Post Office Savings Account Interest Rate – Just like regular savings account, India post office also provides the facility of secure Post Office Savings Account. This account also offers full or partial liquidation of funds at short period of notice if needed as specified by central government. This PO saving account has guaranteed returns and provide risk free regular income with interest rate of 4% per annum and also provide ATM card facility. Post Office Savings Interest Rate Calculator can tell the interest earned and people can make regular post office account balance enquiry.

These savings account provides tax benefit on Interest earned up to Rs. 10,000. This post office saving scheme also resolve query of how to transfer money from bank account to post office account. Finance Ministry has given its nod to link PO Savings Account with IPPB (full fledged digital banking) which enables a person to do NEFT / RTGS / online money transfer to any bank account. This facility has been started from May 2018. Senior Citizens and women living in rural and semi-rural areas mostly invest in this savings scheme as the minimum savings account opening balance is just Rs. 500. For details, visit indiapost.gov.in

People can check other schemes as well before opening savings account in post office and compare interest of other schemes with Post Office Savings Account Interest Rate. Other post office schemes are – Public Provident Fund (PPF), Kisan Vikas Patra (KVP), Sukanya Samriddhi Yojana (girls), National Savings Certificate (NSC), Recurring Deposit – RD Account, Senior Citizen Saving Scheme (SCSS), Time Deposit Account (TD), Monthly Income Scheme (MIS) – check NCS vs PPF vs KVP vs SSY vs TD vs SCSS vs RD vs MIS vs post office savings scheme. You can compare all Post Office Schemes before making investment.

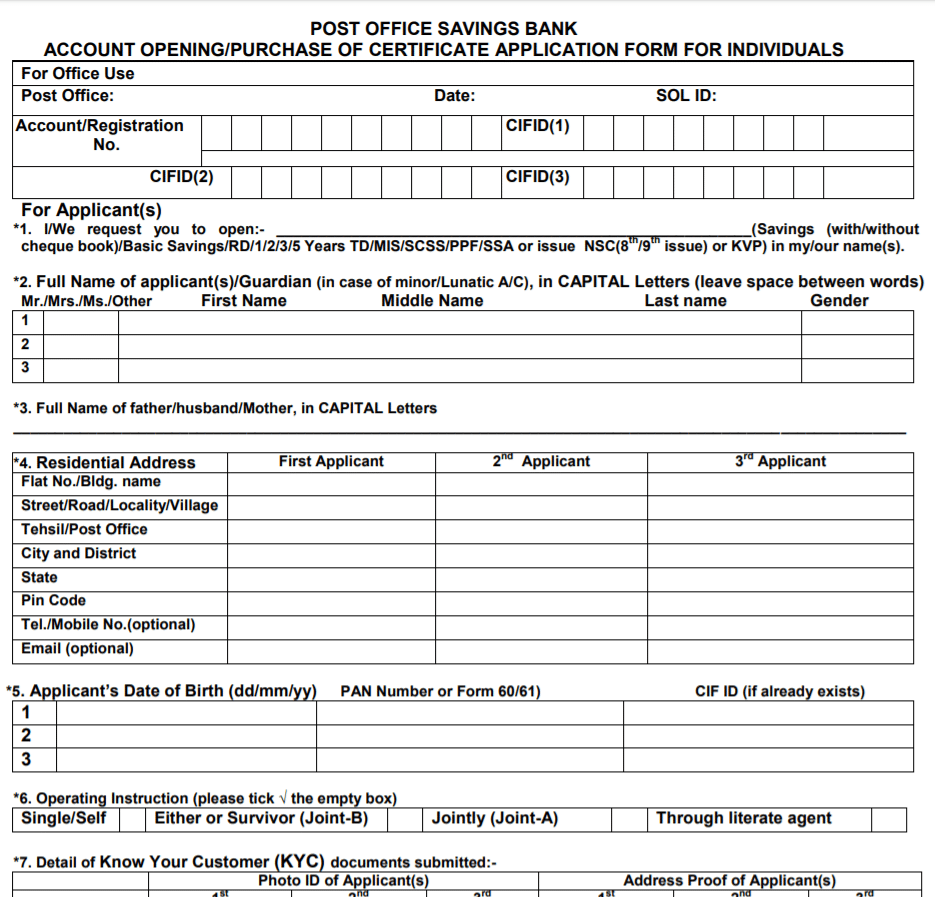

Post Office Savings Account Opening Form – Procedure and Documents

People can open this type of savings account with minimum account balance of only Rs. 500 (in cash only) at any post office. Moreover, to maintain a non-cheque facility account, the maintaining balance of savings account is only Rs. 500 only. Any individual account holder can deposit maximum Rs. 1 lakh in this account while maximum amount is Rs. 2 lakh for joint account holders.

