Central Government started Atal Pension Yojana in 2015 for unorganised workers so that they get a fixed monthly pension in old age. From 1 October 2025, new subscriber registration will be accepted only on the revised APY form issued in line with PFRDA guidelines. Old forms used till 30 September 2025 are no longer valid.

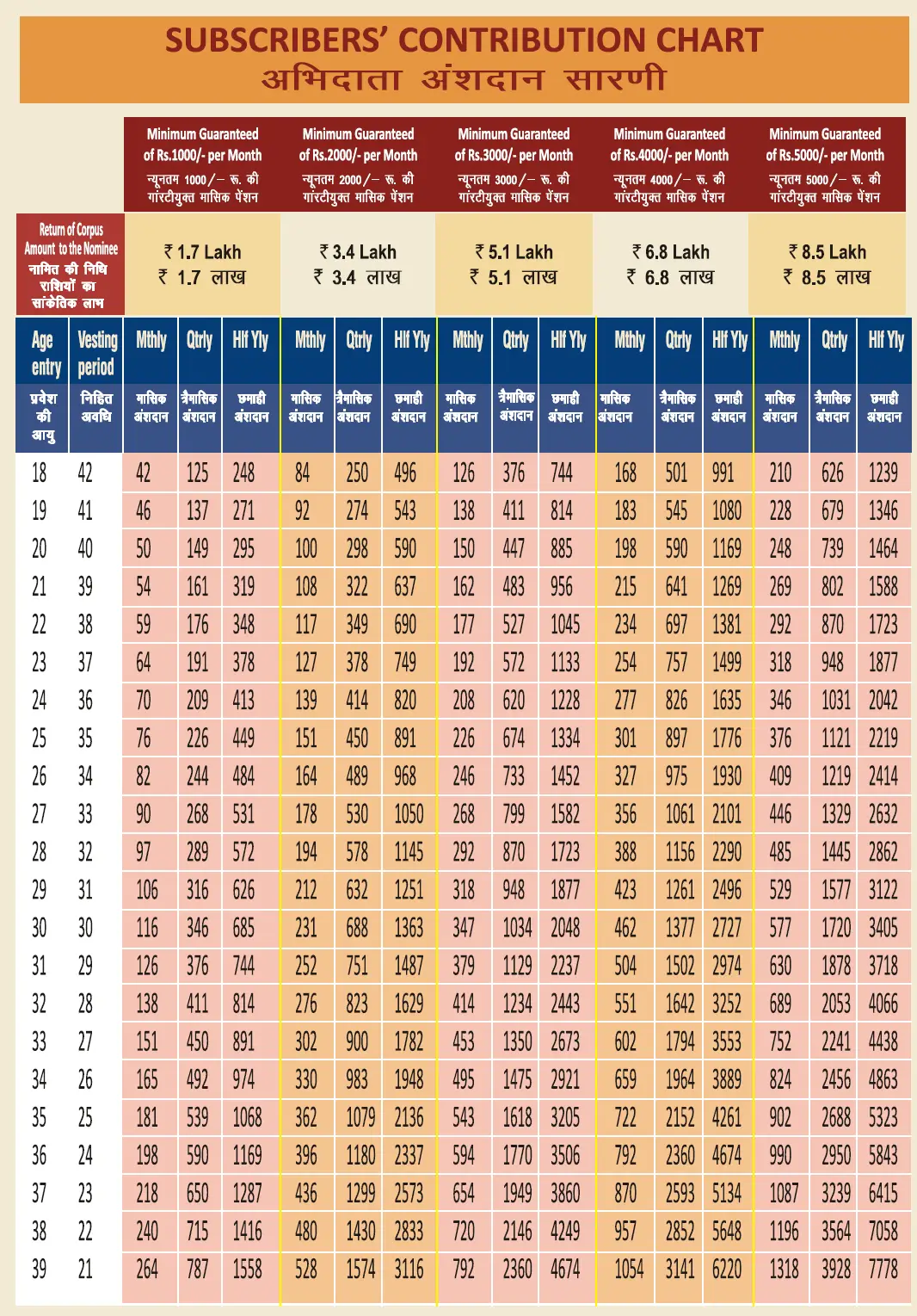

APY gives a guaranteed minimum pension of Rs 1,000 to Rs 5,000 per month after the subscriber turns 60 years. Pension amount depends on age of joining and regular monthly contribution. Post offices and banks have been told to display the new rules and take applications only on the updated form with FATCA/CRS declaration.

