BHIM App or Bharat Interface for Money is a new UPI based payment application for android smartphones launched by Indian government on 30th December 2016. The UPI based payment app is available to download from Google Play Store at https://play.google.com. BHIM app has been developed by the National Payments Corporation of India to enable fast and secure cashless transactions.

BHIM App Download

BHIM (Bharat Interface for Money) is a UPI enabled initiative to facilitate safe, easy & instant digital payments through your mobile phone. BHIM app can be downloaded by visiting the Google Play Store at play.google.com and or open Play Store app in your android smartphone and search for BHIM, or you can simply click the link below.

Download BHIM App – https://play.google.com/store/apps/details?id=in.org.npci.upiapp

How to Use BHIM App – Requirements

- Before you register on the app, please ensure the following:

- You have linked your Mobile Number with your Bank Account and the same is used for accessing BHIM.

- Your phone should have an active SIM linked to your Bank Account.

- In case of Dual SIM, kindly ensure that you’ve selected the SIM card linked to your Bank Account.

- You have a valid Debit Card for your Bank Account. This is required to generate UPI PIN.

BHIM UPI Partners Supported Banks List

At present, BHIM App only supports UPI based payments or only the banks which supports UPI are available in the app for transactions. To use the app, users will just be required to setup a 4 digit PIN by verifying their phone number which is registered with their bank. Below is the list of BHIM UPI Partners supported banks list:-

