MUDRA Loan Scheme 2.0 is a transformative loan scheme designed to enhance financing access for small businesses in India. Started in April 2025, this scheme enables eligible micro-enterprises to secure loans of up to Rs. 20 lakh. With this increased loan limit, small entrepreneurs can more effectively overcome financial hurdles and expand their operations.

Supporting small businesses is vital for the growth of the Indian economy. The Union Budget of 2025 emphasizes the need for better financing options through Mudra Loan Scheme 2.0, aiming to create a nurturing environment for entrepreneurs throughout the country.

What is Mudra Loan Scheme 2.0

Mudra Loan Scheme 2.0 comes with significant enhancements as announced by the Finance Ministry in 2025. The maximum loan amount has been increased from Rs. 10 lakh to Rs. 20 lakh, ensuring essential financial support for small and micro enterprises to scale their operations.

The core aim of this scheme is to promote small business growth and job creation. A budget allocation of Rs. 5.4 lakh crore highlights the government’s commitment to providing effective financial assistance across various sectors, marking the importance of this scheme in revitalizing the Indian economy.

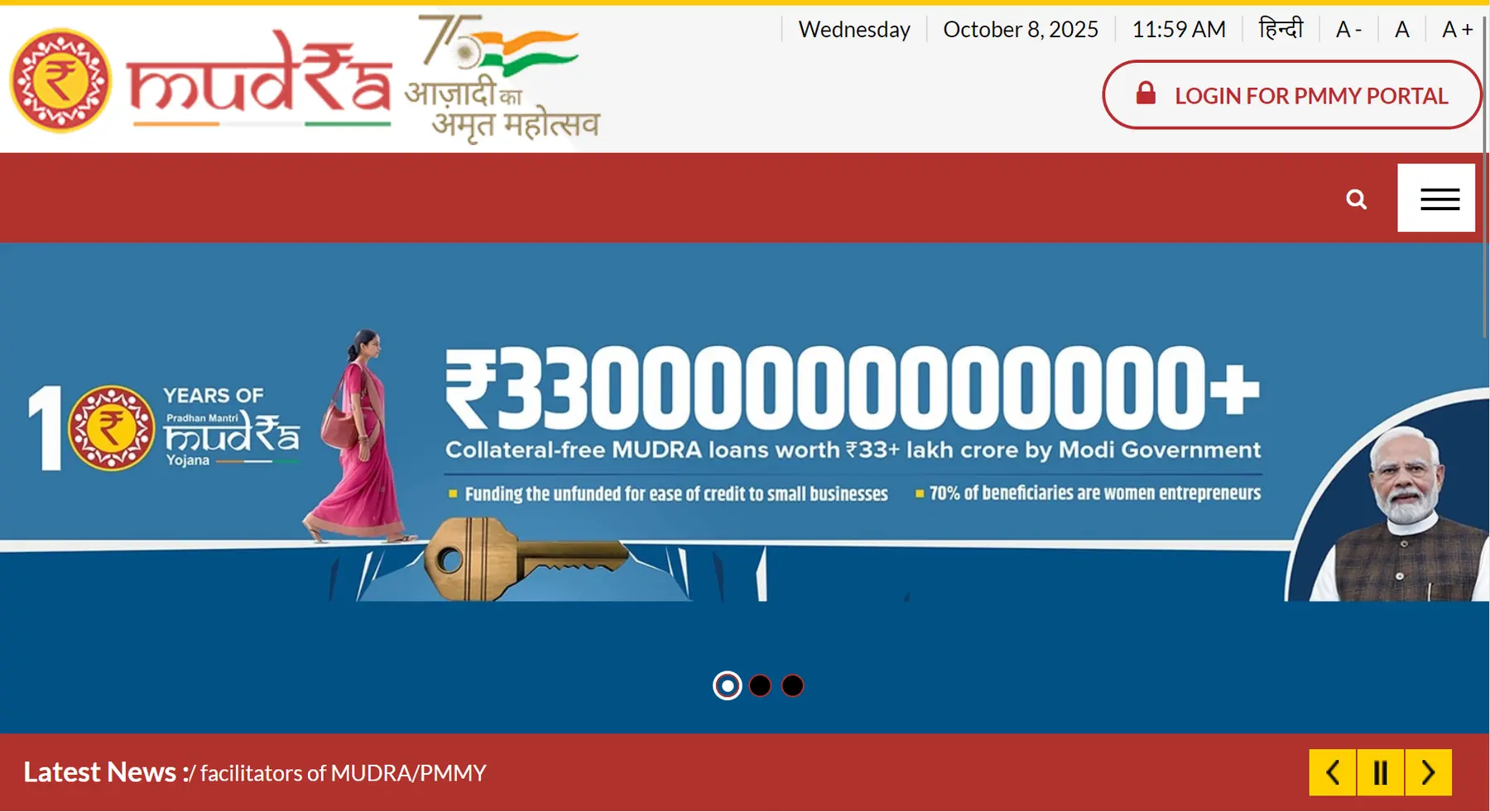

MUDRA works as a refinancing body, which means it gives funds to banks and other financial institutions, not directly to small business owners or individuals. To get a Mudra Loan under the Pradhan Mantri Mudra Yojana (PMMY), people can visit their nearby bank, NBFC, or Micro Finance Institution (MFI) branch or can apply online through the Udyamimitra portal.

