National SC / ST Hub Scheme 2026 at scsthub.in: The National SC/ST Hub has been set up to provide professional support to Scheduled Caste and Scheduled Tribe Entrepreneurs to fulfil the obligations under the Central Government Public Procurement Policy for Micro and Small Enterprises Order 2012. This scheme will ensure adoption of applicable business practices and leverage the Stand-Up India initiative. In this article, we will tell you about the complete list of sub schemes under National SC/ST Hub Scheme.

The National SC/ST Hub is being implemented by the Ministry of MSME, Govt. of India through National Small Industries Corporation (NSIC), a public-sector undertaking under the administrative control of this Ministry. The Prime Minister of India, Shri Narendra Modi Ji had launched the National SC/ST hub for MSME sector on 18 October 2016 in Ludhiana.

What is National SC/ST Hub Scheme 2026

National SC/ST hub has been setup to facilitate things to people from SC/ST categories to start their own micro, small and medium enterprises (MSME) units. The Hub will work towards strengthening market access/linkage, monitoring, capacity building, leveraging financial support schemes and sharing industry-best practices for entrepreneurs belonging to the SC/ST categories. The hub will also enable central public sector enterprises to fulfill the procurement target set by the government. Under the scheme, the nationalized banks will provide loans to SC/ST men and women entrepreneurs up to Rs. 1 Crore to make them self dependent and employ the youth.

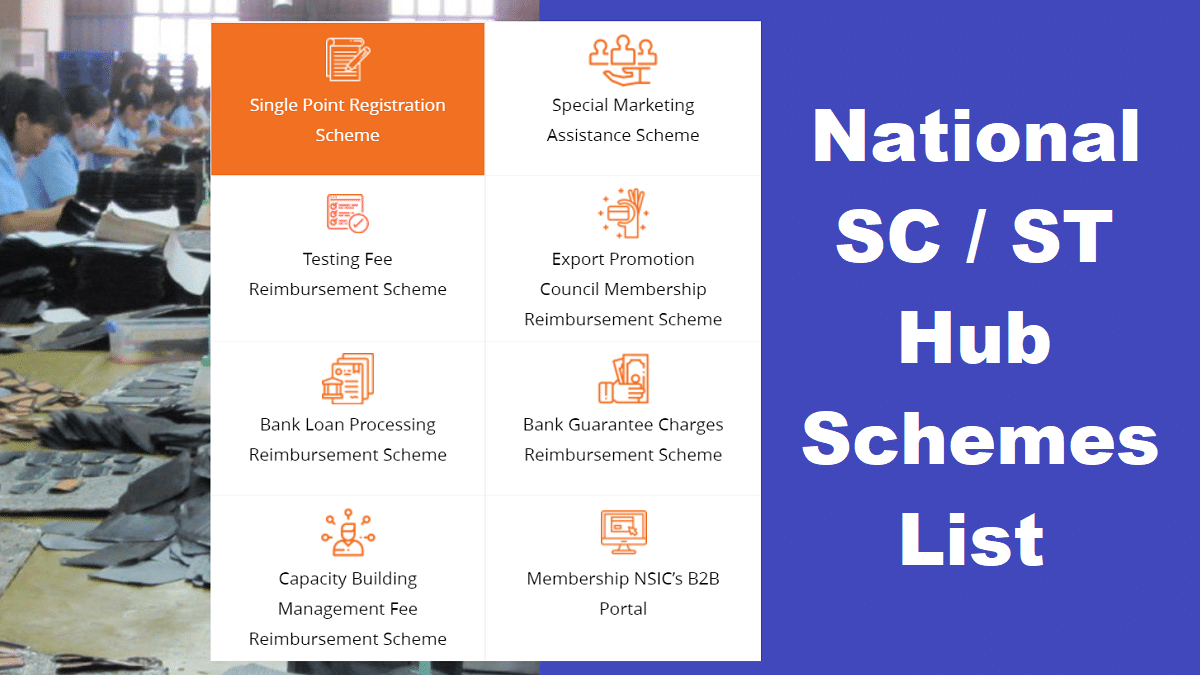

List of Sub Schemes in National SC/ST Hub Scheme

Here is the complete list of sub schemes under the flagship National SC/ST Hub Scheme:-

Special Credit Linked Capital Subsidy Scheme

A Credit Linked Capital Subsidy Scheme has been introduced by M/o MSME with an objective of facilitating technology up-gradation in MSEs by providing an upfront capital subsidy of 15% (on institutional finance of upto Rs 1 crore availed by them) for induction of well-established and improved technology in the specified 51 sub-sectors/products approved. In other words the major objective is to upgrade their plant & machinery with state-of-the-art technology, with or without expansion and also for new MSEs which have set up their facilities with appropriate eligible and proven technology duly approved under scheme guidelines. List of Technologies is available at www.dcmsme.gov.in

To further augment the efforts, a Special Credit Linked Capital Subsidy Scheme (SCLCSS) has been introduced under National SC-ST Hub, wherein 25% capital subsidy with an overall investment ceiling of Rs. 1 crore without any restriction on the sectors or machinery & technology for SC/ST enterprises is provided. The implementation mechanism of the scheme will be as per the guidelines of existing Credit Linked Capital Subsidy Scheme (CLCSS).