Elderly people above 60 years of age can see APY Subscribers Contribution Chart, Statement and use APY Calculator to review their pension amount. Interested candidates can fill Atal Pension Yojana Online Form at enps.nsdl.com

What is Atal Pension Yojana?

Atal Pension Yojana (APY) is a government scheme that gives a fixed monthly pension after 60 years to Indian citizens in the age group 18 to 40 who join and pay contributions regularly. To join, a person needs a savings bank or post office account.

Important eligibility from 1 October 2022: New applicants who are, or have been, income tax payers on or after 1 October 2022 are not eligible to join APY. If anyone joins on or after this date and it is later found that the person was an income tax payer before the application date, the APY account will be closed and the subscriber will get back the accumulated amount in the account till the date of closure.

All post offices and banks must use the new APY Subscriber Registration Form from 1 October 2025. The updated form includes a mandatory FATCA/CRS declaration for tax residency, which helps confirm eligibility and allows only resident Indian citizens to open APY accounts through post offices.

Rs. 10,000 Monthly to Married Couples with Atal Pension Yojana

Atal Pension Yojana can help a husband and wife plan a combined pension of around Rs 10,000 per month by keeping two separate APY accounts and paying as per the chart.

The scheme is open to Indian citizens aged 18 to 40 with a bank or post office account. After turning 60, the fixed monthly pension starts. Aadhaar and mobile number should be linked for alerts and statements.

Depending on the chosen pension slab, a subscriber can opt for Rs 1,000, Rs 2,000, Rs 3,000, Rs 4,000 or Rs 5,000 pension. For example, to get Rs 5,000 monthly pension, a person joining at age 18 needs to contribute Rs 210 per month (as per the chart).

How to Earn a Rs. 10,000 Per Month Pension

A couple below 30 years can open two APY accounts (one each). If both choose the Rs 5,000 pension slab and pay the required contribution (for example, Rs 577 per month each in some age cases as per chart), they can target a combined Rs 10,000 pension after 60. Tax deduction under section 80CCD may apply as per law; however, note that new joiners who are income tax payers are not eligible to join APY from 1 October 2022.

