Ministry of Culture has launched Scheme of Financial Assistance under Seva Bhoj Yojna 2026 to reduce the financial burden of Charitable Religious Institutions. Now the central government is inviting Seva Bhoj Yojana online registration form at csms.nic.in. In this Seva Bhoj Scheme, govt. will waive off Goods and Service Tax (GST) on Langar in holy places. In this article, we will tell you about the complete process of how to apply online, make login for Seva Bhoj Yojana in India.

What is Seva Bhoj Yojna 2026

Under Seva Bhoj Yojana 2026, CGST and central govt’s share of IGST paid on purchase of specific items by charitable religious institutions for distributing free food to public shall be reimbursed as financial assistance by Indian government. It means that under Seva Bhoj Yojna, govt. will reimburse the Central Govt. share of Central Goods and Services Tax (CGST) and Integrated Goods and Service Tax (IGST) on purchase of raw materials such as ghee, edible oil, atta / maida / flour, rice, pulses, sugar, burra.

Central govt. will provide financial assistance to Charitable Religious Institutions who provide Free Food, Prasad, Langar, Bhandara absolutely free to public and devotees without any discrimination.

Title of Central Govt. Scheme for Charitable Religious Institutions

The scheme shall be known as “SEVA BHOJ YOJNA”. The Scheme shall be applicable within the territorial jurisdiction of India. The Seva Bhoj Yojana will remain open from 1st to 15th of every month. Thereafter, the scrutiny of the applications received will be carried out by duly constituted committee on monthly basis.

Objectives of Seva Bhoj Yojna

Under the Seva Bhoj Yojna, Central Goods and Services Tax (CGST) and Central Government’s share of Integrated Goods and Services Tax (IGST) paid on purchase of specific raw food items by Charitable/Religious Institutions for distributing free food to public shall be reimbursed as Financial Assistance by the Government of India.

Scope of Seva Bhoj Scheme

This is a Central Sector Scheme for providing reimbursement of CGST and Central Government’s share of IGST paid by charitable / religious institutions on purchase of specific raw food items for serving free food to public / devotees. The scheme shall be applicable only to such institutions which are eligible under the Seva Bhoj Scheme.

Type of Activities Supported under Seva Bhoj Yojana

Free ‘prasad’ or free food or free ‘langar’ / ‘bhandara’ (community kitchen) offered by charitable/religious institutions like Gurudwara, Temples, Dharmik Ashram, Mosques, Dargah, Church, Math, Monasteries etc. Financial Assistance will be provided on First-cum-First Serve basis of registration linked to fund available for the purpose in a Financial Year.

Quantum of Assistance in Seva Bhoj Yojna

Financial Assistance in the form of reimbursement shall be provided where the institution has already paid GST on all or any of the raw food items listed below:

- Ghee

- Edible oil

- Sugar / Burra / Jaggery

- Rice

- Atta / Maida / Rava /Flour

- Pulses

Criteria for Financial Assistance under Seva Bhoj Yojana

- A Public Trust or society or body corporate, or organisation or institution covered under the provisions of section 10 (23BBA) of the Income Tax Act, 1961 (as amended from time to time) or registered under the provisions of section 12AA of the Income Tax Act, 1961, for charitable/religious purposes, or a company formed and registered under the provisions of section 8 of the Companies Act, 2013 or section 25 of the Companies Act, 1956, as the case may be, for charitable/ religious purposes, or a Public Trust registered as such forcharitable/religious purposes under any Law for the time being in force, or a society registered under the Societies Registration Act, 1860, for charitable/religious purposes.

- The applicant Public Trust or society or body corporate, or organisation or institution, as the case may be, must be involved in charitable/religious activities by way of free and philanthropic distribution of food/prasad/langar(Community Kitchen)/ bhandara free of cost and without discrimination through the modus of public, charitable/religious trusts or endowments including maths, temples, gurdwaras, wakfs, churches, synagogues, agiaries or other places of public religious worship.

- The institutions/organizations should have been in existence for preceding three years before applying for assistance.

- Only those institutions would be eligible for financial assistance which have been distributing free food, langar and prasad to public for at-least past three years on the day of application. For this purpose, entities shall furnish a self- certificate.

