Are you an aspiring entrepreneur dreaming of starting your own business but do not have money?

Maharashtra Government has launched the Annasaheb Patil Loan Yojana 2025 to help people like you. Under this scheme, you can get a loan of 10 to 50 lakh rupees with 35% subsidy by Maharashtra Government, meaning part of your loan amount is covered by the government.

In this article, we’ll share all the important details about this Annasaheb Patil Loan Yojana, like how to apply, what documents you need, and who can benefit from the scheme.

What is Annasaheb Patil Loan Yojana 2025?

Annasaheb Patil Loan Yojana is a government-backed loan scheme by the Maharashtra Government. It was launched to support unemployed youth who want to start a new business or expand an existing one. Here are some key points about this scheme:

- Loan Amount: 10 to 50 lakh rupees

- Subsidy: 35% of the loan amount

- Interest: Low interest rates

- Purpose: Help unemployed youth become self-employed

So far, 354,520 individuals have applied for loan under this scheme, resulting in 179,168 Letters of Intent (LOI) being issued. Out of these, 117,572 applications have received bank sanctions, and 108,354 sanctions have successfully passed the auditor’s approval process.

Highlights of Annasaheb Patil Loan Yojana

| Scheme Name | Annasaheb Patil Loan Yojana |

| Loan Amount | 10 to 50 lakh rupees |

| Subsidy | 35% of the loan amount |

| Interest Rate | Low interest rates |

| Target Group | Unemployed youth in Maharashtra |

| Age Limit | 18 to 50 years |

| Income Requirement | Annual family income below 3 lakh rupees |

| Gender | Men and women are eligible |

| Documents Required | Aadhaar Card, Ration Card, Valid Photo ID, Bank Passbook, PAN Card, Photographs, Educational Certificates, Business Report, Caste Certificate (if applicable), Income Certificate, Domicile Certificate |

| Application Method | Online through official website at udyog.mahaswayam.gov.in |

| Key Benefits | High loan limit, 35% subsidy, low interest rates, complete online process |

Main Objective of Annasaheb Patil Loan Yojana

The primary aim of this loan scheme is to lower unemployment by offering financial assistance to people who want to start a business but do not have funds. By making it easier to get a loan, the scheme helps aspiring entrepreneurs who need funds to launch or expand their ventures.

This initiative will not only creates more job opportunities through new businesses but also encourages innovative minds to bring their ideas to life. Ultimately, by promoting self-employment and personal growth, the scheme fosters greater economic development and independence within the community.

Eligibility Criteria

To get the benefits of Annasaheb Patil Loan Yojana, make sure you are eligible as per the below criteria

- Resident of Maharashtra: You must be a permanent resident of the state.

- Age Limit: Between 18 and 50 years.

- Income Requirement: Annual family income must be below 3 lakh rupees.

- Employment Status: Applicant should be unemployed (but willing to start a business).

- Non-Taxpayer Family: No one in the family should be an income taxpayer or a government employee.

- Gender-Neutral: Both men and women can apply.

Documents Required

During the application process of Annasaheb Patil Loan Yojana, you may need following documents.

- Aadhaar Card

- Mobile Number

- Ration Card

- Any Valid Photo ID (Voter ID, Driving License, etc.)

- Bank Passbook

- PAN Card

- Passport-Size Photographs

- Educational Certificates

- Business/Project Report

- Email ID

- Caste Certificate (if applicable)

- Income Certificate

- Domicile Certificate

- Project Report

NOTE: A well-prepared business plan can boost your chances of quick approval!

