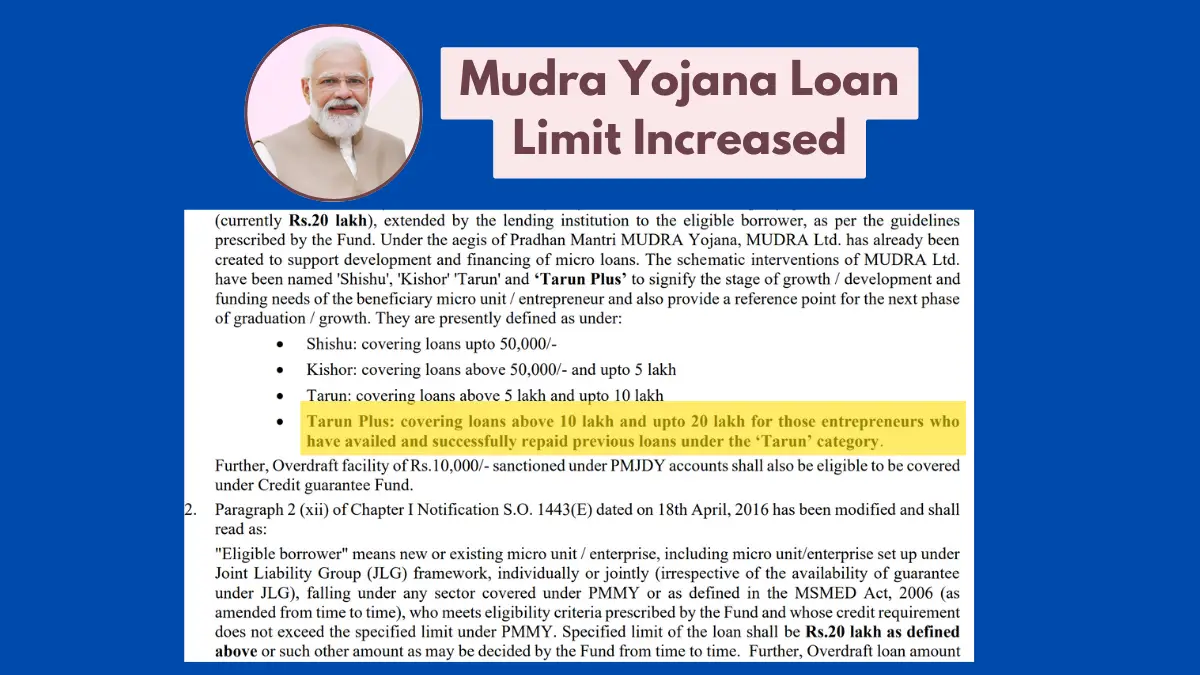

In a significant boost for budding entrepreneurs, the Government of India has increased the loan limit under the Pradhan Mantri Mudra Yojana (PMMY) from ₹10 lakh to ₹20 lakh. Announced by the Finance Minister in the Union Budget 2024-25, this move aligns with the government’s goal of “Funding the Unfunded” and further strengthens India’s micro-enterprise sector.

The newly introduced loan category, Tarun Plus, is specifically designed for entrepreneurs who have previously taken loans under the “Tarun” category and successfully repaid them. This new ceiling, backed by the Credit Guarantee Fund for Micro Units (CGFMU), aims to enhance financial access for those looking to expand their business ventures.

Key Features of PMMY Loan Limit

- Tarun Plus Category: Loan amounts from ₹10 lakh to ₹20 lakh for eligible entrepreneurs.

- Guarantee Coverage: Extended under CGFMU, ensuring a security net for micro-loan providers.

- Eligibility: Reserved for individuals who have repaid their initial loans under the Tarun category.

- Launch Date: Effective from 24th October 2024.

This expansion is expected to provide critical support to Self-Help Groups (SHGs) and micro-entrepreneurs across sectors, with the loan threshold now capped at ₹20 lakh. Additionally, the government has reiterated that the overdraft facility of ₹10,000 under the PM Jan Dhan Yojana (PMJDY) is also covered under the CGFMU guarantee.

PMMY Loan Limit Official Notification PDF

The official notification PDF of increment of Mudra Yojana loan limit can be downloaded from the official website or using the direct link below.

PMMY Loan Categories at a Glance

| Category | Loan Amount | Target Beneficiaries |

|---|---|---|

| Shishu | Up to ₹50,000 | Early-stage micro-enterprises |

| Kishor | ₹50,000 to ₹5 lakh | Growing micro-units |

| Tarun | ₹5 lakh to ₹10 lakh | Expanding businesses |

| Tarun Plus | ₹10 lakh to ₹20 lakh | Established entrepreneurs with loan history |

This revised structure not only supports the aspirations of small business owners but also encourages a more robust entrepreneurial ecosystem, crucial for economic development. This loan increase aligns with other governmental efforts to foster growth in micro, small, and medium enterprises (MSMEs).

Additional Details

According to the recent government notification, the PMMY loan’s upper cap of ₹20 lakh serves as the official limit, subject to changes as per future policy decisions. Entrepreneurs under the Joint Liability Group (JLG) framework, both individually and collectively, are also eligible for these loans, expanding the reach of financial inclusion.

For those looking to avail of the Tarun Plus loan category, consult your local bank or visit the official MUDRA website to confirm eligibility and application details.