Atal Pension Yojana Apply Online

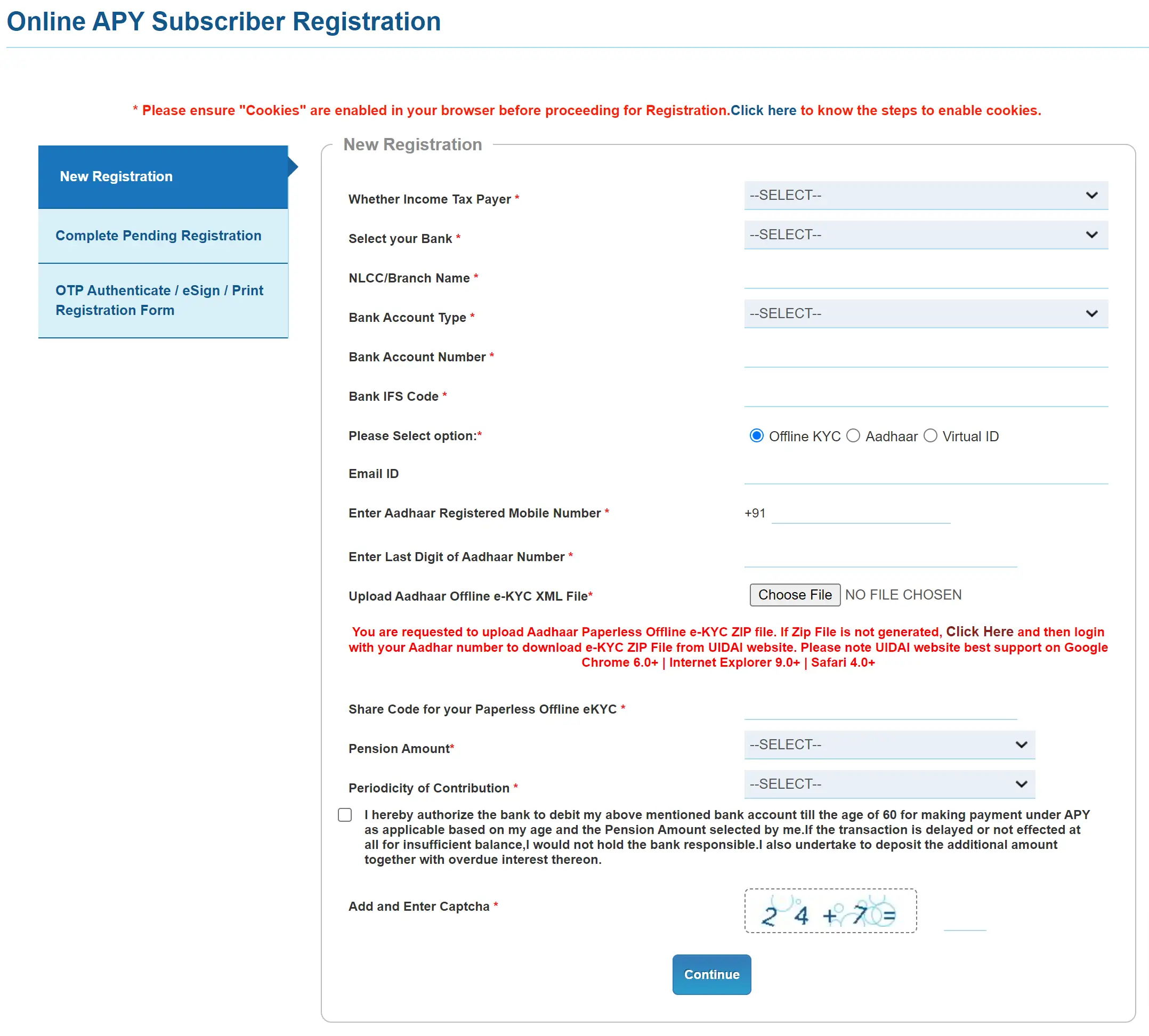

Below is the complete procedure online subscriber application and fill Atal Pension Yojana form online:-

STEP 1: Firstly visit the official website https://enps.nps-proteantech.in/eNPS/ApySubRegistration.html

STEP 2: On the homepage, click “Registration” button under the “Atal Pension Yojana” or directly click this link to open the Atal Pension Yojana Online Subscriber Registration Form as shown below:

STEP 3: Here enter your Aadhaar Number and generate OTP on your registered mobile number. After entering OTP, click “Continue” button.

STEP 4: Now provide personal details, family details and generate acknowledgement number. After acknowledgement Id is generated, enter bank / branch details & account number for bank verification.

STEP 5: Next fill the pension amount, contribution frequency, nominee and upload the supporting documents and make payment to complete the atal pension yojana online registration process.

If the registration process is successful, then bank will debit your account for 1st subscription and will generate Permanent Retirement Account Number (PRAN).

MP Kalyani Pension Yojana Form

APY Subscriber Application Form PDF

You can also apply through any bank or post office by submitting the physical application. Only the revised APY form (effective 1 October 2025) will be accepted. The updated form includes a FATCA/CRS declaration to confirm tax residency and keep data correct.

APY New Subscriber Registration Form PDF 2026:

APY Subscriber Registration Form for Swavalamban Yojana Subscribers: https://npscra.nsdl.co.in/nsdl/forms/APY_Subscriber_Registration_Form_Swavalamban_Yojana_Subscribers.pdf

Eligibility Criteria for Atal Pension Yojana

To join APY, you must be an Indian citizen aged 18 to 40 years, have a savings bank or post office account, and must not be an income tax payer on or after 1 October 2022. If later it is found that you were an income tax payer before applying, your APY account will be closed and you will get back the accumulated amount.

You can choose any pension slab from Rs 1,000 to Rs 5,000 and pay monthly as per the chart. You can also increase or decrease the chosen pension once in a year using the official process.