| Sr. No. | Live Banks | Live on BHIM | Live on BillPay |

|---|---|---|---|

| 1 | A.P.MAHESH CO-OP URBAN BANK LTD | ✓ | |

| 2 | Abhyudaya Co-op Bank Ltd | ✓ | |

| 3 | Adarsh Cooperative Bank Ltd | ✓ | |

| 4 | AHMEDNAGAR MERCHANTS CO OP BANK LTD | ✓ | |

| 5 | Airtel Payments Bank | ✓ | |

| 6 | Allahabad Bank | ✓ | ✓ |

| 7 | Andhra Bank | ✓ | ✓ |

| 8 | Andhra Pradesh Grameena Vikas Bank | ✓ | |

| 9 | Andhra Pragathi Grameena Bank | ✓ | |

| 10 | Apna Sahakari Bank | ✓ | |

| 11 | Assam Gramin VIkash Bank | ✓ | |

| 12 | AU Small Finance Bank | ✓ | |

| 13 | Axis Bank | ✓ | ✓ |

| 14 | Bandhan Bank | ✓ | |

| 15 | Bank Of Baroda | ✓ | ✓ |

| 16 | Bank Of India | ✓ | ✓ |

| 17 | Bank of Maharashtra | ✓ | |

| 18 | Baroda Gujarat Gramin Bank | ✓ | |

| 19 | Baroda Rajasthan Kshetriya Gramin Bank | ✓ | |

| 20 | Baroda Uttar Pradesh Gramin Bank | ✓ | |

| 21 | Bassein Catholic Coop Bank | ✓ | |

| 22 | Bharat Co-op Bank(mumbai) | ✓ | |

| 23 | Bhilwara Urban Co-operative Bank Ltd | ✓ | |

| 24 | Canara Bank | ✓ | ✓ |

| 25 | Capital small finance bank | ✓ | |

| 26 | Catholic Syrian Bank | ✓ | ✓ |

| 27 | Central Bank of india | ✓ | ✓ |

| 28 | Chaitanya Godavari Grameena Bank | ✓ | |

| 29 | Chhattisgarh Rajya Gramin Bank | ✓ | |

| 30 | Citibank Retail | ✓ | |

| 31 | CITIZENS CO-OPERATIVE BANK LTD | ✓ | |

| 32 | City Union Bank | ✓ | ✓ |

| 33 | Coastal Local Area Bank Ltd | ✓ | |

| 34 | Corporation Bank | ✓ | ✓ |

| 35 | DBS Digi Bank | ✓ | |

| 36 | DCB Bank | ✓ | |

| 37 | Dena Bank | ✓ | |

| 38 | Dena Gujarat Gramin Bank | ✓ | |

| 39 | Dhanlaxmi Bank | ✓ | |

| 40 | Dombivali Nagrik Sahakari Bank | ✓ | ✓ |

| 41 | Equitas Small Finance Bank | ✓ | |

| 42 | ESAF Small Finance Bank | ✓ | |

| 43 | Federal Bank | ✓ | ✓ |

| 44 | Fincare Small Finance Bank | ✓ | |

| 45 | FINO Payments Bank | ✓ | |

| 46 | G P Parsik Bank | ✓ | ✓ |

| 47 | HDFC | ✓ | ✓ |

| 48 | Himachal Pradesh Gramin Bank | ✓ | |

| 49 | HSBC | ✓ | |

| 50 | Hutatma Co Op Bank Ltd | ✓ | |

| 51 | ICICI Bank | ✓ | ✓ |

| 52 | IDBI Bank | ✓ | ✓ |

| 53 | IDFC | ✓ | |

| 54 | India Post Payments Bank | ✓ | |

| 55 | Indian Bank | ✓ | |

| 56 | Indian Overseas Bank | ✓ | ✓ |

| 57 | IndusInd Bank | ✓ | ✓ |

| 58 | Jalgaon Janata Sahkari Bank | ✓ | |

| 59 | JALNA MERCHANTS CO-OP BANK LTD. | ✓ | |

| 60 | Jammu & Kashmir Bank | ✓ | |

| 61 | Jammu & Kashmir Grameen Bank | ✓ | |

| 62 | Jana Small Finance Bank | ✓ | |

| 63 | JANAKALYAN S. BANK | ✓ | |

| 64 | Janaseva Sahakari Bank LTD.,Hadapsar,Pune | ✓ | |

| 65 | Janta Sahakari Bank Pune | ✓ | ✓ |

| 66 | Jharkhand Rajya Gramin Bank | ✓ | |

| 67 | Kallappanna Awade Ichalkaranji Janata Sahakari Bank Ltd. | ✓ | |

| 68 | Kalupur Commercial Bank | ✓ | |

| 69 | Karnataka Bank | ✓ | |

| 70 | Karnataka vikas Gramin Bank | ✓ | |

| 71 | Karur Vysaya Bank | ✓ | |

| 72 | Kerala Gramin Bank | ✓ | |

| 73 | KOKAN MERCANTILE CO OP. BANK LTD. | ✓ | |

| 74 | Kotak Mahindra Bank | ✓ | ✓ |

| 75 | KRISHNA BHIMA SAMRUDDHI LOCAL AREA BANK | ✓ | |

| 76 | Maharashtra Grameen Bank | ✓ | |

| 77 | Maharashtra State Co-op Bank | ✓ | |

| 78 | Manipur Rural Bank | ✓ | |

| 79 | Manvi Pattana Souharda Sahakari Bank | ✓ | |

| 80 | Maratha Co-op Bank | ✓ | |

| 81 | Meghalaya Rural Bank | ✓ | |

| 82 | Mizoram Rural Bank | ✓ | |

| 83 | Nagrik Sahakari Bank Maryadhit Vidisha | ✓ | |

| 84 | Nainital Bank | ✓ | |

| 85 | NKGSB CO-Op. Bank Ltd. | ✓ | |

| 86 | NSDL Payments Bank Limited | ✓ | |

| 87 | Nutan Nagrik Sahakari Bank | ✓ | |

| 88 | Oriental Bank of Commerce | ✓ | ✓ |

| 89 | Paschim Banga Gramin Bank | ✓ | |

| 90 | Patan Nagrik Sahakari Bank | ✓ | |

| 91 | Paytm Payments Bank | ✓ | |

| 92 | Pragathi Krishna Gramin Bank | ✓ | |

| 93 | Prathama Bank | ✓ | |

| 94 | Prime Co-Operative Bank Ltd. | ✓ | |

