Atmanirbhar Bharat Rojgar Yojana Registration 2026 is launched to incentivize creation of new employment opportunities during COVID recovery phase. Central government will provide incentive for employers and new employees of eligible establishments registered with EPFO. New employees will get incentive for two years from their date of registration. The direct link to check the Aatmanirbhar Bharat Rojgar Yojana PDF at the labour.gov.in portal is given in this article, so read it till the end.

The Scheme stands commenced from 1st October, 2020 and shall remain open for registration of eligible employers and new employees up to 31th March 2022 (earlier 30 June 2021). The benefit shall be available for a period of twenty-four months from date of registration of new employee, not later than 31/03/2024 (earlier 30/06/2023) in any case.

Atmanirbhar Bharat Rojgar Yojana Registration 2026

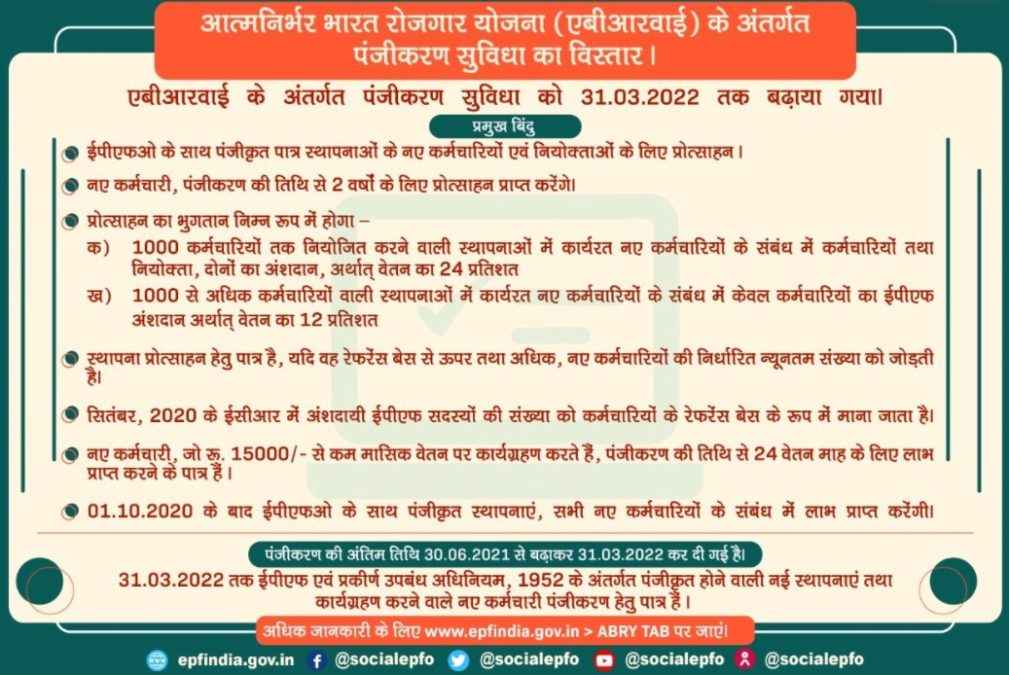

The registration facility under Atmanirbhar Bharat Rojgar Yojana has been extended till 31 March 2022 and benefit will be available till 31 March 2024. Here are some of the key highlights of Atma Nirbhar Bharat Rojgar Yojana:-

- Incentive for employers & new employees of eligible establishments registered with EPFO.

- New employees will receive incentive for 2 years from his/her date of registration.

- Incentive in the form of payment of

- Both employees & employer’s contribution, i.e., 24% of wages in respect of new employees employed in establishments having up to 1000 employees, &

- Only Employees EPF contribution, i.e., 12% of wages in respect of new employees employed in establishments having more than 1000 employees.

- Establishment is eligible for incentive if they add prescribed minimum number of new employees, over and above the reference base.

- Reference Base of Employees is taken as Number of Contributory EPF members in ECR for September, 2020.

- New employees joining with monthly wage of less than Rs. 15,000/- entitled to receive benefits for 24 wage months from date registration.

- Establishments registered with EPFO after 01.10.2020 shall get benefits in respect of all new employees.

Who are Eligible to make ABRY Scheme Registration

The new employees joining & new establishments getting registered under EPF & MP Act, 1952, up to 31.03.2022, are eligible to register.

For more detailed information on ABRY, visit the official website at https://www.epfindia.gov.in/site_en/abry.php

Aatm Nirbhar Bharat Rozgar Yojana Guidelines PDF

In this article on Aatm Nirbhar Bharat Rojgar Yojana 2026, we are providing you the complete details about the new employment scheme.