Madhu Babu Pension Yojana Odisha

Atal Pension Yojana Chart / Contribution Calculator

People can see the subscriber contribution chart to know minimum guaranteed pension per month as per age of entry. For monthly pension of Rs 1,000, Rs 2,000, Rs 3,000, Rs 4,000 and Rs 5,000, see the chart and calculator using the link below:

Download PDF of Atal pension Yojana Chart

People can enter APY at any age between 18 to 40 years and safeguard their future through filling Atal Pension Yojana Online Form.

Atal Pension Yojana Transaction Statement View (e-PRAN)

Subscribers can view their e-PRAN or statement of transactions online. The service helps track contributions and status. Subscribers having PRAN can enter their Bank Account number; without PRAN they can enter Name and Date of Birth to view APY statement using the link – Click Here.

APY Charges from October 2025

PFRDA has revised CRA charges. Below are the account-related charges for APY (taxes extra):

| Sr. No. | CRA Charges | Amount (₹) |

|---|---|---|

| 1 | Account Opening Charges | 15.00 |

| 2 | Annual Maintenance Charges | 20.00 |

| 3 | Downgrade/Upgrade Charges | 25.00 |

| 4 | Transaction Charges | NIL |

Note: As per the broader fee update effective 1 October, APY and NPS-Lite PRAN opening and maintenance were notified at Rs 15 each in some contexts. Banks/post offices will follow the active circular for APY operations; the table above reflects the APY-specific charge list you provided (taxes extra).

Penalty on Delayed Contributions

For non-payment or delayed payment, the following overdue charges apply (taxes extra):

| Sr. No. | Contribution per month | Penalty (₹) |

|---|---|---|

| 1 | Up to ₹100 | 1.00 |

| 2 | ₹101 to ₹500 | 2.00 |

| 3 | ₹501 to ₹1000 | 5.00 |

| 4 | ₹1001 and above | 10.00 |

Non-payment actions: after 6 months account is frozen, after 12 months account is deactivated, and after 24 months account is closed. Bank can recover due contributions any time during the month whenever balance is available.

Atal Pension Yojana Registration at Banks

Visit your bank or post office branch with the new APY form, Aadhaar, passbook, and mobile number. Fill pension choice, nominee, and contribution frequency. After approval and first debit, you will get PRAN by SMS/print.

Once your application is approved, you will receive a confirmation SMS on your registered mobile number.

Progress of Atal Pension Yojana

APY has grown strongly since launch in 2015 with crores of enrollments across banks and post offices. The scheme is administered by PFRDA under the NPS architecture and gives pension to the spouse after the subscriber’s death, and returns the accumulated pension wealth to nominee after both pass away.

Pension Funds Managing APY

APY is presently managed by 3 Pension Funds: SBI Pension Fund, LIC Pension Fund, UTI Pension Fund Limited. NPS Swavalamban is managed by 4 Pension Funds: SBI, LIC, UTI, and Kotak Pension Fund.

Tax Benefits of Atal Pension Yojana

Contributions may be eligible for deduction under section 80CCD of the Income Tax Act, 1961, subject to rules.

Note: New enrollments are not allowed for income tax payers on or after 1 October 2022, so tax benefit is not relevant for such persons joining after this date. Tax rules can change; please check current provisions before investing.

Exiting the Scheme

You can exit as per APY/NPS exit rules. In special cases like death or specified illness under PFRDA (Exit and Withdrawals) Regulations, payout is made to spouse/nominee as applicable.

Contact & Helpline

For Aadhaar linking, grievance and other support, visit npscra.nsdl.co.in

Toll free helpline: 1800 110 069

I AM BANKER CAN I APPLY FR ATAL PENSION PLAN

Kamlesh sharma sun of let Rajnath sharma mai bhi gareeb insan hu mujhe bhi ek aawaaj chahiye

KINDLY LET ME KNOW THE DEAILED STATUS OF APY OF IRN 557902, INSURANCE ACTIVATED ON IMEI 869041029315011, TOTAL AMOUNT PAID RS 999, BILL AMOUNT:RS 10900, DATED 31/07/16 AT MY REGISTERED EMAIL ID kanand2901@gmail.com AT THE EARLIEST.

