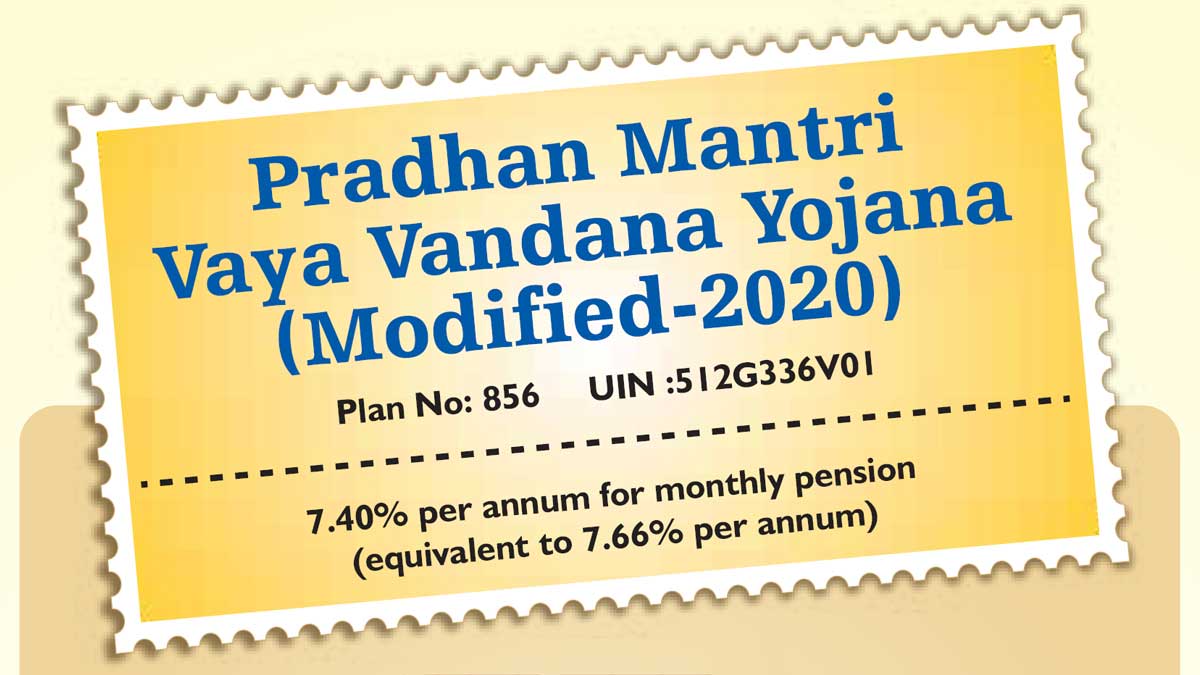

Pradhan Mantri Vaya Vandana Yojana 2026 is a pension scheme being run by the Ministry of Finance to provide immediate pension for senior citizens of 60 years and above. PMVVY pension scheme is being implemented with LIC and interested and eligible candidates can buy LIC PM Vaya Vandana Yojana plan online at www.licindia.in. The revised PMVVY LIC Plan 856 can be purchased by paying a lumpsum amount. For Financial Year 2022-23, the scheme shall provide an assured pension of 7.40% p.a. payable monthly. This assured rate of pension shall be payable for the full policy term of 10 years for all the policies purchased till 31st March, 2023.

LIC PM Vaya Vandana Yojana 2026 plan provides pension payments of stated amount for the policy term of 10 years. PM Vaya Vandana Yojana envisages an assured rate of return of 7.4% per annum (for monthly pension) for the financial year 2026. In this LIC Pension Plan 856, there is a return of purchase price at the end of 10 years.

PMVVY Scheme last date was 31 March 2020, but central govt. has extended its deadline for 3 years i.e Now PMVVY last date is 31 March 2023. PM Vaya Vandana Yojana Pension would be paid at the end of each period as per payment mode chosen starts as early as next month if monthly mode is chosen. On the death of the pensioner at any time during the term of 10 years, the purchase price will be refunded to the legal heirs / nominees.

LIC PMVVY Pension Scheme Apply Online

Pradhan Mantri Vaya Vandana Yojana was recently modified in May 2020 by the central government. PMVVY is a non-linked, non-participating, pension scheme subsidized by the Government of India. According to the new changes, the new interest rate would be reviewed and decided at the beginning of new every financial year by the Ministry of Finance. The scheme was extended for 3 years up to 31st March 2023.