How to Apply Online for Annasaheb Patil Loan Yojana

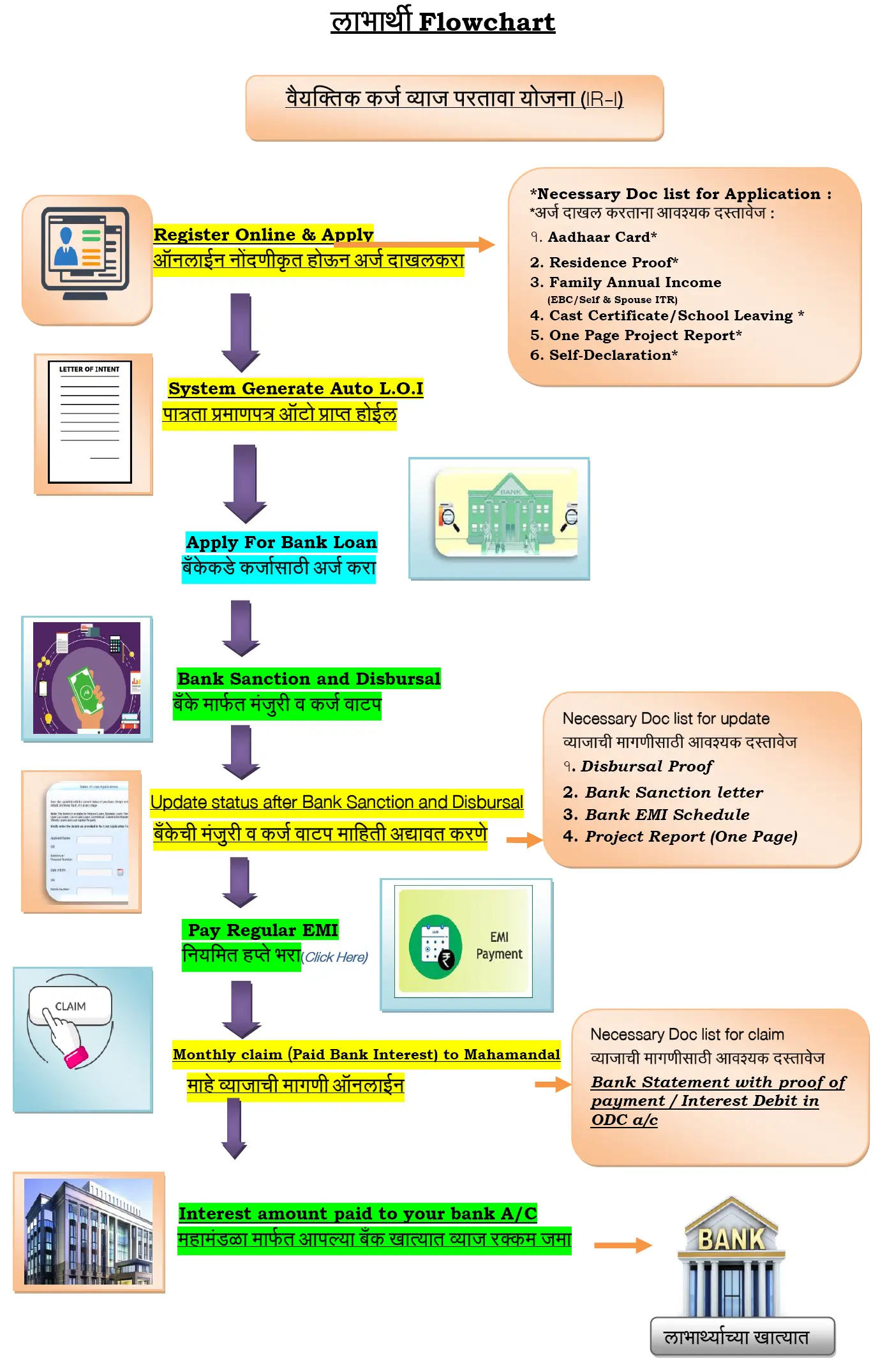

You can follow below steps to apply online for Annasaheb Patil Loan Yojana through the official website.

