PM Jan Dhan Yojana 2025 is a national mission of the central government for financial inclusion of poor people. Under this PMJDY, all the people from economically weaker sections can open zero balance Jan Dhan Yojana Account in banks (savings & deposits account). This account will provide them various yojana benefits directly into their account like remittance, credit, insurance and pension. For this, candidates can see yojana rules and download pradhan mantri jan dhan yojana form at pmjdy.gov.in

People can easily open jan dhan account in any bank branch or with business correspondent (bank mitr). If any person does not possess the officially valid documents then he can open small account subject to the jan dhan yojana rules. Moreover, people can also avail jan dhan yojana loan through any bank.

People can avail all the jan dhan yojana benefits through pdf download of the application form and opening an account. In these accounts, there is also a facility of Rupay Card, Kisan Credit Card (if eligible) and an overdraft (after 6 months of account opening and successful operation).

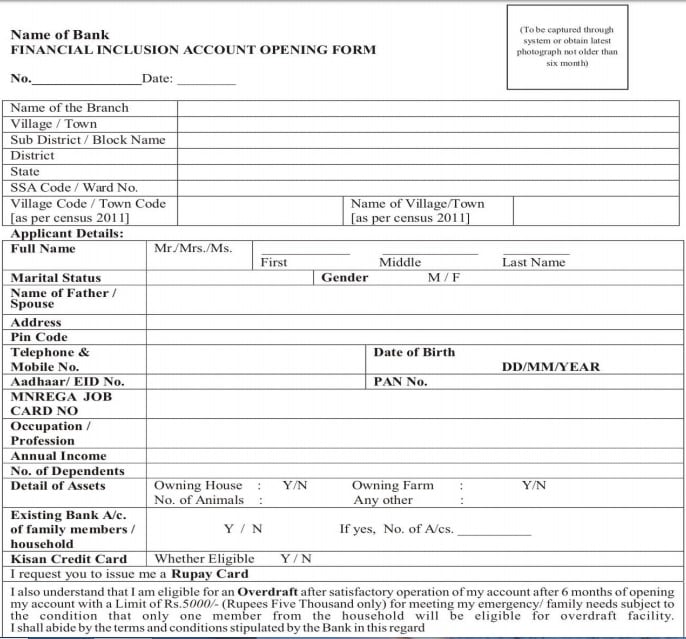

Pradhan Mantri Jan Dhan Yojana Form – Account Opening

All the interested individuals who wishes to open their personal savings account can download this application form. PM Jan Dhan Yojna Form must be dully filled and submitted along with necessary documents. In case the officially valid documents are not present, then poor people can open their small account. To download the application form in pdf format, click the link given below:-

PM Jan Dhan Yojana Form (PDF) – English

PM Jan Dhan Yojana Form (PDF) – Hindi

- Accordingly, Pradhan Mantri Jan Dhan Yojana Account Opening Form will appear as follows:-

- Fill in all the necessary details along with the nominee details. People can avail nomination facility at the time of account opening.

- Finally, candidates can submit this form along with necessary documents to open their zero balance account.

Jan Dhan Yojana Loan Apply – People can apply for Loan in SBI / ICICI / HDFC / Axis and other nationalized banks through the link – Jan Dhan Yojana Loan

List of Documents to Open Jan Dhan Yojana Account

If Aadhaar Card/Aadhaar Number or proof of possession of Aadhar is available then no other documents are required. If address has changed, then a self-certification of current address is sufficient. If Aadhaar Card is not available, then any one of the following Officially Valid Documents (OVD) is required. All the documents given below are officially valid documents. Candidates can submit any one of these documents along with their recent photographs and filled application form to open PMJDY Account.

OVD Documents for Opening Jan Dhan Yojana Account –

| Passport | Driving Licence (DL) |

| MNREGA Job Card | Voter Id Card |

If these documents also contain your address, it can serve both as “Proof of Identity and Address”. If a person does not have any of the “officially valid documents” mentioned above, but it is categorized as ‘low risk’ by the banks, then he/she can open a bank account in a Bank Branch by submitting any one of the following documents:

- Identity Card with applicant’s photograph issued by Central/State Government Departments, Statutory/Regulatory Authorities, Public Sector Undertakings, Scheduled Commercial Banks and Public Financial Institutions;

- Letter issued by a gazette officer, with a duly attested photograph of the person.

