| PDF Name | RODTEP Scheme 2026 Guidelines PDF |

|---|---|

| Last Updated | September 14, 2023 |

| No. of Pages | 41 |

| PDF Size | 6.10 MB |

| Language | English |

| Category | Government Schemes, Forms, Policies & Guidelines PDF |

| Topic / Tag | Govt Scheme Guidelines |

| Source(s) / Credits | files.pdfpdf.in |

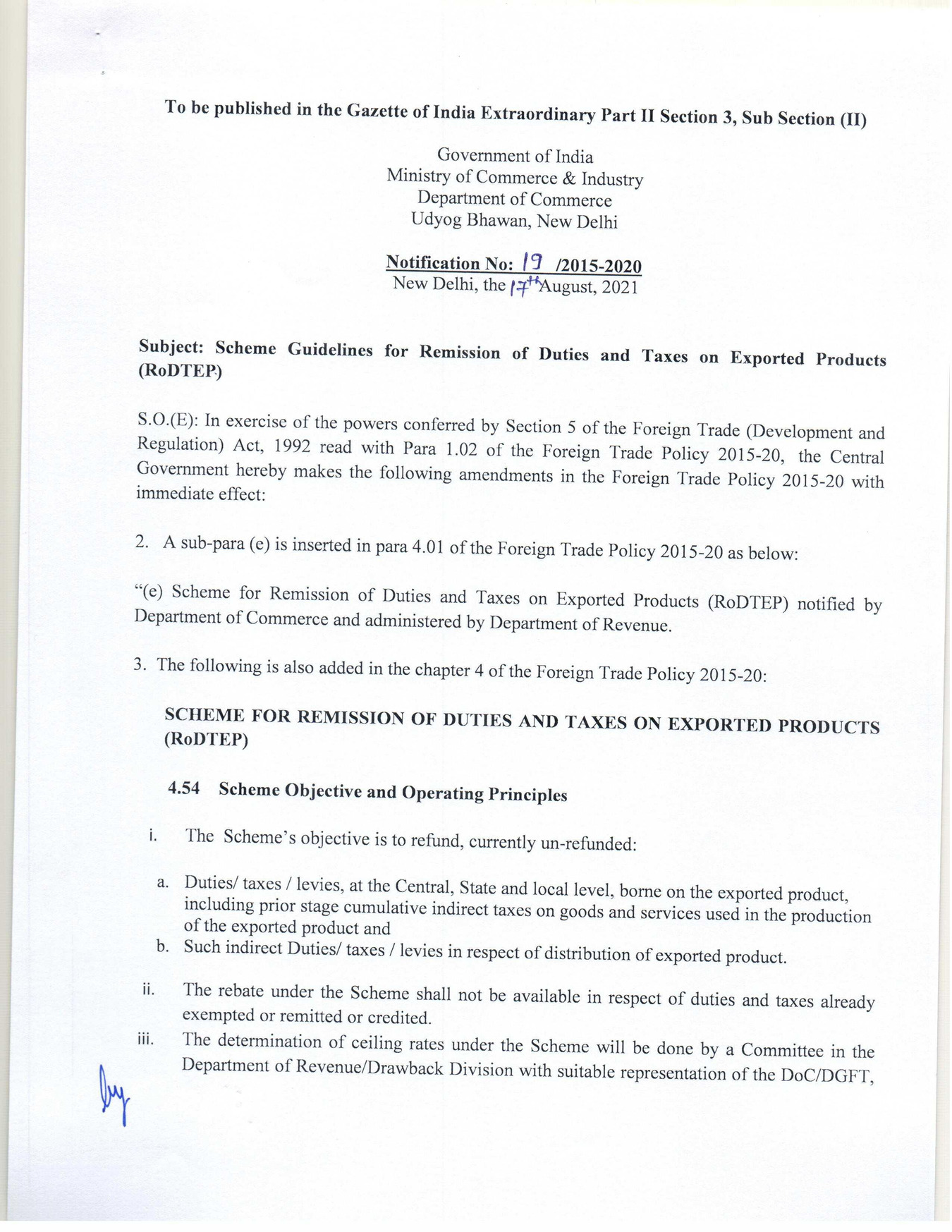

RODTEP Scheme 2026 guidelines available to download in PDF format at www.dgft.gov.in. The scheme guidelines for remission of duties and taxes on exported products (RODTEP) can be checked here. RODTEP scheme for zero rating of exports will boost India’s exports & competitiveness in the global markets.

RODTEP Scheme 2026

Central Government is leaving no stone unturned to support domestic industry and make it more competitive in the international markets. Export centric industries are being reformed and introduced to better mechanisms so as to increase their competitiveness, boost exports, generate employment and contribute to the overall economy. This will go a long way in achieving our vision of building an Aatmanirbhar Bharat.

Remission of Duties and Taxes on Exported Products (RoDTEP) is one such reform, based on the globally accepted principle that taxes and duties should not be exported, and taxes and levies borne on the exported products should be either exempted or remitted to exporters.

Objectives of RODTEP Scheme

RODTEP Scheme’s objective is to refund, currently un-refunded:-

- Duties/ taxes/ levies, at the Central, State & local level, borne on the exported product, including prior stage cumulative indirect taxes on goods & services used in production of the exported product, and

- Such indirect Duties/ taxes/ levies in respect of distribution of exported products.

It may be noted that rebate under the RODTEP Scheme shall not be available in respect of duties and taxes already exempted or remitted or credited. RoDTEP is going to give a boost to Indian exports by providing a level playing field to domestic industry abroad. RoDTEP support will be available to eligible exporters at a notified rate as a percentage of Freight On Board (FOB) value. Rebate on certain export products will also be subject to value cap per unit of the exported product.

The RODTEP Scheme is to be implemented by Customs through a simplified IT System. Rebate will be issued in the form of a transferable duty credit/ electronic scrip (e-scrip) which will be maintained in an electronic ledger by the Central Board of Indirect Taxes & Customs (CBIC). Identified export sectors and rates under RoDTEP cover 8555 tariff lines in addition to similar support being extended to apparel and made-ups exports under RoSCTL scheme of Ministry of Textiles.

Employment Oriented Sectors like Marine, Agriculture, Leather, Gems & Jewellery etc. are covered under the Scheme. Other sectors like Automobile, Plastics, Electrical / Electronics, Machinery etc. also get support. The entire valve chain of textiles also gets covered through RoDTEP & RoSCTL.