Atmanirbhar Bharat Loan Schemes 2024 Application / Registration Forms

Published on sarkariyojana.com

Last year, central govt. has made an announcement of a Rs. 20 lakh crore economic package for Atmanirbhar Bharat Abhiyan to make India self reliant. In this Aatmanirbhar Bharat Abhiyan package, govt. has announced a number of loan scheme for various sectors. Here we are going to tell you about how to apply online for Atmanirbhar Bharat Loan Schemes 2024.

These loan schemes under the Self Reliant India campaign includes MSME loans, Kisan Credit Card (KCC) loans, Street Vendors loans, Shishu Mudra loans, PM Awas Yojana Credit Linked Subsidy Scheme (PMAY-CLSS) loans etc. Now people can apply for these loan schemes by the Union government of India.

For this, interested applicants will have to fill Atmanirbhar Bharat Loan Schemes application / registration form. The Rs. 20 lakh economic booster dose (1 to 5) package announcement was completed on 17th May 2020 by FM Nirmala Sitharaman and these announcements are now being realized.

Atmanirbhar Bharat Loan Schemes 2024 Apply Online Form

PM Modi’s Vision of Rs. 20 lakh crore package has been announced in 5 tranche economic doses on 13th, 14th, 15th, 16th and 17th May 2020. Below is the direct apply online process to avail benefits of various loan schemes announced in different tranches of Atmanirbhar Bharat Abhiyan 2024 package.

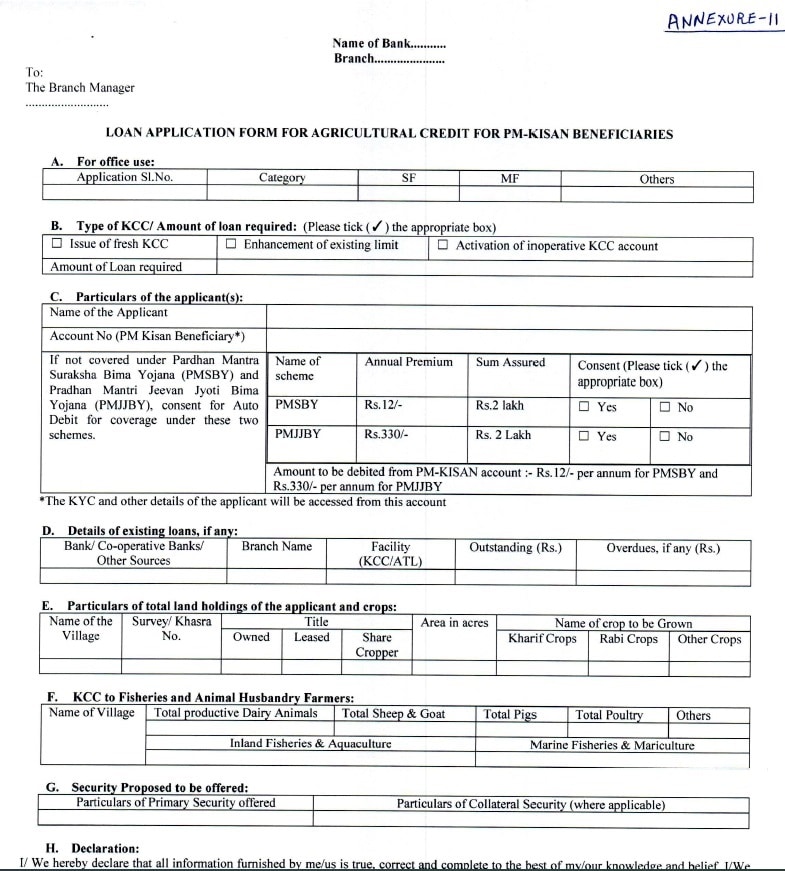

Kisan Credit Card (KCC) Loans

Around Rs. 2 lakh crore concessional credit would be extended for Kisan Credit Card (KCC) Scheme by the central government. Around 2.5 crore farmers to benefit from this KCC scheme. Fisheries and animal husbandry farmers will be included in KCC Scheme. People can take the following benefits by applying online for KCC Scheme.