Pradhan Mantri Vaya Vandana Yojana Application Form 2026

The application form for PMVVY LIC pension scheme can be downloaded from the official website of LIC India or obtained from the nearby office of LIC. However, candidates can also purchase the PM Vaya Vandana Yojana pension plan at the official website of LIC India at licindia.in using the below given procedure.

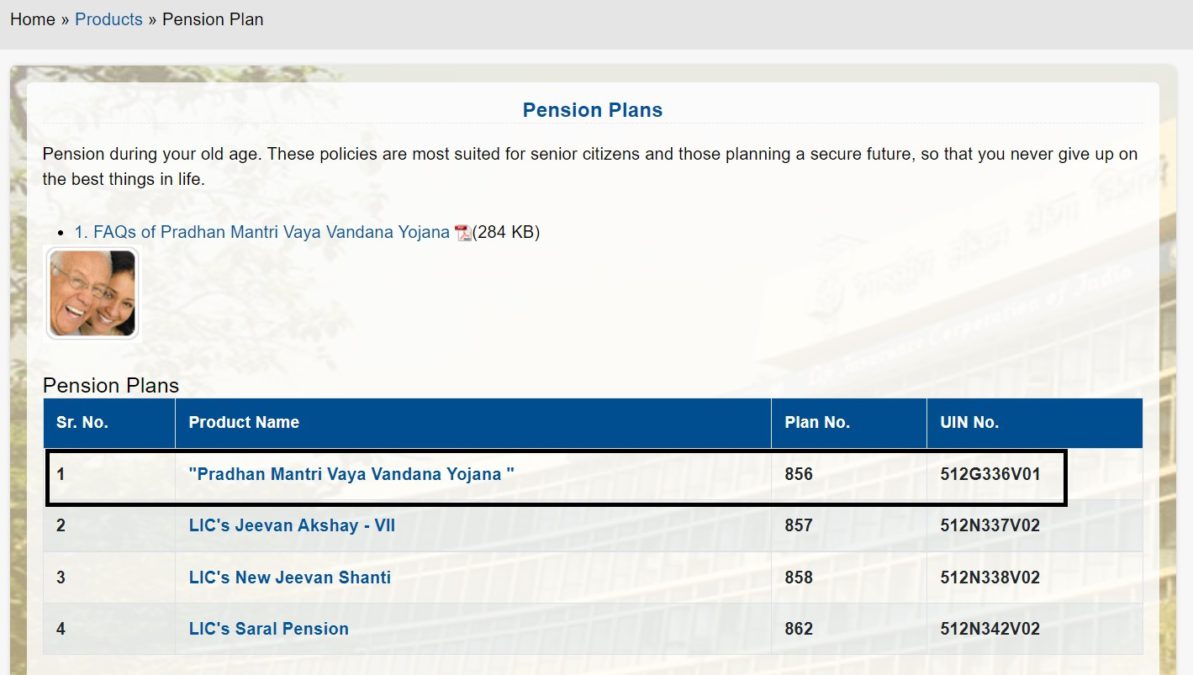

STEP 1: Visit the Online Policy Page at the official website of LIC India at https://licindia.in/

STEP 2: Now scroll over the “Products” link in the header and click at “Pension Plan” option or directly click https://licindia.in/Products/Pension-Plans to open page containing pension plans of LIC India.