MUDRA has no agents or middlemen for loan applications. People should stay alert and avoid anyone claiming to be an agent or helper of MUDRA or PMMY.

Eligibility Criteria for Mudra Loans

A wide range of businesses can qualify for Mudra Loans, including:

- Small manufacturers

- Retail merchants

- Fresh fruit and vegetable vendors

- Artisans

- Transport service providers

- Catering services

- Repair service providers

- Startups

- Craftsmen and craft producers

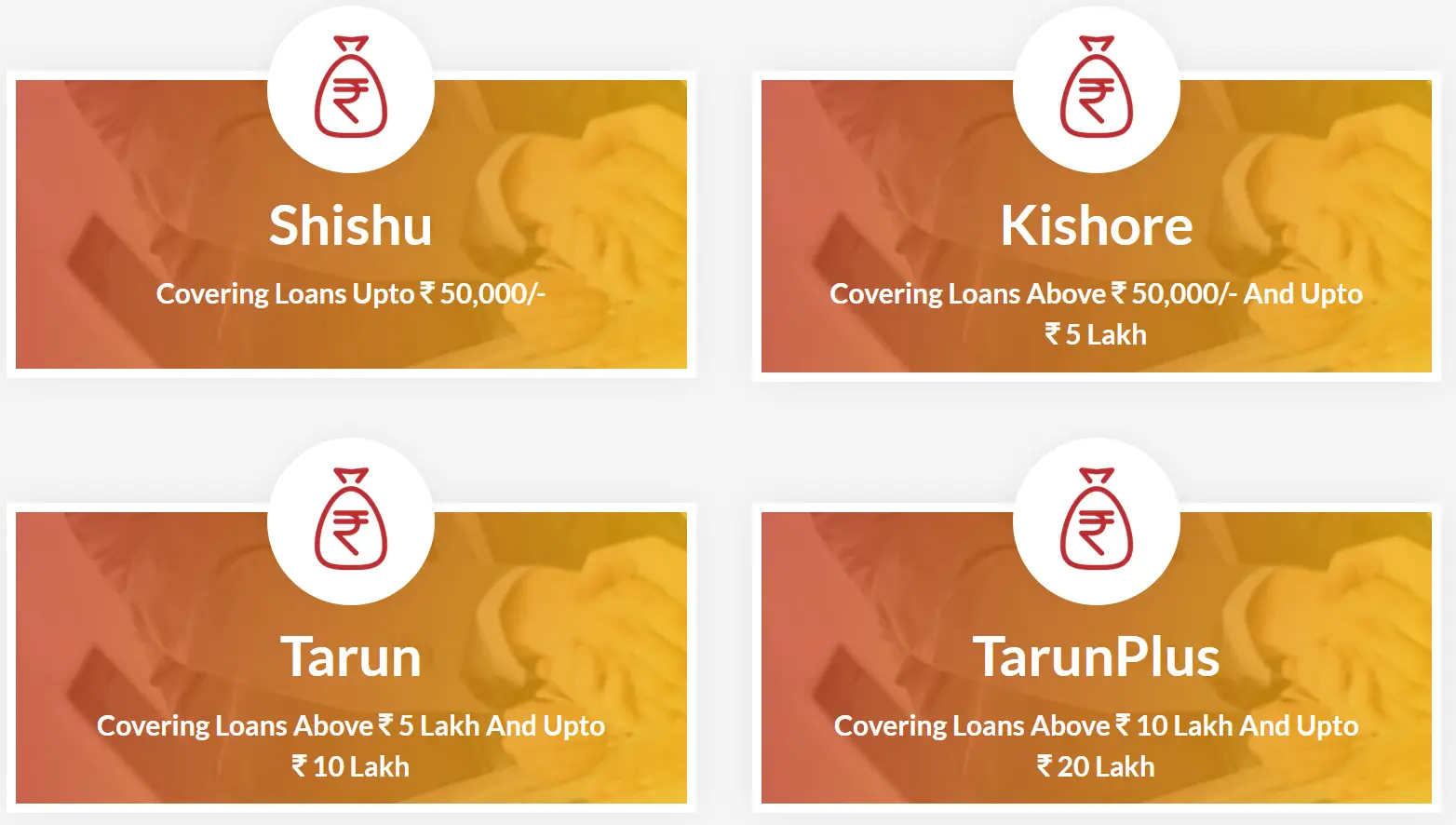

Categories of Loans Under the Mudra Scheme 2.0

The Mudra Loan Scheme categorizes loans according to the needs of applicants:

- Shishu: Loans up to Rs. 50,000.

