Apun Ghar is a new home loan scheme for Assam Government employees under which home loans will be provided to the state govt employees at subsidized interest rates. The Assam government has signed an MoU with the state bank of India to provide home loans at hugely subsidized interest rates to its employees.

Apun Ghar Home Loan Scheme – Introduction

Under the Apun Ghar scheme, the state government would provide housing loans at a subsidized rate of 5% for its women employees and 5.05% for men employees. The loan would be provided without and collateral security and processing fee. The main objective of Apun Ghar housing loan scheme is to provide housing to all state residents. Though, Pradhan Mantri Awas Yojana is also running in all the towns and cities of the state under which loans at subsidized rates are provided.

Under the Apun Ghar scheme, the state government employees can avail a loan of up to Rs 15 Lakh for with an interest subsidy of 3.5%. The subsidy on interest rates would benefit state government employees in terms of lower interest rates and lower EMI’s.

Apun Ghar Home Loan – Interest Rates and Subsidy

| Particulars | Men | Women |

|---|---|---|

| Loan Amount | Rs. 15 Lakh | Rs. 15 Lakh |

| Interest Subsidy | 3.5% | 3.5% |

| Interest Rate after Subsidy | 5.05% | 5% |

| Maximum Loan Tenure | 20 Years | 20 Years |

| Effective EMI (for a loan of Rs. 15 Lakh for 20 Years) Before Subsidy | Rs. 13,017 | Rs. 13,017 |

| Effective EMI (for a loan of Rs. 15 Lakh for 20 Years) After Subsidy | Rs. 10,318 | Rs. 9,899 |

Eligibility for Apun Ghar Home Loan Scheme

Apun Ghar home loan scheme is however targeted to the government employees belonging to the lower income group of the society but applicable for all. The government employees are eligible for the Apun Ghar home loan scheme who has

- Minimum age of 21 years

- Residual service of five years

It would not benefits those state employees who have less than 5 years in their service retirement.

The employees who have already availed of education and the home loan from the SBI at normal rates would also be able to switch over to the subsidized loan scheme of the government after one year or so.

The SBI Loan Scheme to be rolled out in May 2017 and will help the low-income state employees and low-rank police personnel. The loan scheme would also help to generate various economic activities.

How to Apply for Apun Ghar Home Loan

Apun Ghar is a new home loan scheme launched by the government of Assam under which state govt. employees are being provided home loans at subsidized interest rates. The Assam Government has signed an MoU with State Bank of India for providing loans to its employees. The state government would provide an interest subsidy of 3.5% for the government employees for home loan of up to Rs. 15 lakh taken for 20 years of tenure.

After interest subvention, the effective rate at which home loan would be provided by the state bank of India would be 5.0% for women and 5.05% for men employees. The government would provide home loan under the Apun Ghar scheme with a repayment schedule to employees with pensionable service beyond the age of 70 years. The state government employees need not to visit the bank branch to apply for the Apun Ghar scheme, but they can simply submit the applications forms or submit their request to respective district drawing and disbursing officer.