PM Jan Dhan Yojana New Rules

Pradhan Mantri Jan-Dhan Yojana (PMJDY) is National Mission for Financial Inclusion to ensure access to financial services, namely, a basic savings & deposit accounts, remittance, credit, insurance, pension in an affordable manner. Under the scheme, a basic savings bank deposit (BSBD) account can be opened in any bank branch or Business Correspondent (Bank Mitra) outlet, by persons not having any other account. There are certain special benefits under PMJDY Scheme which are as follows:-

- One basic savings bank account is opened for unbanked person.

- There is no requirement to maintain any minimum balance in PMJDY accounts.

- Interest is earned on the deposit in PMJDY accounts.

- Rupay Debit card is provided to PMJDY account holder.

- Accident Insurance Cover of Rs.1 lakh (enhanced to Rs. 2 lakh to new PMJDY accounts opened after 28.8.2018) is available with RuPay card issued to the PMJDY account holders.

- An overdraft (OD) facility up to Rs. 10,000 to eligible account holders is available.

- PMJDY accounts are eligible for Direct Benefit Transfer (DBT), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), Micro Units Development & Refinance Agency Bank (MUDRA) scheme.

Extension of PMJDY Program

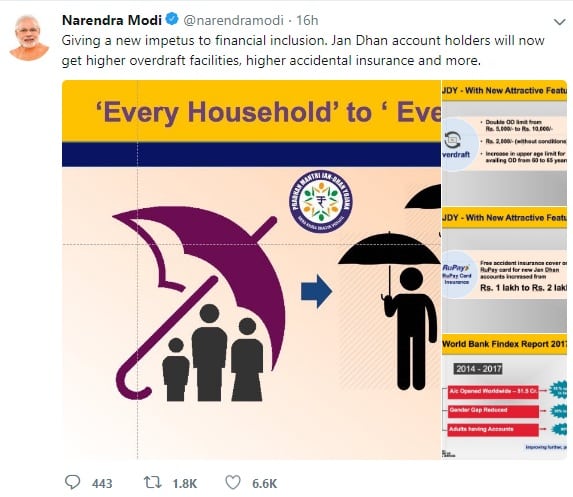

The Government has decided to extend the comprehensive PMJDY program beyond 28.8.2018 with the change in focus on opening accounts from “every household” to “every adult”, with following modification:

- Existing Over Draft (OD) limit of Rs. 5,000 revised to Rs. 10,000.

- No conditions attached for active PMJDY accounts availing OD upto Rs. 2,000.

- Age limit for availing OD facility revised from 18-60 years to 18-65 years.

- The accidental insurance cover for new RuPay card holders raised from existing Rs.1 lakh to Rs. 2 lakh to new PMJDY accounts opened after 28.8.2018.

Progress Report of PMJDY Scheme

| Bank Name / Type | Total Beneficiaries | Deposits in Accounts (in Crore) | Number of Rupay Debit Card Issued to Beneficiaries |

| Public Sector Banks | 34.48 | 113890.92 | 27.14 |

| Regional Rural Banks | 7.94 | 27967.51 | 3.38 |

| Private Sector Banks | 1.27 | 4373.93 | 1.11 |

| Grand Total | 43.70 | 146232.36 | 31.64 |

Beneficiaries as on 20 October 2021. Disclaimer: Information is based upon the data as submitted by different banks

Jan Dhan 2 Scheme – PM Jan Dhan Yojana Open Ended with More Incentives

Central Govt. has decided to make Pradhan Mantri Jan Dhan Yojana an Open Ended Scheme. Under this Jan Dhan 2 Scheme, govt. has now added more number of incentives in order to encourage poor people to open zero balance bank accounts. PM Jan Dhan Yojana scheme was launched in August 2014 for 4 years which is later extended. 1st phase of PMJDY scheme was completely focused on opening basic bank accounts. People also got RuPay debit cards with inbuilt accident insurance cover of Rs. 100,000.