- Financial Assistance under the scheme shall be given only to those institutions which are not in receipt any Financial Assistance from the Central/State Government for the purpose of distributing free food: self- certificate

- The institutions shall serve free food to at least 5000 people in a calendar month.

- The Institution/Organization blacklisted under the provisions of Foreign Contribution Regulation Act (FCRA) or under the provisions of any Act/Rules of the Central/State Government shall not be eligible for Financial Assistance under the Scheme.

Seva Bhoj Yojana Online Registration Form 2026 / Login

All the institutions/ organizations must fillup Seva Bhoj Yojana online registration form 2026 and make login to apply online for incentives under Seva Bhoj Yojana:-

STEP 1: Firstly visit the Seva Bhoj Yojana official website at http://csms.nic.in/login/sevabhoj.php

STEP 2: On the homepage, click at the “For a New Enrollment – Click Here” link or directly click http://csms.nic.in/registration/seva_bhoj_yojana.php

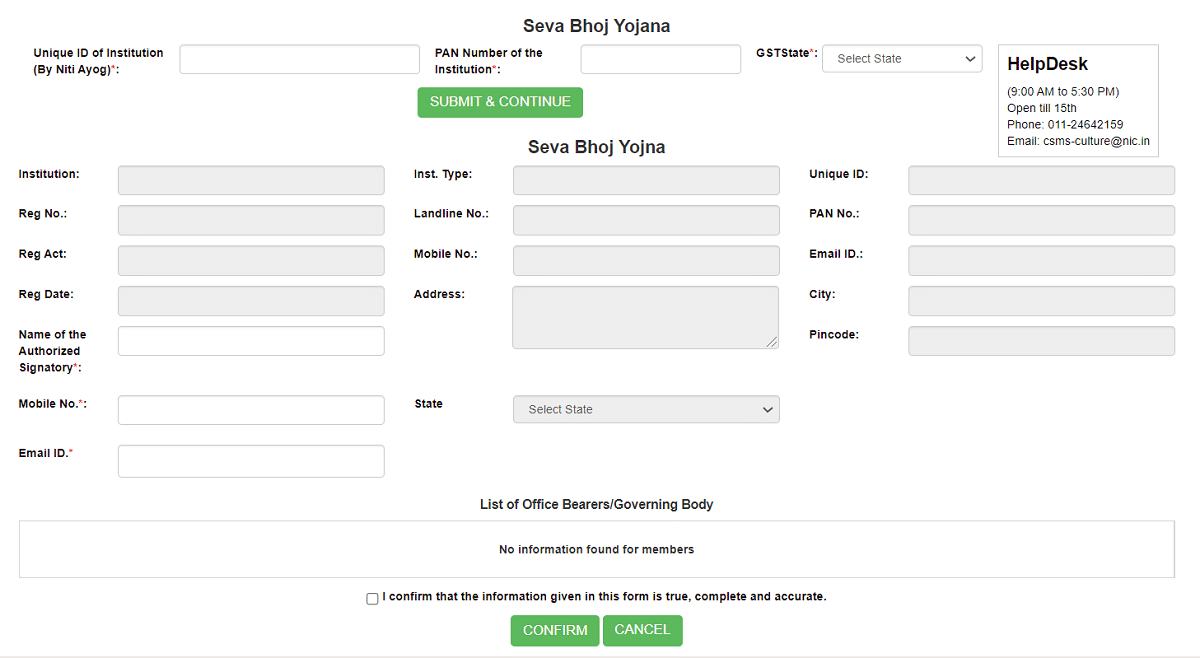

STEP 3: Accordingly, Seva Bhoj Yojana Online Registration Form 2026 will open as shown below:-

STEP 4: Here institutions will have to enter the correct details and click at the “Submit” button to complete the registration process.

