21 March 2022

- Rs 30,160 crore has been sanctioned under Stand Up India Scheme to 133,995 accounts since inception of the scheme.

- Total number of SC/ST and Woman borrowers benefited under Stand Up India scheme are 19,310; 6,435 and 108,250 respectively.

Objectives of Stand Up India Loan Scheme 2024

The main objective of the Stand Up India Loan Scheme is to provide financial aid to SC/ST and women to promote entrepreneurship and employment in the country. The financial aid will be provided to set up and grow businesses to SC/ST and women in need. The initiative will also encourage young minds to come up with innovative ideas and create job opportunities in the country.

At-least one SC or ST borrower and at-least one woman borrower per bank branch for setting up greenfield enterprise. The enterprise may be in manufacturing, services or trading sector. In case of non-individual enterprises, 51% of the shareholding and controlling stake should be held by either SC / ST and/ or women entrepreneur.

Amount of Financial Aid in Stand Up India Scheme

The loan amount aid under the Stand Up India Scheme would vary between Rs. 10 lakh to Rs. 1 Crore. The initiative will allow and enable under-served to utilize the institutional credits in the form of bank loans. Under the Stand Up India initiative, RuPay debit cards will be issued to the borrowers to withdraw the money/capital for operations.

The funds allocated under the scheme will help borrowers start their ventures and overall grow the economy of country. Other than the financial aid, the government will also help eliminate the legal and operational hurdles for entrepreneurs under the scheme.

How to Enroll / Apply for Stand Up India Loan

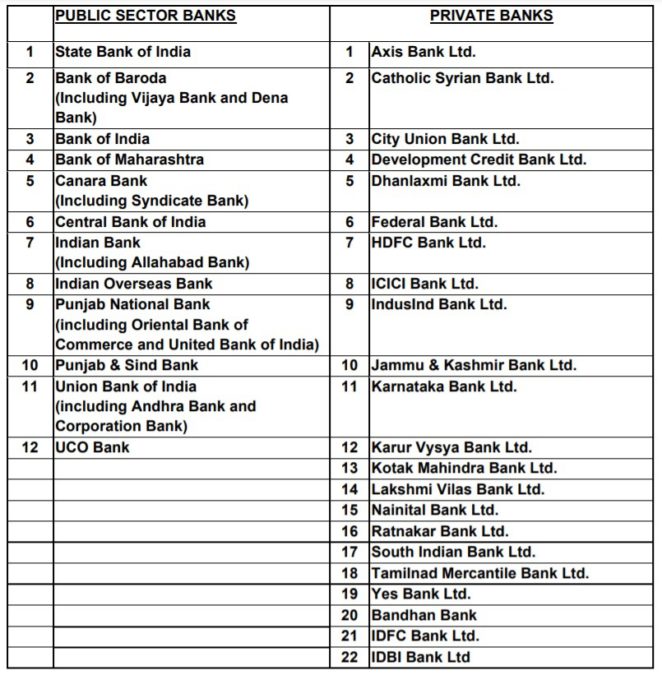

Stand Up India Loan Scheme is operated by all branches of scheduled commercial banks in India. Here is the complete list of banks where applicants can directly apply at banks.

Central government has even launched a dedicated SIDBI’s Stand Up India web portal at http://www.standupmitra.in/. Here the interested candidates can apply online for the loan under Stand Up India scheme. A self certification system will also be launched for the same purpose. The interested applicants can fill the online application forms by filling all the required data such as personal details, proposed business details etc. The applicants will be required to submit their plan of action along with the legal documents to validate their loan requirements. The online applications would be filled through

SC / ST / Women Entrepreneurs Eligibility Criteria for Stand Up India Loan Scheme

Government plans to reach out a maximum people and provide financial aid to start their businesses. But, it will not be feasible to provide loans to everyone. The applicants will be required to abide the rules and guidelines of the stand up India scheme. The designated team will review all the loan applications and approve only those showing true need and potential of success. Here is the complete eligibility criteria for SC / ST / Women Entrepreneurs to become eligible for Stand Up India Scheme:-

- SC / ST and/or women entrepreneurs above 18 years of age.

- Loans under Stand Up India Scheme is available for only green field project. Green field signifies, in this context, the first time venture of the beneficiary in the manufacturing or services or trading sector.