For more details, click the link – https://www.scsthub.in/content/special-credit-linked-capital-subsidy-scheme

Single Point Registration Scheme (SPRS)

The Government is the single largest buyer of a variety of goods. With a view to increase the share of purchases from the small-scale sector, the Government Stores Purchase Programme was launched in 1955-56. NSIC registers Micro & small Enterprises (MSEs) under Single Point Registration scheme (SPRS) for participation in Government Purchases.

Benefits of Registration

The units registered under Single Point Registration Scheme of NSIC are eligible to get the benefits under Public Procurement Policy for Micro & Small Enterprises (MSEs) Order 2012 as notified by the Government of India, Ministry of Micro Small & Medium Enterprises, New Delhi vide Gazette Notification dated 23.03.2012 and amendment vide order no. S.O. 5670(E) dated 9th November 2018.

- Issue of the Tender Sets free of cost

- Exemption from payment of Earnest Money Deposit (EMD);

- In tender participating MSEs quoting price within price band of L1+15 per cent shall also be allowed to supply a portion upto 25% of requirement by bringing down their price to L1 Price where L1 is non MSEs.

- Every Central Ministries/Departments/PSUs shall set an annual goal of minimum 25 per cent of the total annual purchases of the products or services produced or rendered by MSEs. Out of annual requirement of 25% procurement from MSEs, 4% is earmarked for units owned by Schedule Caste /Schedule Tribes and 3% is earmarked for the units owned by Women entrepreneurs.

- In addition to the above, 358 items are also reserved for exclusive purchase from SSI Sector.

Eligibility

- All Micro & Small Enterprises having EM Part-II (Optional)/ Udyog Aadhaar Memorandum (UAM) are eligible for registration with NSIC under its Single Point Registration Scheme (SPRS).

- Micro & Small Enterprises who have already commenced their commercial production but not completed one year of existence. The Provisional Registration Certificate can be issued to such Micro & Small Enterprises under Single Point Registration scheme with monitory limit of Rs. 5.00 Lacs which shall be valid for the period of one year only from the date of issue after levying the registration fee and obtaining the requisite documents

How to Apply

Micro & Small Enterprises (MSEs) shall have to apply either online on our website www.nsicspronline.com or on the prescribed application form in Duplicate and to be submitted to the concerned Zonal/Branch Office of NSIC or NSSH Office located nearest to the unit. In case of any difficulty in filling the application form and completing the documentation, please consult any of the Zonal / Branch/ NSSH office of NSIC. The application form containing Terms & conditions are available free of cost from all offices of the NSIC. The guidelines attached with the Application Form provide a checklist for the documents that are required to be submitted along with the application.

Registration Fee

The registration Fee for SPRS is based on the Net Sales Turnover as per latest audited Balance Sheet of the Micro & Small Enterprise for the Registration, Renewal and any other amendment etc. However, the Registration, Renewal and any other amendment etc in the SPRS for SC/ST owned MSEs is available at a token amount of Rs. 100/- plus GST only.

Registration Process

- Micro & Small Enterprises shall have to apply either online on our website www.nsicspronline.com or on the prescribed application form (in duplicate) along-with requisite fee and documents to the Zonal/Branch/Sub Branch and Sub Office/Extension office of NSIC situated nearest to their location.

- Duplicate copy of the G.P. Registration Application Form submitted by the Micro & Small Enterprise will be forwarded to the concerned Inspecting agency along with copies of required documents and requisite Proof of inspection charges remitted in favor of concerned Inspection Agency requesting for carrying out the Technical Inspection of Micro & Small Enterprise and forward their recommendations in this regard.

- After receiving Inspection Report, NSIC will issue the SPRS Registration Certificate to Micro & Small Enterprise for items/stores as recommended.

For more details, click the link – https://www.scsthub.in/content/single-point-registration-scheme

Special Marketing Assistance Scheme (SMAS)

Marketing support to the SC/ST enterprises for the enhancement of competitiveness and marketability of their products will be provided by way of the following type of events:

- Organizing Visit to International Exhibitions/Trade Fairs/Seminars Abroad

- Participation in International Exhibitions/Trade Fairs Abroad

- Organizing Visit to Domestic Exhibitions/Trade Fairs

- Participation in Domestic Exhibitions/Trade Fairs

- Vendor Development Programmes

- Organizing Workshops/Seminars/Awareness Campaigns

Special Marketing Assistance Scheme Features

The main features of Special Marketing Assistance scheme are as follows:-

- SC/ST units must be registered in the MSME Data Bank at the time of availing the benefit under the scheme.