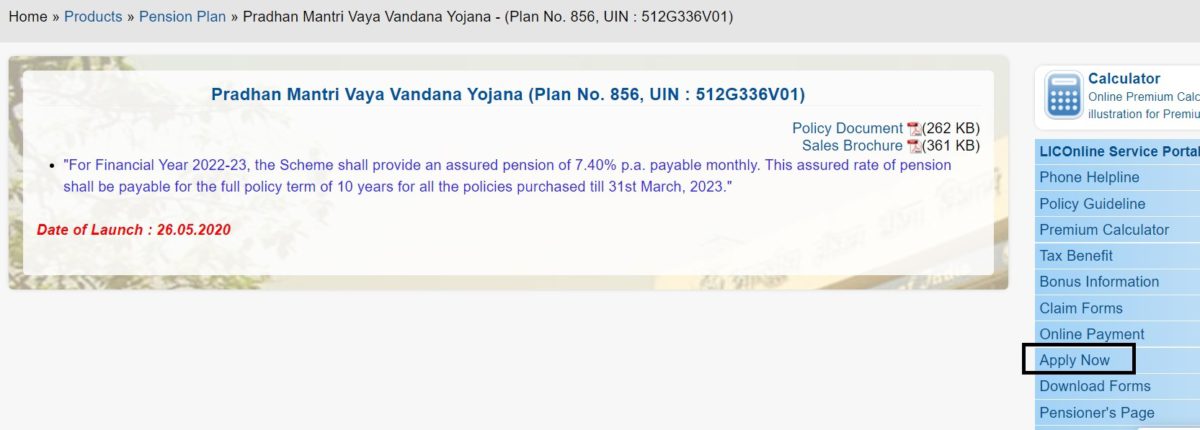

STEP 3: Select Plan No. 856 with Product Name as “Pradhan Mantri Vaya Vandana Yojana” and UIN No. 512G336V01. Then the PMVVY Pension Plan (LIC Plan Number 856) apply online page will open.

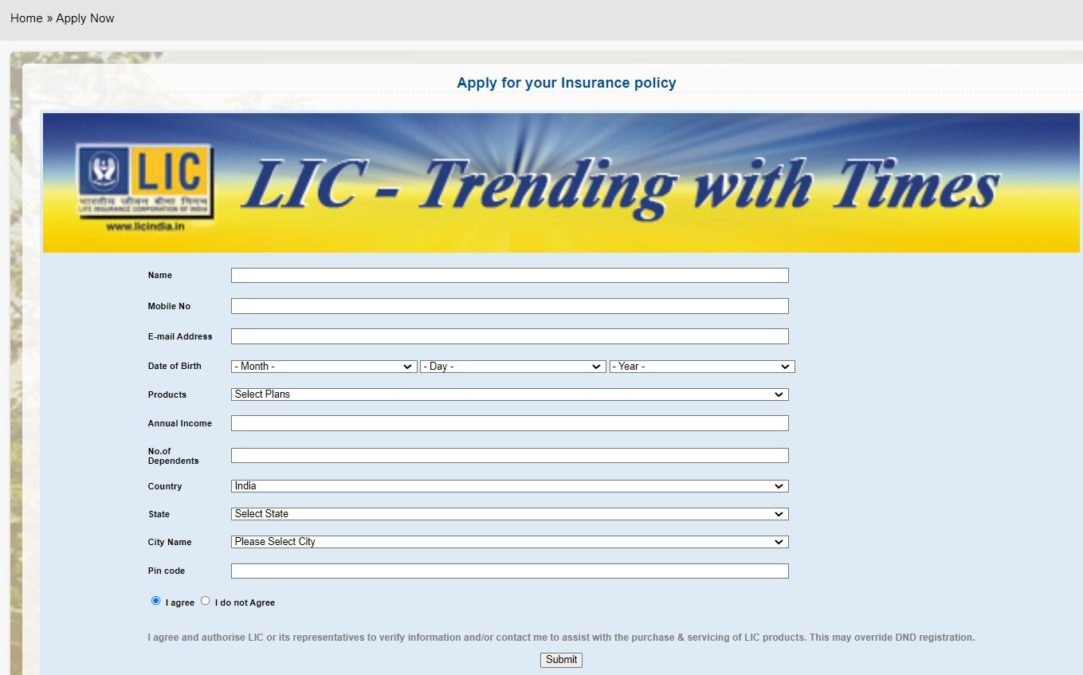

STEP 4: Click at the “Apply Now” link to open the LIC India PMVVY Online Application Form 2026 as shown below:-

STEP 5: Enter name, mobile number, email address, date of birth, products, annual income, number of dependents, country, state, city name, Pin code and click at “Submit” button to fillup PM Vaya Vandana Yojana online registration form.

Pension payment modes available for Pradhan Mantri Vaya Vandana Yojana are monthly, quarterly, half-yearly and yearly. The minimum investment amount is Rs. 1.50 lakh.

PM Vaya Vandana Yojana (PMVVY) Interest Rates

For the first financial year under the extended PMVVY scheme, the interest rate has been fixed at 7.4% for monthly pension which is equivalent to 7.66% per annum. Pension interest rates for 2026 payable under different modes of Payment (Yearly, Half Yearly, Quarterly, Monthly) are as under

| Mode of Pension | Effective Interest Rate per annum |

|---|---|

| Yearly | 7.60% |

| Half-Yearly | 7.52% |

| Quarterly | 7.45% |

| Monthly | 7.40% |

LIC PMVVY Scheme PDF

The revised guidelines and brochure PDF of the Pradhan Mantri Vaya Vandana Yojana can be downloaded using the below links.