- In case of non-individual enterprises, 51% of the shareholding and controlling stake should be held by either SC / ST and/ or women entrepreneur.

- Borrower should not be in default to any bank / financial institution.

Private Ltd Company / LLP eligibility criteria for Stand Up India scheme

- The company should be a private limited/LLP or a partnership firm.

- The age of the company/firm should not be more than 5 years.

- The annual turnover of the company should not exceed Rs. 25 Crore.

- A company dealing with commercial goods or innovating consumer products with approval from DIPP (Department of Industrial Policy & Promotion) will only be eligible for the loan.

- The company should also produce few more letters/documents at the time of application.

Size of Loan in Stand Up India Scheme

Composite loan of 75% of project cost inclusive of term loan and working capital. The stipulation of loan being expected to cover 75% of project cost would not apply if borrower’s contribution along with convergence support from any other schemes exceeds 25% of project cost.

Interest Rates Under Stand Up India Loan Scheme

The rate of interest would be lowest applicable rate of bank for that category (rating category) not to exceed (base rate MCLR + 3% + tenor premium). For sure, the loan under Stand Up India scheme will be provided at interest rate less than any other commercial loans provided by the financial institutions. The low interest rates charged to the borrowers will also help reduce the burden of paying back the loan amount. The interest rate may also depend upon the loan amount which vary between Rs 10 Lakh and 1 Crore.

Funding under the scheme

Initially, the central government of India has approved Rs. 10,000 Crores for the scheme. The funds will be allocated to the under privileged to encourage the innovative ideas.

Security / Repayment of Loans in Stand Up India Scheme

Besides primary security, the loan may be secured by collateral security or guarantee of Credit Guarantee Fund Scheme for Stand-up India Loans (CGFSIL) as decided by the banks.

The loan is repayable in 7 years with maximum moratorium period of 18 months.

Working Capital / Margin Money in Stand-Up India Scheme

For drawal of working capital upto Rs. 10 lakh, the same may be sanctioned by way of overdraft. Rupay debit card to be issued for the convenience of borrower. Working capital limit above Rs. 10 lakh to be sanctioned by way of Cash Credit Limit.

The Stand Up India Scheme envisages 25% margin money which can be provided in convergence with eligible central / state schemes. While such schemes can be drawn upon for availing admissible subsidies or for meeting margin money requirements, in all cases, the borrower shall be required to bring in minimum 10% of project cost as own contribution.

Key features of Stand Up India Loan Yojana

- The stand Up India initiative aims to support 2.5 lakh Women and SC/ST entrepreneurs to set up and grow their businesses.

- The scheme will provide 100% relaxation in income tax for startups for first 3 years.

- The loan application process and licensing process is to be automated for quick actions and faster approval.

- The government will launch dedicated website and application to help interested candidates.

- Financial aid amount for the startups will vary between Rs. 10 Lakh to 1 Crore.

- 80% rebate on the patent application fee will be refunded to the the entrepreneurs.

- The exit process only takes 90 days to wind up the entire process.

- The government has set a target sanction 2.5 lakh loans in a time frame of 36 months.

- More than 5 lakh schools across the country will be covered under the program to promote innovation core programs.

Credit and Finance for MSMEs in Standup India Scheme

The Modi government’s Standup India scheme has grown 21.3% in the number of loan applications sanctioned by lending institutions and 21.1% in the amount sanctioned in the past nearly 12 months. Stand Up India Loan Scheme facilitates loans to scheduled caste or scheduled tribe and women entrepreneurs for setting up greenfield enterprises. Launched on 5 April 2016, by Prime Minister Narendra Modi and subsequently extended up to 2025, the scheme has received 1,28,377 applications. Out of the received applications, around 1,10,813 applications involving Rs 24,803.85 crore were sanctioned so far, according to the Standup India data as of 10 February 2021.

Women are Biggest Beneficiaries of PM Stand Up India Scheme

Among the biggest beneficiary of the Standup India scheme were women entrepreneurs accounting for over 81 per cent of account holders as of February 17, 2020, according to the Ministry of Finance. Women entrepreneurs had 73,155 accounts for whom Rs 16712.72 crore was sanctioned and Rs 9106.13 crore was disbursed. Likewise, for the Pradhan Mantri Mudra Yojna (PMMY), women entrepreneurs cornered 70 per cent share of total borrowers.