- Kishor: Loans between Rs. 50,000 to Rs. 5 lakh.

- Tarun: Loans from Rs. 5 lakh to Rs. 10 lakh.

- TarunPlus: Loans from Rs. 10 lakh to 20 Lakh

Documents Required for MUDRA Loan Application

Before starting your application process, ensure you prepare these documents:

- Aadhaar Card

- Ration Card

- Registered Mobile Number

- Electricity Bill

- Proof of Address

- PAN Card

- Business Registration Document (if applicable)

Benefits of the Mudra Loan Scheme 2.0

This scheme offers numerous advantages for small businesses, such as:

- Access to essential funds for business growth.

- Support for job creation and community development.

- Increased loan amounts for larger investments.

- Quick financial aid for urgent business needs.

How to Apply for Mudra Loan Scheme 2.0

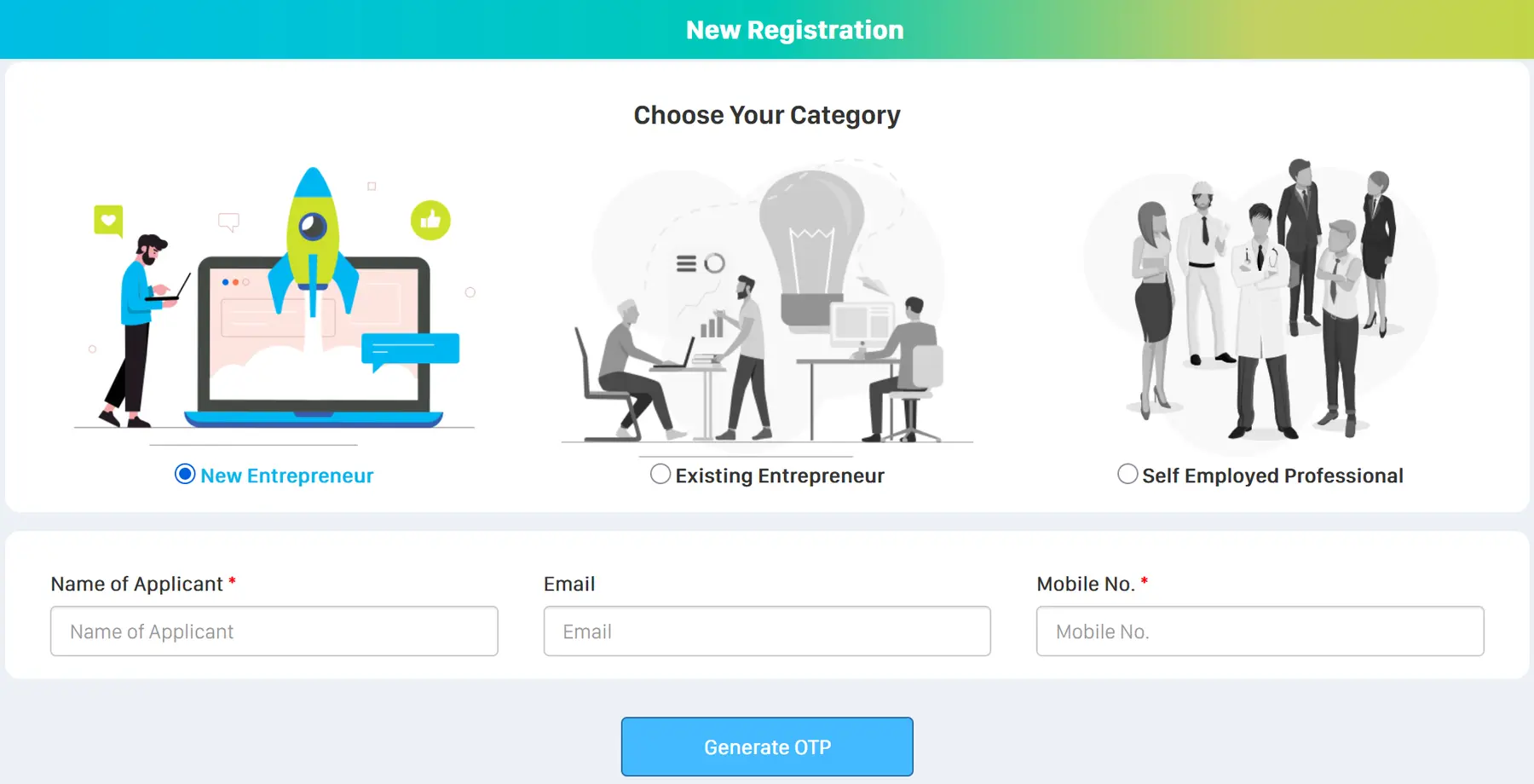

Steps for Online Application

STEP 1: Visit the official website and complete the online loan application form.