- The Interest rate offered on the loan may go as low as 2.00%.

- Banks will not seek security on loans up to Rs. 1.60 lakh.

- Crop insurance coverage against a variety of natural calamities is given to the users.

- Farmer is provided insurance coverage against permanent disability, death, other risks is also provided to the farmer.

- The repayment period is decided on the basis of harvesting of crop and its marketing period. Maximum loan upto Rs. 3 lakh can be availed by KCC card holder.

- Farmers that deposit their money in the Kisan Credit Card account will get a high rate of interest. Moreover, farmers are charged simple interest rate when they make prompt payment.

- To apply online, click the link pmkisan.gov.in/Documents/Kcc.pdf to open single page Kisan Credit Card (KCC) application form.

- The PM Kisan Credit Card Scheme 2024 online application form for PDF download will appear as below:-

Other initiatives for farmers includes creation of Farm Based Infrastructure (Rs. 1 lakh crore), Micro Food enterprises (Rs. 10,000 crore), PM Matsya Sampada Yojana (Rs. 20,000 crore), FMD Livestock Disease Control Scheme (Rs. 13,000 cr), Animal Husbandry Infrastructure Development Fund (Rs. 15000 crore), Promotion of herbal cultivation (Rs. 4000 crore), Promotion of Bee keeping (Rs. 500 crore), TOP to Total: Operation Greens (additional Rs. 500 crore).

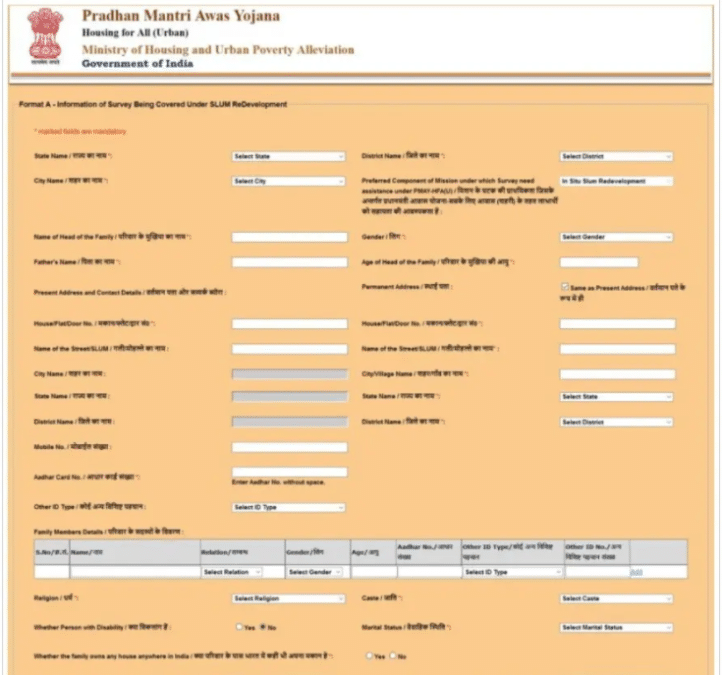

CLSS Loans under PM Awas Yojana

To avail Interest subsidy under CLSS vertical, the applicant should have a sanctioned housing loan and meet the eligibility criteria as the Scheme Guidelines.

- Check your eligibility for CLSS Subsidy: Click Here – https://pmayuclap.gov.in/content/html/Subsidy-Calc.html

- CLSS subsidy application may be submitted to the concerned Bank/HFC branch.

- Track Your Application Status: CLSS Tracker: please open https://pmayuclap.gov.in

- UMANG platform https://pmay-urban.gov.in/umang

- People can apply online for PMAY CLSS through the official website https://pmaymis.gov.in/ and then selecting “Apply Online” link under “Citizen Assessment” section.

