| PDF Name | GST Composition Scheme 2025 FAQ PDF |

|---|---|

| Last Updated | October 14, 2022 |

| No. of Pages | 8 |

| PDF Size | 0.50 MB |

| Language | English |

| Category | Government Schemes, Forms, Policies & Guidelines PDF |

| Topic / Tag | Scheme FAQ |

| Source(s) / Credits | Sarkari Yojana |

GST Composition Scheme 2025 is an alternative method of levy of tax designed for small taxpayers whose turnover is up to Rs. 75 lakhs (Rs. 50 lakhs in case of few states). The primary objective of composition scheme under GST is to bring simplicity and to reduce the compliance cost for the small taxpayers. Moreover, it is optional and the eligible person opting to pay tax under this scheme can pay tax at a prescribed percentage of his turnover every quarter, instead of paying tax at normal rate.

Composition Scheme under GST

Composition scheme is a scheme for payment of GST available to small taxpayers whose aggregate turnover in the preceding financial year did not cross Rs. 75 lakhs. Official website for Composition Scheme under GST is cbic-gst.gov.in

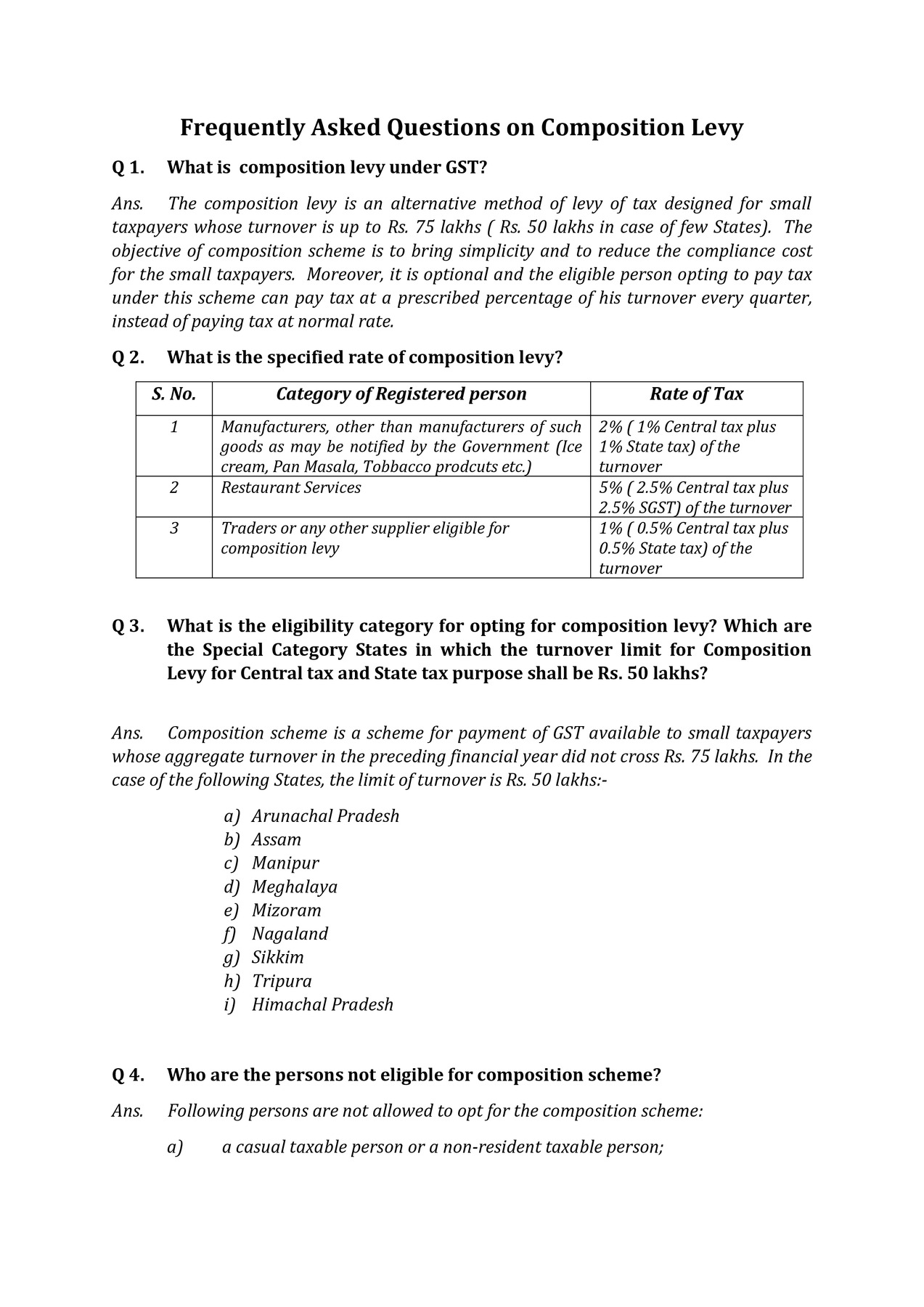

| Category of Registered Person | Rate of Tax |

| Manufacturers, other than manufacturers of such goods as may be notified by the Government (Ice cream, Pan Masala, Tobbacco prodcuts etc.) | 2% (1% Central tax plus 1% State tax) of the turnover |

| Restaurant Services | 5% (2.5% Central tax plus 2.5% SGST) of the turnover |

| Traders or any other supplier eligible for composition levy | 1% ( 0.5% Central tax plus 0.5% State tax) of the turnover |