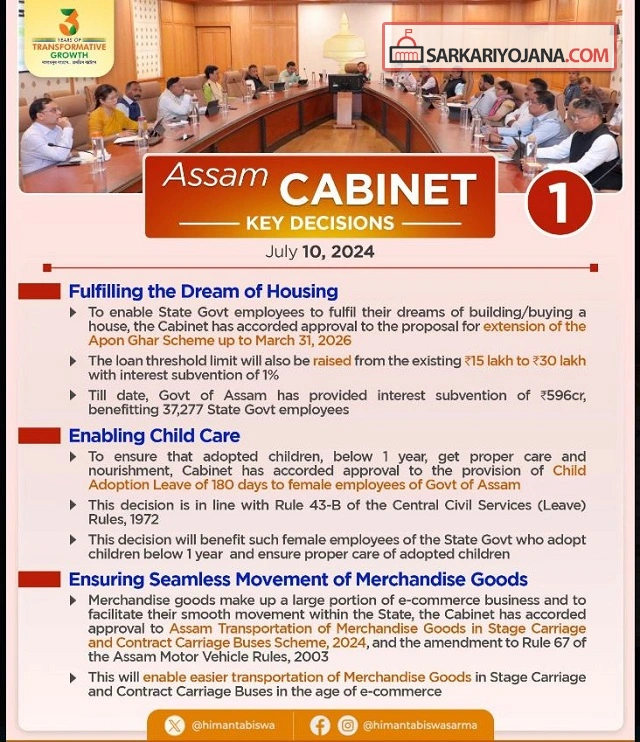

Apun Ghar Loan Scheme 2025 is a significant initiative by the Assam state government aimed at assisting state employees in purchasing their own homes. The government has recently increased the loan limit from INR 15 lakh to INR 30 lakh, making home ownership more accessible to employees. Interested applicants who meet the eligibility criteria can easily apply online through the official website to benefit from this scheme.

This scheme, first introduced in 2016-17, has already provided loans worth INR 5663 crores. The Government of Assam also offers subsidies to help selected applicants under this scheme, ensuring that they can secure a permanent residence without excessive financial burden.

Overview of Apun Ghar Loan Scheme

The primary goal of the Apun Ghar Loan Scheme is to empower government employees of Assam by providing them with housing loans. These loans help enhance their social standing and improve their living conditions. The interest rates are lower than those in the market, making it easier for employees to purchase their first homes.

Aims of the Apun Ghar Loan Scheme

This scheme aims to benefit the Assam state government employees by enabling them to buy houses. The government is committed to uplift financially disadvantaged employees, ensuring they acquire their first home with more manageable loans.

At the recent meeting of the #AssamCabinet, several key decisions were made to improve the welfare of employees, including the extension of the Apon Ghar Scheme for state government staff. View details.— Himanta Biswa Sarma (@himantabiswa) July 10, 2024

Key Highlights of the Scheme

| Name of the Scheme | Apun Ghar Loan Scheme |

|---|---|

| Introduced By | Assam State Government |

| Objective | Providing Housing Loans |

| Beneficiaries | State Government Employees |

| Official Website | Assam Apun Ghar Loan Portal |

Who Can Apply?

- Applicants must be permanent residents of Assam.

- Loans must be taken from any recognised bank within the state.

- The family’s annual income should not exceed INR 20 lakh.

- The loan amount must be over INR 5 lakh and sanctioned after April 1, 2019.

- This must be the first house for the applicant’s family.

Documents Required for Application

- Aadhar Card

- Email ID

- Mobile Number

- Electricity Bill

- Address Proof

- PAN Card

Loan Amount & Interest Rates

- 3.5% interest subsidy for government employees on home loans up to INR 15 lakh for a 20-year duration.

Benefits of the Apun Ghar Loan Scheme

- Successful applicants receive housing loans from the Assam government.

- Applicants can buy homes with reduced financial strain.

- The scheme offers lower interest rates compared to market rates.

- Subsidies provided by the government assist selected applicants significantly.

Application Process for Apun Ghar Loan Scheme 2025

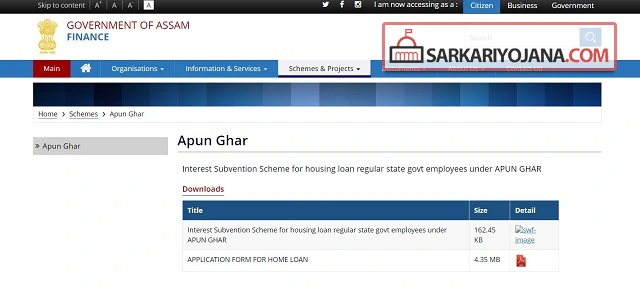

STEP 1: Applicants meeting eligibility can visit the official Apun Ghar Loan website to fill out the application form.

STEP 2: Go to the homepage, and click on APPLICATION FORM FOR HOME LOAN.

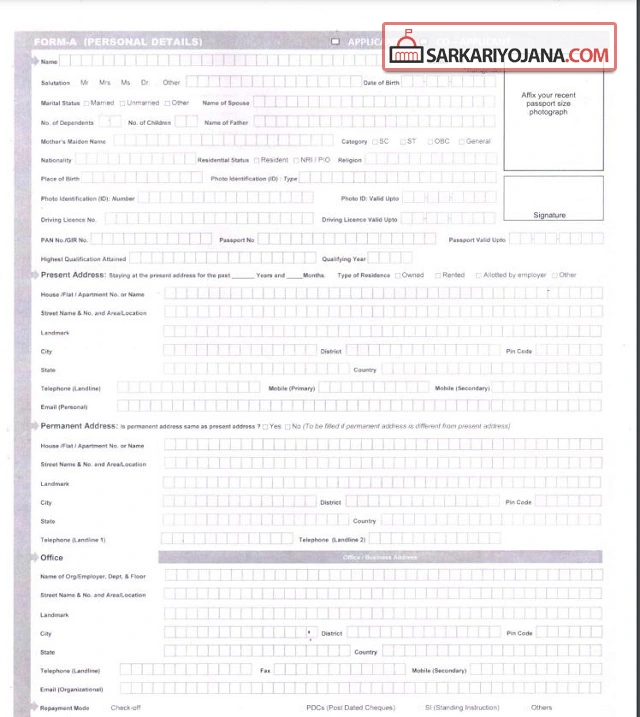

STEP 3: A PDF of the application form will download; print this form.

STEP 4: Complete the form with the required details and attach all necessary documents.

STEP 5: Submit the completed application form to the appropriate government official.

Information Needed in the Application Form

- Name

- Gender

- Date of Birth

- PAN Number

- Email ID

- Mobile Number

- Address

- IFSC Code of Loan Issuing Branch

- Bank Name

- Branch Name

- Account Number

- Loan Sanction Amount

- Date of Loan Sanction

- Property Address

FAQs

Which state launched the Apun Ghar Loan Scheme 2025?

The Assam state government launched the Apun Ghar Loan Scheme 2025.

Who is eligible to avail of the benefits of the scheme 2025?

All government employees of Assam state are eligible to avail the benefits of the Apun Ghar Loan Scheme 2025.

What is the maximum loan amount under the Apun Ghar Loan Scheme 2025?

The maximum loan amount of INR 30 lakh will be provided to successful applicants under the Apun Ghar Loan Scheme 2025.

What are the interest rates for loans under this scheme?

The scheme offers a 3.5% interest subsidy on home loans up to INR 15 lakh for a term of 20 years.

Can private employees apply for this scheme?

No, the scheme is only available to Assam state government employees who meet the specified eligibility criteria.