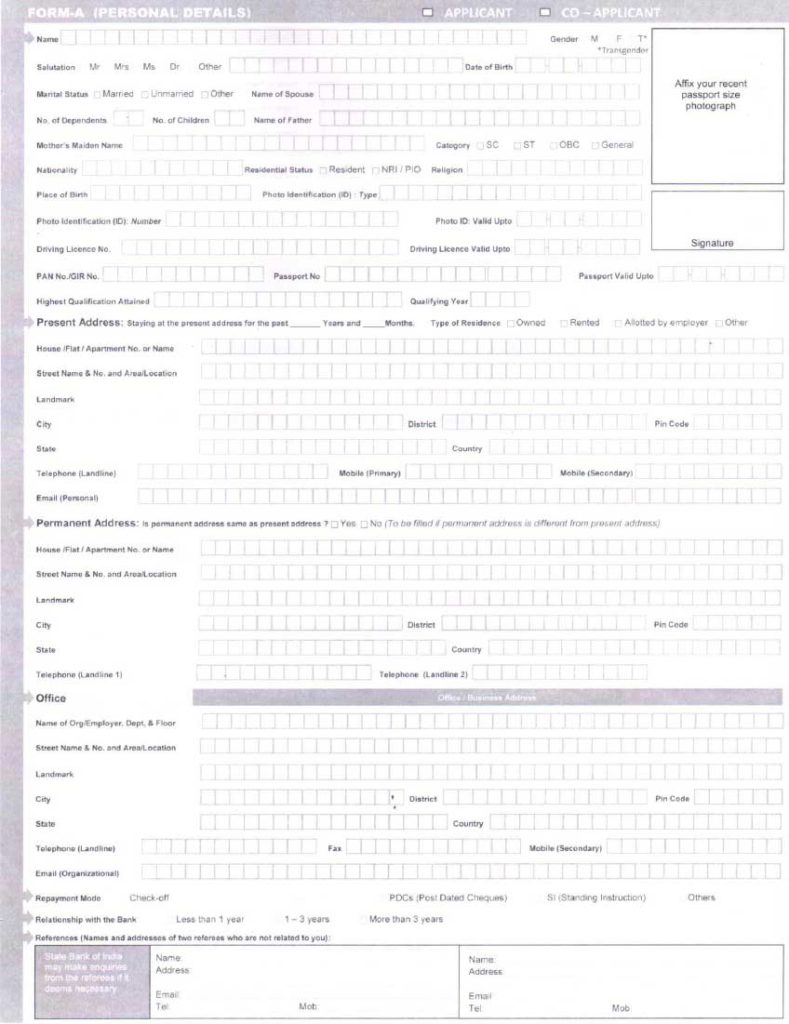

Apun Ghar Assam Home Loan Scheme Application Form

The application forms would be submitted by the employees through their DDO’s (District Drawing and Disbursing Officer) as per the prescribed format of application form along with all the required documents. The application form for Apun Ghar scheme can be downloaded from the official website of Assam Government using the link below.

Download Apun Ghar Application Form through the link – https://finance.assam.gov.in/schemes/detail/apun-ghar

Direct Link for Home Loan Application – https://finance.assam.gov.in/sites/default/files/APPLICATION%20FORM%20FOR%20HOME%20LOAN_2.pdf

Below is the snapshot of the application form.

All the arrangement have been made by government and SBI to ensure hassle-free loans to employees. To get benefits of home loans and education loan, the employee will not have to submit piles of documents which is the normal process to apply for bank loan. To apply for, the employees will simply have to submit applications to their respective Drawing and Disbursement Officers (DDOs). And further, the DDOs will forward the loan applications to the SBI for processing to disburse the loans. No processing fee will be charged from the applicant for the loan application.

Also Read – Aponar Apon Ghar Home Loan Subsidy Scheme

List of Documents Required for Apun Ghar Home Loan

Below is the complete list of documents required to avail home loan under Apun Ghar home loan scheme.

- 5 Copies of Passport size photograph.

- Any one of the following for identification: PAN card / Voter ID / Identity Card / etc.

- Any of the following documents for proof of residence: ELectricity Bill / Landline telephone bill / Passport / SBI account passbook with updated address.

- Form 16 of last 2 years.

- Latest salary slip with all deductions duly certified by DDO.

- Last 6 month statement of salary account.

- No dues salary from the bank if the salary is not credited in SBI account.

- Personal asset’s and liabilities statement in bank’s format.

- Documents evidencing the ownership of land/building to be purchased/constructed, such as Jamabandi copy.

The loan provided under the Apun Ghar scheme would be sanctioned in the name of the govt employee or his/her spouse’s name. There is no need to mortgage property for home loan up to Rs. 10 Lakh. No processing fee would be charged from state government employees for housing loan under the scheme.

More details about the Apun Ghar home loan scheme can be found on the official website of Assam Govt. at this link

Sr place small bisnes place may hawos place Lon

HI Sir mera name SHANAWAZ he or me Delhi me reh ta hun kya mujhe is yojna ka laabh mil sakta he

It’s a good step of govt of assam for lower middle class employees. welcome gov of assam.

lone kab tak hojayega plese fast

Thanks to assam government.also thanks SBI

already iske pahle agar koi personal loan withdraw karne wala employee ko is scheme se loan molega ya nahi ?

