Kerala Financial Corporation (KFC) has started a new Chief Minister Entrepreneurship Development Programme (CMEDP) for entrepreneurs. KFC CMEDP Loan Scheme 2024 apply online process has been started at kfc.org. Now all the interested entrepreneurs can fillup KFC CMEDP Loans application / registration at official website through online mode. In this article, we will mention various aspects like eligibility, list of documents, application form filling process and other details about Kerala CMEDP Loan Yojana.

What is Kerala CMEDP Loan Scheme 2024

In a bid to rev up the business scenario, state owned Kerala Financial Corporation (KFC) has launched a new scheme for small and medium sector enterprises offering loans up to Rs 1 crore at 5% interest under the Chief Minister’s Entrepreneurship Development Programme. This new KFC CMEDP Loan Scheme is a revamped version of earlier CMEDP scheme in which loans upto Rs. 50 lakh is available at 7% interest rate. The loan limit under the new scheme will be changed to provide up to Rs. 1 crore at 5% interest.

Subsidy under Chief Minister’s Entrepreneurship Development Programme

Under the new KFC CMEDP Loan Scheme, Kerala government will provide 3% subsidy and 2% subsidy will be provided by KFC.

- The units looking for loans must have MSME registration.

- The age of the chief entrepreneur should be below 50 years.

- The age limit for SC/ST entrepreneurs, women entrepreneurs and Non-Resident Keralites is up to 55 years.

- Loans are available to start new ventures and modernize the existing ventures.

- The repayment period is up to 10 years.

The target is 2,500 enterprises in five years at the rate of 500 enterprises per annum. For this KFC will set aside 300 crore every year.

Eligible Units under Chief Minister Entrepreneurship Development Programme

- MSME Units

- Startups

- Units referred by NORKA

- Kudumbasree Units

- Agro-based Projects

- Electric Vehicles

Not Eligible Units under CM Entrepreneurship Development Programme

- Bar Hotels

- Transport

- Crusher

- Trading

- CRE Projects

- Contractor Loan

- Cinema / Serial Production

Eligibility of Promoters under KFC CMEDP Loans Yojana

- Age of two thirds of promoters should be less than 50 Years

- None of the promoters should be permanently employed

- CIBIL Score more than 650

- Promoters should not be member of any other entity promoted under the scheme

List of Documents Required for KFC CMEDP Loan Scheme Registration

Here are the list of documents for proprietor and unincorporated associations, partnership firm and private limited company.

Proprietor and Unincorporated associations – Above 5 lakhs

- Loan Application duly filled.

- Bio data of each promoter.

- Project Summary/Report/Quotation.

- Affidavit in Rs. 100 stamp paper.

- Copies of Aadhar (Promoters and Co-obligants).

- Copies of PAN (Promoters and Co-obligants).

- Copies of Udyog Aadhaar.

- IT Return (applicable for IT assessee).

- Competitive quotation for machinery.

- Estimate of Building (If any).

- Permission/Approval of local bodies for construction of Building.

- NOC from Pollution Control Board (If any).

- Sanction/Feasibility Certificate for KSEB.

- Copy of Approved Plan.

Partnership Firm – Above 5 lakhs

- Loan Application duly filled.

- Bio data of each promoter.

- Project Summary/Report/Quotation.

- Affidavit in Rs. 100 stamp paper.

- Copies of Aadhar (Promoters and Co-obligants).

- Copies of PAN (Promoters and Co-obligants).

- Copies of Udyog Aadhaar.

- IT Return (applicable for IT assessee).

- Competitive quotation for machinery.

- Estimate of Building (If any).

- Permission/Approval of local bodies for construction of Building.

- NOC from Pollution Control Board (If any).

- Sanction/Feasibility Certificate for KSEB.

- Copy of Approved Plan.

- Partnership Deed.

- Certified Extract from the Registrar of firms.

- Certificate of registration/Acknowledgement from Registrar of Firms.