- Maximum size of the booth/stall in the exhibition/trade fair should be 3mx3m.

- SC/ST entrepreneurs shall be allowed reimbursement under SMAS for maximum of 2 (two) international events and 4 (four) domestic events in a financial year, irrespective of the number of units they own. Also, a person cannot represent more than one MSE in a financial year.

- Minimum participation of 5 SC/ST Enterprises for visit to International Exhibitions/Trade Fairs/Seminars abroad is essential. There is no minimum number of units prescribed for participation in international exhibitions/trade fairs abroad.

- In case of participation of 5 or more SC/ST enterprises in international events abroad, 1 representative from NSIC may accompany. However, in case of participation of more than 10 SC/ST enterprises, one more representative from NSIC/Ministry of MSME may be considered. The duty allowance for such officials shall be as per their entitlement.

- The SC/ST units may apply to NSSH through field offices of NSIC under SMAS at least a month in advance for domestic events and two months for international events.

- With regard to the Vendor Development Programme, targets should be fixed for each year and MSME this may also be involved in achieving the targets.

- The proposals under SMAS shall be processed at NSSH and placed before the Screening Committee at NSIC for MAS and based upon its recommendation, the approval may be provided by CMD-NSIC. In exceptional cases of deviations, the proposals shall be sent for approval of Administrative Ministry.

- All other terms & conditions, application forms, documents required and eligibility criteria laid down in the guidelines of International Cooperation scheme of Ministry of MSME, as amended from time to time, shall be applicable to SMAS.

- The Scheme of SMAS shall be monitored and funded by the Ministry of MSME under National SC/ST Hub scheme.

For more details, click the link – https://www.scsthub.in/content/special-marketing-assistance-scheme-smas

Bank Loan Processing Reimbursement Scheme

Reimbursement of 50% or Rs. 1,00,000/- (excluding GST and other applicable taxes), whichever is less, on Bank loan processing charges paid by SC/ST MSEs in availing business loans.

For more details, click the link – https://www.scsthub.in/bank-loan-processing-reimbursement-scheme

Bank Guarantee Charges Reimbursement Scheme

Reimbursement of 50% or Rs. 1,00,000/- (excluding GST and other applicable taxes), whichever is less, on Performance Bank guarantee charges paid by SC/ST MSEs for participation in tenders of Central/State Govt. and PSEs.

For more details, click the link – https://www.scsthub.in/bank-guarantee-charges-reimbursement-scheme

Testing Fee Reimbursement Scheme

Reimbursement of 50% or Rs 1,00,000/- (excluding GST and other applicable taxes), whichever is lower, charged as Testing fee, for availing testing services from NABL/BIS accredited Lab or Lab of any Central / State Department / Public Sector Undertaking and license or certification given by Bureau of Indian Standards (BIS), in a financial year.

For more details, click the link – https://www.scsthub.in/testing-fee-reimbursement-scheme

Export Promotion Council Membership Reimbursement Scheme

Reimbursement of 50% or Rs 20,000/- (excluding GST and other applicable taxes), whichever is less, in a financial year to SC/ST MSEs on annual membership subscription fee / one time subscription charges / entry fee charged by various Export Promotion Councils (EPC)

For more details, click the link – https://www.scsthub.in/export-promotion-council-membership-reimbursement-scheme

Top 50 NIRF Rated Management Institution’s Short Term Training Program Fee Reimbursement Scheme

Reimbursement of course fees for SC/ST entrepreneurs and their ward, for attending short term (1-30 days duration) training programs from top 50 management institutes identified by Ministry of Human Resource Development under the National Institute Ranking Framework (NIRF).

For more details, click the link – https://www.scsthub.in/capacity-building-management-fee-reimbursement-scheme

Membership of NSIC’s B2B Portal

Annual Membership fee of NSIC’s B2B portal (www.msmemart.com) is 100% free for the first year and 80% subsidised for subsequent years under National SC ST Hub Scheme for SC/ST MSMEs.

For more details, click the link – https://www.scsthub.in/membership-nsic-b2b-portal

The SC/ST hub will further help in increasing the contributions of MSME sector to India’s GDP which is about 38% at present. The MSME sector employs about 11 Crore people at present. The announcement of setting up the National SC/ST hub was made by the finance minister Shri Arun Jaitley earlier in his budget speech of 2016-17.

The scheme will be implemented by the Ministry of Micro, Small and Medium Enterprises. More information about the National SC/ST hub can be viewed on the official website of ministry at https://www.scsthub.in/