| 95 | PRIYADARSHANI NAGARI SAHAKARI BANK LTD JALNA | ✓ | |

| 96 | Pune Cantonment | ✓ | |

| 97 | Punjab and Maharastra Co. bank | ✓ | ✓ |

| 98 | Punjab and Sind Bank | ✓ | ✓ |

| 99 | Punjab Gramin Bank | ✓ | |

| 100 | Punjab National Bank | ✓ | ✓ |

| 101 | Purvanchal Bank | ✓ | |

| 102 | Rajasthan Marudhara Gramin Bank | ✓ | |

| 103 | Rajkot Nagari Sahakari Bank Ltd | ✓ | |

| 104 | Samarth Sahakari Bank Ltd.,Solapur | ✓ | |

| 105 | Samruddhi Co-op bank ltd | ✓ | |

| 106 | Saraswat Cooperative Bank Limited | ✓ | ✓ |

| 107 | Sarva Haryana Gramin Bank | ✓ | |

| 108 | SARVODAYA COMMERCIAL CO OP BANK | ✓ | |

| 109 | Saurashtra Gramin Bank | ✓ | |

| 110 | Shree Dharati Bank | ✓ | |

| 111 | Shree Kadi Nagrik Sahakari Bank | ✓ | |

| 112 | Shri Rajkot District Cooperative Bank | ✓ | |

| 113 | Sindhudurg DCC Bank | ✓ | |

| 114 | South Indian Bank | ✓ | ✓ |

| 115 | Standard Chartered | ✓ | ✓ |

| 116 | State Bank Of India | ✓ | ✓ |

| 117 | Sterling Bank | ✓ | |

| 118 | Suco Souharda Sahakari Bank Ltd | ✓ | |

| 119 | Surat Peoples Cooperative Bank | ✓ | |

| 120 | Suryoday Small Finance Bank Ltd | ✓ | |

| 121 | Suvarnayug Sahakari Bank | ✓ | |

| 122 | Syndicate Bank | ✓ | ✓ |

| 123 | Tamilnad Mercantile Bank | ✓ | |

| 124 | Telangana Gramin Bank | ✓ | |

| 125 | Telangana State Co-op Apex Bank Ltd | ✓ | |

| 126 | Thane Bharat Sahakari Bank | ✓ | |

| 127 | The Adarsh Co-operative Urban Bank Ltd. | ✓ | |

| 128 | The Ahmedabad District Coop bank | ✓ | |

| 129 | The Ahmedabad Mercantile Coop bank | ✓ | |

| 130 | The Anand Mercantile Cooperative Bank Ltd. | ✓ | |

| 131 | The Andhra Pradesh State Cooperative Bank Ltd. | ✓ | |

| 132 | THE BANASKANTHA DISTRICT CENTRAL CO-OPERATIVE BANK LTD. | ✓ | |

| 133 | The Baroda Central Co-op Bank Ltd | ✓ | |

| 134 | THE GAYATRI COOPERATIVE URBAN BANK LTD | ✓ | |

| 135 | The Gujarat State Co-operative Bank Limited | ✓ | |

| 136 | The Hasti Co-operative Bank Ltd | ✓ | |

| 137 | The Kaira District Cooperative Bank | ✓ | |

| 138 | The Kalyan Janta Sahkari Bank | ✓ | |

| 139 | The Kanakamahalakshmi Co-operative Bank Ltd | ✓ | |

| 140 | The Lakshmi Vilas Bank Limited | ✓ | ✓ |

| 141 | The Mahanagar Co-Op. Bank Ltd | ✓ | |

| 142 | The Malad Sahakari Bank | ✓ | |

| 143 | The Mehsana Urban Co-Operative Bank | ✓ | |

| 144 | The Ratnakar Bank Limited | ✓ | |

| 145 | The Sabarkantha District Cooperative Bank | ✓ | |

| 146 | The Saraswat Co-Operative Bank | ✓ | |

| 147 | The Satara District Central Co-OP Bank Ltd.,Satara | ✓ | |

| 148 | The Surat District Co Op Bank Ltd. | ✓ | |

| 149 | The Sutex Co Op Bank | ✓ | |

| 150 | The SVC Co-Operative Bank Ltd | ✓ | |

| 151 | The Thane Janta Sahakari Bank Ltd(TJSB) | ✓ | |

| 152 | The Udaipur Mahila Samridhi Urban Co-operative Bank Ltd. | ✓ | |

| 153 | The Udaipur Mahila Urban Co-operative Bank Ltd. | ✓ | |

| 154 | The Urban Cooperative Bank Ltd Dharangaon | ✓ | |

| 155 | The Varanchha Co Op Bank Ltd | ✓ | |

| 156 | The Vijay Co-operative Bank Ltd, Ahmedabad | ✓ | |

| 157 | THE VISAKHAPATNAM COOPERATIVE BANK LTD | ✓ | |

| 158 | The Vishweshwar Sahakari Bank Ltd | ✓ | |

| 159 | The Cosmos Co-Operative Bank LTD | ✓ | |

| 160 | TJSB Sahakari Bank | ✓ | ✓ |

| 161 | Tripura Gramin Bank | ✓ | |

| 162 | UCO Bank | ✓ | ✓ |

| 163 | Udaipur Urban Cooperative Bank. | ✓ | |

| 164 | Ujjivan Small Finance Bank Limited | ✓ | |

| 165 | Union Bank of India | ✓ | |

| 166 | United Bank of India | ✓ | ✓ |

| 167 | Uttarakhand Gramin Bank | ✓ | |

| 168 | Vasai Vikas Co-op Bank Ltd | ✓ | |

| 169 | Vijaya Bank | ✓ | |

| 170 | YES Bank | ✓ | ✓ |

BHIM UPI Partner Banks List can be checked using the link – https://www.bhimupi.org.in/our-partners. Money can also be sent to Non UPI enabled banks using the IFSC code or MMID.