Private Limited Company – Above 5 Lakhs

- Loan Application duly filled.

- Bio data of each promoter.

- Project Summary/Report/Quotation.

- Affidavit in Rs. 100 stamp paper.

- Copies of Aadhar (Promoters and Co-obligants).

- Copies of PAN (Promoters and Co-obligants).

- Copies of Udyog Aadhaar.

- IT Return (applicable for IT assessee).

- Competitive quotation for machinery.

- Estimate of Building (If any).

- Permission/Approval of local bodies for construction of Building.

- NOC from Pollution Control Board (If any).

- Sanction/Feasibility Certificate for KSEB.

- Copy of Approved Plan

- Memorandum of Association of Company.

- Articles of Association.

- Certificate of registration of the company.

- Detail Search Report with Share holding pattern.

- Resolution empowering MD/Director/Manager to avail loan from KFC.

KFC CMEDP Loan Scheme Application Procedure

- Online enquiry submission

- Document submission

- Branch verification

- Online Interview

- Training

- Sanction & Disbursement

How to Apply Online for Kerala Financial Corporation CMEDP Loan Scheme

STEP 1: Firstly visit the official website of Kerala Financial Corporation at https://kfc.org/

STEP 2: At the homepage, click at the “CMEDP Loans” link as shown below.

STEP 3: Upon clicking this link, the new page to check Chief Minister Entrepreneurship Development Programme documents and apply online process will open as below.

STEP 4: Then the KFC Online Loan Management System page to make online enquiry regarding CMEDP loans will open.

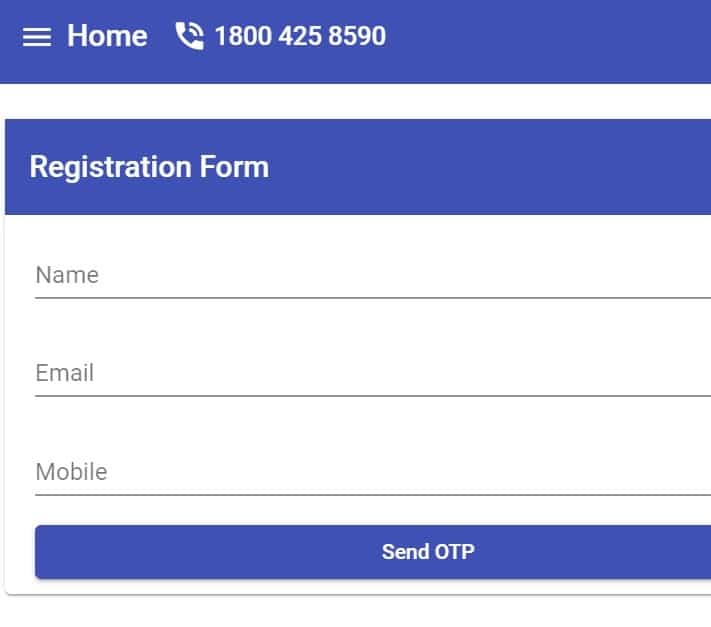

STEP 5: At this page, click at the “Customer Registration” link to open KFC CMEDP Loan application form for make online enquiry:-

STEP 6: Here applicants can enter name, e-mail ID, mobile number and click at “Send OTP” button to make CMEDP loan enquiry online.

Requirements for Submitting Loan Enquiries at CMEDP Loan Portal

This portal is for submitting loan enquiries. The requirements are as below:-

- Chief Promoter Details

- Unit Details, if you are an entrepreneur

- Unit & Promoter PAN details

Documents Required for Submitting Loan Enquiry

- PAN Card Copy

- Address proof (Aadhaar Card, Driving license, Passport and Voter’s id)

- Project Synopsis, 2 page description about the project plan

- Audited Financials, If available (Balance sheet/ P&L statements)

For more details, visit the official website at https://kfc.org/