NPS Vatsalya Scheme 2024: Easy Registration, Benefits, Eligibility, and Documents.

The NPS Vatsalya Scheme was announced by Finance Minister Nirmala Sitharaman during the Union Budget 2024-25 and officially launched on 18 September 2024. This scheme is designed to help parents invest for their children’s future with a secure and reliable platform. It allows parents to save small amounts that grow over time, providing a good return when the child turns 18. You can register for this scheme online through the official website, www.camsnps.com, or visit any cooperative or private bank to open an account for your child. Let’s take a closer look at how the NPS Vatsalya Scheme works, its benefits, and how you can apply.

What is NPS Vatsalya Scheme 2024?

The NPS Vatsalya Scheme was introduced by the Ministry of Finance and Corporate Affairs to help parents invest for their children’s future. It is a long-term investment scheme that allows parents to start saving from the time their child is born, and they can receive a good fund when their child turns 18. This scheme is available to all Indian citizens and is a great way to save for your child’s future with minimal investment. The best part? Once your child turns 18, the NPS account can be converted into a Non-NPS account, giving you even more flexibility.

How to Register for NPS Vatsalya Scheme?

Parents can register for NPS Vatsalya Scheme online by following these simple steps:

- Visit the official website: www.camsnps.com.

- Click on the “Register Now” option.

- Fill in details like your mobile number, email ID, and PAN number.

- Complete the registration by filling out the application form with all necessary details.

- Upload the required documents.

- Click on “Submit” to complete the process.

Alternatively, parents can also visit cooperative or private banks or Common Service Centers (CSC) to open an account for their children.

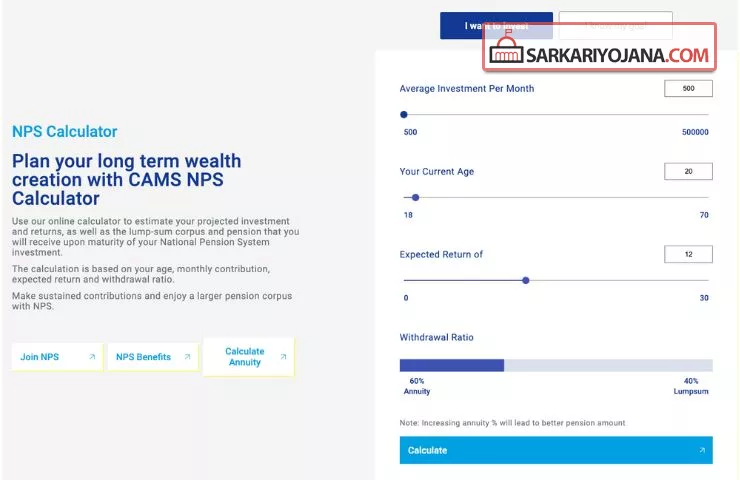

NPS Vatsalya Scheme Calculator 2024

Before investing, it’s important to calculate how much you need to deposit and the returns you can expect. The NPS Vatsalya Calculator is available on the official website www.camsnps.com. You can use this tool to calculate your EMI and understand the interest rate based on how much you invest.

NPS Vatsalya Scheme Interesting Facts by Nirmala Sitharaman

| Scheme Name | NPS Vatsalya Scheme 2024 |

| Started By | Finance Minister Nirmala Sitharaman |

| Launched On | 18 September 2024 |

| Under | Finance and Corporate Affairs department |

| Scheme For | Long Term Investment for Minors |

| Benefits | Invest Money and get good return of fund |

| Online Registration | Available Now |

| Objective | Financial Security |

| Help Line Number | 1800 2100 080 |

| Official Website | www.camsnps.com |

Features of NPS Vatsalya Scheme 2024

- Long-term Investment: Start saving small amounts from your child’s birth and get a good return when they turn 18.

- Secure Platform: The scheme is run by the government, making it a trusted and safe option for investment.

- High Returns: The scheme offers an interest rate of 10% to 11%, ensuring a good return on your investment.

- Easy Registration: The registration process is simple and can be done online without paperwork.

- Tax Benefits: You can save on taxes with the NPS Vatsalya Scheme.

- Monthly or Yearly Payments: You can choose to deposit money monthly or annually, depending on your convenience.

NPS Vatsalya Scheme Eligibility

- Indian citizens can apply for this scheme.

- The child for whom the account is being opened must be below 18 years.

- You need to have basic documents like Aadhaar, PAN, and a bank account.

Documents Required for NPS Vatsalya Registration

To register for NPS Vatsalya Scheme, you need the following documents:

- Aadhaar Card

- Passport-size photos of both the parent and the child

- Bank Account Details of the parents

- PAN Card

- Child’s Date of Birth Certificate

- Mobile Number and Email ID

Benefits of NPS Vatsalya Scheme 2024

- Financial Security: It provides a reliable way to save for your child’s future needs.

- Good Interest Rate: The scheme offers a high return on investment, making it a great option for long-term savings.

- Government-Backed: The scheme is supported by the central government, making it a secure and trustworthy option.

- Less Tax Burden: The amount you invest in this scheme is tax-efficient, reducing your tax liabilities.

How to Check NPS Vatsalya Scheme Status?

Once you have registered, you can check the status of your application by logging in to the NPS Vatsalya portal. Just visit the website, enter your username and password, and you can track your application status and manage your account easily.