More about BHIM

• Transaction limit is Rs. 40,000 per transaction and per day. (Please note that your Bank’s Transaction Limit may vary from BHIM’s limit.)

• BHIM app is compatible with Android 5.0 and above.

Terms & Conditions:- https://www.bhimupi.org.in/terms-conditions

For more information, visit https://www.bhimupi.org.in/

Stop. Think. Act. You will never be asked for a pin to receive money. Use UPI PIN only if you want to pay or check account balance. Enjoy your BHIM APP safely.

Earlier Updates on BHIM UPI App

Here are the earlier updates on BHIM App and the language of writing is as of the update date.

20% Cashback on GST Payment through Rupay, BHIM App, USSD, Digital Means (Update As on 5 August 2018)

In order to promote transactions through Digital means, GST Council has approved to provide 20% Cashback on GST Payment. Now any person who is filing GST through Rupay Debit Card, BHIM App and USSD modes will be incentivized and can get cashback upto Rs. 100. This decision to give discount on cashless transactions was taken in the GST Council meeting held on 4 August 2018.

This 20% GST Cashback Scheme will promote cashless transactions through Debit Card, UPI in rural and urban areas. This incentivising of digital payments would help in maintaining a better database by the govt. and tracking footprints of various taxpayers.

Sh. Piyush Goyal, Minister of Finance, Central government has made this announcement after the meeting of GST Council to promote Cashless Transactions.

Features of 20% Cashback on GST Payment by Digital Means (Rupay, BHIM App)

The important features and highlights of 20% GST Cashback Scheme are as follows:-

- Govt. will now provide 20% discount on making GST Payment through Rupay Card, BHIM App & USSD transactions.

- This discount will be given in the form of cashback to incentivise customers.

- The maximum discount that a person can avail on making payment through Digital means is Rs. 100.

- GST Council focuses on making “Cashless India” and will provide 20% Cashback on GST on every transaction through Digital means.

- Govt. is going to launch this pilot project in only those states who are willing to join under this 20% GST Cashback Scheme.

- To successfully implement this scheme in states, GSTN (IT backbone of GST Network) and National Payments Corporation of India will soon launch a new software.

- In the near future, govt. can decide to implement this 20% GST Cashback Scheme in all states across the country.

- In meeting of GST Council on 4th August 2018, Delhi, Punjab, West Bengal and Kerala state govt. were against this scheme. So initially, only the pilot project will be launched.

GST Council has called the finance ministers of various states to give their opinions on promotion of Micro, Small and Medium Enterprises (MSME). The GST Council also set up a six-member panel of ministers under Minister of State for Finance Shiv Pratap Shukla to look into the issues of MSME Sector.

The GST Council on 4th Aug 2018 approves GoM recommendations to incentivize digital payments through Rupay card and BHIM app by way of cashbacks. After implementation, customers making payments using Rupay card or BHIM UPI will get a cashback of 20 per cent of the total GST amount, subject to a maximum of Rs 100. The next meeting of GST Council will be held on 28th and 29th September 2018.

Claim BHIM App Cashback Scheme upto Rs. 1000 for both Customer and Merchant (Update As on 16 April 2018)

Central govt. has launched BHIM App Cashback Scheme on the birth anniversary of Dr. Bhimrao Ambedkar. This offer will provide cashback upto Rs. 750 for customers and Rs. 1000 for merchants. Under this BHIM Scheme, first successful transaction will provide Rs. 51 as cashback while other transactions will bring more cashback upto Rs. 750 to customers. Moreover, merchants can get cashback upto Rs. 1,000 per month. Interested candidates can claim cashback and for more details, visit at bhimupi.org.in/bhim-scheme

Last Year, BHIM App was launched on 14 April 2018 and has launched this cashback offer on completion of its 1 year. For cashback of Rs. 51 on First transaction, there is no minimum limit. So, any person can avail this cashback even on transaction of Rs. 1.

National Payments Corporation of India runs this Bharat Interface for Money. This app is available at the Playstore and can easily be downloaded. To run this app, people must have their bank account linked with their mobile number.

Claim Cashback for Customers – BHIM App Cashback Scheme

All the customers are entitled to avail cashback upto Rs. 750. In order to claim the cashback offer, candidates need to follow the following steps:-

- Cashback On Joining (Rs. 51) – Customers will get Rs. 51 as cashback after successful completion of their first transaction of Sending Money to any other user. This includes the following steps:-

- Firstly download the BHIM App from Playstore.

