Central Government starts GST E Way Bill Registration, enrolment for transporters, e-way bill for citizens at ewaybill.nic.in. All the taxpayers can generate e-way bill online which is essential for the movement of goods across the country. Accordingly, transporters can access the portal and make enrollment along with citizens through the official website ewaybill.nic.in / ewaybillgst.gov.in

Transporters have to make registration every time for transportation of goods worth Rs. 50,000. So, central govt. has made inter state and intra state e-way bill compulsory. Make e way bill login at the e-way bill portal. Several states already started using e-way bill through GST Network (GSTN). National Informatics Center (NIC) has developed this portal.

GST E Way Bill Online Registration 2024

Below are the complete details to make GST E Way Bill online registration 2024:-

- Firstly visit the official website E Way Bill System – https://ewaybill.nic.in/ / https://ewaybillgst.gov.in/

- On the homepage, scroll over the “Registration” link under click the “e-way bill Registration” link present at the right side of the page.

- Direct Link – Businesses can directly click this link to make GST E Way Bill online registration at https://ewaybillgst.gov.in/Account/EWBUserRegistration.aspx

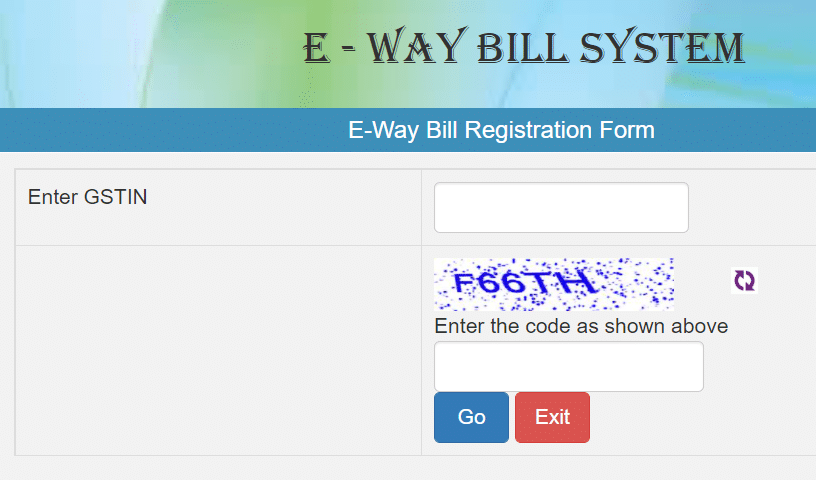

- The GST E Way Bill Registration Form will appear as follows:-

- Here candidates have to fill the GSTIN Number, click the captcha and then click the Go option to make online registration.

Important Points to be Noted by Suppliers / Recipients of Goods

- You can register on the portal of e-way bill namely http://ewaybillgst.gov.in by using your GSTIN.

- E-way bill is required to be generated only where the value of the consignment exceeds Rs. 50,000 which includes tax, but doesn’t include value of exempted goods.

- In case of movement of goods on account of job-work, the supplier or the registered job-worker is required to generate the e-way bill.

- Supplier can authorize the transporter, courier agency and e-commerce operator to fill even PART-A ofe-way bill on his behalf.

- If the distance between the principal place of business of the supplier to the place of business of the transporter is less than 50 Km, PART-B of the e-way bill is not required. Only PART-A of e-way bill is required to be filled.

- Time period for the recipient to communicate his acceptance or rejection of the consignment would be the validity period of the concerned e-way bill or 72 hours, whichever is earlier.

- Where the goods are transported by railways or by air or vessel, the e-way bill shall be generated by the registered supplier or registered recipient only and not by the transporter, and the same can be generated even after the commencement of the movement of the goods.

- E-way bill number can be assigned by supplier/recipient or transporter to another registered or enrolled transporter.

Even the transporters and citizens can make online enrollment and thus can make Login at the official website.

Transporters Enrollment Online Application Procedure

The complete procedure to apply online for Transporters Enrollment has been specified below:-

- Firstly visit the official website https://ewaybill.nic.in/

- Accordingly, scroll over the “Registration” tab and then click the “Enrollment for Transporters” link present at the right side of the page.