STEP 2: Navigate to the Udaymimitra portal link provided on the homepage of Mudra website.

STEP 3: Click on Apply Now under the MUDRA Yojana on the homepage under schemes section.

STEP 4: Enter your name, email, and mobile number, then select Generate OTP.

STEP 5: Enter the received OTP and click Submit.

STEP 6: Finalize your registration by providing all required documents.

STEP 7: Review all entered information and click Submit to complete your loan application.

How to Apply Offline

If you are unable to apply online for MUDRA Yojana, you can visit any of the nearest bank branch to apply for the scheme, follow the below steps.

STEP 1: Visit your nearest Commercial Bank, Regional Rural Bank, Small Finance Bank, Micro Finance Institution, or Non-Banking Financial Company.

STEP 2: Download the relevant application form from the official website based on your loan type.

STEP 3: Select the form for Shishu, Kishor, or Tarun.

STEP 4: Carefully complete the application form and attach all necessary documents.

STEP 5: Ensure all details are accurate before submitting your application.

MUDRA Loan Interest Rates

The latest Mudra loan (PMMY) interest rates offered by top Indian banks in 2026 generally range from around 8.40% to 12% per annum, but rates vary by bank and type of loan (Shishu, Kishor, Tarun). Here’s an overview of MUDRA loan interest rates from leading banks:

| Bank | Mudra Loan Interest Rate (p.a.) |

|---|---|

| State Bank of India | Linked to EBLR; usually 3.25% above EBLR (e.g. ~12.15%) |

| Punjab National Bank | Around 9% – 11% |

| HDFC Bank | ~10% – 12% |

| ICICI Bank | ~10% – 12% (estimated) |

| Canara Bank | Starts from 8.85% |

| Bank of Maharashtra | 11.8% |

| Union Bank of India | 10.30% (Shishu), 11–12% (others) |

| Bank of Baroda | BRLLR+SP to BRLLR+SP+2.35% (Complete Rate List) |

| Central Bank of India | 10.05% p.a. |

| Axis Bank | ~10% – 12% (estimated) |

Contact / Helpline Information

For any inquiries, please reach out via email at help@mudra.org.in or PMMY national toll free numbers at 1800 180 1111 and 1800 11 0001

State Wise Toll Free Numbers of MUDRA Yojana

You can also contact at the dedicated helpline number of Mudra yojana for your state, below is the state wise list.

| Name of the State / U.T | Toll Free No |

|---|---|

| ANDAMAN & NICOBAR ISLANDS | 18003454545 |

| ANDHRA PRADESH | 18004251525 |

| ARUNACHAL PRADESH | 18003453988 |

| ASSAM | 18003453988 |

| BIHAR | 18003456195 |

| CHANDIGARH | 18001804383 |

| CHHATTISGARH | 18002334358 |

| DADRA & NAGAR HAVELI | 18002338944 |

| DAMAN & DIU | 18002338944 |

| GOA | 18002333202 |

| GUJARAT | 18002338944 |

| HARYANA | 18001802222 |

| HIMACHAL PRADESH | 18001802222 |

| JAMMU & KASHMIR | 18001807087 |

| JHARKHAND | 18003456576 |

| KARNATAKA | 180042597777 |

| KERALA | 180042511222 |

| LAKSHADWEEP | 0484-2369090 |

| MADHYA PRADESH | 18002334035 |

| MAHARASHTRA | 18001022636 |

| MANIPUR | 18003453988 |

| MEGHALAYA | 18003453988 |

| MIZORAM | 18003453988 |

| NAGALAND | 18003453988 |

| NCT OF DELHI | 18001800124 |

| ORISSA | 18003456551 |

| PUDUCHERRY | 18004250016 |

| PUNJAB | 18001802222 |

| RAJASTHAN | 18001806546 |

| SIKKIM | 18003453988 |

| TAMIL NADU | 18004251646 |

| TELANGANA | 18004258933 |

| TRIPURA | 18003453344 |

| UTTAR PRADESH | 18001027788 |

| UTTARAKHAND | 18001804167 |

| WEST BENGAL | 18003453344 |