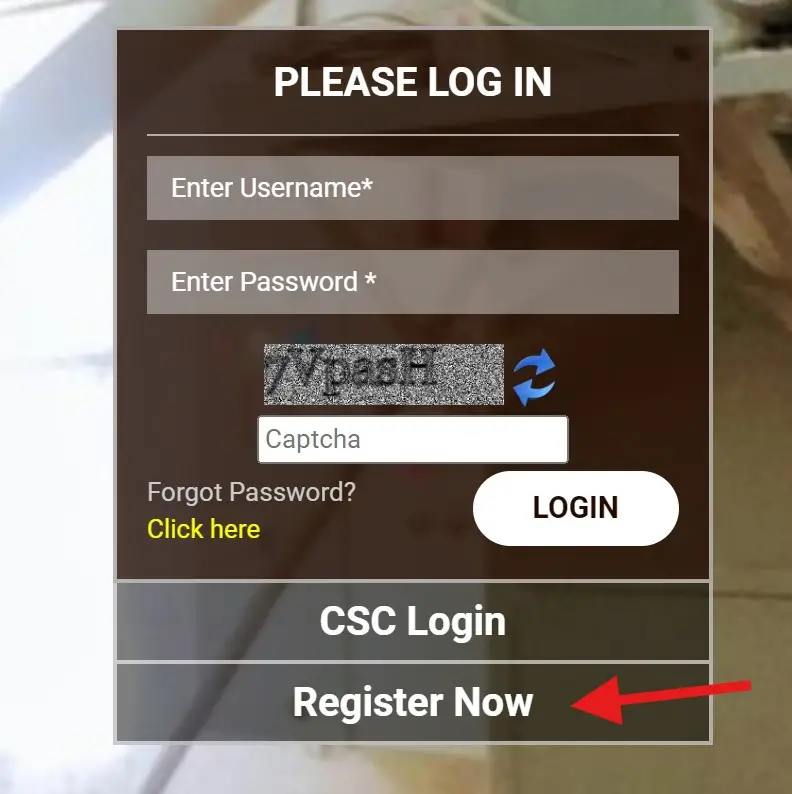

Visit Official Website: In the first step, Go to the Annasaheb Patil Loan Yojana official portal at https://udyog.mahaswayam.gov.in.

Create an Account: Look for the “Register Now” button on the homepage and click on it.

