Post Office Senior Citizen Saving Scheme (SCSS) is an important post office scheme for senior citizens which provide extra interest rate and enables them to save Income Tax. This scheme offers 8.2% Interest Rate (effective for the current quarter) and can be determined with the help of senior citizen savings scheme calculator.

Candidates can fill online application to avail benefit of this central government scheme. All the investment in this savings scheme qualifies for the tax benefit under 80C of the IT Act. Senior Citizen Saving Scheme (SCSS) Account Maturity Period (Lock-In Period) is only 5 years with maximum limit of Rs. 30 lakh. SCSS interest is paid quarterly on the first working day of April, July, October and January as per rules, and the account can be extended for 3 years after maturity. These rules are as per National Savings Institute / India Post notifications.

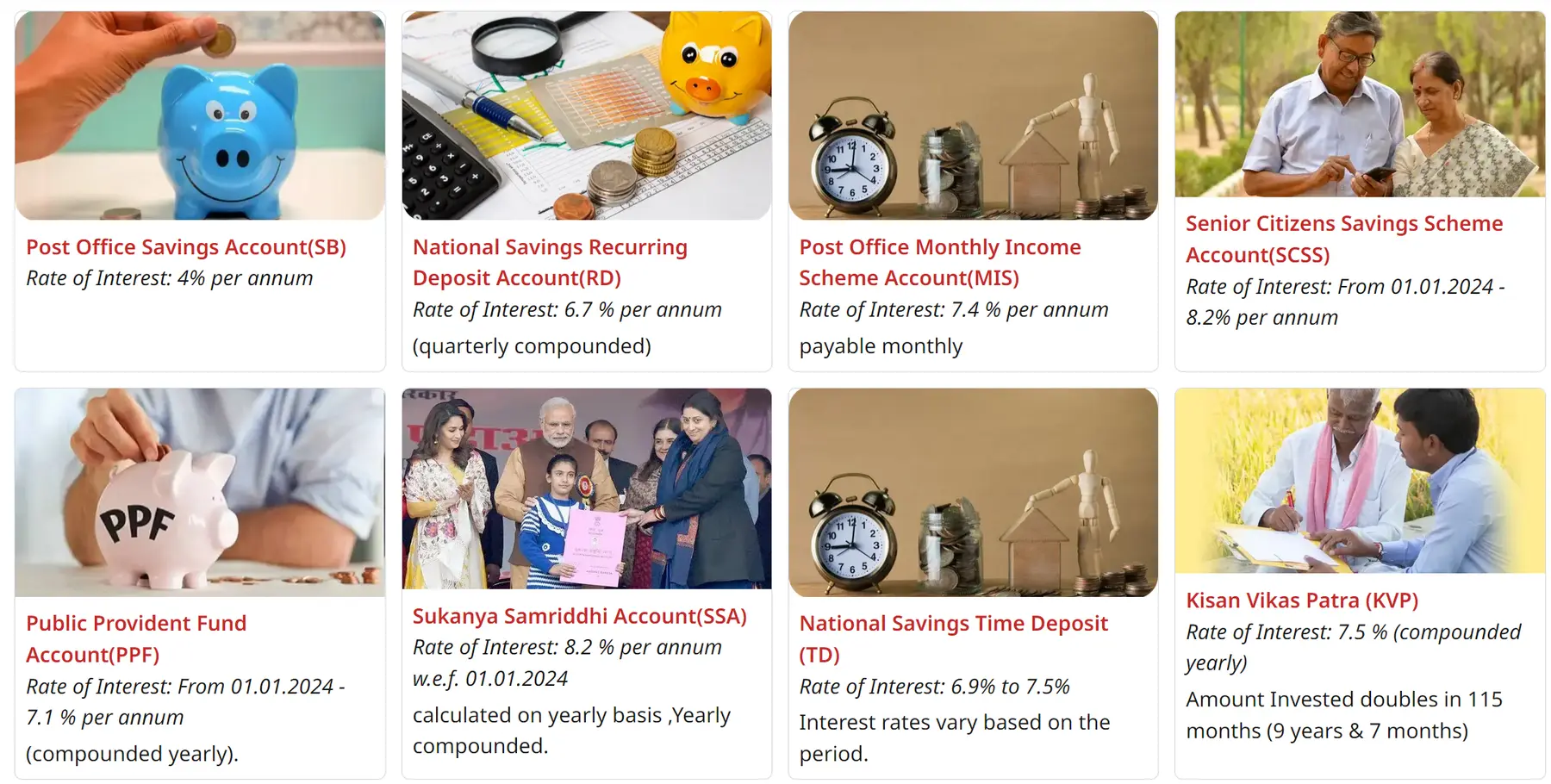

SCSS Interest Rate chart shows that this scheme is at par with other Post Office Schemes like National Saving Certificate (NSC), Public Provident Fund (PPF), Kisan Vikas Patra (KVP), Sukanya Samriddhi Yojana (SSY), Recurring Deposit – RD Account, Post Office Savings Account, Time Deposit Account (TD), Monthly Income Scheme (MIS) – check nsc vs ppf vs kvp vs ssy vs rd vs td vs scss vs mis vs post office savings scheme.