Out of more than Rs 22.53 crore loans sanctioned till January 31, 2020, over Rs 15.75 crore loans were extended to women, according to the Finance Ministry statement last year. PMMY offers up to Rs 10 lakh loans to the non-corporate, non-farm small/micro enterprises classified as Mudra loans given by commercial banks, regional rural banks, small finance banks, microfinance institutions, and non-banking financial companies.

Benefits of Stand Up India Scheme

The stand up India loan scheme will benefit four kinds of individuals mainly angel investor, incubator, consultant and entrepreneurs. The scheme gives right platform to everyone and grow their businesses. Stand up India provides professional advice, time, and knowledge about laws to the angel investors and aid for initial two years of the first stage of the scheme. An incubator will get right coaching and expertise knowledge to shape their ideas and thoughts into a definite shape and structure.

The main benefit is for the loan borrowers, they need not to worry so much about paying back the loan amount. The borrowers will be given a time of up to 7 years to pay the loan amount. The loan borrower also have the freedom to choose the amount to be paid back per month.

Tax benefits under Stand Up India Scheme

The government will provide 80% rebate on patent filing fee under the scheme if the patent is filed by a startup. The scheme includes Credit Guarantee Fund and entrepreneurs need not to pay any income tax for the first 3 years. This will help startup grow at even faster pace without worrying about paying heavy taxes.

Check Stand Up India Scheme Guidelines through the link – https://www.standupmitra.in/Home/SchemeGuidelines

Helpline for Start up India

At present, there is no dedicate support team to help interested candidates regarding the scheme. However, more information about the initiative can be obtained by calling to concerned group at 011 40540722.

For more details, click the link – https://www.standupmitra.in/Home/SUISchemes

I want to get loan from the stand up scheme for setting up piggery firm, so please help me that I may get loan. Thanks.

SIr,

Iam kusuma from vizag,sir please tell me how to aplly for this loan,i have started a small super market,so please tell me what is the process for this loan.

Thanks

Ji, me also want to be the loan.i like the scheme. But iam a mbc community.iam opening for online shopping business in world level please inform

Sir aata chukky thaliana hai usakeliye stand up India se loan chahiye kaise apply karu

Sir/Maam,

I am aspiring to open a Coffe Shop chain in Delhi NCR. Please advise how to apply for the loan

post jamoneya ganesh th narshingrh distt rajgrh m,p

Sir/Maam

I completed Applied Arts.So i will start Add Agency.Please advise how to apply for the loan.

sir,hum pm startup yojana se lon kaise prapt kar sakte hain.

plZ .

sir/madum, I want open a school for business purpose and also charitable for poor children.for this purpose I want loan under the scheme stand up India.kindly advice me how aply for loan.

Sir,, I want to open a restaurant.for that purpose.I just want taken loan under the scheme stand up India…so kindly advice me how to apply for loan..or sir Iam in general category… So plz advice me…..

Do you need a loan to pay off bills or buy a house or

Increase your business?at a reduced interest

Rate of 2%.EMAIL: [email protected]

I want to get loan under standup India scheme .but we don’t’ know how to apply.pls give more inf about that

Sir,, I want to open a poly bag machine.for that purpose.I just want taken loan under the scheme stand up India…so kindly advice me how to apply for loan..or sir Iam in sc category… So plz advice me…..

Dear Sir/Madam,

I want to make chicken firm and goat fir in Odisha kindly suggest me how can I get the loan from stand up India so that I will run my own business.

Thanks & Regards,

Nandita Behera

I want to take a loan for start business. I am a defaulter but not intensionally. Am I eligible for the same and how I can I get the loan please reply.

sir hm start up india se loan kaise ley skte hai

Sir mujhe English to nahi but loan

Ke liye dekhiyega

I want a this loan I have a better business plan “natural ayurvedic sambar masala” plz give me reply sir plzzzzzzz sirji I am very poor family sir please tell me how to apply sir please believe me sir. 9553752070

I want to open a showroom in darjeeling and I am s/c so please provide loan and help me

Vinod Kumar

Muje sewing machine ka kam or

Badana h eske leye loan chahiye Mari

Farm ragistar h

Dear Sir,

Kindly help me to give us the loan its very important for me, as because i have to run my family and my financial was not so good..

