Kerala Saranya Loan Yojana 2024 Registration & Login at employment.kerala.gov.in. Kerala govt. has launched Saranya scheme for unemployed women. The main motive of this self employment scheme to uplift backward and segregated women like widow, uneducated, divorced women and those who are above the age of 30 yrs and unwedded mothers belonging to Schedule Tribe. Under this scheme banks will give interest-free loan up to Rs. 50,000 to start self business.

Under Saranya scheme, 50% loan amount up to maximum limit of Rs. 25,000 will be given as Government subsidy by Employment department. To return loan amount under Saranya self employment scheme, there will be 60 equal monthly installments.

Saranya scheme is applicable for all individual entrepreneurs. Still this loan scheme is applicable for those women who wants to start joint business by more than one entrepreneur. Each woman in this joint startup would benefit the business more amount of loan than single one and receive maximum amount of loan and its subsidy.

Kerala Saranya Loan Yojana 2024 – Complete Details

This scheme was sanctioned vide GO(P)No.81/2010/Labour date 24.07.2010. Saranya is the new self-Employment scheme introduced by the State Government for uplifting the most backward and segregated women in the State, namely widows, divorced, deserted, spinsters above the age of 30 and unwedded mothers of Scheduled Tribe,Differently abled and Wife of Bed Ridden patients.

Interest free loan of upto Rs. 50,000 is given for starting self-employment ventures, out of which 50% is reimbursed as Government subsidy subject to a maximum of Rs. 25,000/- through Employment Department. Repayment will be in 60 equal monthly installments.

If the venture requires an amount above the limit of Rs.50000/, the applicant has to remit her beneficiary contribution of 10% of that amount. More over, the beneficiary has to remit 3% as interest at flat rate for the amount she avails in excess to Rs. 50000/. For ventures that are running successfully and have repaid at-least 50% of the loan amount, additional loan amount subject to a maximum of 80% of the original loan amount at nominal interest rates is eligible for expanding the venture.

This scheme is intended for individual ventures, but it is also allowed to start joint venture by more than one entrepreneurs. Each person of this joint venture will get maximum amount of loan and its subsidy. The beneficiary is exempted from providing any security for the loan amount.

Kerala Saranya Scheme Registration & Login at employment.kerala.gov.in

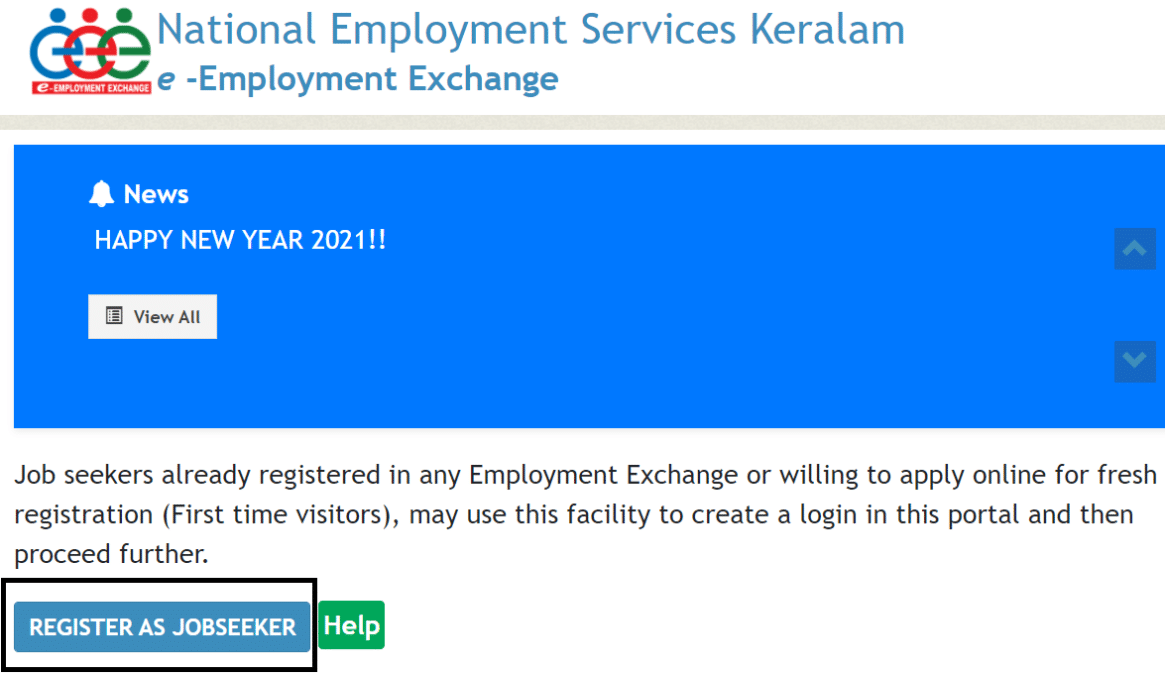

Job seekers already registered in any Employment Exchange or willing to apply online for fresh registration (First time visitors), may use this facility to create a login in this portal and then proceed further.

