National Savings Time Deposit Scheme 2024 | Post Office TD Account | Post Office Fixed Deposit Interest Rate | Post Office FD Calculator | Post Office Term Deposit Account Opening Form.. Post Office Time Deposit Account is similar to the Fixed Deposit Account in banks where any person can save their money for a definite time period. In PO TD Account, Indian Post Offices provides guaranteed returns. Post Office TD Interest Rate 2024 lies between 6.9% to 7.5% based on the number of years (1, 2, 3, 5) of term deposit. People can easily calculate their post office TD interest earned through TD calculator. People can fill post office TD account opening form through indiapost.gov.in. The Finance Ministry has notified new National Savings Time Deposit Rules vide GSR 922 9E dated 12 December 2019.

People can open their TD account through filling the application form and make fixed deposit for a definite time in PO. Before opening the account, people must check the post office TD interest as it is different for different time period. Moreover, people can calculate TD interest as per the current rates through Post Office TD Calculator 2024. The interest on PO Fixed deposit (FD) account or TD account is payable annually but calculated quarterly.

Post Office Saving Schemes Interest Rates 2024

People can also compare other Post Office Schemes like National Saving Certificate (NSC), Public Provident Fund (PPF), Kisan Vikas Patra (KVP), Sukanya Samriddhi Yojana (SSY), Post Office Savings Account, Senior Citizen Saving Scheme (SCSS), Recurring Deposit, Monthly Income Scheme (MIS) – check NCS vs PPF vs KVP vs SSY vs TD vs SCSS vs RD vs MIS vs post office savings scheme. People can Compare All Post Office Schemes before making investment.

Post Office Time Deposit (TD) Account Interest Rate 2024

TD Account can be opened in any Post Office across India. Any individual can open this account in the name of a minor or for himself or also can open joint account to earn guaranteed interest. Post Office TD Interest Rate 2024 (effective from 1 January 2024) is 6.9% for 1 year term deposit, 7.0% for 2 year term deposit, 7.0% for 3 years term deposit account and 7.5% for 5 year term deposit account.

Post Office Time Deposit (TD) Account Interest Rate

| Maturity Period | Interest Rate |

|---|---|

| 1 Year Time Deposit | 6.9% |

| 2 Year Time Deposit | 7.0% |

| 3 Year Time Deposit | 7.1% |

| 5 Year Time Deposit | 7.5% |

Post Office TD Interest is calculated quarterly but is payable annually. Any person can open any number of TD accounts in post office. Even Post Office TD account can be transferred from one post office to another. Account can be opened with minimum of Rs. 1000 and in multiple of Rs. 100. No maximum limit for investment. Any individual can open TD account in cash or through cheque. People can also open TD account (FD) in various nationalized and private banks like SBI, Canara Bank, Axis Bank, HDFC Bank, ICICI Bank.

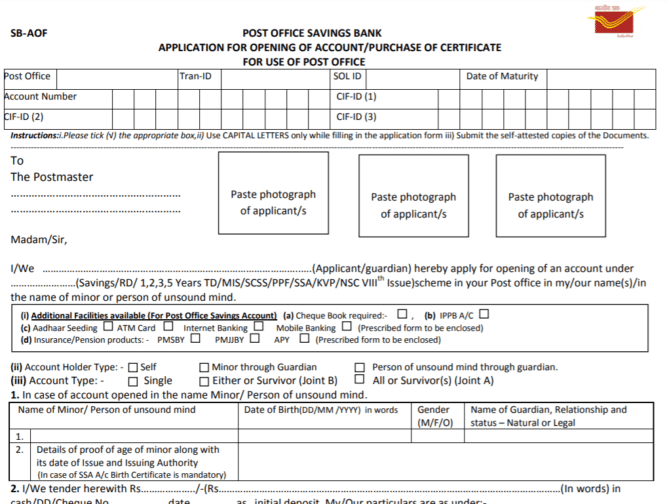

Time Deposit (TD) Account Opening Form 2024

To open an account, people can download the application form in PDF Format through the link – Post Office TD Account Opening Form PDF. The Post Office Time Deposit (TD) Account Opening Application Form 2024 will appear as shown below:-

Alternate Link to Check Forms for Post Office FD Account – https://www.indiapost.gov.in/VAS/Pages/Form.aspx#SavingBank

Who is Eligible to Open Fixed Deposit Account in Post Office

- A single adult

- Joint Account (up to 3 adults) (Joint A or Joint B)

- A guardian on behalf of minor

- Guardian on behalf of person of unsound mind

- Minor above 10 years in his own name

The TD account can be opened by a single adult, upto three adults in joint names, a minor above 10 years of age or a guardian on behalf of a minor below 10 years of age or a person on unsound mind. An individual can have more than one TD account in his name or jointly with another.

