The Odisha state government launched the Odisha Swayam Scheme 2026 or (Swatantra Yuva Udyami Scheme) to help the financially unstable residents of Odisha state. This scheme will help the youth of Odisha through financial assistance as interest-free loans.

Under the Odisha Swayam Scheme, interest-free loan of up to INR 1 lakh will be given to the selected applicants under the Odisha Swayam Scheme 2026. All the applicants who clear the eligibility criteria must fill out the application form on the official website to avail the benefits of this scheme. Only the permanent residents of Odisha state are eligible to avail the benefits of this scheme.

Odisha Swayam Scheme 2026

The Odisha Swayam scheme was launched by the Odisha state government to help the financially unstable citizens of Odisha state so that they can start their own small businesses. By starting small or micro businesses, state residents will eventually increase the employment rate in the state by employing people.

The financial assistance of INR 1 lakh will be given to the selected candidates under the Odisha Swayam Scheme 2026 as interest-free loans. The repayment period of interest-free loans under the Odisha Swayam scheme is 4 years.

How to Apply for Odisha Swayam Scheme Online?

STEP 1: Go to the Official Website

To apply for the Odisha Swayam Scheme online, the applicant first need to go to the official website.

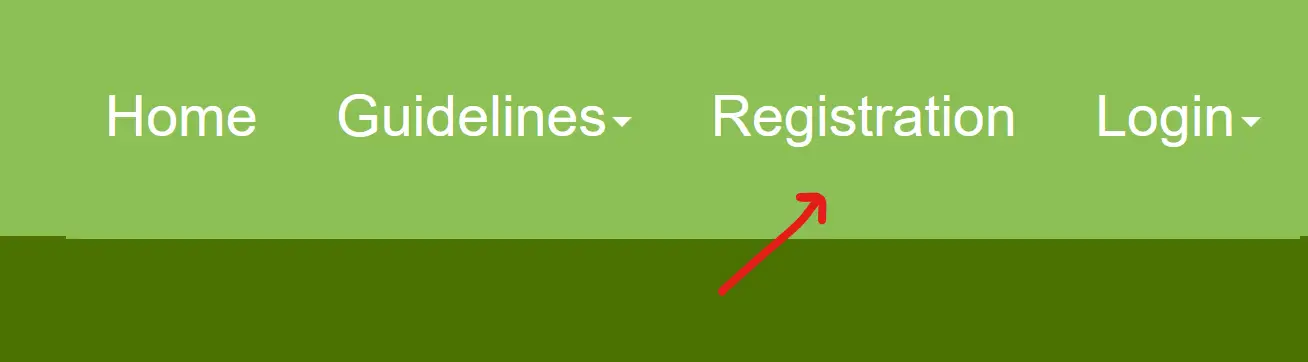

STEP 2: Click the Registration Link

On the home page click on the of Registration.