PM Jan Dhan Yojana is the biggest financial inclusion scheme in the entire World. Now the govt. wants to make scheme more open ended with more incentives keeping in view of its “runaway success”. So, central govt. has decided to launch Jan Dhan 2 Scheme. Now the over-draft limit for account holders has now been doubled to Rs. 10,000.

Jan Dhan 2 Scheme – PMJDY is Now Open Ended with More Incentives

The important features which have been included in Pradhan Mantri Jan Dhan Yojana are as follows:-

- Accidental Insurance Now Rs. 2 Lakh – All the people who opens new Jan Dhan Bank Accounts after 28 August 2018 will now get Free Accident Insurance Cover of double amount of Rs. 2 lakh.

- Over-draft Limit Now Rs. 10,000 – Now there would be no conditions attached for overdraft of upto Rs. 2,000. Now the maximum limit for over-draft is set at Rs. 10,000 (previously Rs. 5,000). IN PMJDY, this facility is available after 6 months of opening bank accounts. Over-Draft facility means that the account holder can withdraw money from his account which is more than the actual balance present in bank account.

- Upper Age Limit now 65 Years – Also the upper age limit to avail the Jan Dhan Yojana facility is now raised from 60 years to 65 years.

- There are around 43.70 crore Jan Dhan Account holders and total deposit balance has now reached to Rs. 1,46,232.36 crore (as on 20 October 2021).

- Now the Central govt. has decided to continue the flagship PM Jan Dhan Yojana financial inclusion scheme. PMJDY will now focus on opening account from every household to every adult.

Jandhan-Aadhaar-Mobile (JAM) linking will continue to provide the essential backbone to cover various activities. This includes Banking / Savings & Deposit Accounts, Remittance, Credit, Insurance, Pension in an affordable manner.

This decision to make Pradhan Mantri Jan Dhan Yojana an open ended scheme will accelerate the pace of digitised financially included and insured society. In Jan Dhan 2 Scheme, overdraft is raised to Rs. 10,000, Upper Age limit is now 65 years and accidental insurance now Rs. 2 lakh.

Rs. 2 Lakh Insurance Cover Scheme for Jan Dhan Account Holders PDF

Rs. 2 Lakh Insurance Cover Scheme launched for Jan Dhan Account Holders. All Pradhan Mantri Jan Dhan Yojana accounts opened after 28-08-2018 will attract accidental Insurance cover of Rs. 2 lakh per annum. Under Rupay Scheme, each PM Jan Dhan Yojana account is offering accidental insurance cover of Rs. 1 lakh if opened before 28 August 2018. In this article, we will tell you about the complete details of the new Rs. 2 Lakh Insurance Cover Scheme.

Rs. 2 Lakh Insurance Cover Scheme Details

The insurance cover under the new Rs. 2 Lakh Insurance Cover Scheme would be provided free of cost, i.e. there is no need to pay any premium to avail the scheme benefits. You just need to have a saving bank account opened under the Jan Dhan Yojana which can be opened in any Bank Branch or CSP Outlets. PMJDY is a National Mission on Financial Inclusion. The plan envisages universal access to banking facilities with at least one basic banking account for ‘every adult’, financial literacy, access to credit, insurance and pension facility.

Objectives of Rs. 2 Lakh Insurance Cover Scheme

The main objective of the new insurance scheme for Jan Dhan Account holders is to push the social security net for the poor. Till 6 August 2021, there are about 42.83 Crore Jan Dhan account holders in the country who will be benefited by the insurance scheme. Out of the 42.83 crore, around 31.12 crore accounts have been seeded with the Aadhar number of the account holder and rest will be seeded soon to ensure that the welfare payments reach the right beneficiaries in time.

Premium Amount for Rs. 2 Lakh Insurance Cover Scheme

The central government would bear the cost of premium to be paid to the insurance companies under Rs. 2 Lakh Insurance Cover Scheme. The new insurance scheme is now being implemented and cover is provided by the insurance companies to all Jan Dhan account holders

Three social security schemes are already been running named Pradhan Mantri Suraksha Bima Yojana (PMSBY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Atal Pension Yojana (APY) which were launched in 2014. The premium amount under the PMJJBY is just Rs. 330 per year while the 2 lakh accidental cover is available at a premium of just Rs. 12 per year under Pradhan Mantri Suraksha Bima Yojana (PMSBY).