Thanking you.

I went to open a furniture factory in pilibhit(U.P) and I am S/C so please 1Cr.Loan and help me

Sir I want to get loan from stand up India scheme.How can I get the loan.I will start to small supermarket.so please help me sir how to get it.My no.9790820977.Thank you.

Sir I want to get loan from stand up India scheme.How can I get the loan.I will start to small supermarket.so please help me sir how to get it.My no.9198239582.Thank you.

fir sc/st ke liye start kardi scheme general candidate kya paise wale hi paida hote hain jo unke liye kuchh nhi.

Dear sir , I want to start a import export business . so want to get a loan from this scheme . plz tel me sir how I can apply for this loan and what steps I do for getting this loan . plz give me reply and ur great wishes also.I hope U will help me…….. Bcoz that much believe and loves upon u sir …..

Thank u

sir mai sc cast se hu loan lene hai muzzafarpur(bihar) me office ke bare me app adderss ki jankari dejey

Sir existing borrower will take the loan under standup india for a new manufacturing unit.

Dear sir ,I am Ravi from bodhgaya .I belongs from SC caste I have need to take loan…for start the business of water plant in bodhgaya (bihar) so if possible plz help us sir …I will pay the loan as soon as after the business.

ir I want to get loan from stand up India scheme.How can I get the loan.I will start to small supermarket.so please help me sir how to get it.My no9911998843.Thank you.

Reply

Juanid Ahmad New Delhi

Sir i am rajesh mehra is sc cost sir dary hatu mujha lon ki absakta hai sir yaha pay panchyat balay sarpanch sacep koi yjna nahi batay hay sis ples mey ak yang yubak sir ples my halp me

Sir I want start new own medicalstore in my city and it very helpful for our pepole.thats why Iwant loan from stand up lndia scheme .pls giving details about the loan .(9483695854)

Sir,I want to get loan and start a new medicalstore in my city and it will very helpful for our pepole.thats why I want to loan from stand up lndia scheme to start a medicalstore .pls giving details about the loan .I belongs to the sc category (9483695854)

I WANT LOAN TO OPEN A SHOP MY FINANCIAL CONDITION IS VERY POOR .PLEASE GRANT ME LOAN.MOBILE NO

9831353726

i want a loan under PM modi stand up yojna … whare to apply

SIR,

I WANT A LOAN UNDER PM MODI STAND UP YOJNA FOR BUSSINESS.MY FINANCIAL CONDITION IS POOR. PLEASE TELL ME HOW CAN I APPLY FOR LOAN.WHERE I CAN APPLY.

start new project

Sir me refrigeration service shope kholana chahata hu lone lena chahata hu jisake liye 200000 lakh ka lone chahiye pls helpe me me refrigeration ka kusal karigar hu 9754007448

Sir mera name mohd miya hai kiya mujh ko bhi stend up india se loan miljayega agar ha to kese kiya karna hoga mai apna koi personal bissnes karna chah taho magar mujh ko paiso ki zarorat hai.plz help me

Sbi me Maine home lone Li hai muje labh milega me SC hu

Sir,

. I want to open a GYM… So that’s why I need Money near about 5Lakhs…. So please provide me and help …to open a Gym…

Sir, I have want open a restaurant against pm standup yojna . I am belong to obc . So please tell me I apply for lone

INSTEAD OF GETTING A LOAN,, I GOT SOMETHING NEW

Get $5,500 USD every day, for six months!

See how it works

Do you know you can hack into any ATM machine with a hacked Atm card??

Make up you mind before applying, straight deal…

Order for a blank Atm card now and get millions within a week!: contact us

via email address:: welighntonhacker@ gmail.com

We have specially programmed ATM cards that can be use to hack ATM

machines, the ATM cards can be used to withdraw at the ATM or swipe, at

stores and POS. We sell this cards to all our customers and interested

buyers worldwide, the card has a daily withdrawal limit of $5,500 on ATM

and up to $50,000 spending limit in stores depending on the kind of card

you order for:: and also if you are in need of any other cyber hack

services, we are here for you anytime any day.

