Central government has launched a new Champions Portal at www.champions.gov.in for MSMEs. This is an initiative of Ministry of Micro, Small and Medium Enterprises (MSME) to start CHAMPIONS Grievance Management System. Here people or organizations can now fill MSME Grievance online registration form at the official website to get their concern addressed. This CHAMPIONS Portal has been launched to put up and promote unified, empowered, robust, bundled and technology driven platform to help and promote MSMEs of India.

CHAMPIONS stands for Creation and Harmonious Application of Modern Processes for Increasing the Output and National Strength. Champions Grievance Management Service is launched by Nitin Gadkari and is now functional online. The new portal has facility to register here, seek / give ideas, view status and access control rooms for MSME grievance redressal.

Champions portal is going to turn smaller units big by supporting, encouraging, helping and handholding MSMEs. Now check how to make MSME Grievance online registration at Champions Portal.

Champions Portal MSME Grievance Online Registration Form 2024

Here is the complete procedure to fill MSME Grievance online registration form at the Champions Portal:-

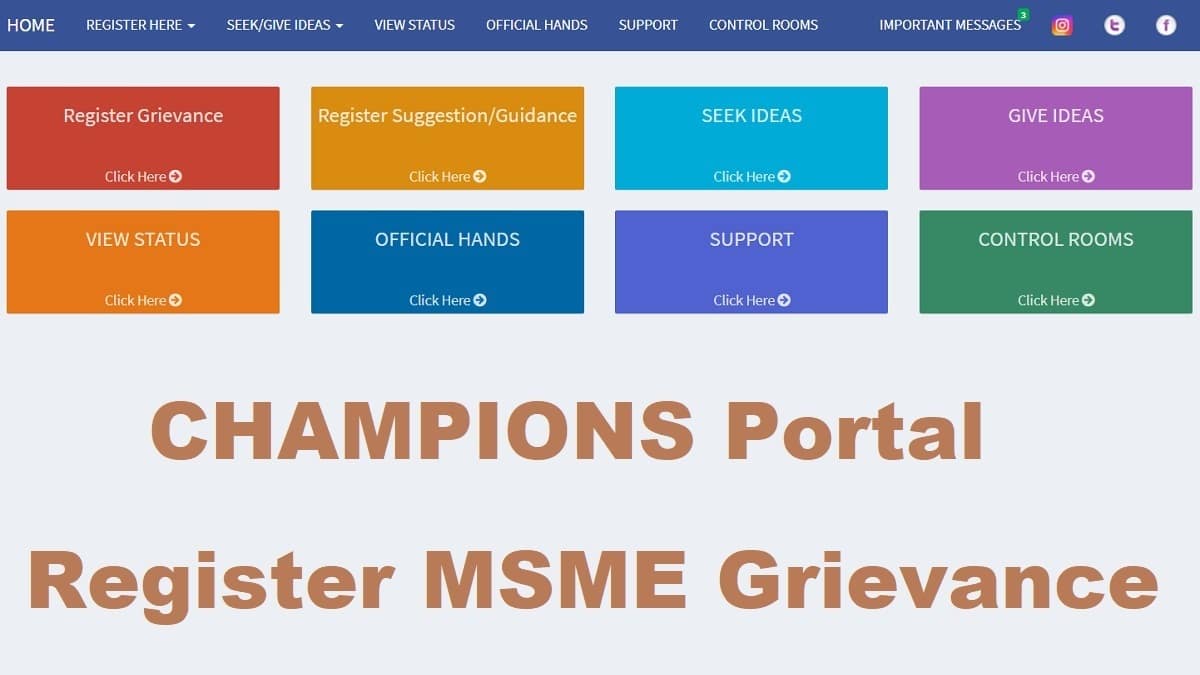

STEP 1: Firstly visit the official portal at www.champions.gov.in

STEP 2: On the homepage, scroll over the “Register here” tab present in the main menu and click at “Register Grievance” link as shown below:-