- Make registration using the mobile number registered with bank account.

- Finally send Rs. 1 or more in a transaction to earn a cashback of Rs. 51.

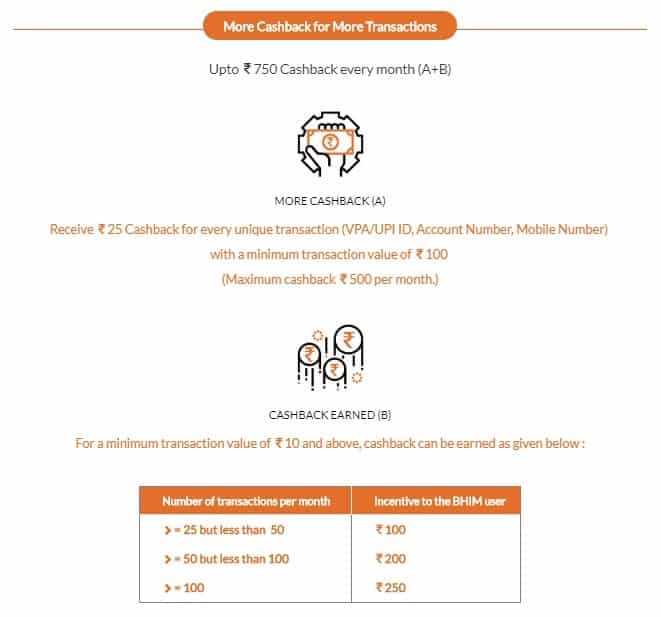

- Cashback on Unique Transactions (Max. Cashback is Rs. 500) – For every unique transaction with minimum value of Rs. 100 through VPA / UPI ID / Account Number / Mobile Number, candidates will get cashback of Rs. 25. The maximum cashback which any customer can earn is Rs. 500 in a single month.

- Earned Cashback for Transactions with Minimum Value of Rs. 10 (Max. Cashback is Rs. 250) – For all transactions having a min. value of Rs. 10, cashback can be earned depending on the number of transactions in a month as follows:-

- If number of transactions lies between 25 to 50, then BHIM App customers will get an incentive of Rs. 100.

- For number of transactions lying between 50 to 100, then customers of BHIM Scheme will get Rs. 200 as cashback.

- If number of transactions are more than 100, then customers will get Rs. 250 as cashback.

Thus the cashback on Joining for new users is Rs. 51. Moreover, there is more cashback on more transactions and a customer can earn cashback worth Rs. 750 in a single month.

Claim Cashback For Mechants – BHIM App Cashback Scheme

All the merchants can avail cashback worth Rs. 1000 in a month. To claim the cashback offer, candidates need to follow the steps given below:-

- Cashback for BHIM App Users – All the BHIM App Users who have downloaded the BHIM App and declared themselves as “I am a Merchant” can claim cashback as follows:-

- All the Merchants of BHIM App who are receiving payments via BHIM / BHIM UPI App will get a cashback of 10% of transaction value. Maximum cashback limit is Rs. 50 per transaction.

- For this cashback, minimum number of credit transactions must be more than 10.

- Moreover, value of each transaction must be equal to or greater than Rs. 25.

- Any Other BHIM UPI App User – Any Bank merchant who is not a BHIM App User but is receiving payments through BHIM / BHIM UPI App will also get cashback as follows:-

- Any User receiving payments through BHIM UPI App will get cashback of 10% of the transaction value with maximum limit of Rs. 50.

- For this cashback for merchants, number of transactions must be equal to or greater than 5 and minimum transaction value should be greater than Rs. 25.

- For this, all the customers and merchants nees to have a bank account to get payment.

BHIM also has options to transfer via IFSC, MMID as well for non-UPI banks. This is a major step towards the “Digital India” initiative. For more details, visit the official website bhimupi.org.in/bhim-scheme

BHIM Referral Bonus Scheme & Cashback Scheme – Complete Details (Update As on 14 April 2017)

Prime Minister Narendra Modi has launched BHIM – Aadhaar, a new merchant app for accepting payments from customers using their Aadhar identity. Along with this, the PM has also launched two schemes named as “BHIM Referral Bonus Scheme” and “BHIM Cashback” schemes for consumers and merchants respectively.

The BHIM referral bonus and cashback schemes have been launched by the Narendra Modi in order to push the use of BHIM App and hence the digital payments. The schemes have been launched from Nagpur for all the BHIM app users. The government has set an budget outlay of Rs. 495 Crore for 6 months for the implementation of the schemes.