I am want house loan

What about for the private employees? Please do the same for the private sectors too.

Thanks

I am D garde empolee , sir I already personal loan sir it possible benefited to new home loan .?

Vill-nalia pt-1 po-dimakure p,s -golakganj D,s dhubri assam

Kab de ye loan diya jayega? plz reply sir

ইতিমধ্যে যিসকল কৰ্মচাৰীয়ে ব্যঙ্কৰ পৰা ব্যক্তিগত ঋণ লৈছে আৰু ঋণ পৰিশোধৰ পৰিমান বাকী আছে কিন্তু সেইসকল কৰ্মচাৰীয়ে যদি আকৌ “আপোন ঘৰ” আঁচনীৰ অধীনত গৃহ ঋণ লব বিচাৰে তেন্তে তেখেতসকলে এই আঁচনীৰ অধীনত গৃহ ঋণ লব পাৰিব নে নাই ?

OUR ASPIRATION CAN FULFILLRD. HOW CAN I GET LOAN APPLICATION FORM

Mahakhoi,

Ai scheam tu mor atikoi praujon. Sir kindly grant me the apun ghar loan..

My job age already 14yr can I apply apun ghar home loan

Document ki lagibo ?

আচনি বৰ ভাল লাগিছে কিন্তু কেনেকৈ সুবিধাটো পাম বহলাই কব নেকি ।

দ্বিজেন নাথ

Thx Assam govt for taking this step

mur maa civil t iv grade t kare loan pabole karone ki karibo lagibo

Sir my father is working as an Assam police Designation-A.S.I.let us know Did he applying in This loan ..

about apon ghor

Jamin ki kakjat 4 bhai ki Nam pe Hai. Un me se ek Mera vi Nam Hai Matlab hum 4 vai ke Nam pe meiyadi patta Hai. To Kiya muse lon milega. Plse answer me

Moi miadi mati 1katha 5 lessa agreement kariso housing loanar babe atiaa mok mati kina aaru ghar banowar babe loan dibone .

jodi personnal loan thake tente housing loan toh dibone?

sir , Apun ghar home lone scheme tu kun tu month pora diya hoba jonale hukhi ham.

Sir,the former loan can be converted to this Apun Ghar scheme who already taken the loan and started his construction is going on.

I have no lend document.so can I eligible Assam govt Apun ghar loan scheme?

Plz tell me,,apun ghar loan very good steps for government of assam…but plz mention requires of documents…

Plz tell me,,apun ghar loan very good steps for government of assam…but plz mention requires of documents…I have no patta land..will I eligible for the apun ghar scheme…

Sir main ek education lorka hoon main porhai korke gharmain hoon mujhe bussness korne keliye ek loan chahiye plz sir my numbr 7035543138

I am a contractual employee of Assam government (integrated child protection scheme under social welfare depart.)..can I eligible..

মহাশয ,মই LICHFL ৰ পৰা OCT./2015 ত 17 lakh টকা,9.6% সুত ত লোান লৈছো ।এতি্য়া মই SBI ৰ পৰা ‘আপোন-ঘৰ’ আচনিৰ জৰি্য়তে লোন লৈ LICHFL ৰ লোনটো পৰিশোধ কৰিব বিচাৰো। অনুগ্ৰহ কৰি কি কৰিব লাগিব জনা্য় যেন ।

Land is under my wife, will I get dis benefit?

Kia koi pensioners v apply kor sakta hay?

sir / mam .. moi ghoror babe lone lobo bosaru .. gotike eyar ki prosiduse .. keneke ki koribo lagibo .jonai diyok na plzz

keneke mi koribo lagibo .. plzz

moi to kono dhonor lone loya nai kintu atiya bhabisu j ata home lone lom kintu amar assan sorkare amar nicina dhukia manuhak lone debo bichare ne jodi diye tente ami bohut sohai pam ami udhar pam

Sir

Moi ajon din hajari kora manus. Moi apon ghar home lone kenakoi loba parim.