- Direct Link – To make online enrollment, transporters can directly click the link https://ewaybillgst.gov.in/Account/Enrolment.aspx for Enrolment For Transporters

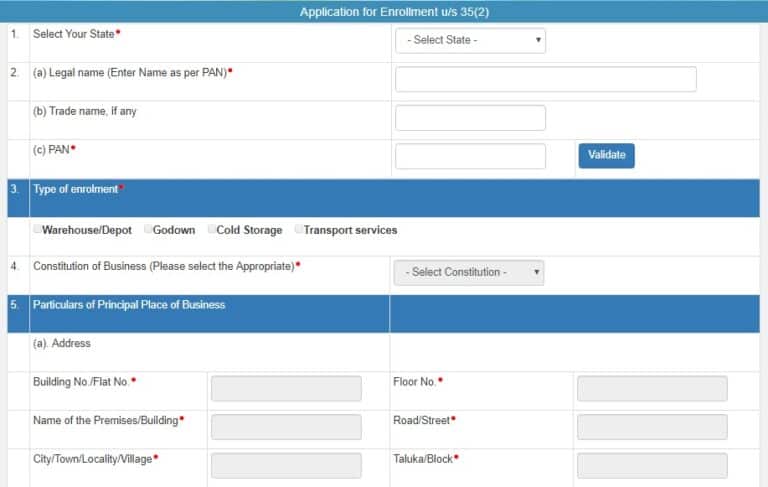

- The E-Way Bill Enrollment Form for the Transporters will appear as shown below:-

- Accordingly, candidates have to fill the enrollment form along with the complete details.

- Finally, candidates have to click the “Submit” button.

Important Points to be Noted by Transporters of Goods

- You can register on the portal of e-way bill namely http://ewaybillgst.gov.in by using your GSTIN. If you don’t have GSTIN, then you can enrol on the portal without GSTIN too.

- No e-way bill is required if the value of the goods in an individual consignment is less than Rs. 50,000/-, even if the total value of all such consignments in a single conveyance is more than Rs. 50,000.

- Railways have been exempted from generation and carrying of e-way bill. But railways are required to carry invoice or delivery challan etc. However, e-way bill has to be produced by the recipient before the delivery of the goods by the Railways

- If the goods cannot be transported within the validity period of the e-way bill, the transporter may extend the validity period in case of transhipment or in case of circumstances of exceptional nature.

- Transporters can generate consolidated e way bills in FORM GST EWS-02

- Where the goods are transferred from one conveyance to another details of conveyance should be updated by the transporter in Part B of FORM GST EWB-01.

- Once verified by any tax officer, the same conveyance will not be subject to a second check in any State or Union Territory, unless and until, specific information concerning the same is received.

- The validity of e-way bill is one day up to 100 km (20 km in case of Over dimensional Cargo). For every 100 km or part thereof, it is one additional day, So if the distance to transport the cargo is 500 km, the transporters have 5 days to transport the cargo with valid e-way bill. Validity of one day will expire at midnight of the day Immediately following the date of generation of e-way bill.

E-Way Bill for Citizens Online Application Procedure

The complete procedure to apply online for E-Way Bill for Citizens has been specified below:-

- Firstly visit the official website https://ewaybill.nic.in/

- Accordingly, scroll over the “Registration” tab and then click the “E-Way Bill for Citizens” link present at the right side of the page.

- Direct Link – To make online enrollment, citizens can directly click the link https://mis.ewaybillgst.gov.in/ewb_ctz/citizen/citizenmenu.aspx for E-Way Bill for Citizens.