BHIM Referral Bonus Scheme

Under the BHIM referral bonus scheme, the government would provide cash bonus to both existing and new BHIM app users for referring BHIM app to new users. The cash bonus will directly be credited into their accounts. For every successful referral, Rs. 10 will be credited into the bank account of the beneficiary referrer. If you help at least 3 people install and understand BHIM app then you will get Rs 10 from govt.

The new users who adopts BHIM would also get a cash bonus credited directly in to their account.

BHIM Cashback Scheme for Merchants

Under the BHIM cashback scheme for merchants, the merchants will get a cashback on every transaction using BHIM (Bharat Interface for Money). Those who install BHIM app for business transaction will get Rs 25 in their bank accounts.

Through the BHIM referral bonus and cashback scheme, the government aims to give boost to the use of BHIM app leading to the increased use of digital mode of payments. The scheme will overall help in providing greater push to making India a cashless (rather less-cash) economy.

Both schemes are to be administered by MEITY and implemented by NPCI. New schemes will run until 14 October as that was day Ambedkar saheb took diksha.

Narendra Modi also announced the winners of Mega Draw of Lucky Grahak Yojana and Digi Dhan Vyapar Yojana during the event organized in Nagpur.

BHIM Aadhar – Aadhar Payment App for Merchants (Update As on 13 April 2017)

BHIM Aadhar – a new Payment App for Merchants being launched by the Prime Minister Narendra Modi. BHIM Aadhar, the much awaited app may now soon be available to download from Google Play store and can be used by merchants to accept digital payments. BHIM Aadhar app is basically the merchant interface of BHIM (Bharat Interface for Money) app.

BHIM Aadhaar Pay App – Introduction

BHIM Aadhar Pay app will enable the merchants to accept digital payments from their customers without the need of any PoS machine or e-wallet. The BHIM Aadhar Pay app would authorize the payments from customer using his/her fingerprint. The amount to be paid to the merchant would directly be transferred from the saving bank account of the customer to the current/saving account of the merchant.

BHIM Aadhar Pay app is expected to revolutionize the whole payment system in India. To make payments using the BHIM Aadhar Pay app, customers would not require to download any app or even a mobile phone. The transactions would be authenticated using their fingerprint which is saved in the Aadhar database.

How To Download BHIM Aadhaar Pay App

The BHIM Merchant app can either be downloaded from the Google Play store (If released there) or the merchants would be required to contact their respective bank branches. The bank officials would then help setup the BHIM Aadhar app on the mobile phone of the merchants. The app would be initially available for Android Smartphone but it may be available for iOS at later stage.

In case the BHIM Aadhar Pay app is uploaded/released on Google Play store, we will share the direct link to download the app.

How to Use BHIM Aadhar Pay App

The use of BHIM Aadhar Pay app is very simple, the customers who have completed the e-KYC of their bank accounts or have linked their Aadhar Card with their bank accounts would be able to pay using this app. The customers while making payments to any merchant would be required to just use their thumb and then select the bank account to make the payment, that’s it.

Merchants would be required to download the app on their smartphone and link their bank account where they wish to receive the payment. After that theyr would be required to connect their phone to a fingerprint reader to accept payments from the customers.\

The BHIM Aadhar app would be most beneficial to those who can not read or write as their thumb impression would work as the authentication password for the transaction.

The basic use of BHIM Aadhar Pay App

- Customers would be required to connect their Aadhar Number with their bank accounts.

- Merchants would be required to download the app, link with their bank account and attach a fingerprint scanner.

- While accepting payments, merchants would enter the Aadhar number customer, select the bank and enter the amount to be charged.

- After that, customer would place his finger/thumb on the fingerprint scanner to authorize the payment.

- Once the fingerprint matches with the Aadhar Database, the amount will directly be transferred from customer’s account to merchant’s bank account.

Using BHIM Aadhar Pay app, transactions can be made through Aadhaar-linked bank accounts (AEBA) only. BHIM Aadhar is a highly secure app which will use two main platforms – Aadhaar Payment Bridge (APB) and Aadhaar Enabled Payment System (AEPS). APB will act as repository between the banks and the customers to provide a smooth flow of transactions, while AEPS will help in authenticating the online process.

Using BHIM Aadhar Pay, the merchants would not be required to pay Merchant Discount Rate (MDR) which they pay while accepting payments using credit or debit cards.