Job thoka bilake Val ghr bonabor karne lone pabo Val ktha but jihkolor govt job ni din hajira kre ba company t kam kri khai ase hihte ki Val ghrt thakibr odhikar ni neki , mhodoy dukhiya manukhir karnei kiba ata anekuwa ktha vabile nthoi anondito hm …

Mr government job ni ki kribo lagibo sir

Sir mera abvitok gar nehi he to apka eye yojana ke joriyote loan dijiye please please mera nam mukul das assam govt employ kripa krke muje eye loan dijiye sir

Hello sir… Atu loan kenekoi lobo pari plz ebar jonabo

can we avail this loan given that we do not have patta land and are living in forest villages though for a very long time?

My land property is in my father name and it is not in ASSAM. I want to take 100000 loan . What will be the condition. Please share

I have a personal loan in sbi. and I have no land of my own and i have completed only 4 years of service…am i eligible for applying this loan? Please replyReply

Mok ata hom loan lagsel …mor ghar tamulpur…

I want to take 700000 housing loan. I m doing service since 19 years. I m not permanent resident of Assam. WILL I get loan.

I guess its not that easy that i came to know about this scheme .its a long process .infact its kind of headache .speak up .need to know .all about it .

মহাশয়,মই এজন চৰকাৰী চাকৰীয়াল । “আপোন ঘৰ” আচনিৰ অধীনত মই এটি লোন লব বিচাৰিছো । মোৰ দেউতাই, মোৰ নামত মাটিখিনি আদালতৰ যোগেদি উইল কৰি থৈছে । কিন্ত এতিয়ালৈকে মোৰ নামত নামজাৰি হোৱা নাই । মই এতিয়া এই আচনিৰ অধীনত লোন পোৱা হবনে নহয়, জনাবচোন ।

But bank managers asked various documents as like as normal Loan. I request the governments please take kind notice and some necessary action. Otherwise this scheme will become Flop. Thnks

Download the application form and fill up it go your nearest SBI branch and consults ABOUT the Assam Government “Apun ghar” loan thanks

Respective Assam govt.’s finance Minister hon’able Himanta Biswa Sarmah Sir wants to provide a home to those who has no a home of his own, But in practical it’s not for those who has no myadi land. More over it seems it wouldn’t be hassle free.

Me jamin kharidna sahta hu. .kya mujhe lon milega. ..

মই ঘৰ বনাবলৈ মাটি কিনিব বিছাৰিছো…তাৰ পাছত হে ঘৰ বনাম ..মই এই লোন পাম নে.

All this thing’s are fake…. Just to get popularity they are doing all this N*****se

This is a fake news… No one knows exactly what this APUN GHAR home loan all about…. All the responsibilities officer should go through this article and understand exactly what does it mean…. Specially for the documents requirement to becomeeligible….

This is a fake news… No one knows exactly what this APUN GHAR home loan all about…. All the responsibilities officer should go through this article and understand exactly what does it mean…. Specially for the documents requirement to b

This is not a fake news, you can check it on official website of Assam Govt at http://finance.assam.gov.in/schemes/detail/apun-ghar

Respect sir new s.b.i r home loan r bikhoye jani otikoi hukhi….hoixu….

Kin2 mur service 1yr 9 month h Hoise…..xo moi napam neki?????

Aru

Pensioner hokole apun ghr r loan lobo paribone???

Hi sir I worked in Police as I had got the job last year so I want to take the loan but thing is that, how much it will take extra amount as interest, in the info, as mentioned I have read that for the low rank police it will be less interest charge. So I just want the conclusion sir.

bihar goverment hospital pharmacist

400000

300000

Is there any home loan scheme for karnataka state so please share the information

30000

what about the forest villagers who do not possess any land documents though living there since independence ? and what about the landless employees? unless the government comes out with some policy in this regard a large section of the employee will not be able to avail of the scheme. pls comment.

Sir, I wants Apun Ghar home loan Amount Rs 1200000/ but land value Rs 120000(Approximately) and own lands record my grant fathers name. so i state govt employees pls reply me

For lone

Sir , I have a loan at assam Garmin Bikash Bank taken for business purpose.but I got a govt job just 3 years ago.can I be a beneficiary of apon ghar Scheme? After all deduction will be made from my salary.

