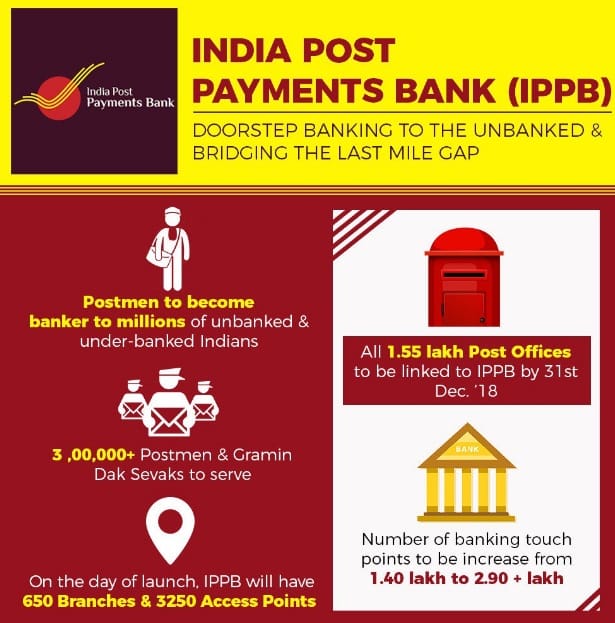

PM Narendra Modi has launched India Post Payments Bank (IPPB) at Talkatora Stadium in New Delhi. Now people can avail banking services at 1.5 lakh Post Offices with 3 lakh Postman or Grameen Dak Sevaks as banking agents. IPPB will enable money transfer, transfer of govt. benefits, bill payments, investment, insurance services etc. Postmen will deliver these services at their doorstep. It will remain available at 650 bank branches along with 3250 customer access points. People can open a regular savings or current account at ippbonline.com

They will be empowered with smartphones and digital devices to provide financial services. IPPB will also facilitate digital transactions and availing benefits of govt. schemes such as Pradhan Mantri Fasal Bima Yojana for farmers. It is a public sector company under the Department of Posts with 100% GOI equity and is governed by Reserve Bank of India (RBI).

Function was witnessed at around 3000 locations across the country. This initiative is to provide boost to banking services to the remotest people in the country. Now the revised cost for IPPB is Rs. 1435 crore.

India Post Payments Bank (IPPB) – Complete Details

From 1 September 2018, IPPB branches are opened across 650 districts today to achieve this financial inclusion. PM said that postman has been seen as a respected, trusted and accepted person in any village. Govt. is focusing on making reforms to existing frameworks and structures in accordance with changing times. Now around 3 lakh postman will deliver banking services to the people at their doorstep.

How to Open a Regular Savings / Current Account in IPPB

The main objective is that “Every customer is important, every transaction significant and every deposit valuable”. This will ensure receiving money in fastest possible manner, save money for loved ones or investing for bright future. People can visit the official website ippbonline.com. Then go the “Products” section and then click the ‘Savings Account‘ to open Savings bank account and ‘Current Account‘ link to open the a new Current Account.

The main features of the regular savings / current account in IPPB are Instant account opening at your doorstep or post office counters, Aadhaar based Direct Benefit Transfer (DBT), Simple & secure, Instant, 24×7 money transfer, Hassle free cash withdrawals and deposits, Convenient way to pay your bills, Simple, affordable and reliable services.

IPPB Services – Boost to Banking Services

People can avail various types of services at India’s Post Payments Banks which includes:-

- Doorstep Banking

- Mobile Banking

- Phone Banking (IVR/Call Center)

- SMS Banking

- Missed Call Banking

- Post Office Counters

All the candidates can even download the mobile app for India’s Post Payments Bank (IPPB).

IPPB Launch by PM Narendra Modi

IPPB move is to resolve the problem in banking sector which exists due to indiscriminate loan advances. Existing loans are being reviewed and a professional approach has been adopted. PM Modi said that the central govt. has also approved Fugitive Economic Offenders Bill to take strict action against bank defaulters.