THANKING YOU,

KUMAR ANAND

sarkar logo ko gumraha kar rahi ha ya fir khud ka passa ka ghar bana rahi ap log aisa ky kerta ho

sub lidero ko fansi da dane chya

chutiya sarkar indian fojeyo ko mar diya jata aur ledar dheli ma ghutmut baita kerti ara india ka ledaro kahi ja mar jao ap kuch nahi ker sakta kynoke ap ko mardanga jissa ap darta ho ap to apna ghar ma jaker gus jaio aj fir rajdhani ek ek ladki ko chaku marker mardata apke pol to yahi khul gaye pak ka khilap ap kuch nahi ker ya ma guranti ka saath kahta hu ager mard ke bacha ho to dikha do na mard

ATAL PENSION YOJANA 18 SE 40 VARSHA KI UMRA KA KOI BHI VYAKTI IS YOJANA ME APPLY KAR SAKTA HAI.EMI KI RASHI UPAR DI GAYI HAI.FORM AP ONLINE DOWNLOAD KARKE ADHAR NUMBER BANK ACCOUNT NUMBER KYC FORM KE SATH NODAL KENDRA PE JAMA KAR DE.NODAL KENDRA GENERALLY SARKAR DWARA CHINHIT DUKANO KO BOLA JATA HAI.THANKS

very good

atal pensan yojana ka labha lena chahate hai

Sir mai garibo ko pension Lene me bhout dikhat uthana padta hi .Is lia mai un sab ko dilanai me madat krna chatahu Q ki sab officer mil kr garibo ka paisa udher hi kha jata hi .or khata hi ki apka paisa nhi aaia hi is lia mai us bivag me nakuri krna chauta hu taki garibo ka paisa aram se dila saku.

sir mai apse ye nivedan krna chahti hu ki is badti hui mahgai ko km kiya jaye and sabhi ko rojgar or education ka avsar prapt ho taki kisi vyakti ko heen bhawna ka sikar na hona pade …

Respected sir,

Mai mohammad Faiyaz complain karta hun ke meri mata shree ki age 65 varsh ho gai hai, mata ji ne old age fund ke liye apply ki thi 2 saal pahle, uska form paas bhi ho gaya, lekin kuch notified area ke officers ke karan aajtak 1 rupya bhi nahi mila, wahan jane par wo log kahte hai ke bank me bhej diya hun, bank jaane par pata chalta hai ke wahan kuch bhi paisa nahi aaya hai. Is tarah JNAC jamshedpur and bank ka chakkar laga laga ke hum thak chuke hai, aur meri mata ab is age me itni bhagambhag nahi kar sakti. Aapse prarthna hai ke aap hamari madad kare, hum sada aapke abhari rahenge.

Aapka biswasi

Faiyaz gaddi

Mata ka naam – NAZMA

ADDRESS – 71 RAMDAS BHATTA, GOWALA BASTEE, BISTUPUR, JAMSHEDPUR, JHARKHAND

MOBILE. 9304952774

P.m sir Aap ki yojna to Bahot achhi hai lekin turnt karyavit kare Bahot Dhanyawad

I’m satisfied narndar modi tall

Me apy ko band karna chahta hu

Sir hm bihar se but bihar me koi bi yojna garibo ko sahi se ni mil pa ra h itne sare sarkari officer baithe hai ki pesa garibo tk pahuch ni paa ri h. Plzzz sir ek bar garibo k lie bataiye kaha se madad le..

NOW I AM AGE 49 KA HU KYA MUGHE ATAL PENSION YOJNA KA LABH MIL SAKTA H YA NI

सर नमस्कार मेरे दादा दादी60 वर्ष से जयादा उम्र के है मुझे अप्लाई करना है। क्या प्रक्रिया होगी कृपया स्पष्ठ करे। धन्यवाद

Sir Mai garib hu or mera kacha makan hai na Mai bpl Mai muje koi suvidha nhi milti hai Mai rajasthan se hu Mai Aapse nivedan hai ki muje makan dilene ka kast kre Aapke Raj Mai grib ko koi suvidha avvaible nhi hai