Aadhar Pay – BHIM Aadhar Payment App Download & How to Use (Update on 4 April 2017)

Aadhar Pay is a new mobile app to be launched by the central government to promote the use of digital payments. The new smartphone app may be named as “BHIM – Aadhar Pay” and will be launched in 14th April. BHIM Aadhar Pay app would be a merchant app which will allow customers to pay using their thumb impression.

BHIM – Aadhar Pay is a biometric-based payment system which will allow all the Aadhar Linked account holders to carry out transactions just by the use of their thumb impression. The initiative is the part of increasing the use of digital payments.

Aadhar Pay – BHIM Aadhar Payment App

The main objective of the Aadhar Pay App is to increase the use of digital payments and bringing transparency in the economy. The central government has already launched UPI based BHIM (Bharat Interface for Money) app in order to push the number of digital transactions and making the country a cashless economy.

Narendra Modi Government has asked all the public sector banks to come on board the Aadhar Payment System by April 14th. IDFC bank has already launched its own version of Aadhar Payment App few weeks ago. The government has also asked the banks to encourage the merchants to use the Aadhar Pay App to receive payments from their customers. The government expects adding 5 Lakh merchants on board within just two weeks after the launch of the app.

Aadhar Payment App Download & Use

However, the app would be available on play store after launch on 14th April. After that, you can follow the below steps to download Aadhar Pay app from the Google Play Store

- Visit play.google.com from your desktop or open play store app in your android mobile.

- Search for “Aadhar Pay” or “BHIM Aadhar Pay” in the search box and select the official app from the list.

- Click the “Download” button and click “Accept” for giving permissions to the app.

- App would be downloaded and installed.

- After installing, the merchants would be required to connect their bank account with the app where they want to receive payments from their customers.

- Merchants would be required to attach a fingerprint scanner with the mobile app in order to receive payments from customers.

The direct link to download Aadhar Pay app would be available only after the app is launched.

Benefits of Aadhar Pay App

The Aadhar Pay app would completely eliminate the use of credit/debit cards for payments and will also help reduce the theft of private banking information. In order to pay through the Aadhar Pay App, customers would not be required to install any app or even a smartphone.

If the bank account of the customer is linked with their Aadhar Number, they would be able to pay just by using their thumb impression. In case, the customer have multiple bank accounts, they can select the bank account from the list which is displayed in the App after thumb impression and then proceed.

Introduction of Aadhar Based Payment System on BHIM App

Users will be able to send and receive money using the Unified Payment Interface but later Aadhar based payment system would also bee added to the app. Once the Aadhar based system is added, people even would not require a phone for doing cashless payments. The Aadhar based system is currently being tested and is expected to be added to BHIM app within next few weeks.

BHIM app, after Aadhar based system is added, would not require an internet connection, it will just need your thumb impression. Your thumb will act as bank and password for cashless transactions. The app will also work on feature phones through an upgraded USSD platform.

People would be able to send and receive payments using any of the three modes UPI (Unified Payment Interface), AEPS (Aadhar Enabled Payment System) and USSD (Unstructured Supplementary Service Data) using the single BHIM app.

BHIM App – Highlights

- You can also collect money by sending a request and reverse payments if required.

- You can check your bank balance and transactions details on the go.

- You can create a custom payment address in addition to your phone number.

- You can scan a QR code for faster entry of payment addresses. Merchants can easily print their QR Code for display.

- Maximum of Rs. 10,000 per transaction and Rs. 20,000 within 24 hours.

- At present Hindi and English languages are supported by BHIM App, more languages will be added soon.

For more information about UPI app, visit https://upi.npci.org.in/static/faq/en_US/

Fingerprint will work as the security password to authenticate every transaction using the app.

Tum se bada madarchod aur chutiya koi nahi hai, search kar ke download koi bhi kar lega.

Chutiyo app nahi aayi hai abhi tak. Tumhaare fake post aur SEO ki toh aisi behenchodo

Smart phone Akhilesh yojna

cashless software add

nic

sir kaise bim app download hoga

pzl sir batna 7398187183 ma.karna

Its better to modify in such a way that other phone number can be entered.

Now the app needs the phone containing registered phone number with bank and the sim should be in first slot.

Please modify in such a way that , entering the registered phone number of bank with any phone ( having different sim)

Good

Not select bank

I get bhim app.afetr getting passcode its does not working.. when i entered passcode then app will goes directly on bank selection page..because on second page there is a basic information.but app will goes on third page directly..please help me

I think it is better for all

all the schemes are very good but implimentation level seems to be very slow.the reason may be poor network,specialy in the rural arias

sir bhim apps ke liye bank me fone number resister karna hoga.

