| PDF Name | RBI LRS Scheme 2026 FAQ’s PDF |

|---|---|

| Last Updated | October 15, 2022 |

| No. of Pages | 4 |

| PDF Size | 0.20 MB |

| Language | English |

| Category | Government Schemes, Forms, Policies & Guidelines PDF |

| Topic / Tag | Scheme FAQ |

| Source(s) / Credits | Sarkari Yojana |

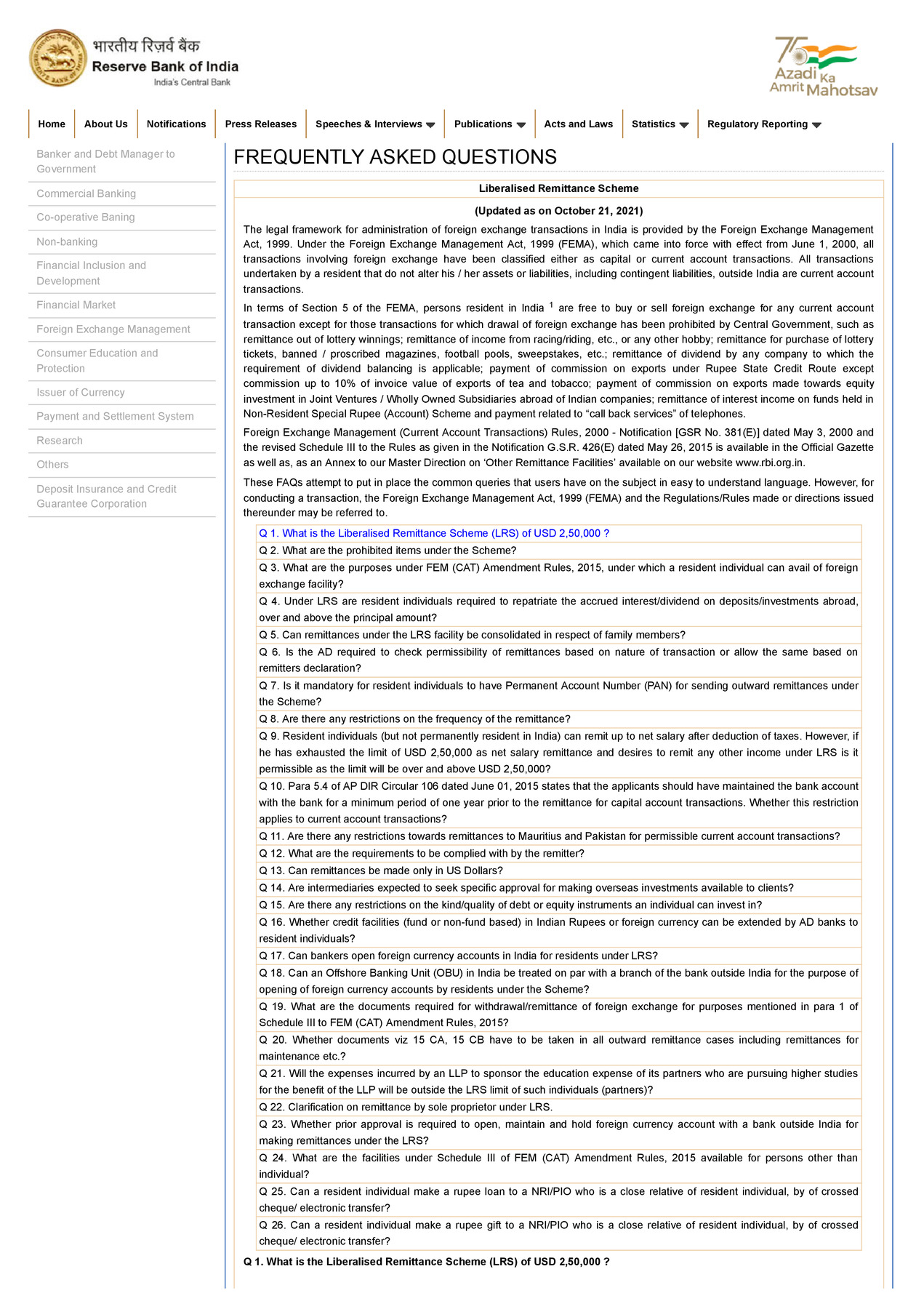

Check frequently asked questions on LRS Scheme 2026 of Reserve Bank of India. Under RBI Liberalised Remittance Scheme, all resident individuals, including minors, are allowed to freely remit up to USD 2,50,000 per financial year (April – March) for any permissible current or capital account transaction or a combination of both. Further, resident individuals can avail of foreign exchange facility for the purposes mentioned in Para 1 of Schedule III of FEM (CAT) Amendment Rules 2015, dated May 26, 2015, within the limit of USD 2,50,000 only.

RBI LRS Scheme 2026

The RBI LRS Scheme was introduced on February 4, 2004, with a limit of USD 25,000. The LRS limit has been revised in stages consistent with prevailing macro and micro economic conditions. In case of remitter being a minor, the LRS declaration form must be countersigned by the minor’s natural guardian. The LRS Scheme is not available to corporates, partnership firms, HUF, Trusts etc.

Prohibited Items under LRS Scheme

The remittance facility under the Scheme is not available for the following:-

- Remittance for any purpose specifically prohibited under Schedule-I (like purchase of lottery tickets/sweep stakes, proscribed magazines, etc.) or any item restricted under Schedule II of Foreign Exchange Management (Current Account Transactions) Rules, 2000.

- Remittance from India for margins or margin calls to overseas exchanges / overseas counterparty.

- Remittances for purchase of FCCBs issued by Indian companies in the overseas secondary market.

- Remittance for trading in foreign exchange abroad.

- Capital account remittances, directly or indirectly, to countries identified by the Financial Action Task Force (FATF) as “non- cooperative countries and territories”, from time to time.

- Remittances directly or indirectly to those individuals and entities identified as posing significant risk of committing acts of terrorism as advised separately by the Reserve Bank to the banks.