Special Benefits under PMJDY Scheme

- Interest on deposit.

- Accidental Insurance cover of Rs. 1 Lac under Rupay Scheme and for accounts opened after 28-08-2018 accidental Insurance Cover is of Rs. 2 lakh.

- No minimum balance required.

- The scheme provide life cover of Rs. 30,000/- payable on death of the beneficiary, subject to fulfillment of the eligibility condition i.e. accounts opened between 15.08.2014 – 31.01.2015.

- Easy Transfer of money across India

- Beneficiaries of Government Schemes will get Direct Benefit Transfer in these accounts.

- After satisfactory operation of the account for 6 months, an overdraft facility will be permitted

- Access to Pension, insurance products.

- The Claim under Personal Accidental Insurance under PMJDY shall be payable if the Rupay Card holder have performed minimum one successful financial or non-financial customer induced transaction at any Bank Branch, Bank Mitra, ATM, POS, E-COM etc.

- Channel both Intra and Inter-bank i.e. on-bank (Bank Customer/Rupay card holder transacting at same Bank channels) and off-bank (Bank Customer/Rupay card holder transacting at other Bank Channels) within 90 days prior to date of accident including accident date will be included as eligible transactions under the Rupay Insurance Program 2016-2017.

- Overdraft facility upto Rs. 10000/- is available in only one account per household, preferably lady of the household subject to eligibility and Overdraft for Rs. 2000/- is hassle free

References

— In case of further query, please call National Toll Free Number: 1800-11-0001 or 1800-180-1111.

— For more details on Pradhan Mantri Jan Dhan Yojana, please visit the official website pmjdy.gov.in

Mahinam bahera darbhanga

Akbar Ali

Sir mujhe loan chahiy

Am study at kanpur in parbhat engineering college diploma mechanical production please sir my students lone passing and I am poor family to relative

Business Loan

Sir Mujhe SwamRojgar me Liye 2 Lakh Rs ka Loan Lena Hai sir Help Kijiye 9793133760

ami bigness lon korta chi pachi na help

dear sir,

please note I need 3 lakh rs. loan for urgent requirement. please help and arrange

Sir i needed 3, lacs rs, for our work please tell me.

Sir muhje 2 lac rupees ke help kar dega please request to allies have yadav to help me in my poor I live in fzd

Sir mughe 2 lac ruppes ke help kar deja please I live in fzd please akilesh yadav sir please

Good evening sir,

Myself Lakshmi , am postgraduate student(MCA) and I’m unemployed .I’m from schedule cast. I need a personal loan for my new business . Please help me out .How can I get loan

Sir please rs 3 lakh . loan for urgent requirement. please help me

Sir me construction work per suttring ka work start karne ke liye lon chahiye.

krpya madad kijiye..

i cww trade compleet from iti mandla (mp)

I need personal load

Sir mujhe service center kholne me liye loan chahiye

I want bussiness loan..

Sir mujhe dhukan ke leye Lon lena hi

Sir….muje Stationery Vypar ke liye Rs 2 Lakh ki Loan chahiye Rayshibhai Rathod Costmer S.b.i…Jandhan yojna ATm….09825151369

Sir mujhe computer ki dhukan ke leye Lon lena hi

mene computer se ITI kar choka hu me apni ak dhukan kholna chata hu

mobile no. 8534839500

Sar mugya mobail reepyringh kee dukan kolna ka liya 100000₹rupya chiha

Sar mugh reepyringh kee dukan kolna ka liya/ 100000₹de do my mob no 7830240550 7617676933 Account no pugna ka liya apkee ati keerpa hogee

sir muje business loans chahiea please

Vijay Hatila village pipleepada post dhekal bad I district jhabua

Vijay Hatila village pipleepada post dhekal badi district jhabua m.7566226282 sir mujhe rojgar loan chahiye sir please 500000 ka loan ki jarurat hai

I am Raghothamrao from Hyderabad requesting loan for 5 lakhs.

I am naresh kumar . I took education lone from sbi.but i am not getting job yet now. It is dificult to pay lone as jobless. I belong from poor family. My father is a auto driver. Sir i need your help .