मेरे पिता जी का उम्र 60 से ज्यादा है । फिर भी कोई लाभ नही मिल रहा है।

Sir mere bade Bhai ki bimari me dait ho gayi thi 30,3,2017 age 35 saal unke chote chote 3 bacche he 1ladkA he age 1 saal he sir hame bhabhi ke pensan badvani he please sir

Sir mai ग़रीब नही हू मगर मुझे एक सरकारी नौकरी चाहिए Sir sms ko जरुर पढि़ए गा please Sir so request ARVIND KUMAR, DHARAMSALA ROAD EASTERN BAZAAR MUGHALASARAI, CHUNDULI 232101 U.P , PHONE NUMBER 9307212061

Pm Awas yojana

Vill.Mattutola po.palashgachi ps.radhanagar dist.sahibganj jharkhand pin 816108

SIR ME

sir mujhe study ke liye pese chiye 9179360998

hai.sir thanka.s all suvidha ham karibo ke liye .le ke aye hai.?

Atal pansion yojana

Dear sir my atal paison yojna account is closed and my refund is not back in my account please any solutions.

गुजरात में कब बनेगी ऐ योजना

Star ma Delhi ma rhata ho makan kharid na kaleya lon

hi sar muga apy me kam karnah hay plz coll 7385484088

Hi

sir me chaheta hnu ke mere gaon ke har grib ko srkari

yojnao ka lab mle

My mother is an 62y old woman. But how can online application for the Aral panson?

Mai bahut garib faimly se hu sir agar mujhe koi sarkari noikri mil jata to tik rahta jisase mere faimly ka gujara sahi dhang se ho sake

Please sir

kindly i want APY current accout statement for 2017-18

kindly i want APY accout statement for 2017-18 for income tax purpose.

\

Sir.

Mai bhut garib ghar se bilong karta hu ..

Mere father ki theth Ho gayi. .

Meri family me se sirf char log hai..

Isliye meri riqust hai ki koi mujhe choti si jab de do to apki mahan daya hogi..

My. Qualification.bsckanpur

Sir.

Mai bhut garib ghar se bilong karta hu ..

Mere father ki theth Ho gayi. .

Meri family me se sirf char log hai..

Isliye meri riqust hai ki koi mujhe choti si jab de do to apki mahan daya hogi..

My. Qualification.bsckanpur

Sir mere sister ke sadi main bank se lon liya hai ghar main kafe dekat hai sir lon maf karne main todhi se maddat kare aapke mahaan kirpya hoge bank of baroda korihar raebareli

BEROJGAARO KO ROJGAR DILANE KI YOJNA KAB CHALU HOGI

Kapil Ji Pandey s/, Ram Babu Village Dhondhari Post Kaundhiyara Karchhana Allahabad Uttar Pradesh. Pin Cord. 212106

Kapil Ji Pandey 28y Allahabad Kaundhiyara Karchhana Post Pin. 212106

hello sir/madam

i need my apy statement. how can i get my statement on line without number

Atal pension yojna time se phale band karne per balance kab return hoga. U.p. kanpur mai iska office address kya hai.

please any solutions.

Mail add – anoop.saxena9175@gmail.com

Thanks

Sar mai baht his garib aadmi hu .

Mera papa 14.10.2017. Ko subah 7.bje .

Det kar gay hai . Our mere pash Kam karane ke liy paisha nhi hai . Kipya kar ke ke mujhe koe help kigiy mera nambar hai . 8227921113

सर मेरे दादाजी की उमर 75-80 से भी जयादा है उनकी पैनशण नही बनी उनके कागज कई बार जमा करवा चुके है सही कहते है बन जायेगी।समझ मे नही आ रहा कया करउ कैसे बनवाऊ कृपया मागदशर्शन करे खतौली िजला मु.नगर यूपी

i found this article really helful. thanks for haring the information. The legislature has approached in empowering this effectively by giving the general population of India an approach to secure their annuity plot. Atal Pension Yojana APY is one of the most recent plans propelled by the legislature whose primary point is to secure the eventual fate of each working national of India. http://www.atalpensionyojana.co.in/how-can-i-check-apy-status/ with the help of this portal, you can check status of atal pension yoajana. be a member of APY sheme.