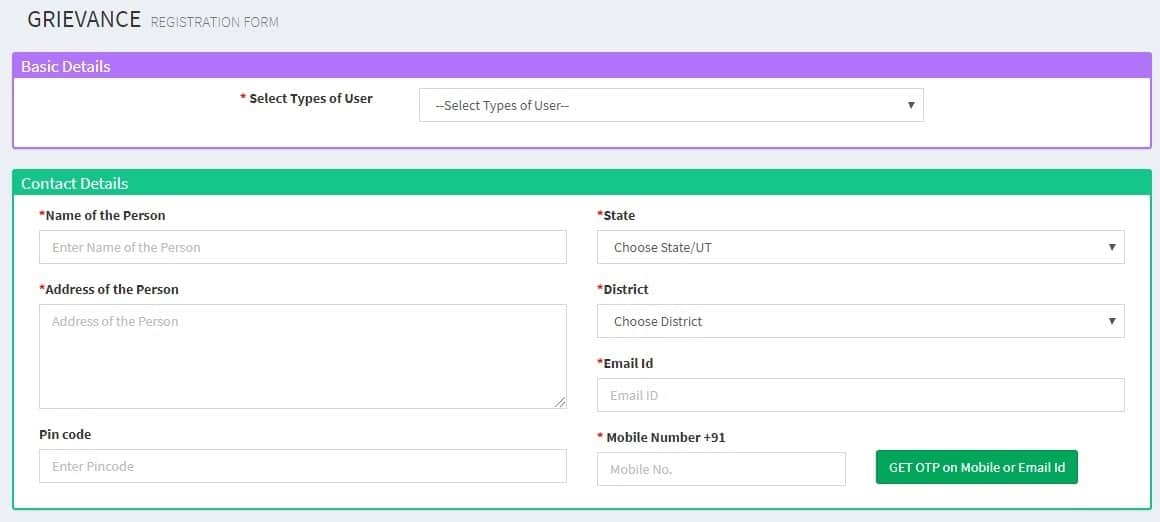

STEP 3: Accordingly, MSME Grievance online registration form at Champions Portal will appear as shown below:-

STEP 4: Applicant person or organization can enter the user type, name of person, state, address of person, district, e-mail ID, pin code, mobile number and click at “GET OTP on mobile no. or e-mail ID” button.

STEP 5: Afterwards, people can successfully validate the OTP by entering the OTP sent on registered mobile number. Then people or MSME can register their grievance.

STEP 6: After submission of MSME grievance, govt. will address the issue and solve it soon as possible to benefit MSMEs.

Who can Register Grievance at Champions Portal

The following persons or organizations can register their grievance at the Champions Portal:-

- Association

- MSME Unit

- MSME Employee

- Government Officials

- Would be Entrepreneur

- Individual

- Other

Objectives behind Launch of Champions Grievance Management Portal

Here are the 3 basic objectives to launch Champions Grievance Management Portal:-

1. In order to help MSMEs in this difficult situation in terms of finance, raw materials, labour, permissions, etc.

2. To help MSMEs to capture new opportunities like manufacturing of medical accessories and products like PPEs, masks, etc.

3. To identify the sparks i.e. the bright MSMEs who can not only withstand but can also become national and international champions.

www.champions.gov.in is a technology driven Control Room-Cum-Management Information System.

Features Available at Champions Portal

Champions Portal is a real one stop shop solution launched by the MSME ministry. The system utilizes modern ICT tools to assist Indian MSMEs march into big league as National and Global CHAMPIONS. In addition to ICT tools including telephone, internet and video conference, the system is enabled by Artificial Intelligence, Data Analytics and Machine Learning.

CHAMPIONS is also fully integrated on real time basis with GOI’s main grievances portal CPGRAMS and MSME Ministry’s own other web based mechanisms. The entire ICT architecture is created in house with the help of NIC in no cost. Accordingly, the physical infrastructure is created in one of ministry’s dumping rooms in a record time.

As part of the system a network of control rooms is created in a Hub & Spoke Model. The Hub is situated in New Delhi in the Secretary MSME’s office. The spokes will be in the States in various offices and institutions of Ministry. As of now, 66 state level control rooms are created as part of the system.

I am 83 years old very senior citizen.

By don’t of my 40 years of banking experience,20years of business running, 8 years of MSME UNIT, Legally 4 years expertise in civil & criminal, latest organic products 4 years. I can be a CONSULTANT with name,by assisting the Secy Mr A K Sharma, to save many MSME unit by becoming sick, get NPA reduction with banks.Lastly executed Roof Top Cafe a brain child project of Nitin Gadkari ji

Mind Blowing Mr Arvind Kumar Sharma, Secy.