The most striking features of Post Office Savings Account is that there is no lock-in / maturity period. In addition to this, people can also opt for opening savings account with Rs. 500/- to avail cheque and ATM facility. Cheque facility available if an account is opened with Rs. 500/- and for this purpose minimum balance of INR 500/- in an account is to be maintained. Post Office Savings Account Interest Rate does not depend on market prices in any way, so is safe.

Procedure for Opening Savings Account in Post Office

It is a very simple process to open a new saving account in any post office branch:-

STEP 1: Candidates can purchase savings account application form any post office or can download it online through the link given here – https://www.indiapost.gov.in/VAS/DOP_PDFFiles/form/SB-3.pdf

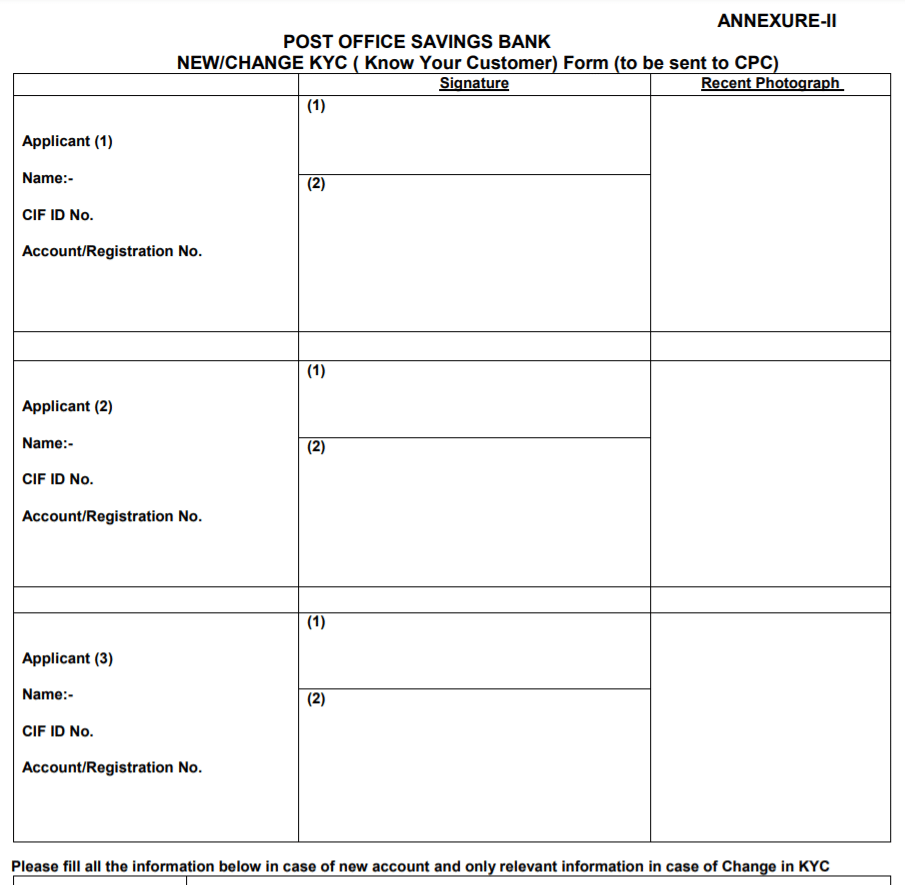

STEP 2: Fill the Savings Account Application Form and submit the form along with KYC documents and recent photograph. The PO Savings Bank Account KYC Form can be downloaded in PDF format using the link below:-

https://www.indiapost.gov.in/VAS/DOP_PDFFiles/form/KYC.pdf

STEP 3: Then subscribers will have to make payment equals to the amount they want to deposit (minimum Rs. 500). After payment the account will open.

Furthermore, there are separate forms for senior citizens to avail this scheme benefits. Post Office Savings Account Interest Rate is secure and free from any market risks.

List of Documents for PO Savings Bank Account

Candidates must submit the following documents along with the completed application form to open their new savings account:-

- ID Proof – Electoral Photo Identity card (Voter Card), Aadhaar Card, Ration Card, Passport, Driving License, Photo Identity Card from School / University, PSU, Identity card issued by Central / State Government.

- Address Proof – Bank or Post Office Passbook,Passport, Ration Card, Electricity Bill, Telephone Bill, Salary Slip, Aadhaar Card.

- 1 Recent passport Size Photograph. In case of Joint Account, photographs of all joint account holders.

Post Office Savings Account Interest Rate vs Other Schemes

All the subscribers can check the Post Office Savings Account Interest Rate for current year before opening of India Post Office Saving Account. Compare PPF vs NSC vs KVP vs SCSS vs SSY vs MIS vs TD vs RD vs Savings Account.