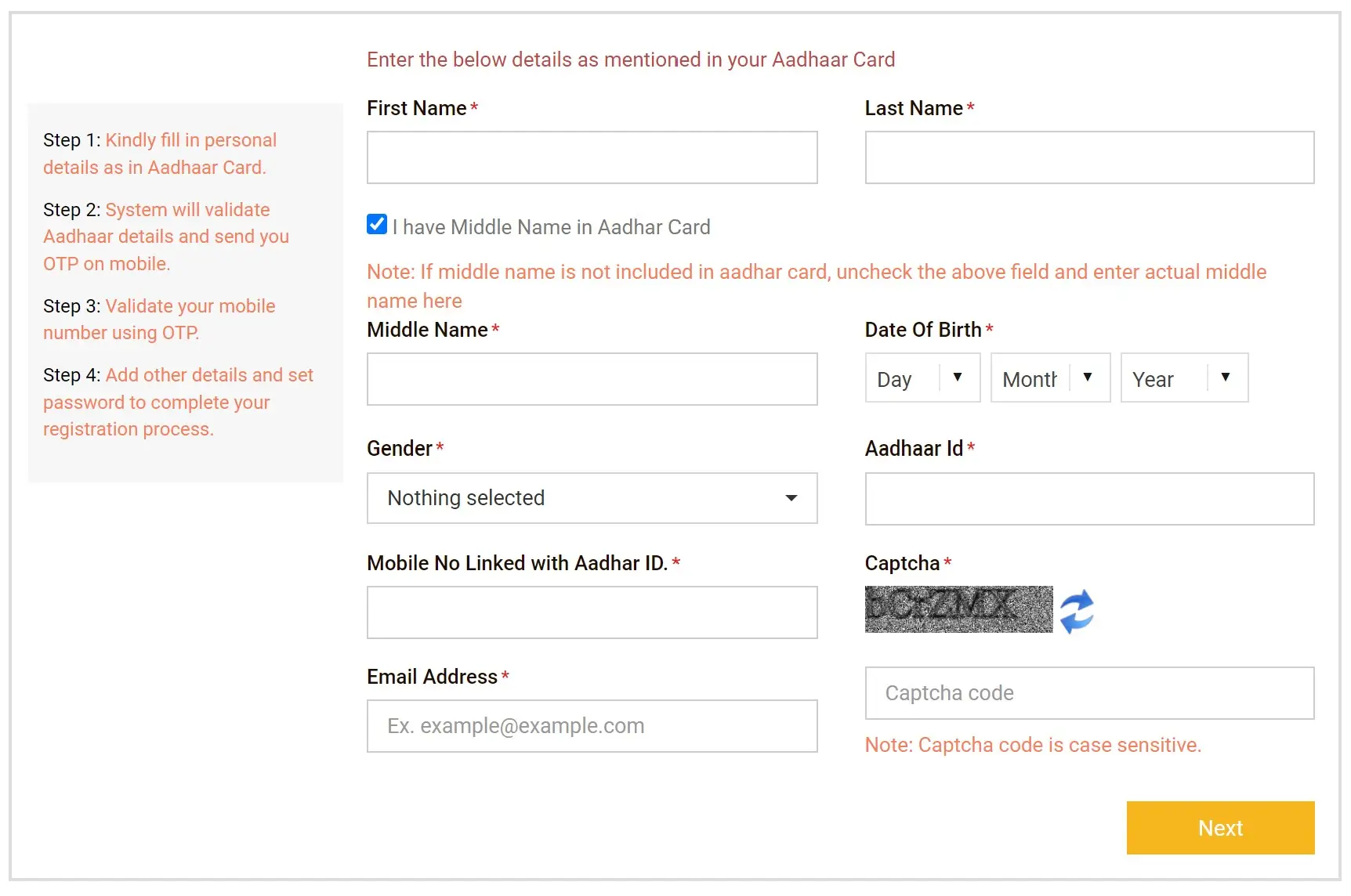

Fill the Form: Enter your personal details like name, address, contact info, and other required details in the registration Form etc.

Apply For Bank Loan: After successful registration, find the option of Applying for the loan.

Upload Documents: Fill all the required details in the form, scan and upload all required documents (listed above).

Choose Loan Amount: Mention how much loan you need (between 10 and 50 lakh rupees).

Submit: Double-check your information and click on “Submit”.

The officials will review your application. If you’re eligible, they will approve your loan and transfer the amount directly to your bank account.

Loan Application Flowchart

Benefits of Annasaheb Patil Loan Yojana

- High Loan Limit: Up to 50 lakh rupees to start or grow your business.

- 35% Subsidy: This reduces the loan amount you actually pay back.

- Low Interest Rate: Interest rates are lower under this scheme as compared to other private loans.

- Online Application: There is no need to physically visit any government office or the bank for application, complete process is online.

The Annasaheb Patil Loan Yojana 2024 is a golden opportunity for anyone in Maharashtra who wants to become self-employed or expand their existing business. The government offers up to 50 lakh rupees with a 35% subsidy and low interest rates, so don’t let this chance slip away.

FAQs

How much loan can I get under Annasaheb Patil Loan Yojana?

You can get between 10 to 50 lakh rupees.

Is there a subsidy?

Yes, you get a 35% subsidy on the approved loan amount.

What is the age limit to apply?

You must be between 18 and 50 years old.

Are women eligible for this scheme?

Yes, both men and women can apply if they meet the criteria.

Do I need a business plan?

A proper plan or project report can improve your chances of faster approval.