Mujhe bhi lon chahiye gar bnanane ke liye

Mre rehna ka koi thikana nhi hai

Kirpa karke meri madad karain

8948806117

Mujhe bhi lon chahiye gar bnanane ke liye

Mere rehna ka koi thikana nhi hai

Kirpa karke meri madad karain

8948806117

Plz help me muje nay business suru karna he loan dijiye plz plz co my number.+919723828246

Sir /madam mera graduation complete hua hai aur mujhe aage ki padhai ke liye 1 lakh loan chayiye.

I want loan 1 lakh for study

Sir Kay app mujhe 200000 ki madad kar sakte ho please help me

apply for loan at SBI

Sir mujhe 1lakh ka loan Chiyee pls.

muje bhi bisuness suru karne ke lia loan cahiye plzzzz help m sir…….

मोदी सर हम जनजधन योना वाले है हमारे भि ऊपर कूछ ढालिये मै बिठूल कूमार गूप्त सर हमे जायदा नही चाहिये बस एक चोटा सा चाय के दूकान ढालना आब इस मे कितना लगता है ये तो आप खूद जानते है वनलि चाय कि दूकान सर मेरा दूकान खोलवाने कि इछा आपकी होगी तो इस नम7309672697 परमैसे ढाल सकते है निवेदक बिठूल गूप्त आपके सिश

Sar mujhe bhi Karobar ke liye 100000 de dijiye

Muje urgent lone chiye

Sir muje business ke liye 5 lakh ke loan ki jrurat h plz meri help kre Sir.

Kaushal

Business loan

PALES LOANS 300000

Sir muje krja dane h muje 3 lakh ke lone ki jrurat h plz meri help kre sir or ma jandan vale h plz sir

Sir, i want 2 lakh for madhumakhi palan

Jan dhan ka labh kaise len

Iske liye hame kya karna chahiye

Shri man ji mujhe rojgar karne ke liye (500000)ka loan chahiye kripya kar ke mujhe loan lene ke liye kya karana hoga iski jankari dijiye dhanyvad

Mujhe loan chahye 500000 mobel no 9008032305 pls help me

Hami koi loan nahi deta kiyn ki hum enkam taxes nahi bharte ham kiya kare ham to lebar kam karte hai plz help me

I want to New opening account, Jan dhan yojna, plzzzz send me details and contact me 09764083374

2lakh rupesloan in my name ravi panika mp shahdol jaisinghnagar

Thakor shravanji mepaji koita

Sir Mera Jan Dhan Ka Account H JO Ki Band H Me use Cahalu KRANA CHATA HU PLZ KRA DANA OR UES KE DATAILS AND CONTACT ME-9520805026

Plz help me mujko 200000ka loan chahiye help me plz

SIR MUJHE SOUND K BUSSINES K LIYE 2 LAKH RUPAYE KI JAROORAT HAI KRIPYA MERI MADAD KAREY NIKHIL SRIVASTAVA 8808979197……….

APPLY FOR SECURED LOAN

Do you need a Loan ? Email: ekoloan5@gmail.com We Are Currently Offering Private * Commercial and Personal Loan * Business Loan * Payday Loan * Student Loan * Mortgage Loan* Auto Loans * Bad credit Loan * Home equity Loan *Project/Contract Loan * Debt Consolidation Loan to interested individuals at 3% Interest Rates. Apply with us Via Email:ekoloan5@gmail.com

आप आवश्यक वित्तीय सहायता या ऋण की आवश्यकता है? संपर्क करें या करने के लिए +2348151 009371 ekoloan5@ gmail.com एसएमएस पाठ संदेश भेजने के लिए

plz halp sar meri sister ki shadhi h mujhe 2 lakh ka lone chiye my contect num… 9599321420

New jan dhan yojna7080987414

dear sir. mujhe lone chaiye 500000

ghor ko be thik karna he. business korta tha .sob dub geya .new note aneke bajese.