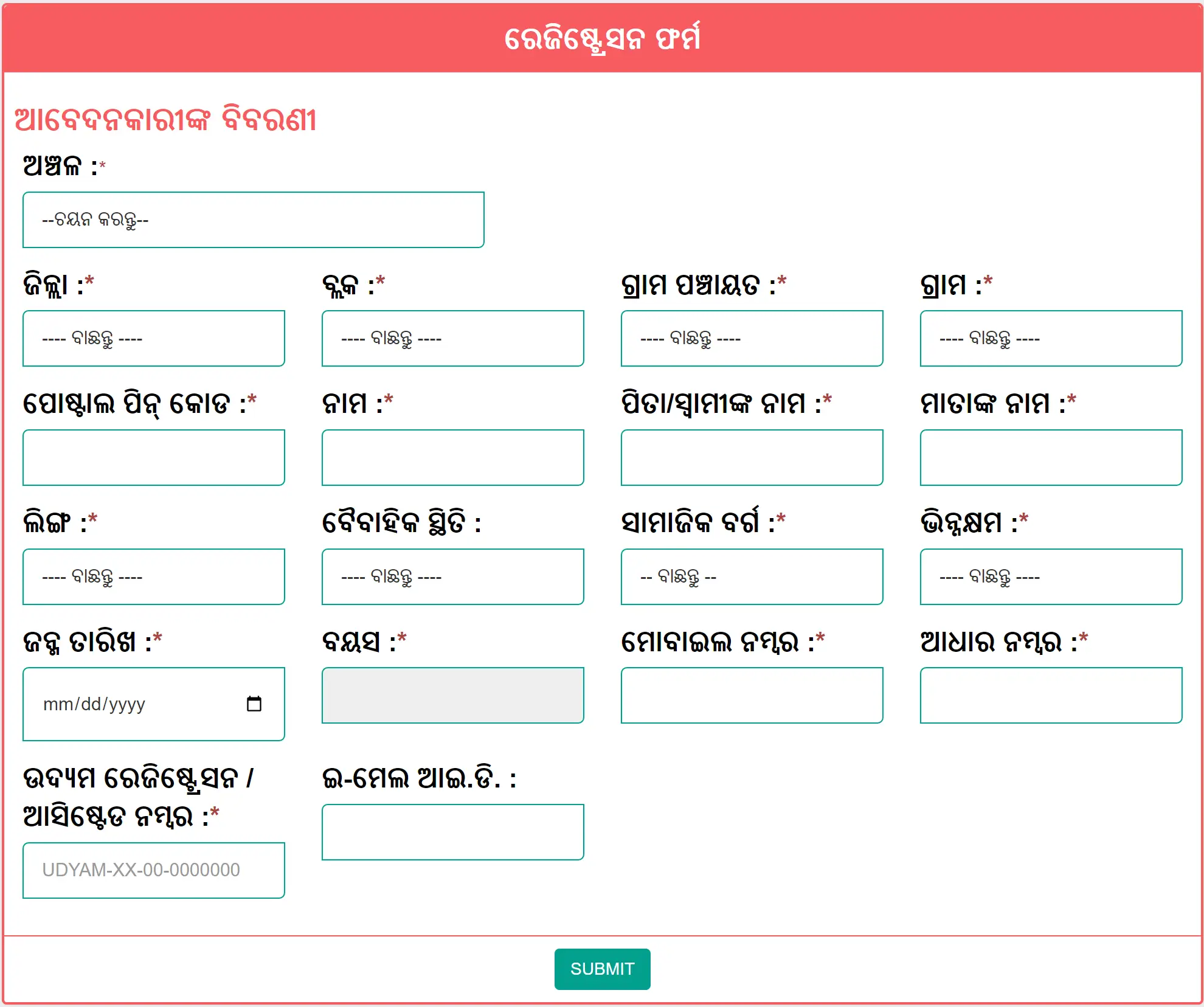

STEP 3: Fill the Registration Form

A new Swayam Scheme registration form page will appear on your screen. Fill out all the details that are asked and attach all the necessary documents.

STEP 4: Submit the Form

Click on the Submit to complete your process. Complete further steps, is any. An application number or the acknowledge number will be provided, keep not of it for future reference.

Odisha Swayam Scheme Login / Check Status

- To do Odisha Swayam Scheme Login, applicants again can go to the official website.

- Select the applicant Login link on the website or directly click here.

- A new page will appear on your screen.

- Enter your user ID and password.

- Click on the option Submit to login into your dashboard where you can check the details and status of your application.

Odisha Swayam Scheme Guidelines PDF

The detailed guidelines of Odisha Swayam Scheme can be downloaded in PDF format from the official website in English and Odia using the following direct links.

Motive of Odisha Swayam Scheme

The main motive for launching the Odisha Swayam Scheme is to reduce the unemployment rate in the state by providing various benefits. The Government of Odisha aims to decrease the unemployment rate significantly by providing financial assistance to the applicants so that they can start their micro businesses.

The scheme will be in operation for 2 years from the date of notification by State Government which may be extended further as per the decision of the Government. One Lakh youth will be covered in 2 years which may be extended as per the decision of Government. PR& DW Department will allocate district-wise target which SLBC will allocate amongst eligible banks of the District.

Who Launched Odisha Swayam Scheme 2026?

The Odisha state government launched the Swayam Scheme to provide interest-free loans to the youth of state. All the permanent residents of the state between the age of 18 and 35 years are eligible to avail the benefits of the Odisha Swayam Scheme. The financial assistance of INR 1 lakh as loan will be given to the selected applicants under this scheme.

Highlights of Odisha Swayam Scheme

| Name of the scheme | Odisha Swayam Scheme – Swatantra Yuva Udyami |

| Launched by | Odisha state government |

| Benefits | Interest free loan of up to Rs. 1 Lakh |

| Loan Repayment Period | 4 Years |

| Objective | To increase the employment rate in the state |

| Beneficiaries | Odisha state citizens |

| Official website | https://swayam.odisha.gov.in/ |

Eligibility Criteria for Odisha Swayam Scheme

- The applicant must be a permanent resident of Odisha state.

- The applicant must be between the age group of 18 to 35 years.

- The age limit is 40 years for all the applicants who belong to the SC ST or PWD categories.

- The annual income of the applicant’s family must not exceed INR 2 Lakh.

- The applicant must be a UDYAM registered applicant.

Required Documents

- Passport Size Photo

- Aadhar Card

- Ration Card

- PAN Card

- Address Proof

- Mobile Number

- Email ID

Odisha Swayam Scheme Benefits

- The selected applicants under the Odisha Swayam scheme will get financial assistance in the form of interest-free loans from the authorities.

- The loan amount of INR 1 lakh will be transferred directly to the selected applicant’s bank account.

- The applicants can start their own micro business in Odisha state with the help of financial assistance.

- This scheme will create employment opportunities for all the citizens of Odisha state.

- The applicant can repay the loan amount easily after a period of 4 years.

Insurance Coverage

- There will be compressive insurance coverage on all types of risks including floods and earthquakes

Mode of Implementation for Swayam Scheme

- There will be a dedicated website for registration and submission of applications.

- The services of Mo-Seva Kendra can also be utilized by the applicant for submission of the application

- The beneficiaries will select bank during filing application

- The concerned Bank, on receipt of application, will carry out the required due diligence (desk and field verification) after which will sanction eligible applications.

- During field verification bank will assist the applicant in preparing required simplified DPR for sanctioning loan.

- The banks will disburse the loan amount to the applicant after sanction and deposit of State Guarantee and margin money.

- The beneficiary will deposit the EMI with the concerned bank regularly after the moratorium period. However, the bank will charge interest during such moratorium as well. Even though the interest is chargeable from the date of 1st disbursal, the beneficiary will repay only after the moratorium period.

- The beneficiaries are at the liberty to repay the loan amount earlier than the scheduled period. They can also opt for paying higher EMIs. The banks shall charge no penalty for such modification in the repayment schedule for the fore-closure of the loan.

Contact Details

0674 – 2974093