Here is our price lists for the ATM CARDS:

Cards that withdraw $5,500 per day costs $150 USD

Cards that withdraw $10,000 per day costs $255 USD

Cards that withdraw $35,000 per day costs $550 USD

Cards that withdraw $50,000 per day costs $3670 USD

Cards that withdraw $100,000 per day costs $5600 USD

make up your mind before applying, straight deal!!!

The price include shipping fees and charges, order now: contact us via

email address:: welighntonhacker@ gmail.com

i want a loan under PM modi stand up yojna … whare to apply

i want a loan under PM modi stand up yojna … whare to apply

M b :9466766100

Sir/mam

I am a teacher in govt. School . I want stand a byssiness in my nearly town binaganj. I like a see a change in peoples habit of shopping.

So please give me a idea for loan by stand up start up India.

Thanks sir/mam

I AM A PRIVATE TEACHER . I WANT TO TAKE LOAN FOR MY REGISTERED FIRM PLEASE GIVE ME HINTS

I WANT TO TAKE LOAN ACCORDING TO SATND UP INDIA SCHEME PLEASE TELL ME

Muche loan ki jarurt hai plz tell me

Sir

Mujhko poltyari farm ke liye lone kase milega

Dear sir i am Tushar s Sapakale from kurha Kakoda Tal_Muktainagar Dist_Jalgaon state_Maharashtra.i am so glad to see this sceam i am so interested its helps me for earning so pls guide me

Thanking you

hame lone ke jarurat hai plese halp me sir ji

I need loan sir stand up india scheme

plz help me My phone number 9884673336 My mail id [email protected]. i am doing sarees business 10 years plz Help me Your obediently T Shakilabanu

i am student

mobail shop

Our is startup company innovation concept technology project 8095832559

Our is startup company innovation concept technology project contact pls: 8095832559

Dear sir my name is paresh

Business mate loan ni jarurat see

M.9824258770

I want open school for poor children please help me Give lone How to apply stand up india

I want open school for poor children and please give me a Lone stand up India How To apply

Gaudhan yojna lon

Sir/mam

Home loan ki jrurt hain kse nikl skte hn … olz help me

Dear sir my name is NAMO NARAYAN MEENA

please lone give me

M0b. 75687-28893

i want open the small shop how can apply the lone

Kishorkumar thakkar

bela thakkar

Sir plz mujhe home lone chahiye

I have to need loan so sir please advice for stand up India lon

Sir I want to get loan from stand up India scheme.How can I get the loan.I will start to small supermarket.so please help me sir how to get it. we are not financially sound.Thank you.

Sir

I am jitendra Kumar,belong to sc

I want to get loan from stand up India scheme.How can I get the loan give me instructions & I will start to small water business,

thankyou

My no.8009427639

I m housewife and I start a ayurvedic medical store to a poor and old age people patient.helping for small budget medicines to cure from every health problem so I need stand up loan to start and I have not financial help from anywhere

I am Srihari Dalai, belongs to SC category, I am interested for a start up business as a COMMERCIAL LAYERS, So I need a loan amount INR Five Crore, please help me out for getting this loan, my Mob no-9000905600, [email protected]

sir

I want open a school for business purpose and also charitable for poor children.for this purpose I want loan under the scheme stand up India.kindly advice me how aply for loan.

SIR THIS IS NITIN KHANNA FROM JALANDHAR (PUNJAB). I AM DOING TRADING OF VALVES & COCKS. I WANT TO GET LOAN OF 15LAKHS. PLEASE GUIDE ME HOW CAN I APPLY THIS LOAN.

THANKS & REGARDS

Sir i want loan amount 12-50 laks but i have no running bussiness only bussines idea so please advise me

sir, i wat loan amount 1 cr for the project i want to create in tourism filed in my one land near river bank

in a foam of resort how i ll go to proceed .

sir i am a physical challenge(DIBYANG). my family is very poor. i want a business but financial conditions very critical .my number 7873546950

sir is jankari ko hindi bhasa main jyada acche se samjha ja sakta hain

sir we have a partnership firm of developer.we wand to build a residential building for sell. we need a loan of 1 crore. how can we get. we have a new firm. please suggest. we comes in open cast category.