So far everything was theoritical.

Sir by launching CHAMPION it will be a milestone for making India on the top of the world. I am a very senior citizen 83 years old, Promoter of a MSME UNIT , which has been slaughtered by a fradulent Builder, is still fighting by delivering most prestigious brainchild project of Hon Nitin Gadkari.

Already lodged grievanvces complaint on CHAMPIONS.

APPRECIATE IF YOU SHARE YOUR WORDSAPP NO.

Thanks Mr. Satish for your words…

Sir, we are helping of our small business Eligible loan amount Thank-you by BM construction Balasubramanian k

bissness loan apply

Sir we sterted developing 100% import sabsitute product for core steel industry in 2015 after hearing the speech and vision of our honorable prime minister Sh Modi ji being imported worth approx rs 500 cr per year in India an essential for producing steel anywhere in globe we have developed this product with our own resource and hard work since 2015 has huge export potential also as well as saves huge out go of scared foreign exchange as only 6 or 7 countries has developed this product so far and we are the first and only in India developed this product (copper mould tube) used in continuous casting of steel request guidance and support for commercial operations

Regards

To

The Respected

Minister

Sub: An Appeal for reducing GST percentage in Cake industry.

Respected Madam

We run a Flour Confectionery unit at West Bengal Kolkata to make Cake & Snacks.

We work under the Brand THE SUGARR AND SPICE a Pvt Ltd Company in the name “Creative Bakers and Confectioners Pvt Ltd”. We have 143 Exclusive outlets and 250 Distributors all over West Bengal. We have more than 500 direct employees today with us to run the organisation. We train our staff to achieve the skill. We innovate attractive new food products for our customers.

In Flour Confectionery GST for Cake is 18 % & Snacks is 12 %

Where as in Milk Confectionery GST is only 5%.

In the market Milk Confectionery (Sweets & Snacks) have competition with Flour Confectionery( Cakes & snacks)

For sweet product GST is 5% only, where as for Bakery and Confectionery product GST is 18% and 12%(abnormally high).

Main ingredients required in Milk Confectionery (Sweet & snacks) are Gram Flour, Fat Sugar & milk.

Where as Main ingredients required for Flour Confectionery (Cake & Snacks) is Flour, Fat, sugar & egg, which is almost same with Milk Confectionery (sweet & Snacks).

Milk Confectionery (Sweet & Snacks ) are paying much lower GST ,only 5%

where as Flour Confectionery (Cake & Snacks ) are paying much higher GST 18% 12%.

Because of the difference in Tax percentage between the two industries it has been very difficult To face the competition . My request is to focus on this point. For this unhealthy competition Flour Confectionery is in great trouble.

Apparently these two products are same & are catering the same market.

Both are being sold out & served either in paper plates or in packed boxes.

Both are consumed as food in between meals..

Both are being displayed in shelves in the shops for sales.

In terms of market share both the industry have almost same contribution.

Bakery and confectionery set up needs much more investment in terms of machinery & equipment in comparison with Sweet manufacturing unit.

Ours are handmade products. We need skilled & highly paid man power to decorate the Cakes.

At restaurant snacks or sweets are served with 5% tax.

But a way side Confectionery shop has to pay 12% or 18% tax for selling the same items.

Because of the Corona Pandemic situation the market is shattered & thousands of families depending on Flour Confectionery all over INDIA are in great danger. May be some Companies will be closed down resulting in increased poverty & hunger.

It is my humble request to your good Office to reduce the GST of Flour Confectionery & snacks (Cakes & Snacks) to 5% like Milk Confectionery (sweets & snacks) & save the life of thousands of families depending on Flour Confectionery all over INDIA.

Thanking you very much for giving me the chance to place my request.

Mrs Supriya Roy

Managing Director

For

Creative Bakers & Confectioners Pvt Ltd

THE SUGARR & SPICE

Goo suggestion, Why don’t you share it with MSME department

according to them the complaint has to be made to GST Council.So I lodged a complaint to GST cOUNCIL,BUT THERE WAS NO REPLY.

according to them the complaint has to be made to GST Council.So I lodged a complaint to GST Council, but there was no reply.

This government of India very good and intelligent and support agriculture and poor people

how can i get msme distress loan under the sheme atmanirbhar yoyajana launched by govt. of india.

if CIBIL is bad how can i get the loan.