2

Fdgjvx

Aawash chahiye

Sad mujhe 500000 loan ki jarurt h Kya aap dene ki krepa Kare please sar arjent contect n. 8178063137

requirement 3 lac

2,50000 loan chahiye please modi ji

bussines ka laya two lac chahiya ac bussines

bussines ka laya two lac chahiya ac bussines mo 8655786842

Sur mujhe lone lena hai sur meri help karo sur contect no. 8871847464

gmail account

shubhambarman00@gmail.com

Sur mujhe lone lena hai sur meri help karo please sur contect no. 8871847464

Sir..i need a job but. Iam handicapd plz..help

sir,if population will not help you,i am sure god will defiantly help you,

buz your one faithful and chalenger,person for our country.

sir,i am from, jammu, I was lefted my family 15yers back due to my education propose, my age 28yers, i completed H.S.C. without my family sport, from mumbai bord, from 7th_Std, i started job , in mumbai as a (TEA SHOP).

Sir, after this hard work i reach this stage, i got pvt job, but now i dont, have any own home, and any secoure job,

i never demanded nay thig from my family,

i never demanding any things from you, i am proud of my self because i am Son of INDIA.

*(sir advised me but i can do more for my future setup)*

Insurance Scheme for Jan Dhan Account Holders

avas. job cahia

modi sir mero ko 4 lakh ki loan chahiye kyuki me abhi job karta hu or mene mera ghar banane dusre logo se pese. liye the oshko mera selary usaka vyaj bharne me hi chala jata hai or mere pas pese nahi rehte esliye please muje itani loan dijiye na please me aapko hath jodkar vinnanti karta hu please sir mo.9624618774

Sir I need Rs.8laks loan please help me. Thanks

sir mujhe awash chahiye

Sir

Srikanta samanta please help me city gold werk new business starting lona

pls sir kumar mengal bhima chandrabhan at/po samsherpur ta akole dist ahemadanagar stet maharashtra muje 400000 lon chahie

Dear sir

Mujhe Ghar banane k liye ,

1lakh ke loan ki jarurat h.

Sir I need Rs.6laks loan please help me. Thanks

Riya Singh 9540047707

Jitendra kumar.

Dear Sir .

Hum ko ghar bnane ki liye 15 lak tak lon lena chahta hu eska upay btaye ki humko

Lon kaise melega aap ki mahan kirpa hogi.

Sir, please mere kheti bil kul nahin hai is liye mujhe koi bhi bank loan dene se mona kar raha hai mai sach much se bohut gorib hun nahin to ap inquari bhi kar sakte hai choti moti kuchh business ke liye 1 lakh rupees loan darkar hai please sir mere upar daya karke mujhe ek loan di jiye main ap ka bohut abhari rahunga mobile no 8018982505

Sir ,main bohut gorib hun meri kheti nahin hone ke karan mujhe koi bhi bank loan dene se mona kor raha hai nahin to ap inquari kar sakte hai please sir ek chhota mota business ke liye mujhe 1 lakh loan dene ka daya koriye main apka morte dum tak abhari rahunga mer biwi ke nam se sbi main ek jon dhon ac hai unka nam hai madhusmita Das mera mobile no hai 8018982505

sir,

I want to start new business But i have insufficient fund. plz. provide me 5 lakh loan

Thanks

Gaurav Dewan

9910033113

sir,

I want to start new business But i have insufficient fund. plz. provide me 5 lakh loan

Thanks

Gaurav Dewan

9910033113

sir

me manoj verma kathwari panna m.p

3 lakh ka lon chaeia bahut garib hu

koi bijanesh karna chahta hu

mob.9273524014

Sir ,please help me please koi job main meri health main problem hai Age 20 year hai please help?

District:Fazilka-Abohar

8968502539

Sir me bohut gorib hun islie mujhe 1 lakh help kr dijie na

SIR, PLEASE HELP KOI JOB MUJHE DILA DIJYE .

NAME- PRABHAKAR SHARMA BELONG TO GONDA DISTIC

QUALIFICATION-B.A.PART TWO COMPLITE HAI

AGE-20YEAR HAI MOB NO.7309208313

Sir mai bijanesh karane ke liye lon mang RHA hu please hme lon dijiye

SIR PLS HELP ME …..

PLS GIVE M LOAN ONLY 1CROR.

M OPEN BIKE SHOWROOM.`

SIR

PLS GIVE ME LOAN ONLY 1CROR RUPISE.

ME OPEN BIKE SHOWROOM.