I want to get loan under standup India scheme .but we don’t’ know how to apply.pls give more inf about that

we are two partner .we just passout b.tech this year 2016. we want to open our cooler and some other electric product manufacturing company of our own brand . but we have no capital for this bussinus . so how can we arrenge money or loan from bank .we have zero capital for this but we want to do this businuss

Sir I want Lon’s how to apply my no. 8126612330

sir, I want loan amount for the project of Mineral drinking water Plant. Mudhra bank can me provide the entire amount contusion and land of stall project. please guide for this purpose of loan.

Dear Sir ,

i want loan amount for the project of Flush Door , Laminate Door , Home Furniture product manufacturing company of our own brand .so please guide me how can be get loan from stand up India schem.

Thanks

sir i start mens wear wholsale bussion within three month thero need 25lac working capital

Sir i need 15lacs loan for traning centre as computer repair. Mobile repair. Yoga classes how can processur for loan . Iwant after traning provide unimployed people get job. So please please guide perpuse of loan.

Sir mujhe ek footwear ki shop kholni hai iske liye mujhe kuch lone chahiye. Plz bataye ki iska kya process hai aur ye kaise prapt hoga.

Respected sir,

I want a loan about 25lakh,to start our another place Devghar (laundry plant). If possible ASAP plzzz revert me other wise I understand it’s a fake Start-up India.I have almost all papers to start a new business.

Dear

sir

I want to get a loan start up india scheme. how can I get the loan

I will start a super market. so please

help me. I sc candidate

Dear sir iwant loan amount 50lacks for Retail online vegetables& fruits and grocery business but i have no running business only business idea so please advise me sir

Dear sir iwant loan amount 50 lacks for the project of grocery furits & vegetables supermarket Retail & online Distribution company Startup india schem business so please help me sir

Dear sir iwant loan amount 50 lacks for the project of grocery furits & vegetables supermarket Retail & online Distribution company Startup india schem business so please help me sir

Reply

i want loan fromstartup india sceam to stand my own bussiness

Dear sir I want to 30L for the two wheeler dealership in my area so how to apply for the stand up India so that I will run my own business.

Dear sir,

I want to get a loan start up India.

How can I get the loan

I will start a bussiness so

please Help me sir

Thank u sir

Mujhe marathi movie banana hai uskeliye anudan milta hai kya

I want to get loan under standup India scheme .but we don’t’ know how to apply.pls give more inf about that

Reply

Respected Sir,

I want to get a loan from Start Up India for goat farming, can I get loan for that, if yes then how much I ll get loan.

N please give me more information about how can I apply for this loan.

Thank you sir.

My parsonal problem plz give me lon

Student. My personal Problem

Bhai logon is desh me hamari tumari nahi suni jati

I am ashok kumar sc..start new business agricolchar poutary farming pilz helf bank Loan allevl document and cpdo safitict and udhyog register msme pilz helf bank Loan

सेवा मैं

श्रीमान नरेन्द्रमोदी जी

सर-

सविनय निवेदन है कि सर जी एक लोन का लाभ मुझे भी दिलाने की कृपा करें आपकी अति कृपा होगी

मेरा मोबाइल नम्बर-8650033438

आपका आज्ञाकारी शिष्य

अमित कुमार दिनांक 27/072017

Are you in debt? If you are interested in borrowing cash to rise your financial status please don’t hesitate to contact us via Email : [email protected]

Best Regards

Mr Terry Haji

sir mh pooja punjab shh hu sir mh sc categiriy sh hu mh traning air hostes ki traning lena cahhti hu sir sir muje 2,50,000 ru cahiye pikzz help me thanks

sir muje 2,50,000 ki jrurt haa plzz help me

Hello ppl

i would like to start one restaurant in hyd so am i eligible for stand up,,,,please let me know………can i apply stand up scheme to start restaurant…

sir aapki vyapaar ki sari yojana bekar hai jab tak vayapaari ko vayapaar ke liye sahi mahol nahi milta.. ek chota kaamgar kaise market me vayapaar kar payega jab usko kachcha maal sasta nahi milega…. agr har bhartwasiyo ko vayapaar ka sahi mahol mil jaye to hum logo ko goverment ke ek rupaye ki bhi jarurat nahi hi… 7% par kaam karne wala aadmi goverment ko 12,18 aur 28 % GST deta h wo bhi ek baar nahi jab tak ek maal bazaar me nahi pahuch jata us par kam se kam 5 baar gst lag jata h…

jo samaan is desh ke nagriko ko 3 rs me milni chahiye wo samaan govt ke karan 10 rupaye me milti hai….

pahle janta par gst ki maar aur uske upar income tax ki bhi maar……yojana mme lagne wala paisa usi janta ka hai….sirf naam aapka hai….

sir ,

need loan for water minral plant/genrices medicin how can i get pl.help.