Amended Atmanirbhar Bharat Rojgar Yojana Scheme Guidelines PDF applicable from 2 July 2021 – https://www.epfindia.gov.in/site_docs/PDFs/Abry/ABRY_Scheme_Guidelines_Amended_on_02_07_2021.pdf

Atmanirbhar Bharat Rozgar Yojana Brochure – https://www.epfindia.gov.in/site_docs/PDFs/Abry/Brochure_ABRY_Scheme_Eng_25112021.pdf

Atma Nirbhar Bharat Rojgar Yojana FAQ’s – https://www.epfindia.gov.in/site_docs/PDFs/Abry/FAQ_ABRY.pdf

Aatmanirbhar Bharat Rojgar Yojana Previous Guidelines as on 31 December 2020 – https://www.epfindia.gov.in/site_docs/PDFs/Abry/ABRY_Scheme_Guidelines_31122020.pdf

Make Aatm Nirbhar Bharat Rojgar Yojana Registration at http://www.epfindia.gov.in/site_en/index.php or https://labour.gov.in/

Scale for Aatm Nirbhar Bharat Rojgar Yojana

| Establishments employing upto 1000 Employees | Establishments employing more than 1000 Employees |

| Employee’s Contribution (12% of Wages), Employer’s Contribution (12% of Wages), Total – 24% of Wages | Only Employee’s EPF contributions (12% of EPF Wages) |

Beneficiary Criteria for Aatm Nirbhar Bharat Rojgar Yojana

The Atmanirbhar Bharat Rozgar Yojna will be applicable for eligible new employees joining EPFO-registered establishments and for those who exited these establishments during the COVID pandemic. The beneficiary criteria for Aatm Nirbhar Bharat Rojgar Yojana is as follows:-

- New Employees joining employment in EPFO registered establishments on monthly wages less than Rs. 15,000 during validity period of the Aatm Nirbhar Bharat Rojgar Yojana.

- EPF members drawing monthly wage of less than Rs. 15,000 who made exit from employment during COVID pandemic from 1 March 2020 to 30 September 2020 and are employed on or after 1 October 2020.

- The subsidy support to get credited upfront in Aadhaar seeded EPFO Account (UAN) of eligible new employees.

Eligibility Criteria for Establishments in Aatm Nirbhar Bharat Rojgar Yojana

Establishments registered with EPFO if they add new employees compared to reference base of employees as in September 2020 as – Minimum of 2 new employees if the reference base is 50 employees or less. Minimum of 5 new employees if the reference base is more than 50 employees. Establishments registering with EPFO after commencement of Aatm Nirbhar Bharat Rojgar Yojana to get subsidy for all new employees.

Cabinet Approval for Aatm Nirbhar Bharat Rojgar Yojana

The Union Cabinet, chaired by the Prime Minister, Shri Narendra Modi has given its approval for Atmanirbhar Bharat Rozgar Yojna (ABRY). This Aatm Nirbhar Bharat Rojgar Yojana would boost employment in formal sector and incentivize creation of new employment opportunities during the Covid recovery phase. ABRY was announced as a part of Aatmanirbhar Bharat 3.0 package to boost the economy, increase the employment generation in post Covid recovery phase and to incentivize creation of new employment along with social security benefits and restoration of loss of employment during COVID-19 pandemic.

- This scheme being implemented through the Employees Provident Fund Organization (EPFO), reduces the financial burden of the employers of various sectors/industries and encourages them to hire more workers.

- Under ABRY, Government of India is crediting for a period of two years both the employees’ share (12% of wages) and employers share’ (12% of wages) of contribution payable or only the employees’ share, depending on employment strength of the EPFO registered establishments. Under ABRY benefits are provided to every establishment registered with EPFO and their new employees (earning wage less that Rs. 15,000/- per month) if the establishments take new employees on or after 1.10.2020 and upto 30th June, 2021 or those who lost jobs between 01.03.2020 to 30.09.2020.;

- The scope of the scheme i.e. last date for registration of new employees under the scheme has been extended from 30th June 2021 to 31st march 2022 with the approval of CCEA in its meeting held on 30.06.2021. Approximately 71.8 Lakh employees are likely to get benefited during the scheme period. The beneficiaries registered upto 31st March, 2022 will continue to receive the benefits for 2 years from the date of registration under the scheme.

Salient Features of Aatm Nirbhar Bharat Rojgar Yojana

The salient features of the Aatm Nirbhar Bharat Rojgar Yojana are as under:-

- Indian govt. is going to provide subsidy for 2 years in respect of new employees engaged on or after 1st October 2020 and upto 31st March 2022.

- Government of India will pay both 12% employees contribution and 12% employers contribution i.e. 24% of wages towards EPF in respect of new employees in establishments employing upto 1000 employees for two years,

- Union govt. of India will pay only employees share of EPF contribution i.e. 12% of wages in respect of new employees in establishments employing more than 1000 employees for two years.

- An employee drawing monthly wage of less than Rs. 15000 who was not working in any establishment registered with the Employees Provident Fund Organisation (EPFO) before 1st October, 2020 and did not have a Universal Account Number or EPF Member account number prior to 1st October 2020 will be eligible for the benefit,

- Any EPF member possessing Universal Account Number (UAN) drawing monthly wage of less than Rs. 15000/- who made exit from employment during Covid pandemic from 01 March 2020 to 30 September 2020 and did not join employment in any EPF covered establishment up to 30 Sept 2020 will also be eligible to avail benefit,

- EPFO will credit the contribution in Aadhaar seeded account of members in electronic manner,

- The EPFO shall develop a software for the scheme and also develop a procedure which is transparent and accountable at their end.

- EPFO shall work out modality to ensure that there is no overlapping of benefits provided under ABRY with any other scheme implemented by EPFO.

More Details can be checked at https://labour.gov.in/aatmanirbhar-bharat-rojgar-yojana-abry