STEP 1: Firstly visit the official website of National Employment Service of Kerala at https://employment.kerala.gov.in/

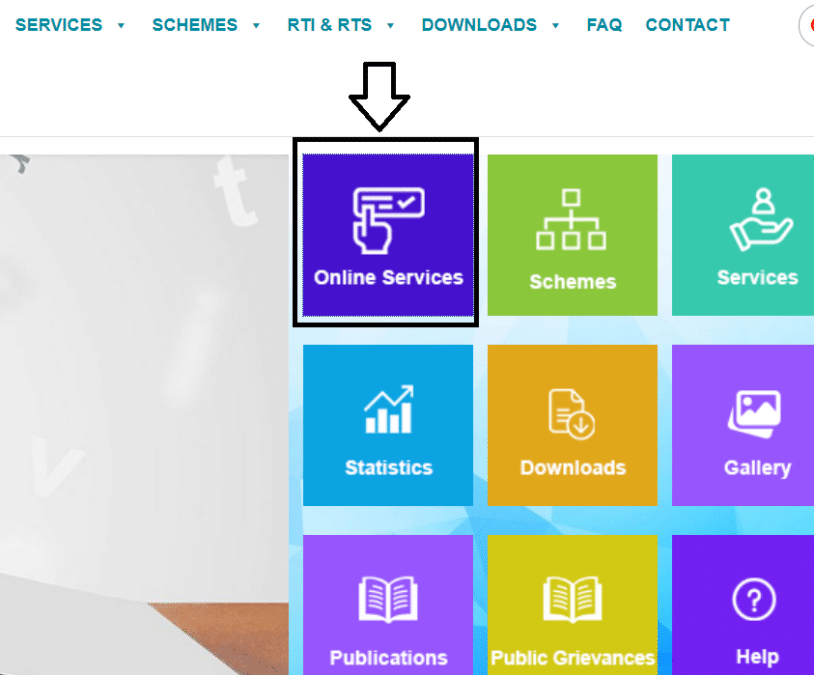

STEP 2: At the homepage, click at the “Online Services” tab or directly click https://eemployment.kerala.gov.in/ to open the National Employment Services Keralam e-Employment Exchange Portal page.

STEP 3: Then click at “Register as Jobseeker” tab to open the e Employment Exchange Registration Form as shown below:-