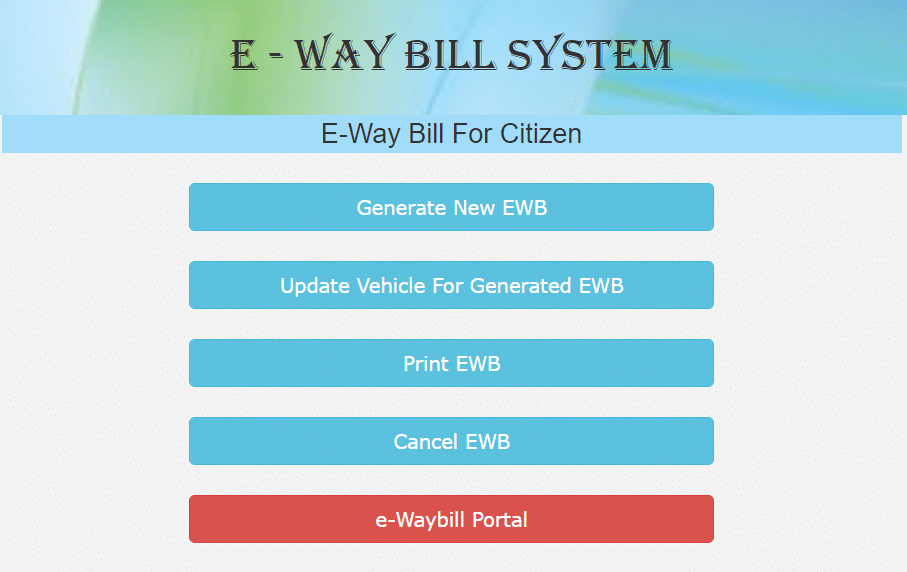

- The E-Way Bill Enrollment Form for the citizens will appear as shown below:-

This E-Way Bill is based on the motto “One Nation, One Tax, One Market”. VAT Authorities has already issued printed booklet to all the businesses / dealers who are regularly paying taxes. Central govt. has also made the inter state and intra state e-way bill mandatory.

good information,sir

thanks

GOOD INFORMATION

9427661643

HOW THE SYSTEM CHECK EVASION OF TAX WHEN A TRADED TRANSPORT GOODS BY NON-MOTORISED VECHILE EXCEEDING RS.50,000.00 IN ABSENCE OF E-WAYBILL ?

Job

Created ID & Pass word , but while opening e way bill portal, login not working, invalid password, invalid user name and captha,

we tried for forgot pass word, and we going for details but showing in correct details, please guide in this matter

Created ID & Pass word , but while opening e way bill portal, login not working, invalid password, invalid user name and captha,

we tried for forgot pass word, and we going for details but showing in correct details, please guide

the government of haryana thinks that all the educated people are idiots… the site never works …it means a lot

8073186255

VENKATASAI KRISHNA TRADERS

VENKATASAI KRISHNA TRADERS MANAGING PARTNER; KOLLI VENKATARAO ‘DOORNO.15-207/A VELAMPETA VEERAVASARAM VEERAVASARAM MANDAL CONTRACTORS;SRI LALITHA BOILED RAW RICE MILL VELAGAPALLI GANAPAVARAM MANDAL W’G’DT

TOTALY BAKWAS….& WASTE OF TIME BUSINESMAN NO WORK ACCEPT DOCUMANTAION ….

Created ID & Pass word , but while opening e way bill portal, login not working, invalid password, invalid user name and captha,

we tried for forgot pass word, and we going for details but showing in correct details, please guide

Chandranaik.s shankranaik pujarahalli Thanda .kudligi t.ballari.d Karnataka.583218

thanks

सर प्रणाम ,

लंबे समय से में आपके apps से जुड़ा हुआ हूं,ओर कई महत्वपूर्ण योजनाओं की जानकारी का स्त्रोत आपका ऐप्स रहा है । में आपके इस डिजिटल प्लेटफार्म के लिए आपका तहे दिल से आभारी हुं।

सर योजनाओं से जुड़ी जानकारियां जो आप पहले विस्तृत रूप में बताते थे कुछ समय से उसमें अभाव आया है । अब योजना की जानकारी में केवल उसका नाम और वेबसाइट ही होती है ,पहले जैसे विस्तृत जानकारी का अभाव होता है ।