| PDF Name | EPF Scheme 1952 Guidelines | Employees’ Provident Fund Act, 1952 Rules PDF |

|---|---|

| Last Updated | October 25, 2023 |

| No. of Pages | 99 |

| PDF Size | 0.82 MB |

| Language | English |

| Category | Government Schemes, Forms, Policies & Guidelines PDF |

| Topic / Tag | Govt Scheme Guidelines |

| Source(s) / Credits | Sarkari Yojana |

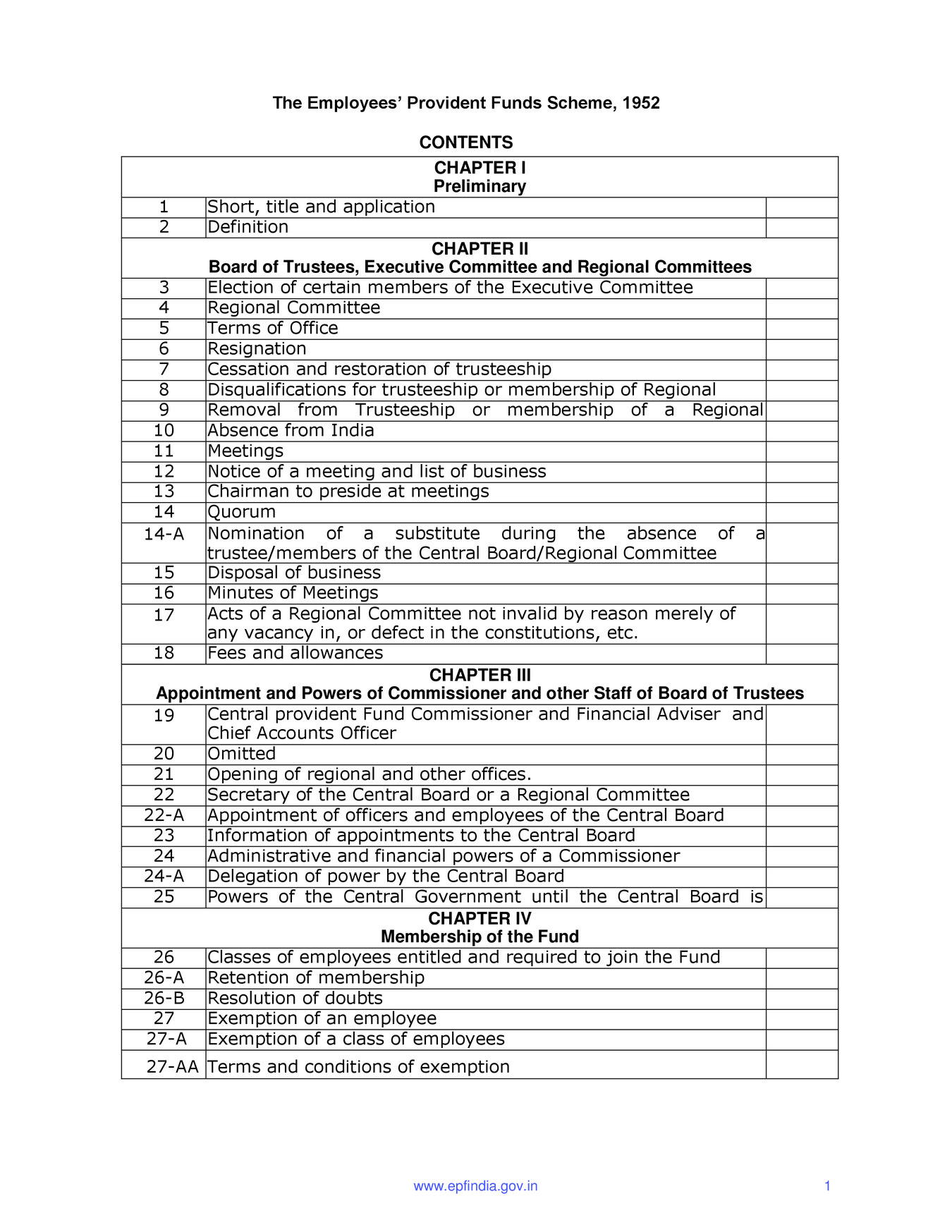

EPF Scheme 1952 Guidelines available to download in PDF format at www.epfindia.gov.in. Employees Provident Funds Scheme (EPFS) is a long-term retirement saving scheme managed by Employees provident fund organization (EPFO) and it is covered under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. Check all Employees’ Provident Fund Act, 1952 Rules and detailed information regarding the scheme.

About EPF Scheme 1952

Under EPF Scheme, an employee and employer have to pay certain percentage of equal contribution in the provident fund account and on retirement, an employee gets a lump sum amount of contribution made by employer and employee with interest on both. EPF Scheme extends to the whole territory of India except the state of Jammu and Kashmir.

Objective of EPF Scheme, 1952

EPF Scheme is implemented to help the government, public or private sector employees financially by providing a lump sum amount on their retirement or separation from their job by managing provident fund of them. It helps in providing social security to the members of the scheme.

This scheme is applicable to every establishment in which 20 or more persons are employed other than excluded employees and in certain cases organisation employing less than 20 persons are also covered, subject to certain conditions and exceptions. However, excluded employees (employees who wages is above Rs. 15000) can also become the member of EPF Scheme, if the Assistant PF Commissioner granted permission to them.