Policy Document | Policy Sales Brocure (Basic Guidelines) | LIC PMVVY Sales Brochure – English | LIC PMVVY Sales Brochure – Hindi

PMVVY Investment / Pension Amount

Below are the complete details of investment and pension amount for different modes of pension

Minimum and maximum Purchase price under different modes of Pension:

| Mode of Pension | Minimum Purchase Price (Rs.) | Corresponding Pension Amount |

|---|---|---|

| Yearly | 1,56,658 | 12,000 per annum |

| Half-Yearly | 1,59,574 | 6,000 Half year |

| Quarterly | 1,61,074 | 3,000 per Qtr. |

| Monthly | 1,62,162 | 1,000 per month |

Minimum and maximum Pension under different modes of Pension:

| Mode of Pension | Maximum Purchase Price (Rs.) | Corresponding Pension Amount |

|---|---|---|

| Yearly | 14,49,086 | 1,11,000 per annum |

| Half-Yearly | 14,76,064 | 55,500 per half year |

| Quarterly | 14,89,933 | 27,750 per Qtr. |

| Monthly | 15,00,000 | 9,250 per month |

PMVVY Loan Facility

This is one of the biggest advantages of the Pradhan Mantri Vaya Vandana Yojana. Under the scheme, applicants can apply for loan after completion of 3 policy years. Policy holders can get up to 75% of the purchase price as loan. The rate of interest for the loan is determined by the LIC of India at periodic intervals.

Loan interest will be recovered from the pension amount payable under the policy. The Loan interest will accrue as per the frequency of pension payment under the policy and it will be due on the due date of pension.

Eligibility Criteria for Pradhan Mantri Vaya Vandana Yojana

Below is the basic eligibility criteria for the PM Vaya Vandana Yojana pension scheme.

- Minimum Entry Age: 60 years (completed)

- Maximum Entry Age: No limit

- Policy Term: 10 years

- Minimum Pension: 1,000/- per month, 3,000/- per quarter, 6,000/- per 6 months, Rs. 12,000/- per year

- Maximum Pension: 9,250/- per month, 27,750/- per quarter, 55,500/- per half-year, 1,11,000/- per year

Total amount of purchase price under all the policies taken under Pradhan Mantri Vaya Vandana Yojana shall not exceed Rs. 15 lakhs.

LIC PMVVY Scheme Features

The important features and highlights of LIC Plan Number 842 are as follows:-

| Medical | No medical examination is required. |

| Surrender Value | Premature exit is allowed during policy term under exceptional circumstances like Critical/Terminal illness of self or spouse. Surrender Value payable in such cases is 98% of the Purchase Price. |

| Loan | Loan is available under the policy after completion of 3 policy years. Maximum loan granted will be 75% of the purchase price. |

| Suicide | There is no exclusion in case of suicide. In such a case, the full purchase price will be payable to the nominee / legal heir. |

Aadhaar Card Mandatory for PMVVY Benefits

An individual eligible for receiving the benefit under PM Vaya Vandana Yojana (PMVVY scheme) shall hereby be required to furnish proof of possession of Aadhaar number. As per the Finance Ministry notification, applicant must possess the unique 12-digit biometric identity number or undergo Aadhaar authentication. In case aadhar card is not available, applicant must enroll for Aadhaar number first before making PM Vaya Vandana Yojana registration.

Tax Benefits of PM Vaya Vandana Yojana

PM Vaya Vandana Yojana pension scheme for senior citizens is not a tax saving scheme but an investment plan to fund their retirement. All the elderly people above 60 years were allowed to invest a max. amount of Rs. 15 lakh on or before 31 March 2023. For the policy term of 10 years, senior citizens can get a minimum pension of Rs. 1,000 per month and a maximum pension of Rs. 9,250 per month depending on the amount invested.

Will you get tax savings benefit under section 80C?

Returns from this scheme will be taxed as per existing tax laws and the rate of tax as applicable from time to time. The scheme is exempted from Goods and Services Tax (GST). All general insurance scheme includes 18 percent GST such as term insurance. However, to give a relief to senior citizens, there are a few LIC schemes including Pradhan Mantri Vaya Vandana Yojana scheme, which continues to be exempted under GST as they were exempted from service tax before July 1, 2017.

This PMVVY scheme will not allow investor to claim a deduction for investments up to Rs. 1.5 lakh under section 80C of the Income Tax Act. This scheme is not an eligible investment under this section of the Income Tax Act. However, a representation can be filed before IT dept. to include the sum paid under PMVVY scheme as an eligible deduction under section 80C of Income Tax Act to bring this scheme on par with Senior Citizens Saving Scheme. The inclusion however, will require legislative amendment which can be made in the subsequent budgets.