Hello, Information you provide is really good. Thanks!!

सर मेरे दादा जी कि उम् 80 साल कि है उनहे 2000 से बुढा पेनसन मिल रहा था लेकिन अब 2016. से उनहे पैसा नहि मिल रह है घर बराहिमपुर गोपि हैै जिला छपरा थाना मशरख पोसट बाराहिमपुर

नरेन्दर मोदि जी मै बहुत गरीब हु किपया मुझे कुछ लोन दे ताकी मैं अपन घर बनवा सकु

घर बराहिमपुर गोपि थाना मशरख जिला छपरा पोसट बराहिमपुर गोपि

Number 9771652241

7519026523

sir,my name is lalrinpuia,please i want to stop my pay scheme,because of money problem

sir,I want to stop my apy scheme,because of money problem,please help me as fast as you can.all of my money was cut on this scheme,i never know how can i pay another rupee on this scheme,so,please stop this scheme for me

Dear Team,

I am working on Private IT organization ,my organization deducting PF .

so I would like to know ,Am I eligible to opt Atal Pension Yognana scheme?

Kindly assist me.

hamare pradhaan mantri ji hum uttrakhand ke log aapki sewa ka labh uthane ki kosis me he lekin is baat ko ham logon tak pahuchane ka kaam sirf aapke specal log kar sakte he ham logo ko aapki sewao ka pata hi nahi chalta hai hamare champawat jile ka to bahut bura hal hai ham logo ko aapse bahut apeksha hai sir

Manoj Ji, hum aapke paas saari yojnayo ki news pahunchaenge

how to download apy statement in PDF format

Dear Sir / Madam

please inform me how can I get my statement of account in atal pension yojana.

Hello Sir me nahi janta apne desh me kya chal raha he but mera desh mahan tha Mahaan h mahaan rahega or hamare desh me kon kon si sarkary yojna chal rahi he pleases muje bataye kyoki Me garibo ki madat karna chahata hu to please bataye

Hello Sir

Muje ye bataye vidva ladkiyo ke liye kon kon si yojna he

SIR KYA YE SACH ME HOGA YA AISE BOLO SIR PLS

sach mein hoga

Jawed khan

15000

Kanaishah843@gmail.com

Loan

15000

how to change my account number

faahmad797@gmail.com

prime minister lunching many scheme but we didn”t get any support from govt deportment.

सर मैंने आपका पोस्ट पढ़ा इससे हमें बहुत कुछ जानकारी मिली आप बहुत अच्छे तरह से और आच्छी जानकारी लिखते है एक सवाल है

बिहार में राशन कार्ड का नाम ONLION देख सकते है क्या क्योकि दो ब्लॉग में पढ़ा की हम अपना नाम देखा सकते है .लेकिन वहा पर

कोई अपसंन नहीं है.

Sir mera naam raju ku patwa hai may ballia jile ka rahane wala hu aur meri age 35 saal hai sir may bahut garib pariwar se hu may berojgar hu kripaya meri madad kare plz

its fake i cant able to download atalpension yojana statement ….. still i didnot get any paper or email by this yojana, every month my amount deduct with my account…any one help

When will be started Rs10000/ month age 50 year?

Purana esua thana Sarmera jila nalnada

7020917925

Hii

hendikep

महेश कुमार थाना अतरौली जिला ग्राम तहसील संडीला जिला हरदोई आवास योजना की जानकारी

प्रधानमंत्री आवास योजना 2020 के लिए ऑनलाइन आवेदन कैसे करें – पूरी जानकारी

मेरी आयु 18 वर्ष है और मै बेरोजगार हूं एवं 10 पास होने के साथ साथ iti करता हूं। मै भी पैंशन चाहता हूं। मेरे पास आगे की पढ़ाई लिखाई करने के लिए धन की कमी है

You can now invest in Atal Pension Yojana and the contribution amount will be same as per the pension chart.

Jo already retired person hain but unka koi pension nhi hai to unke liy kya koi yojna hai

Check this http://sarkariyojana.com/pmvvy-online-application-form/

Hamlog poor family se bilom karte hai Ham ak majdhur hai bahr me kam karte hai.