Post Office Savings Account Interest Rate in Table for 2024

| Post Office Savings Scheme | Interest Rate |

|---|---|

| Public Provident Fund (PPF) | 7.1% compounded yearly |

| Senior Citizen Savings Scheme (SCSS) | 8.2% p.a from 31 March / 30 Sept / 31 December |

| Kisan Vikas Patra (KVP) | 7.5% compounded yearly |

| Sukanya Samriddhi Yojana (SSY) | 8.0% p.a compounded annually |

| Post Office Monthly Income Scheme (MIS) | 7.4% per year payable monthly |

| National Savings Certificate (NSC) | 7.7% compounded p.a but payable at maturity |

| Post Office Savings Bank Account | 4% p.a |

| Time Deposit Account (TD) | 6.9% to 7.5% p.a calculated quarterly |

| Post Office Recurring Deposit Account (RD) | 6.7% p.a compounded quarterly |

Eligibility for Post Office New Savings Account & Withdrawal

The candidates must fulfill the following eligibility criteria to open savings account in post office:-

- Any Individual Adult.

- Two adults only (Joint A or B)

- Minors above the age of 10 years can apply.

- Any guardian can open this account on the behalf of a minor.

- Any guardian on behalf of Person with unsound mind is also permissible to open savings account.

- Moreover, there is also a facility to open joint account by 2 or 3 individuals having equal share.

In this Post Office Savings Scheme – group accounts, institutional accounts, security deposit accounts and Official capacity accounts are not allowed.

Post Office Savings Account Withdrawal – There is no lock in or maturity period in this savings scheme, so any individual can withdraw his money anytime. However, the person has to maintain minimum balance of Rs. 500 (for non-cheque facility account) and Rs. 500 (for cheque facility account).

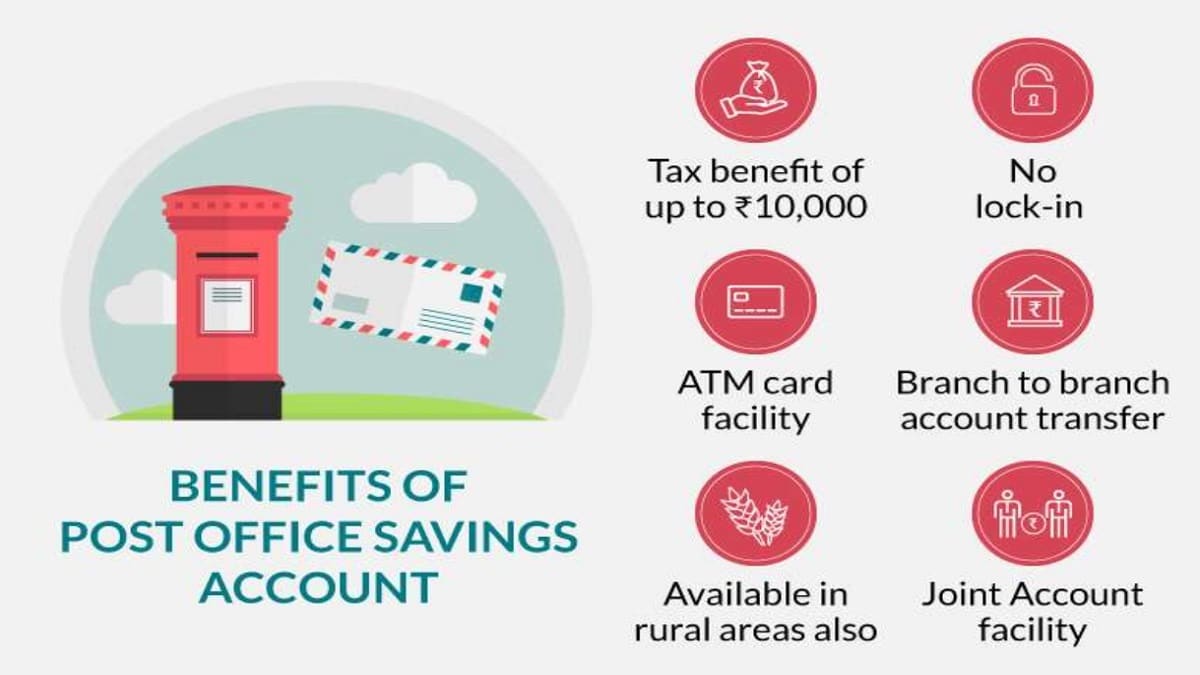

Benefits of Post Office Savings Account

All the subscribers can avail various benefits of this type of saving account like Cheque Facility, ATM / Debit Card:-

Cheque Facility – Cheque book is available at the time of opening of account. For this candidates have to make an initial deposit of Rs. 500. Moreover, all the existing account holders can also avail the cheque book facility. Hence, they have to maintain a minimum balance of Rs. 500 in their account and make a request for check book issuance.