PMVVY Frequently Asked Questions (FAQ’s)

What is PM Vaya Vandana Yojana

Pradhan Mantri Vaya Vandana Yojana (PMVVY) is a pension scheme for senior citizens offered by Life insurance Corporation (LIC) and run by the ministry of Finance, Government of India.

What is the interest rate under PMVVY Scheme

As per the new guidelines, the interest rate for FY 2026 for PMVVY Scheme is 7.4% per annum and thereafter to be reset every year.

What is the minimum and maximum entry age for PM Vaya Vandana Scheme

The minimum entry age for PMVVY Scheme is 60 years while the maximum entry age has no limit.

What is the minimum and maximum pension amount for PMVVY Scheme

The minimum pension amount is Rs. 1,000 per month while the maximum pension amount is Rs. 9,250 per month.

What is the Maturity Benefit for PMVVY

If the pensioner survives till the end of the policy term of 10 years, purchase price of the annuity along with final pension installment will be payable to the policyholder.

What is the death benefit of PMVVY

If the pensioner dies during the policy term of 10 years, the purchase price of the annuity scheme will be refunded to the legal heir / nominee.

How to apply online for PMVVY

Citizens can now apply online for PMVVY Scheme at the official website of Life Insurance Corporation (LIC) India at www.licindia.in

Is Aadhaar Card Mandatory for PMVVY

Yes, Aadhaar Card is mandatory

What is minimum and maximum purchase amount under PMVVY

The minimum investment amount is Rs. 1,62,162 for Rs. 1,000 p.m pension while the maximum investment is Rs. 15,00,000 for Rs. 9,250 p.m as pension.

What is the Last Date of PMVVY

The new last date for PMVVY policy purchase is 31 March 2023.

Read more FAQ’s through the link – https://licindia.in/getattachment/Products/Pension-Plans/PMVVY_FAQ_Final.pdf.aspx

LIC PMVVY Helpline

Visit the official website of LIC India at licindia.in for more details or reach at the below helpline contact details

PHONE: +91-022 6827 6827 (24*7)

Plz helap home

Home plz mob 9058494013

Khoobsoorat planning…….new plan should be retirement plan for unorganized sector….

sir, I want to take this polocy to my parents. Request concern Pls call me on mobile 8978525756

sir, I want to take this polocy for my parents. Request concern Pls call me on mobile 8054573446

my parents is poor. please help me and my family for available a short pension for my parents.

my mobile no.- 7451815255

Batista Bhima Yojana announced by the prime minister of India and incorporated in the budget and also cleared by the cabinet for implementation go LIC is yet to take off. Many senior citizens are waiting to participate. Request LIC quick implementation.

Max.ceilng should have been 15.0 lakhs instead of 7.5 lakhs only.

yes

yes.

want to apply online senior citizen pension scheme please give me details its start or not how to apply for our parents

IWANT TO ENROLL IN THIS YUJANA.PLHELPIN WITH APPLICATION FORMA AND GUIDEME IN FILLING .IAMTOO OLD TO GO TO LIC OFFICE AT CHIRALA.

sir very simple online. keep adhar, pan card, photo, signature uploaded in your computer. then reply to step by step.

IT IS WONDERFUL TO SEE THAT OUR BELOVED PRIME MINISTER HAS BEEN SO CONCERN ABOUT THE WELL BEING OF THE CITIZENS SPECIALLY THE LOWER INCOME GROUP.

HOWEVER DOES THE PMO KNOW OR HAVE ANY MECHANISM TO ASSES WHETHER THE PEOPLE ARE AWARE OF SUCH SCHEME!!

THE AREA WHERE I LIVE HARDLY ANY ONE KNOWS ABOUT SUCH SCHEME TO TAKE BENEFIT OF THOSE SCHEME.

RECENTLY I WAS LISTENING TO THE ‘PRADHAN MANTRY’S MON KI BATT’ AND RADIO BROADCAST BY FM RAINBOW WITH ONE MR.BIPLAB CHATERJI.

I WAS DEEPLY TOUCHED TO HEAR ABOUT THE “PRADHAN MANTRY JANA AUSHADHI SCHEME”. IT WAS HIGHLY DEPRESSING THAT PEOPLE OF THIS AREA ARE DEPRIVED OF SUCH SCHEME WHERE MILLIONS OF POOR PEOPLE COULD BE BENEFITED.

