Employment Linked Incentive (ELI) Scheme 2025 was announced in the Union Budget 2024–25 to support job creation and strengthen India’s workforce. Supported by a ₹2 lakh crore budget, this scheme is one of five important government initiatives started to help 4.1 crore young people, create jobs, and provide skill development opportunities. ELI Scheme 2025 includes three new employment-focused incentives aimed at increasing formal sector hiring and directly supporting companies and new employees.

What is Employment Linked Incentive Scheme

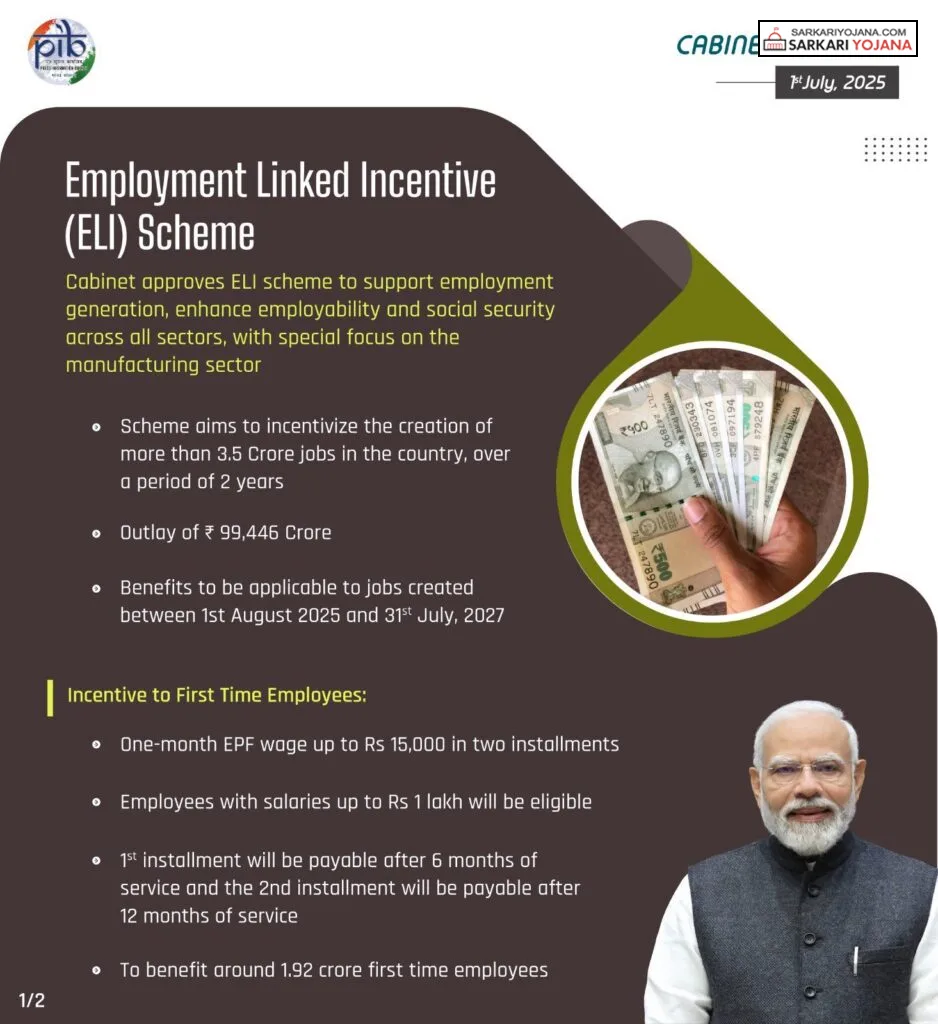

The main purpose of Employment Linked Incentive Scheme is to give financial support to companies and new employees, encouraging formal employment. Through this scheme, employers get incentives for hiring, while new workers can receive up to ₹15,000 as one month’s salary. Overall, the scheme aims to create over 3.5 crore jobs across India within two years, with 1.92 crore of these as new hires. Jobs created from August 1, 2025, to July 31, 2027, qualify for benefits.