- Direct Link to Apply Online is https://pmaymis.gov.in/Open/Check_Aadhar_Existence.aspx?comp=b

- At this page, enter your Aadhar number or Virtual ID and Name as per Aadhar Card and click the “Check” button. If your aadhaar number and name matches, then the PMAY CLSS Loan Apply Online Form will appear as shown below:-

D) For complete process and detailed information, click – PMAY CLSS Application / Registration Process

This extension of PMAY CLSS Scheme for EWS / LIG households will lead to more investment in housing sector in India.

Street Vendors Loan Scheme – PM Svanidhi Yojana

PM Svanidhi Yojana has been launched by the central govt. as Street Vendors Loan Scheme. The official website to apply online for Street Vendors Loan is https://pmsvanidhi.mohua.gov.in/. Go to this page, then hit at “Apply for Loan”, then fill form and submit it to get Rs. 10,000 as loan. It is a special micro credit facility for street vendors. In order to check complete process, click at the link – PM Svanidhi Scheme Application / Registration Process.

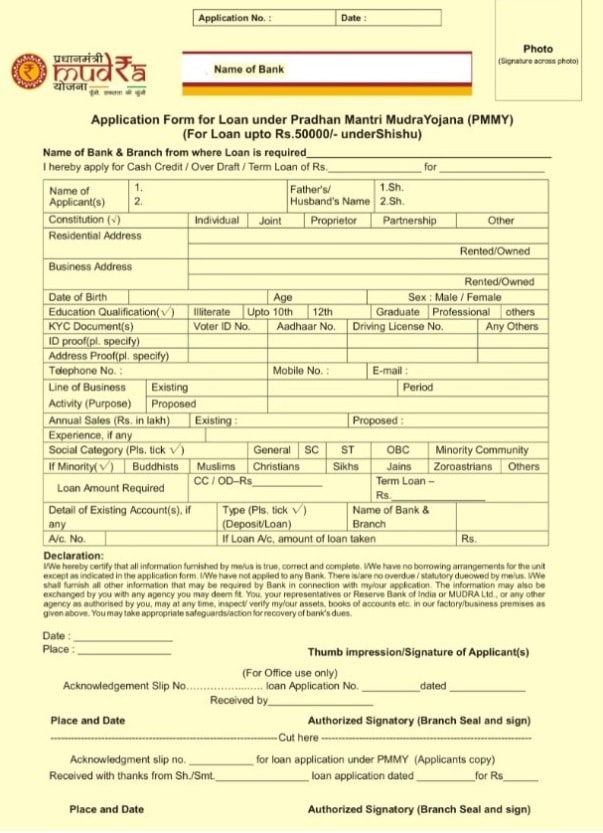

Shishu Loans under MUDRA Yojana

Small businesses under MUDRA have been disrupted the most due to Coronavirus (COVID-19) lockdown & has also impacted their capacity to pay EMIs. So, Loan moratorium has already been granted by RBI. The current portfolio of MUDRA-Shishu loans is Rs. 1.62 Lakh crore (Maximum loan amount of Rs. 50,000). Now the Government of India will provide Interest subvention of 2% for prompt payees for a period of 12 months. This will provide relief of Rs. 1500 crore to MUDRA-Shishu loanees. People can check the process here – PM Mudra Yojana Shishu Loans Apply Online / Offline Form

The Mudra Shishu Loan Yojana application form will appear as shown below:-

All the interested people who wants to avail the Shishu Mudra loans along with benefits of Atmanirbhar Bharat Abhiyan package can now apply online or offline as suitable.

MSME Loans

The central govt. has made a a provision of Rs. 3 lakh crore for Micro, Small and Medium Enterprises sector. These business loans can be used for setting up new enterprise or stepping up (expansion, diversification, modernization, technology up-gradation). These can be for:-

- Acquisition of factory, land and construction of building spaces.

- Purchase of Plant and Machinery including lab equipment, testing equipment, furniture, electric fittings etc.

- Meeting working capital requirements like raw materials, stock-in-progress, finished goods, etc.

- Trade Finance (Bill discounting) for paying the creditors, while awaiting payment from debtors.