India is consistently advancing on the path of development and excels at World level. This could be seen through the best ever performance of India at Asian Games. India is the fastest growing economy and is also eradicating poverty at a fast rate.

Initially, there will be 3250 customer access points and 3,00,000 dak sevaks to provide financial services to every home, every farmer and every enterprise in villages. Govt. is also taking various steps for the welfare of dak sevaks and has accepted long pending demand of increasing salary.

IPPB has reached over 1.5 lakh post offices across the country. Now we are telling you how to open a regular savings or current account in IPPB. IPPB facilitates Aapka Bank, Aapke Dwaar. For more details, visit the official website https://ippbonline.com/

Revised Cost for IPPB to Boost Banking Services at Post Offices

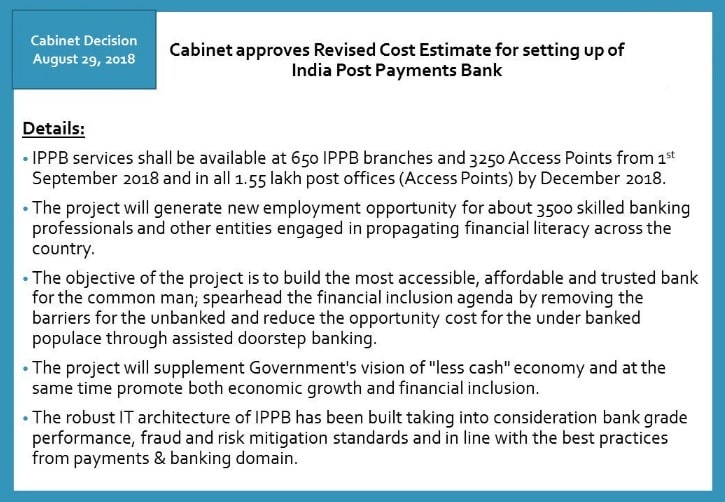

Cabinet Committee of Central Govt. has Revised Cost for India Post Payments Bank (IPPB) from Rs. 800 crore to Rs. 1,435 crore. The decision to make revision in the project cost to setup IPPB is made to give a Boost to Banking Services at Post Offices. The additional sum of Rs. 635 crore in the revised cost is on the account of Rs. 400 crore for Technology costs and Rs. 235 crore for Human Resource Costs.

This decision is taken in the Union Cabinet meeting presided over by Prime Minister Shri Narendra Modi. 1st India Post Payments Bank (IPPB) was launched by PM Narendra Modi on 1 September 2018. In the upcoming few months, IPPB will be spread across the country with at-least one branch in every district and focus on financial services in rural areas. The Union Cabinet has approved the revised project cost for setup of India Post Payments Bank (IPPB). The important features and highlights of this decision are as follows:-

- IPPB services is available at 650 IPPB branches and 3250 Access Points from 1st September 2018.

- There would be 1.55 lakh post offices (Access Points) by the end of December 2018.

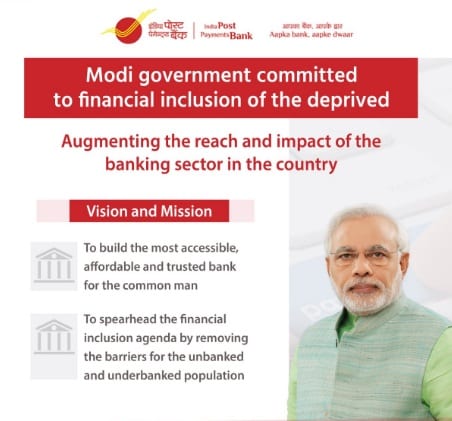

- This project is going to generate new employment opportunities for about 3500 skilled banking professionals. IPPB will also provide jobs to other people engaged in spreading financial literacy across the entire country. The main vision and mission of India Post Payment Banks is as follows:-

- The primary focus is to build the most accessible, affordable, trusted and user friendly bank for the common man.