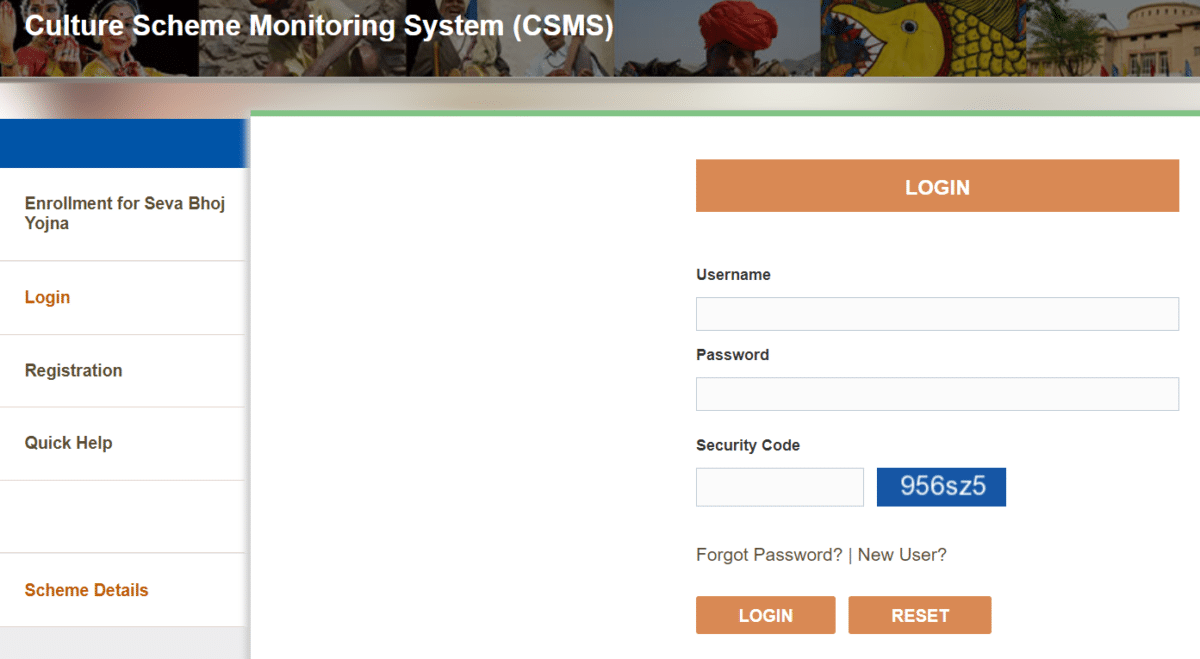

STEP 5: Afterwards, candidates can click at http://csms.nic.in/login/index.php to make Seva Bhoj Yojna Login:-

STEP 6: Here applicants can enter username, password to make Seva Bhoj Yojana login. Finally complete the Seva Bhoj Scheme apply online process.

A special committee will examine the applications received from the institutions within 4 weeks. On the basis of recommendation, competent authority in Ministry will register Charitable Religious Institutions for reimbursing CGST Claim and Central Govt’s share of IGST.

Check Revised Guidelines for Scheme of Financial Assistance under Seva Bhoj Yojana – https://www.indiaculture.nic.in/sites/default/files/Schemes/RevisedGuidelinesforSevaBhojYojna_31.08.2018.pdf

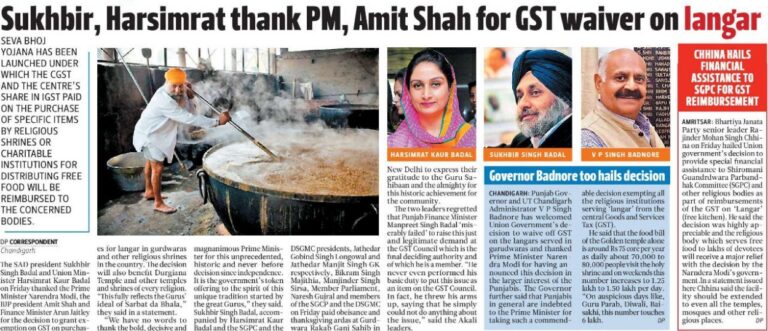

Langar GST Waiver Scheme Launch

All the Langars in various devotional places will now receive refunds from the Central government. Various Ministers like Sukhbir Singh Badal, Harsimrat Kaur Badal thanks PM Narendra Modi and Mr. Amit Shah for this decision.

For more details, visit the link – https://www.indiaculture.nic.in/scheme-financial-assistance-under-seva-bhoj-yojna-new