Also read: PMFBY List

Quick Overview

| Name of the scheme | Employment Linked Incentive Scheme |

| Launched by | Prime Minister of India |

| Objective | Boost formal employment in India |

| Benefits | Financial aid to employees & companies |

| Beneficiaries | New employees and employers |

| Year | 2025-27 |

| Application mode | Online / Offline |

| Official website | EPFO website |

Part A: Incentives for Newly Enrolled EPFO Employees

Under Part A, employees who have just joined and enrolled with EPFO can get a one-month EPF salary incentive of up to ₹15,000, paid in two installments. To qualify, employees must earn up to ₹1 lakh per month. The first installment is paid after six months of employment and the second after twelve months, once financial literacy training is finished. Some part of the incentive is kept in a savings account for a set time to encourage saving, which can be withdrawn later.

Financial Benefits for Employees

Newly joined EPFO employees get up to one month’s EPF salary (maximum ₹15,000), paid in two parts for staying on the job.

Part B: Incentives for Employers in Manufacturing and Other Industries

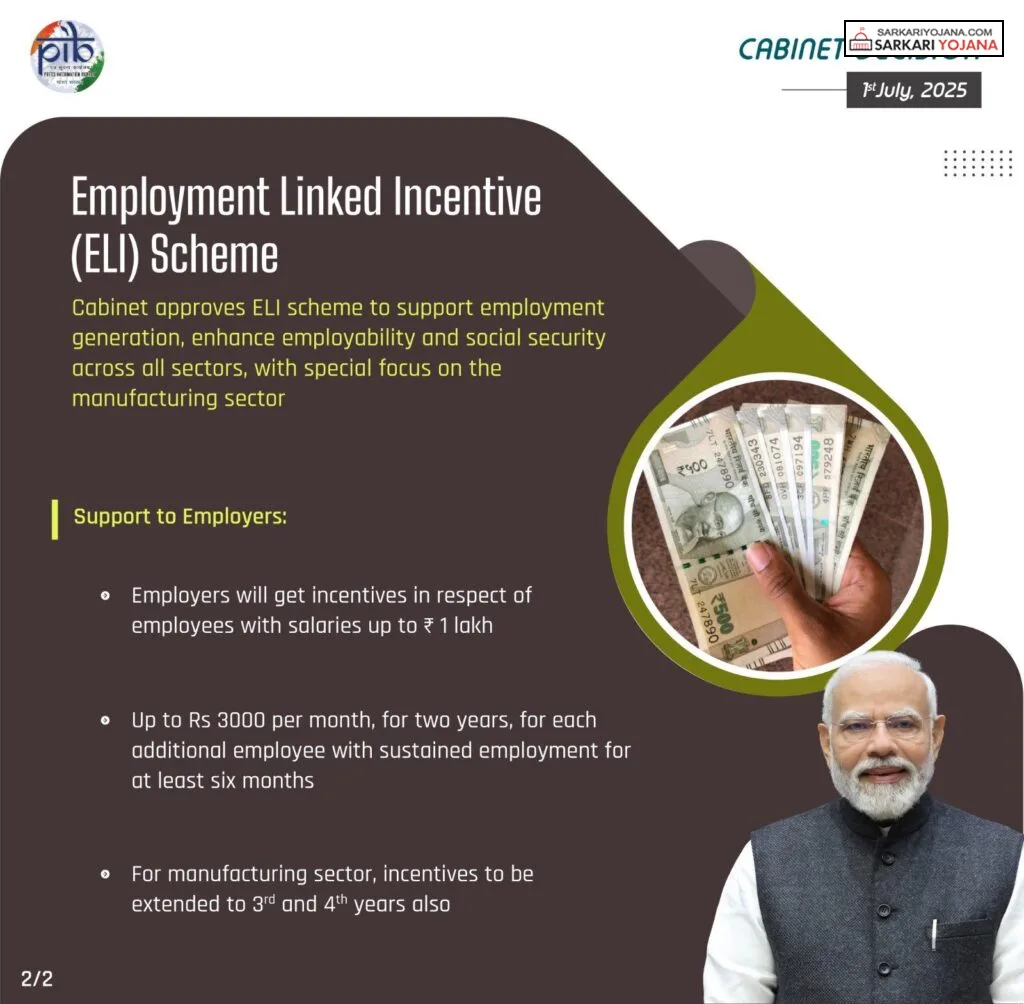

Part B focuses on creating more jobs, especially in manufacturing. Employers with EPFO registration get incentives for every new employee earning up to ₹1 lakh, after the employee has worked at least six months. For industrial sectors, these incentives continue into the third and fourth years. Employers must hire at least two new workers (or five for larger companies) and keep them employed for six months to qualify.

Financial Benefits for Employers

| EPF Wage Slabs of Additional Employee (in ₹) | Benefit to the Employer (per additional employee per month) |

| Up to ₹10,000 | Up to ₹1,000 |

| ₹10,001 – ₹20,000 | ₹2,000 |

| ₹20,001 – ₹1,00,000 | ₹3,000 |

For every additional employee kept for at least six months, employers get up to ₹3,000 monthly for two years (extended for manufacturing sectors).

Eligibility Criteria for Employment Linked Incentive Scheme 2025

- Permanent resident of India

- Must be working for a registered company

- Recently hired staff in all sectors are eligible

- Monthly pay should be less than ₹1 lakh, and enrollment with EPFO is required

Also read: Apaar ID Card Registration

Documents Needed

- Aadhaar card

- PAN card

- Email ID

- Mobile number

- Address proof

- Contact details

