The concept of ‘Stree Shakti’ (Women Power) is witnessing renewed legislative focus across India, manifesting in two significant yet distinct forms: a massive financial injection for state-level welfare and continued support for a cornerstone national entrepreneurship scheme.

Recently, the Andhra Pradesh government approved a substantial release of ₹400 crore in additional funding for the state’s Stree Shakti scheme 2026. This state-specific initiative is a powerful welfare measure, primarily designed to subsidize the expenses for free travel for women on RTC buses throughout Andhra Pradesh. The timely release of these funds underscores the government’s commitment to easing the daily financial burden on women, promoting mobility, and enhancing public welfare across the state.

However, on a national level, the name ‘Stree Shakti’ is synonymous with a powerful scheme dedicated to fostering women entrepreneurship since its inception.

The National Stree Shakti Yojana – Fueling Women Entrepreneurs

Launched in October 2000 and primarily administered through the State Bank of India (SBI) and other participating financial institutions, the Stree Shakti Yojana (SSY) is a flagship government initiative. It aims to propel women toward economic independence by providing critical financial and structural support to help them start or expand their businesses.

The scheme is designed to dismantle traditional barriers to finance, ensuring that aspiring and established women entrepreneurs can access capital and compete effectively in the market.

Key Financial Features and Loan Incentives

The SSY stands out by offering substantial benefits tailored to the needs of women-led businesses, making it highly accessible and financially viable:

| Feature | Detail | Impact on Entrepreneur |

| Maximum Loan Amount | Up to ₹50 Lakhs | Provides significant capital for business expansion or starting large-scale ventures. |

| Collateral-Free Limit | Up to ₹5 Lakhs | Removes the major hurdle of collateral, particularly for small-scale and new entrepreneurs. |

| Interest Rate Concession | 0.50% reduction | Applicable for all loans exceeding ₹2 Lakhs, lowering the overall cost of borrowing and boosting profitability. |

| Repayment Tenure | Generally up to 36 months (3 years) with a potential one-month moratorium. | Offers flexible terms that align with a business’s cash flow cycle. |

Crucially, to qualify for the loan under this national scheme, the applicant must ensure that the business, whether a sole proprietorship, partnership, or company, has at least 50% ownership held by women.

Eligibility and Application Pathway

The SSY supports a wide range of enterprises, including those in retail, manufacturing, service-based activities, handicrafts, food processing, and agriculture. Self-employed professionals like doctors, architects, and Chartered Accountants are also eligible.

Mandatory Criteria:

- The applicant must be a woman entrepreneur.

- She must hold a minimum of 50% ownership in the business.

- Participation in or commitment to pursuing an Entrepreneurship Development Program (EDP) is often mandatory. This ensures women are equipped with essential business, management, and financial skills.

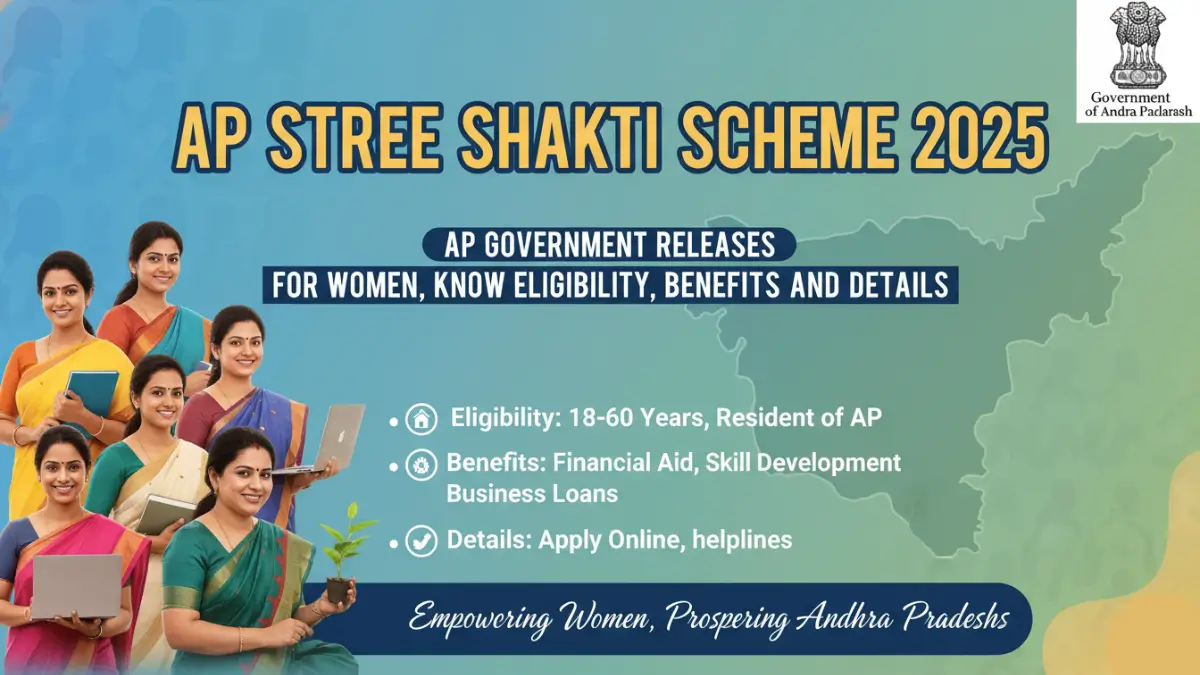

Application Process for AP Stree Shakti Scheme 2026

The application process involves approaching the nearest branch of a participating bank (like SBI). Applicants must submit a comprehensive set of documents, including a government-issued ID, proof of address, income statements (for existing businesses), and a detailed business plan outlining the venture’s objectives and financial projections.

For more details visit the official website – https://dwcd.karnataka.gov.in/40/stree-shakthi-scheme/en