Kripya Kar Mu6e jan dhan yojna ke bare me batye y loan kese mil sakta hai aur kya formlities karni hogi krpya kar jankari de

krprya kar jan dhan yojna ki jankari dene ki krpa kare taki hum bhi iska labh utha sake

RESPECTED SIR, NAMASKAR. I HAVE URGENTLY REQUIRED RS. 3 LAKHS AS LOAN. THEREFORE I PRAY TO YOU KINDLY GIVE ME THE SAID LOAN AND OBLIGE.

sir muje small busines ke lie loan chahie 80000 ki please provide me

Namaskaram sir nenu oka chinna business pettadaniki naku 300000 lone kavali

Sir mujhe bhi Hom lon 5 lac ka chahiya

Sar mujhe lon chahiye

Sir, I am very poor person. I need 500000 rupees loan for home loan. Please help me sir. (ph.no. 09831653610)

Plz help me sir ji

Machhali shahar

You can’t believe what i just got,… A loan of $ 60,000. I have been looking for a loan for the past 2years untill i was referred to a legitimate lender. Though it was not that easy to approve my loan, as you know nothing good comes easy. But I got my loan within 4 hours i got my loan, and before i knew it, the loan was transferred to me. please friends, don’t let any body deceive you and scam you for this is real. Contact them via Email: jamesben614@gmail.com

dear sir muje loan chaiye 200000 ka mujko apna cemra purchase karna working ke liye mei 5 years se photography kr rha so plz help me jo hoga contion mei apna luga plzzz mujko apki jarurt hai 9990916394 ek bqar call jarur kare mujko

Press me Private Job ke liye sampark kare what app number 07533869569.

sir/ mujhe apne business ko a age badane ke liye 200.000 loan chaiye aap de sakte he my no..7617752339

sier iam sambhu nath das mery linoe chey 50000 ropes place hialp 8250295769

hame bhi jankari dijiy sur pradhan matri aavas yojna ke bare me contect no. 8109939990

sir im from prabhukumar,mavillapadu(v),santhavellor(p),varadhaiahpallem(m),chittoor(d),ap,pin517646.mobile nu:9849334622.sir im pvt company salary employee i will do one off the Adidas shoes manufacturing company 7years i know shoes full manufacturing i will interest iwill strat miny shoes manufacturing company so i have no mony im vpoor but work skill very well please help poor people im also development please help me sir

Hi Luz…

Thank you for the information. I have sent an email on “jamesben614@gmail.com”. Now, will they contact me via email or how is the procedure to apply with them?

Please guide me about the same…

Thank you,

Niyogisinh Chauhan

sar ma ratipal mujha 100000 ka loan ki jrurt ha apne shop ka liya pls mo. 9795584998

Hello sir mera sbi ma jandhan khata khula huva hai muje loan chahiye so muje kya krna hoga aur bank se kese muje loan mil sajti hai?

ye sab scheme nikalte h bewakuf banane k liye jab apply krne jao to kahenge aesa koi scheme nhi h ya fir bhagate rahenge …..public chhutita h jitna chhaho banate raho koi bhi sch6 ka fayada to sirf dalalo ko ya powerfull logo ho hi milti h.

GOOD MORNING SIR BIHAR SE HU JOB CHAHIYE SIR BIHAR KE LIYE KUCHHA KIJIYE SIR YHA PAR KAM SE KAM 5 BARE COMMPANY LAGWAYE SIR MY, M COM KIYA HU SIR

sir mujhe loan ki jarurat hai aur mera acount jan dhan yojna me hai iske liye mujhe kya krna hoga please my no 8863812124

mara khata jandhan yojna sbi bank me h mb.7210088465

sonvir singh me khata sbi bank me h lon mb.7210088465

2lakh rupesloan in my name balwan singh

bapcha post bapcha chhabra baran rajasthan

pls tell me why the account holder cannot deposit the amount directly into the bank neither he/she can withdraw any amount directly from the bank. Is there any rules for that because the sbi (mundka branch) bank refuses to do so.I have to do it online or any similar way .it is so frustating. pls reply,Thanking you.