Main Features of ELI Scheme 2025

- Started to support formal job creation by giving financial help to companies and new employees

- Union Budget 2024–25 included three ELI Schemes to boost formal employment

- New employees can get up to ₹15,000 or a full month’s salary under Part A

- Employers get incentives for two years, and manufacturing sectors for up to four years

How to Apply Online for Employment Linked Incentive Scheme 2025?

There is no application process for this scheme, all the employees who fulfills the criteria under the scheme just need to register themselves on the EPFO portal using the Universal Account Number provided by the employer and claim or check status of their benefit.

Here is the complete process: pmvbry.epfindia.gov.in – PMVBRY Portal Login & Registration Process

Payment Method under ELI Scheme

For Part A, payments to eligible new employees are made through the Aadhaar Bridge Payment System (ABPS) using Direct Benefit Transfer (DBT).

For Part B, incentives are directly transferred to employers’ PAN-linked accounts.

Contact / Helpline

Employees Provident Fund Organization, (Ministry of Labour & Employment)

Plate A Ground Floor, Office Block-II, East Kidwai Nagar, New Delhi-110023

FAQ’s

What is Employment Linked Incentive Scheme (ELI)?

Employment Linked Incentive (ELI) 2025 Scheme is a Central Government scheme announced in Budget 2024-2025 to boost formal employment by supporting companies and new workers through financial incentives.

What are the main benefits of this scheme?

This scheme helps both new employees and employers with financial support. New workers receive up to ₹15,000 as incentive and employers get benefits for hiring formal staff.

Who is eligible to apply for ELI Scheme 2025?

Anyone hired recently in India, earning less than ₹1 lakh per month, and registered with EPFO can apply along with their employer.

How do I apply for the scheme?

You can apply online by visiting https://www.epfindia.gov.in and completing the application process as explained above.

Are the incentives available for all sectors and company sizes?

Yes, the scheme is open to recently hired employees across all sectors, but employers must meet the minimum hiring criteria.

What is the duration for getting scheme benefits?

Benefits are available for up to two years for most sectors, and up to four years for manufacturing companies, depending on meeting eligibility requirements.