I want home loan

Sir,My wife & Myself both of we are Regular TET teacher.Can i take loan 15 lacs+15 lacs=30 lacs.Land name is only my name.pliz reply sir.

sarkare ata kole bank k belek koi

Iam Private company employee, May I eligible for home Loan of Rs.5 to 10 Lcs ? May my dream house came true ?

Sir/Madam, I am permanent resident of Assam and serving in Indian Army. Can I avail Apun Ghar Scheme?

নমস্কাৰ ছাৰ মই অসম চৰকাৰৰ এজন কৰ্মচাৰী মই আপোন ঘৰ লোন লবলৈ হাকলো কামকাজ কৰিছো এতিয়া মুৰ ছারটিফিকেটত জন্ম তাৰিখ 02/01/29,84 পানকাটত 31/12/19,86 মই এতিয়া কি কৰিম ছাৰ

নমস্কাৰ ছাৰ /মেডম ,মই এজন্ অসম চৰকাৰৰ কৰ্মচাৰী মই আপোন ঘৰ হোম লোন এপ্লাই কৰিব খুজিছিলো কিন্তু মুৰ ই ছারটিফিকেটত আৰু চাকৰিত জন্ম তাৰিখ 02/01/19,84 আৰু পানকাটত হল 31/12 19,86 মই এতিয়া কেনেকে লোন টু হোনকালে পাম ছাৰ মোক হাঁহায়কৰিব ছাৰ

muje ek loan sahiye plz

Sir I have a HBL reiceve from CBI since 2013 which is now running and finish on 2023 now can I convert this loan to spin ghor loan

I am an employee of APDCL. Can I apply for spun ghar scheme

Sir,I hv a housing loan in the SBI.May apply for home loan under apunghar

Respected sir/Madam

I am an employee of Central Paramilitary Forces & my home state is Assam . Can i eligible for Apun ghar Assam home loan scheme.

i have a home loan, now may i apply again apon ghar

I have a housing loan on sbi which will be continued till 2036 which is granted on 2015 can I be able to convert it to apun ghor ?

I am Assam govt employee.. But my salary credited in United bank of India. Not in SBI.but I have alrdy an account in Sbi.. In this regard…..wll I able to get the loan ..sir???

My date of birth is 30/11/1959,may I eligible for obtaining loan under Assam state Govt. APUN GHAR Scheme as

an pensionable State Govt.Employee.

I have been working since 3 years in arrigation deppartment and i want to apply home can you please inform me the process of apply via email or mobile number 9706508520, Thank you

sir/madam, i m serving in central employee as armed force. so i want to get apun ghar scheme.would i get that apun ghar scheme? pl reply soon sir/madam.

Dear Sir

Though i am a state govt employee i have no land in my name. At first i want to buy land to construct home as apun ghor with the loan .Am i competent for the apun ghor loan .

I employeed in apdcl assam. Can i apply apun ghar loan?

sir I am assam govt employee and have a personal loan at sbi.sir all my land documents owner is my father.at this moments who can I able to get a home loan under apun gharat scheme? my phone no 9435257092

Can contractual tet teacher under SSA apply ?

I want apply APONGHOR loan

I want to apply APONGHOR

I am a tea garden service holder. Can I apply apun ghar home loan

I want to apply apunghar home loan.But I am a tea garden serviceholder.can I able to apply for

I want to apply Apun Ghar Home Loan, Kindly I needed Loan

..Also North Lakhimpur, Assam.

SBI Bank Loan Officer Number

I have taken personel loan Rs.6ooooo/- May take Apun Ghar loan?

I want APUNGHAR loan.

I already availed a housing loan at normal interest but as per apun ghar rule I can avail the rate of interest at the rate of 5.5%.But SBI loan section refused to allow me because SBI authorityI has not allowed to do so.

So I request to implement the rule immediately.

I already availed a housing loan at normal interest but as per apun ghar rule I can avail the rate of interest at the rate of 5.5%.But SBI loan section refused to allow me because SBI authorityI has not allowed to do so…..6003235625….Much needed

Iam leaving at goalpara district .l have Ned loan.