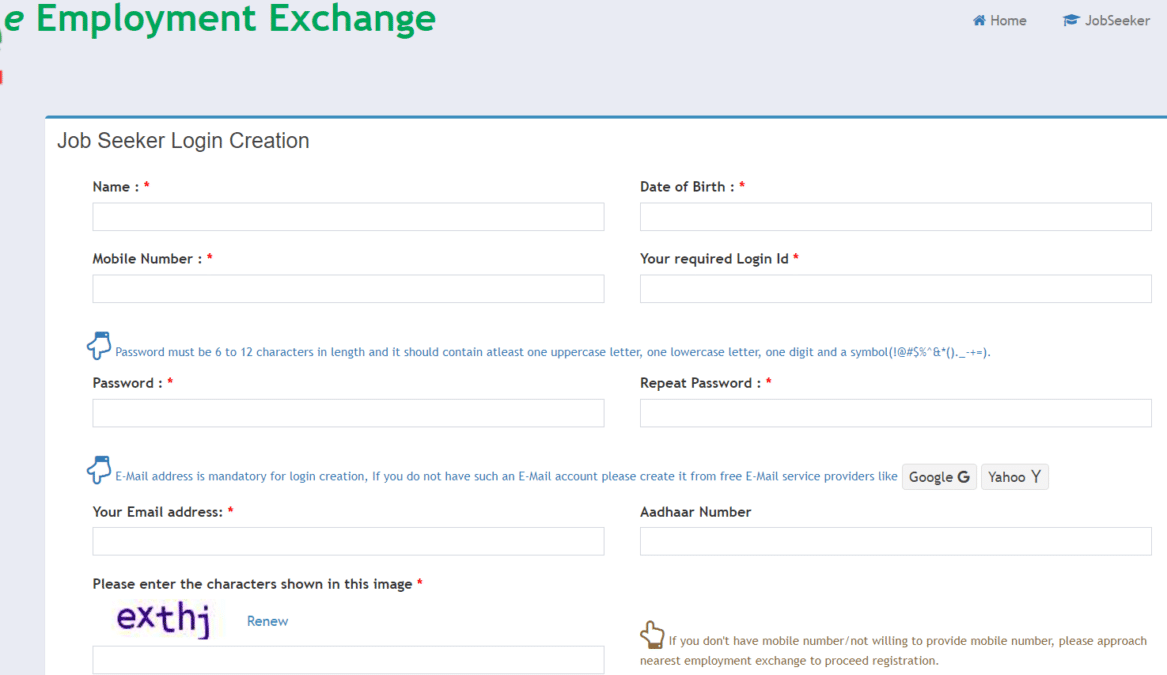

STEP 4: Here applicants can enter name, date of birth, mobile number, required login ID, password, e-mail address, aadhaar number and then click at “Login” button.

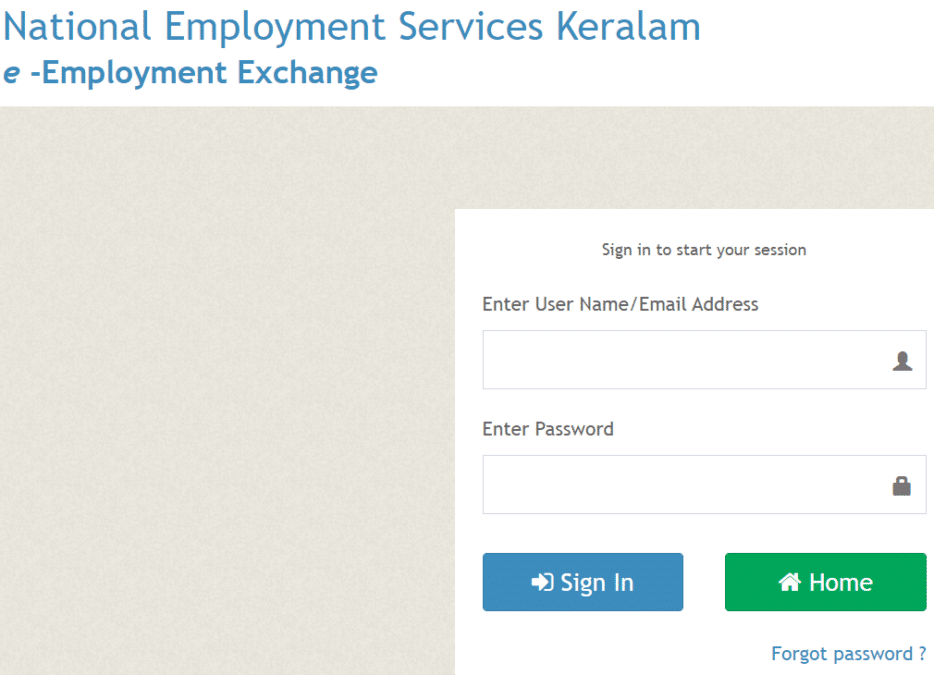

STEP 5: Applicants can enter username, password and then click at “Sign In” button to make Kerala Saranya Loan Scheme login.

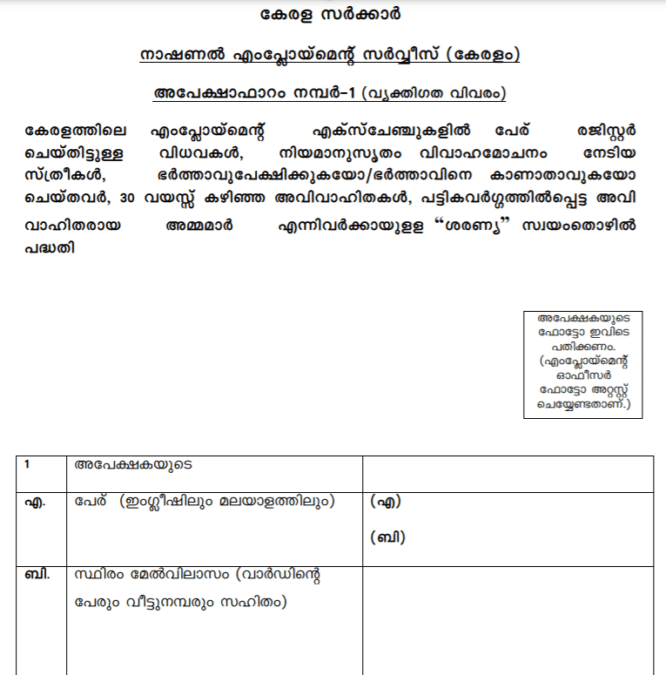

Saranya Loan Scheme Application Form PDF Download

Candidate can download the application form official website or physically from Employment Exchange.Then they have to fill complete details and submit application form with the detailed project report and income certificate to the village officer. People can easily download the Saranya Scheme Application Form in PDF format through the link given below:-

- Visit Official Website at employment.kerala.gov.in

- Hit at Downloads tab or directly click at https://employment.kerala.gov.in/downloads/ link.