- IPPB banks will promote economic growth and financial inclusion. This project will also encourage the vision of central govt. of having a Cashless Economy.

- IPPB Banks will remove the barriers for persons who does not have access to banks.

- IT Architecture has been build in a robust manner and compatible to bank grade performance. This platform will also ensure fraud and risk mitigation standards following the lines of banking payments and domain.

IPPB would also reduce the opportunity cost for under banked population by assisted doorstep banking.

IPPB Services – Boost to Banking Services at Post Offices

IPPB will provide various payments / financial services by the help of its technology enabled solutions. This will be distributed by the Department of Posts (DoP) employees / last mile agents. These employees and agents will transform them from mail deliverer to financial services deliverer.

IPPB will pay incentive / commission to Postal Staff and Gramin Dak Sewaks (agents) directly into their bank accounts. This would enable them to provide IPPB services in order to motivate them to promote IPPB digital services to customers. One part of the commission would be paid by IPPB to Department of Posts.

Source: https://pib.gov.in/PressReleseDetail.aspx?PRID=1544217

Online Banking Facility for Post Office Savings Account Holders

People who have a savings account in any post office can now avail a full fledged digital banking service. Central govt. has now approved linking of all such accounts to the India Post Payments Bank (IPPB). Around 34 crore account holders will now be entitled to transfer money from their post office account to any bank account.

Reserve Bank of India (RBI) governs IPPB while finance ministry governs the banking service of post offices. IPPB customers are applicable for usage of NEFT, RTGS or other money transfer modes just like banking customers. After the savings account gets linked with IPPB, customers will be enabled for money transfer service like other banks.

Post Office is going to become the largest banking network as India Post is going to link all 1.55 lakh PO branches with IPPB. Previously, India post has started core banking service such as money transfer facility but it was confined only to the money transfer within post office savings bank (POSB) accounts. People can also Compare All Post Office Schemes.

RBI Role in Providing Online Banking to PO Savings Account Holders

RBI is the monitoring body for IPPB which enables all the bank account holders to use NEFT / RTGS and other services. Banking Services in Post Offices comes under the finance ministry. Now FM has taken a step forward to provide banking like facilities to all its customers.

Now Finance Ministry gives its nod to link all post office savings account to IPPB to benefit 34 crore POSB account holders. There are around 17 crore post office saving bank accounts and another 17 crore people are subscribed for monthly income scheme, time deposit, national saving certificate or other post office schemes. Previously all PO Account holders were able to transfer money only from one POSB account to other POSB accounts.

India Post will now provide an option to POSB account holders to avail the benefits of this new facility. However, this service will remain optional (not compulsive). Only if a person opts for it, then only their POSB account will get linked to IPPB.

Digital Banking Service Implementation

India Post is planning to implement this move through all 650 IPPB branches from the current month onward. Accordingly, all the IPPB branches will now get connected to smaller post offices in various districts across the country. Moreover all the IPPB branches along with access points will get linked to postal network. Till date, the Postal Network includes around 1.5 lakh branches out of which, approx. 1.3 lakh are in rural areas. This move of linking POSB with IPPB in 1.55 lakh branches will make India Post as the biggest and most reliable banking network.

In next phase, India post will provide an option to all the POSB account holders for payment of post office products through their IPPB account. This service would include payment (money deposit) for Sukanya Samridhi Yojana, Kisan Vikas Patra, PPF, Speed Post etc.

This facility will expand the base of India Post and also new merchants will get registered. This will be done through the registration of merchants who accept payment from post office customer with the help of an application. Furthermore, any POSB account holder can then make payment to merchants like stores, shops, ticket booking etc.

Bhim compair tez super Bhim app slowly thats why don’t slow this app

hello thanks

आवास योजना

Shambhu Colony pansara Yamunanagar

How to apply

Entrenched in 2013, Suja Enterprise was esblished at Technology and Service Provider afterwards the company evolved in 2015 as Asuja eServ Private Limited company to facilitate the delivery of public platform services and schemes focused for the betterment of ordinary people.