500000

apun ghar

I have joined irrigation department on last December 2017…, Right now…, i have completed 5 months of job period.

My question is…am i elegible for this home loan…?

Please answer my question. ..

I met with with the higher officials of SBI ,RASMECCC,Tinsukia branch to covert my houseing loan in APUN GHOR scheme at the rate 5.5%.But I came to realize that they are very confused wheather earlier loan will switch over from the 8.5% to 5.5% or not.

Apun ghar sheme says yes but RASMECCC officials has not obtain the clear systm guideline from RASMECCC chief.

I am very anxious about State Bank of India,Banking system.My contact no 9435472083.

I have to join irrigation department on last April 2017, can i apply apun ghar home lone? My cont no 7896387257

Can contractual tet teacher under SSA apply ?

sir I am submitting my application in the scheme of apun ghor housing loan today our nearest SBI Baihata Chariali branch but loan section madam said to me that the land document of jamanbandi copy is completely separate in loan holder name not Ejamali copy and patta is completely separate as per RBI discussion and already returned 12 nos of application from RBI so madam is not take my loan application and madam said next Monday you will come, actually what happen I don’t know so plz tell me sir

I’m a self employe,I live at nalbari district. I’ve want a laon in under govt. Apun Ghar schem, and I’ve to 5 to 10 lack, because I have to complete my dream home.may I eligible for the loan ?

I need loan .I am a defence person .

VILL. UDMARI P O .KORAIGURI LOAN -=300000 9653383878

VILL KAROIGURI LOAN 500000 8011968357

Kaise aplied kiya … Humko Bhi aplied karna tha

https://finance.assam.gov.in/schemes/detail/apun-ghar

DOBOK ROAD NEAR JIME MASZID LOAN 2000000 8822937085

200000

VILL-SADARGAON PO-NILBAGAN PS-MURAZAR DIST-HOJAI PIN-782445

NOMENI-ROSUMA BEGUM RELOTION-WIFE

AGE-48

MOBILE NO-8011219060

LOAN AMOUNT-1000000

TAJ UDDIN TALUKDAR SO-LT SHUHAG ALI TALUKDAR

VILL-PUBJARONI PO-KARAIGURI PS-MURAZAR

PIN NO-782440

NOMENI NAME-MINAJ UDDIN RELOTION-BRATHER

AGE-37

MOBILE NO-9365961342

LOAN AMOUNT-900000

TAPATJURI P.O DOBOKA P.S DOBOKA DIST HOJAI ASSAM PIN 782440 NOME NE MALIKA BEGUM LOAN AMOUNT 5000000

500000

500000

PUBJARUNI [P0 KORIGURI LOAN AMONT 300000

400000

10005644764

LOAN AMONT 9401061131 /300000 TOTAL

LOAN MOINT 350000 TOTAL

LOAN AMONT 320000 TIOTAL AMOINT

LOAN AMOINT 150000 AMOINT

6655

loan 500000

VILL TOWN CHANGMAJI MIKIR PATHAR DATEOF BIRTH AGE 22 YRS LOAN AMUNT 300000

LOAN AMONT 400000

AMB ARRI BONGAN ARJUN DAS P.S AMBARI P.S MORAJHAR HOJAI LOAN AMONT 500000 TOTLA AMOUNT FORIJ UDDIN 8472080430 IDFC BINK BORANC H RUQST

VILL AMBARI BANGAON P0O AMBARI P.S MURAZAR HOJAI ASSM 782445 LOAN AMOUNT 1200000 TOTAL OMANT

VILL AMBARI BONGON P.O AMBARI P.S MURAZAR HOJAI ASSAM 782445 LOA5 500000 AMONT TOTOL

LOAN 800000 OAMANT TOTAL

LOAN 2000000

bisune against loan 500000 total amont

I applay apunar apun ghar home lone. Kindly please comment on my apunar apun ghar home Lone.

LOAN AMONT 1000000 TOITAL HOME LON

Can I get the application form in ms word?

I need lone amount 5 lack

Contact: 8822138323

Thanks for the information….

Its very helpful to know about the scheme….thank you

Is it available now from Apr 2023

Need loan Rs1500000