Post Office TD Premature Closure & Tax Benefits

Post Office Fixed Deposit Account type includes 1 year, 2 year, 3 year, 5 year. Account can be opened with minimum of Rs. 1000 and in multiple of Rs. 100. No maximum limit for investment. Interest shall be payable annually and no additional interest shall be payable on the amount of interest that has become due for payment but not withdrawn by the account holder. The annual interest may be credited to the savings account of the account holder by submitting application. The investment under 5 year TD qualifies for the benefit of section 80C of Income Tax Act, 1961.

All the deposits made in the term deposit account are allowed for withdrawal through TD premature closure. TD Account is liquid despite the lock-in period. Only the TD accounts with lock-in (maturity) period of 5 years are eligible for tax benefits under s/c 80C of IT Act, 1961 from 1 April 2007. However TD Accounts of 1, 2 and 3 years does not gets tax exemption under 80C. The following points are applicable in case of post office TD premature closure which are as follows:-

- TD Account is risk free but No deposit shall be withdrawn before the expiry of six months from the date of deposit. Candidates can make premature closure of their TD accounts after 6 months of initial deposits.

- In case the TD premature closure period is after 6 months but before 1 year than the subscribers will get an interest rate of PO Savings Account Interest rate.

- If 2/3/5 year TD account prematurely closed after 1 year, interest shall be calculated 2% less than of TD interest rate (i.e. 1/2/3 years) for completed years, and for part period less than a year, PO Savings Interest rates will be applicable.

- TD account can be closed prematurely by submitting prescribed application form with pass book at concerned Post Office.

Pledging of TD Account

The TD account can be pledged or transferred as security, on an application made by the depositor in Form-5 supported with acceptance letter from the pledgee. Transfer/pledging can be made to the following authorities –

a) The President of India/Governor of the State.

b) RBI/Scheduled Bank/Co-operative Society/Co-operative Bank.

c) Corporation (public/private)/Govt. Company/Local Authority.

d) Housing finance company.

Post Office TD Calculator 2024 – Maximum / Minimum Amount

Candidates can open his account with minimum Rs. 1000 and can make subsequent deposits in multiples of Rs. 100. There is no limit on the maximum amount of deposits in TD Account. People can keep a track of their records and calculate their interest using POTD Passbook with rules applicable to the account. Deposit amount shall be repayable after expiry of 1 year, 2 year, 3 year, 5 year (as the case may be) from the date of opening.

In case the TD deposits get matured in any CBS Post office then the same TD account will automatically gets renewed for the same period for which the initial account was opened. For eg – Any 2 years TD Account can automatically gets renewed for 2 years after maturity. An account holder can get the interest income credited to his/her savings bank account. In case the depositor doesn’t withdraw the annual interest earned on his deposited amount, it won’t earn any additional interest, according to the scheme.

Time Deposit Account 2024 is somewhat similar to the RD Account of the Post Office. However, RD Interest is paid quarterly while TD Interest is paid yearly but calculated quarterly. People can also make TD login at website of Post Office TD Account Check Online.

New National Saving Time Deposit (TD) Scheme Nomination Facility

Subscribers are allowed to multiple accounts in any post office as well as joint TD accounts. People can open this type of account in the name of a minor below 10 years or for themselves. Nomination Facility is available at the time of account opening and even after opening the TD account.

In TD accounts, subscriber can operate more than 1 accounts in individual capacity or jointly. After 10 years, minor must convert TD account in his name. There is no maximum limit on the deposits made by an individual. People can convert their single account to joint account and vice versa.

Post Office Time Deposit – Highlights at a Glance

All the people who want to save their money for a defined time period and assured returns can open a TD Account. The important features and highlights of Post Office TD Account are as follows:-

Time Deposit Account – Post Office TD Calculator and Salient Features

| TD Interest Rate 2024, Periodicity | Minimum Term Deposit Account Opening Balance and Maximum Balance |

|---|---|

| TD Interest Rate 2024 currently varies from 6.9% to 7.5% per annum quarterly calculated while payable yearly (effective from 1 October 2024). This post office TD interest is 6.9% for 1 year account, 7.0% for 2 year account, 7.0% for 3 year account and 7.5% for 5 year account. | Minimum TD account opening balance is Rs. 1000 and candidates can deposit any further amount in multiples of 100. There is no maximum limit. |

| Important Features | |

| |

What will be the yearly returns on an investment of Rs.5 lakhs in post office for a period of 5 years.