IT WOULD HAVE BEEN GREAT HELP TO THE PEOPLE WHO CAN NOT AFFORD TO BUY COSTLY MEDICINE FOR THEIR TREATMENT IF SUCH FACILITIES ARE MADE AVAILABLE IN THIS AREA.

B.BASU

KARBALLA T.E.

BANARHAT.

DST.-JALPAIGURI

PIN-735202

for all those seeking benefit i suggest to look for some Lic agent through internet to get this benefit.

kannauj

please call me at 9920122261

I AM A FARMER INTERESTED FOR PENSION JOJNA . PLEASE GUIDE .MY NO-9090953721,9937402908

If you are a farmer and interested in pension scheme, then apply for Kisan Maan-dhan pension yojana – http://sarkariyojana.com/pm-kisan-mandhan-yojana-application-form/

Ajay Kumar Mishra Faizabad

While online pmvvy I complete, but I could’nt noted the acknowledge no.and policy no.due to error accured. However I complete online full process payment throygh NEFT.,and an emailed sent to me by onlinedmc@lic india for NEFT transfer for amount filled by me on 31/03/2020 in Axis Bank in LIC account Bombay immediately after compleletion. I only have access I’d. No. Due to lockdown I could not done NEFT & No LIC excetive available on custumer care and phone is always show busy. How can I get ack. No. & policy No.? I have email detailed for NEFT transfer & Access I’d.

The only help you can get is by calling at the phone numbers given here https://licindia.in/Customer-Services/Phone-Help-Line

CURRENTLY THIS POLICE NO. 842 STILL IT IS CONTINUE OR NOT PLS. REPLY SOON

No, this scheme has been closed, however, due to COVID-19 Pandamic lockdown, Govt. may extend the last date which was 31st March 2020,

how many commission rate given to agent by lic on this policy pmvvy.

You better ask any LIC agent…

ONLY 2%

0.5%

i am having joint a/c.with my husband either or survival with first name of my husband i have not taken debit card and amount shall be paid through netbanking of husband i feel there should be no problem kindly confirm.a

amount will be on the first name only

I approached Patna branch -1, for pension under PMVVY . The branch deed not show intereste in fact neglected and insisted on other lic pension plan to which I was not interested.

Secondly he explained me that the interest in PMVVY is floating rate therefore the pension fixed in 2020 may change after april 2021.

I do not agree with, my reading is that, the pension fixed in march 2020 @ 7.4% interest. Will continue same for ten years.

Reluctance to implement social security yojana of the govt. is not good and will deprive the willing senior citizens. Kindly reach the grievance to appropriate authority. kindly reply.

Hello Mr. Surya Narayan,

Yes, you are right that reluctance to implement any of the government scheme is not good, however,

Since this scheme is being run by the Department of Financial Services under the Ministry of Finance, Govt. of India, you may reach about the same at contact details of the department given at https://financialservices.gov.in/contact-us.

And Yes, the government has recently made the changes to the scheme while extending it further. according to the recent changes, the interest rate for each financial year will be decided and applicable from 1st April every year.

The maximum rate of interest is capped at 7.75 per cent at any point.

Thanks

Nice information

Thank You

मी व माझी पत्नी दोघानाही ६० वर्ष पूर्ण झालेत. दोघेही या योजनेत पत्र आहे का. म्हणजे दोघेही मिळून १५-१५ लाख जमा करू शतो का

Yes

I am personal loan

I am personal loan

Can you please let me know the interest rate for the year 2021-2022?

same till 10 years if you purchase

7.4%

plz provide online registration side and yojana details.

I want to open PMVVY. I would like confirm that once I open this scheme in this F.Y.2021-22, whether I can get the same fixed rate of 7.40% monthly pension for the next 10 years, irrespective of the deduction of interest rate, if any, made applicable in the subsequent financial years.

In other words, I want to know whether any changes in interest rate made by govt. in the subsequent FYs, would affect my existing scheme already opened in FY 2021-22 ?

Kindly clarify ?

same interest till 10 years

same till 10 years if you purchase

My mother is 60+ and interested to take PVVY plan. But from when onwards monthly pension will get start.

is there and waiting period to get started with the pension.

Please advice ASAP.

next month onwards

which address proof is required document. If Aadhar is sufficient for address proof for this scheme.

Can an individual open multiple accounts under pmvvy within the limit?

Say year one individual could invest only 5lacs. Next year he wants to invest 4lacs. Is that possible?

PLEASE MAIL TWO SET OF APPLICATION FORM FOR PMVVY of LICI