Dear sir ,

I wnana start up ma business . I need money . So , plz help me .

i want a loan under PM modi stand up yojna … whare to apply

plz.inform me at email:[email protected]

i want a loan under PM modi startup yojna … whare to apply

plz.inform me at email:[email protected]

sir

I am raju kumar vill+po-Sandh ps -sirdala Nawada Bihar 805127 main kya krun jo hume bisnus ke liye lone mil sake . main bahoot har gaya hun thak gaya hun ab duniya se tang aa gaya hun .

agar mujhe koyi bisunes ke liye lone nhi mila to ……………….

sab jhuth falsh hai ye sab neta mantri vidhayak ke liye hai public keliye nhi hota.

kyun sab itna vishwas karte ho yhaan ke loktantra par. loktantra neta keliye amir keliye chor ke liye badmash keliye aatanki ke liye gathit jati dharm ki sarkar hai hai. samvidhan sirf dikhane keliye bana hai

wo kahten hain na Hathi ke dant dikhane ke aur khane ke aur hote hain wahi yahaan ke samvidhan ki hal hai.

I sivaraj I start travel business in Coimbatore how to get loan from pm midi stand up India scheme

I sivaraj I start travel business in Coimbatore how to get loan from pm midi stand up India scheme my contact number 9842657682

Hello Sir I need bussnese loan urjent please halp me … my number 9563779437

Liars Liars Liars….

In dhanbad Accoroding to bankers we can’t get start up loan without mortgage so please stop fake promise

Hai my name is Jaya Christy I have all the documents.I need some guide and support kindly guide me. kindly support me.

SIR Muzaffarnagar m koi bi sanstha start up loan nahi deti bank bolte h aise koi scheme nahi h sir m apna business start krna chahta hu but government sath ni deti h or bolte h garibo ke liye yojna h but loan to sirf amerio k hi accept kiye jate h or bank maneger baat ni krte jin ke beech m broker hote h loan bi unhi logo ka hota h

Sir app poors k liya schemes launch krta h but untak pahuchnti nhii h

Bilkul Sahi baat, I have also tried for this but not got any type of help,,

Bilkul Sahi,

I have also tried to startup but not got any help…

What are the conditions for taking loan.

Bilkul shi my no 7380597719

Sir I belong to SC caste & I wanted to start wedding decorations business can I get loan for this if yes then please tell the formalities I have to do.

Your precious information will help me to achieve my goal

Cont:-9673660338

[email protected]

Sir iska loan Lena h to me Kahan iska pata Karuin Himachal Pradesh

Ineed lon

For busniss

I WANT TO GET THE LOAN IN TELANGANA STATE

Dear sir /Madam

I want to start a business with help of start up India loan but no one is helping pls suggest what I can do.

Rgds

Vikash

sir please tell me expline loan for business my cell no.9652700591

hello sir apki yojna bahut hi acchi hoti h pr unke liye jinke pass capital hoti h thanks

these schemes are not for poor , these all schemes are for sc/st only . i want to ask you a question , cant a gen. category person poor? .

Ravi Kumar S 9000382597

SIR I WANT TO START UP A BUSSINESS CAN I NEED YOURHELP PLZ FOR BEAUTY PARLOUR.I NEED 1 LAKH IN THIS SCHEME.

Sir I want to do a new business .so i request u what are the processess to take the loan under standup india yojna

ASHU 7455985572

I WANTED TO START NEW BUSINESS I GET LONE BUT NOT ANY HELP

I want to make a wheat flour , maida,suji making unit, please help me.

Gam – ghughash ta- fatepura nalva faliyu dis- dahod

i want also loan please suggest me how to get it

Thank you for the information.

I really appreciate the work of the writer. It is actually very helpful for the new start ups in India by women. To know how to avail this loan and many more information about this loan and other ones too.

Please visit:- https://www.mecitizen.in/business/stand-up-india