Chitalwana jila jalor t h chitlawana mali ka was mo 9930993460

STILL OPEN ACCOUNT TODAY OR NOT PLS REPLY. ANY BANK 0 ACCOUNT BALANCE OPEN MARCH 2018 ONWARDS

i need account

village kakrowa post said nagli tehshil hasanpur distt amroha

Payal1997@

I need this post

AKASH956574@GMAIL.COM

Sar hme kisi bhi yojana ka labh nhi mil rha h

Me kidney transplant hu meri wife bhi bimar rhti h mere 3 ladki or 1 ladka h mera rasancard bhi chalu nhi h please help kre

Hello sir mera name noni mera account sbi vich a jj loan de jaurat a jj

TO-MANAS KUMAR DAS

AT-Khandayata patana

po-balanga

dist-puri

pin-752105

adharaa-500227643166

SBI-A/C-33523443116

ifsc-SBIN0013571

ph-7894760768

Bhadurpur.bhopalpur lalganj azamgarh

Jan dhan yojna lone how to apply

Dear Sir/Madam

I am Mr kadir Are you a business man or woman? Are you in any financial stress or do you need funds to start up your own business? Do you need a loan or for any reason

funding such as, a) Personal Loan, Business Expansion.b) Business Start-up and Education.c) Debt Consolidation.? I can help you with the urgent loan you need.contact

us at globalserviceloana@gmail.com

shailender

hhgaretg

dear, sir

me padna chahata hu but mere pass pese ni h or meri family ki bhi bahut karab haalt h please sir meri help kro please ni mujhe apni jaan bhi deni pd sakti h aap hi sahara ho agr apne bhi meri help ni ki tho pata ni me kya kr lu

Sarkari Yojana

Lon 5laakh chahte

Padna chahta hu sir par..

Mujhe bhi lone chahiye Sir mene 12th pass kiye h or pdhai k liye aage ghr me paisa kamane wala koi nhi h isliye kaam b bhi nhi mila to kaam krke ghr ka guajara kar rha hu

Mera A/c SBI me hai hame business ke liye loan chahiye .7905217401 contact me

BILARIPUR POST MANUJAMPUR D KANPUR NAGAR

Mujhe loan chahiye

west champarna bihar

Sir mein bank 7saal phle open Kiya,Lekin aaj tak mujh aapse help nahi mila

ashok

Sar mujhe bhi Karobar ke liye ek lakh rupaye ki jarurat hai kripya mujhe de de

sir mein 5saal pehele bank open kiya, lekin abhi tak mujhe apki koi help nahi mila. mnai kiya karu?

Hi

Taluku kustigi jila koppal …… .. …… hanamasagar

I’m not account

Pm janadana aconta

Pm janadana account

BAGAVVA DAVALESHWAR pm jan dan yojana please

Please do not share your personal details, also visit the bank branch to open an account under the scheme

Create account video sir

HOW CAN I APPLY ONLINE FOR JAN DHAN ACCOUNT

Apply on the bank’s website where you want the account to be opened or most probably you will have to visit the branch physically to get the PMJDY account opened.

#439 kithganoor colony Kr Puram Bangalore post 560036

thimmappasanju@gmail.com scholarship metiorious girl 2students for sanjana t manasa t

iam thimmappa d sayssir iam foor man ples help me 1 lake

How should I open my pmjdy account

Go to bank branch

sir IAM apply to jandhan yojna

हमें सारकरी योजना का नहीं मिलता है

It’s account open only bank not post office any framed bank

Any Bank

Union Bank

सर मेरा जनधन खाता है लेकिन अभी तक में ₹1 की राशि नहीं मिली है अकाउंट नंबर

please don’t leave your account numbers in here

हमें लोन लेना है जनधन अकाउंट से जीरो ठेके पर

Je dir

Narayan das kolani

Sir mera Jan dhan khata hai par mujhe abhitak 1Rupeea nahi mila hai please sir ab mujhe bhimilegana sir

I am having 2 bank accounts one IOB and other in IB can I open jan Dan in SBI.

In somashekar.m.e.erappa.holenarasepur.hassan.karnataka.st

Holenarasepur.sbi.bank.ac.no.64123125924.in.acno.pm.jan.dhanyojanacno.oppanig.zeruacnoincoma.wel.coma

iam poor family please help me

Hello

Jan.dhan.yojana.accun.open

Hy

Sir mera naam damodar verma hi Muje loan chaye mere mobile no 9587226977

i am poor family please help me.