Post Office ATM Card / Debit Card – All those subscribers maintaining the minimum balance in their saving account are entitled to get Post Office ATM Card through CBS Post Offices. Post Office Savings Account Interest Rate is 4% p.a. Even the total principal amount along with the Post Office Savings Account Interest Rate is completely secure.

Minor Accounts – Minors below 10 years can also open their Post Office Saving Account in their name. However, the rights to operate the account still remain available to the parents. Minors with 10 years or above age can operate their account on their own.

Portability – People can transfer their savings account from one branch to another in case of change in address or some other reason. Moreover if people wants to know how to transfer money from bank account to post office account, then they can get assistance at post office Branch.

Nomination – People can choose their nominee at the time of opening of their saving account in post office. Moreover, existing account holders can also choose their nominee after the opening of account.

Joint Holdings – Under Joint Account facility, 2 or 3 adults can open an account together. Moreover, individuals cannot convert their single account to joint account and vice versa.

Tax Exemptions – The interest upto Rs. 10,000 of Post Office Savings Account is exempted from tax under 80L of IT Act.

Electronic Facilities – Individuals can make savings account withdrawal through electronic mode in CSBS Post offices.

Inactivity Period – In case account balance not raised to Rs. 500 at the end of financial year Rs. 50 will be deducted as Account Maintenance Fee and if account balance became Nil the account shall stands automatically closed

Post Office Savings Account Features – Highlights at a Glance

Post office savings account interest rate is 4% per annum. Minimum Initial Deposit for Account Opening is Rs. 500, Maintenance Balance without cheque book / cheque book enabled accounts is Rs. 500. The important features and highlights of Post Office Saving Account Scheme are as follows:-

| Salient features |

|---|

| a) Who can open:- a single adult, two adults only (Joint A or Joint B), a guardian on behalf of minor, a guardian on behalf of person of unsound mind, a minor above 10 years in his own name. |

| Only one account can be opened by an individual as a single account. |

| Only one account can be opened in the name of minor/above 10 years of age (self)/person of unsound mind. |

| In case of death of a Joint holder, the surviving holder will be the sole holder, if surviving holder already has single account in his/her name, Joint account have to be closed. |

| Conversion of single to joint account or vice versa is not allowed. |

| Nomination is mandatory at the time of opening of account. |

| Minor after attaining majority has to submit fresh account opening form and KYC documents of his/her name at concerned Post Office for conversion of the in his/her name. |

| b) Deposit and Withdrawal:- All deposits/ withdrawals shall be in whole rupees only. (i) Minimum deposit amount:- Rs. 500 (subsequent deposit not less than 10 rupees) (ii) Minimum withdrawal amount:- Rs. 50 (ii) Maximum deposit:- No maximum limit (iii) No withdrawal will be permitted which effect reducing of minimum balance Rs. 500 (iv) In case account balance not raised to Rs. 500 at the end of financial year Rs. 50 will be deducted as Account Maintenance Fee and if account balance became Nil the account shall stands automatically closed |

| (c) Post Office Savings Account Interest Rate:- (i) Interest will be calculated on the basis of minimum balance between 10th of the month and end of the month and allowed in whole rupees only (ii) No interest will be allowed in a month if balance between 10th and last day of the month falls below Rs. 500 (iii) Interest shall be credited in account at the end of each Financial Year at the interest rate prescribed by Ministry of Finance (iv) At the time of closure of account, Post Office Savings Account Interest Rate will be paid up to the preceding month in which account is closed (iv) u/s 80TTA of the Income Tax Act, from all Savings Bank Accounts, interest up to Rs. 10,000 earned in a Financial Year is exempted from taxable Income |

| (d) Silent Account:- (i) If no deposit/withdrawal takes place in an account during continuous three financial years, the account shall be treated as silent/dormant (ii) Revival of such account can be done by submitting application along with fresh KYC documents and passbook at concerned Post Office. |

| (e) Additional Facilities available on PO Savings Account:- To avail below facilities on your PO Savings Account, kindly download and submit respective form at concerned Post Office – Cheque book, ATM Card, ebanking/mobile banking, Aadhaar Seeding, Atal Pension Yojana (APY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Pradhan Mantri Jeevan Jeevan Jyoti Bima Yojana (PMJJBY) |

| Note :- (1) Post Office Savings Account Rules 2019 (2) Government Savings Promotion General Rules 2018 Forms available |

References

— For more details, visit the official website indiapost.gov.in

It is advised that all the people must check the Post Office Savings Account Interest Rate first before making investment. The Post Office Savings Account Interest Rate is lower than other instruments but is risk free.

good information for all people.

What’s up, its nice post about media print, we all be aware of media

is a fantastic source of information.