- Launch of new product range, expansion of business, warehousing need, credit for marketing and advertising purpose.

- Additional monitory assistance for any eligible purpose.

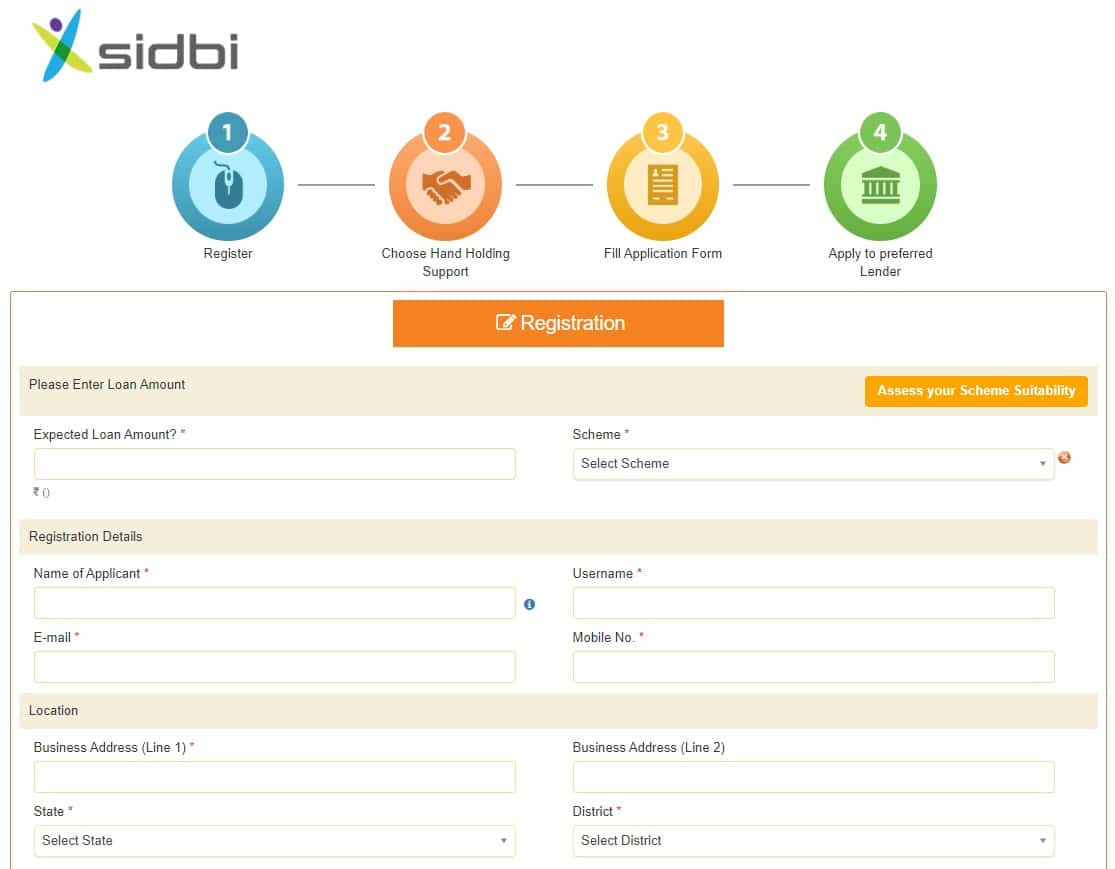

- To apply online, click at the Direct Link – https://site.udyamimitra.in/Login/Register

- The page to apply online for MSME Loans at the SIDBI Udyami Mitra website will appear as shown below:-

The definition of MSMEs would be changed with an increase in investment limit and size along with turnover size. Moreover, the differentiation b/w manufacturing and service MSME will be removed. Now, all the global tender upto Rs. 200 crore to be disallowed and govt. procurement tenders upto 200 crore will no longer be on global tender group. E-market linkage would also be provided across the board in absence of trade fairs to promote e-commerce. Within 45 days, CPSEs and Govt. of India will clear their receivables. MSME Schemes – https://msme.gov.in/all-schemes