Senior Citizen Saving Scheme Interest Rates

Central govt. reviews small savings rates quarterly. SCSS currently stands at 8.2% per annum for this quarter. PPF is 7.1%, NSC is 7.7% and other Post Office rates remain unchanged for Oct–Dec 2025.

Post Office Interest Rates Table

| Post Office Savings Scheme | Interest Rate |

|---|---|

| National Savings Certificate (NSC) | 7.7% compounded p.a. but payable at maturity |

| Public Provident Fund (PPF) | 7.1% compounded yearly |

| Kisan Vikas Patra (KVP) | 7.5% compounded yearly |

| Senior Citizen Savings Scheme (SCSS) | 8.2% p.a.; interest paid quarterly on 1st working day of Apr/Jul/Oct/Jan |

| Post Office Recurring Deposit Account (RD) | 6.7% p.a. compounded quarterly |

| Time Deposit Account (TD) | 6.9% (1 year), 7.0% (2 year), 7.1% (3 year), 7.5% (5 year) p.a. calculated quarterly |

| Sukanya Samriddhi Yojana (SSY) | 8.2% p.a. compounded annually |

| Post Office Monthly Income Scheme (MIS) | 7.4% per year, payable monthly |

| Post Office Savings Bank Account | 4% p.a. |

Notes: KVP at 7.5% currently doubles in about 115 months (9 years 7 months). SSY is 8.2% w.e.f. 01.01.2024 on yearly compounding as per India Post. TD slab of 3 years is 7.1% now.

Senior Citizen Savings Scheme interest is more than typical Bank FDs. Another practical plus: FD interest is usually credited yearly, whereas SCSS credits quarterly on the first working day of April, July, October and January.

SCSS interest is taxable. TDS may be deducted if total interest in a financial year crosses the threshold; seniors should check Form 15H / 15G applicability with the post office. Section 80C benefits are available on deposits.

Senior Citizen Saving Scheme Account Opening & Eligibility

Senior Citizens Saving Scheme can be opened in any post office pan India. Candidates can also open SCSS in banks. Govt has permitted account opening in nationalized and private banks for wider reach. For deposits below Rs. 1 lakh, cash is allowed; for more than Rs. 1 lakh, payment must be by cheque.

Individuals can fill the application form in Form A along with pay-in-slip in Form D. Any individual who falls in the below mentioned categories can open Senior Citizen Saving Scheme Account:-

- An individual above 60 years of age.

- Retired Civilian Employees above 55 years and below 60 years, subject to investment within 1 month of receipt of retirement benefits.

- Retired Defense Employees above 50 years and below 60 years, subject to investment within 1 month of receipt of retirement benefits.

- Account can be opened singly or jointly with spouse only.

- The whole deposit in a joint account is attributable to the first holder.

SCSS Account Opening Form PDF

You can download the below Post Office account opening form which can be used to open SCSS account as well as normal saving account, RS, TD, MIS, PPF, SSA, KVP or NSC account.

Senior Citizen Saving Scheme – Nomination Facility

Single or joint account with spouse is allowed. Age of first applicant is considered for eligibility. Nomination can be added at opening or any time later by submitting Form C. In case of death of the account holder, if spouse is joint holder or sole nominee and eligible, the account can continue till maturity.

Senior Citizens Savings Scheme – Maximum / Minimum amount

Only one deposit is permitted in an account in multiples of Rs. 1000. Minimum deposit is Rs. 1000. The maximum across all SCSS accounts is Rs. 30 lakh or the retirement benefits received, whichever is lower.

Check Investment / Lock In / Risk of Other Post Office Savings Scheme

Individuals can compare all Post Office Schemes on Maturity period, minimum and maximum amounts, and risk factors (all are government-backed, so risk-free in principal terms). TD premature closure and other rules are as per India Post / notified guidelines.

Thanks for your post. What will happen to my Scss if bank goes bankrupt or shuts down.

Is there safety for senior citizens in case bank shuts down

Hi,

Do SCSS at post office attract TDS…….Please clarify

TIA

Senior citizens already have a SCSS FOR 15 lacs . In the new SCSS 2023 scheme how can he open another account for 15 lacs as ₹30 lacs is allowed

If I deposit an amount of 5.00 Lacs @ 8.2% and after June’23 if interest rate either come down or increase, is there any effect on my deposited interest rate i.e. deposited money interest rate either come down or increase?