- In the next window, click at “Forms” link or directly click https://employment.kerala.gov.in/forms/

- In next window, click at “Saranya Form” link.

- The Application for Loan under Saranya Scheme will appear as follows:-

- Employment exchange officers will verify the correctness of application and supporting documents.Then finally it will be forwarded to District Employment Exchange.

Direct Link to Download Saranya Loan Scheme Application Form PDF – https://employment.kerala.gov.in/wp-content/uploads/2020/12/Saranya-Form.pdf

Eligibility Criteria for Saranya Loan Scheme

All unemployed widows, divorced, deserted, spinsters above the age of 30 and unwedded mothers of Scheduled Tribe in the live Register of Employment Exchanges between the age limit 18 – 55 except in the case of spinsters, are eligible.

| Widow |

|---|

| Widows(wife of late) means, the woman whose husband is deceased and she has not remarried till date. Certificate is to be obtained from the Village Officer/President of the Grama Panchayath or Chairman of the Municipal Corporation or the Mayor of the Corporation as the case may be. |

| Divorced Woman |

| Divorced women are those women who are divorced / received divorcee certificate by court or by their religious organization. She can belong to any religion. That divorcee certificate will show that she has not remarried until the Village Officer forwards the application. |

| Deserted Woman |

| Deserted means woman deserted by her husband/ woman whose husband is missing means woman whose husband is absconding or otherwise missing for the last seven years. Such woman should produce certificate from the Tahsildar to this effect and also that she has not remarried till date. |

| Spinsters |

| Spinsters means unmarried woman means a woman who has completed the age of 30 years as on 1st April of the year of application and not yet married. Certificate to this effect is to be produced from the Village Officer. |

| Unmarried Mother |

| Unmarried mother means those women who belongs to Scheduled Tribe Category means woman who belongs to Scheduled Tribe Category and became mother without having married. Certificate to this effect is to be obtained from the Village Officer stating clearly the caste and community in the certificate. |

The annual family income should not exceed Rs. 1,00,000/-. Preference will be given to those with professional or technical qualification. For more information on the Saranya Loan Yojana – Click Here

Processing of Application

Application forms are available free of cost from the Employment Exchange where the candidate is registered and is to be submitted there along with the detailed project report and income certificate from the village officer.

Primary verification of the application will be conducted at the Employment Exchange regarding the correctness of the data filled in the application, income certificate, community certificate, certificate regarding their marital status etc. Then if it is submitted in the Town Employment Exchange, it will be forwarded to the District Employment Exchange concerned.

Scrutinised applications are submitted by the District Employment Officer to the District Committee for sanctioning loans. Sanctioning authority is the District Committee for Saranya where District Collector is the Chairman and District Employment Officer is the Convener. Government of Kerala is the appellate authority.

The loan amount is directly sent to bank account of the applicant from the Employment department. The beneficiaries of Saranya Self Employment Scheme will be considered for regular vacancy only and not for temporary vacancy.

Monitoring of Self Employment Scheme for Destitute Women

The Director of Employment is the controlling officer of the Kerala Saranya Loan Yojana. The scheme is directly monitored by the District Employment Officer and officers of Town Employment Exchanges. If the beneficiary does not repay 3 consecutive installments, two reminders will be sent.

If no reply is received, revenue recovery action to realize the loan amount with interest will be initiated. Moreover, if it is found later that the loan amount is utilized for other purposes than the project sanctioned; the full amount including the subsidy will be recovered through revenue recovery.

Overview of Kerala Saranya Yojana

- The Kerala Saranya Scheme is introduced by the state government for uplifting the most backward and segregated women in the state.

- Widows, divorced, deserted, spinsters above the age of 30 and unwedded mothers of Scheduled Tribe, Differentially abled and wife of bedridden patients are the benefiters.

- Interest fee loan upto Rs. 50,000 is given for starting self-employment ventures.

- All unemployed widows, divorced, deserted, spinsters above the age of 30 and unwedded mothers of Scheduled Tribes in the live Register of Employment Exchanges between the age limit 18.

Check Self Employment Schemes List at https://employment.kerala.gov.in/schemes/

Source / Reference Link: https://employment.kerala.gov.in/saranya/