Bank refused to accept,bank a/c not tetect.Please help.Thanks. Please answer.

Sir kya kerna hoga mujh garib ko nhi pta kuch bhi kripya maded kre

मान्यवर

श्री प्रधानमंत्री नरेन्द्र मोदी जी को कौटी- कौटी प्रणाम

सह धन्यवाद

भारत मे पहली बार कोई शेर आया हैं।

NAMO NARAYAN MEENA

7568728893

BHIM app is a Fast and Secure cashless app..This is really a helpful article for using this app.

Thanks for sharing..!!!!!

http://condolencemessages.org/

We the people of digital forensics firm named SysTools Software (https://www.systoolsgroup.com/) love this app. Our organization is encouraging our employees to use this app for online payments. A good step taken by the Govt. of India in making India go cashless.

Nice Work by PM Modi Ji to spread awareness about how we can fight against black money.

Modi ji aapko mera pranam mai padhna chahata hu PR HM bahu garib hai mai class, 12th me hu

Pahali baar koai ser aaya hai ab mza aayega

Mera no. 7084229262

सर, मैने क्रेडिट कार्ड का बिल भीम एप्लीकेशन के द्ववारा कीया लेकीन नही हुई कृप्या करके इसके बारे मै जानकारी दे, कि ईस ऐप के द्वारा किसी भी प्रकार बिल कैसे भरा जाये इसका तरीका बताये आपका अति कृपा होगी आपका एक भारतीय. जय हिन्द,

Modi Ji thanks bheem App lonch.

Everyone bhim App download.. Thanks

Modi Ji great ideas ceaseless economy.. And bhim App service.. Thanks

Very good idea to STOP corruption with encouraging public, go ahead DESH APKE SATH HAI.

Thanks a lot.

Nice app

Dear.sir. we not believe bhim App. Because i transaction name address my wife. But I don’t know this is not safe. So its go wrong account. But my problem not solve. 4march ki complant .answer aa raha h ki wrong credited icici bank account. So i not believe bhim App. Dear pm ji my mobile num.9466254238.pls solve my problem.

Yess the app is very good. Thanks for Modi sir.

Rate house 25years goa areyi no my house

Can i helpe me

Date of birth goa

26.06.1983

Place vasco da gama

No house

Rate house

Can i help me BJP GOVERNMENT

MODI PLEASE HELP ME

Goa rati house small house rate3500

Vasco areay khariwada newveddem

Baina magur. Sada

Modi ji! gr8 idea for path of digital india …. Good job

Our india can become cashless by this.

***

Thanksss

rajendra solanki

सर, मैने क्रेडिट कार्ड का बिल भीम एप्लीकेशन के द्ववारा कीया लेकीन नही हुई कृप्या करके इसके बारे मै जानकारी दे, कि ईस ऐप के द्वारा किसी भी प्रकार बिल कैसे भरा जाये इसका तरीका बताये आपका अति कृपा होगी आपका एक भारतीय. जय हिन्द,

VLLRUHIA po+ Islampur dist utterdenajpur pin733202 mobile no. 8768291240

Very nice

Sir PM I know about this yojna please tell me so kindly i request you plz reply As my choice & my help plz

nice n very usefull app, our economy being degital day by day….

House loan apply

How to use my bhim app

Mai kese use kar sakta ho mere bhim app ko

hiiiiiiiiiiiiiii

thanks modi ji

Modi g hamra village bhout grib a ha … Koe bi rojgar ni ha … Na koe study college. Ham kya karaaa hama app ki koe yojana ka bi ni pta lagda ..in employment jayda ha.

App sa hamaaa bhout umidaaa ha app best person ho.

please help me

Shivnala dhandara maharashtra 441910

Mudaked plan

Sir pm please help me arjent job .Me my request sir…..

Har har mahadev

Har har Modi ji

Very nice sir

Name change

[email protected]

[email protected]

karan chhabra ji se meri request hai ki wo apna contact number dene ka kast kare please

karan chhabra ji meri gmail par sarkari yojanao ki gmail ati rahti hain to unke baare mein informition lene ke liye please koi aisa contact number den jisse ki main apni gmail par masess ke baare mein jankari informition le sakoon

20% Cashback is very attractive but the condition of subject to a maximum of Rs.100/- will blow out and it gives a wrong notion towards Govt. Instead make only 5% of the Total Tax Payable, I am sure many will start paying through these Apps or Cards. It should be practical coz people have been fooled by luring like this by many banks in India and hence the Cash Back System has no meaning in it.

Bhim app customer care number 8249673874

bhim app customer care number 7488534168