Sukanya Samriddhi Yojana (सुकन्या समृद्धि योजना) is an ambitious scheme of Narendra Modi Led NDA Government to reinforce the idea of “Save for every girl child”. As a part of “Beti Bachao Beti Padhao” campaign, Sukanya Samriddhi Account Scheme is a small saving scheme.

The Sukanya Samriddhi Yojana will also encourage the parents to save for the girl child and spend on their education and marriage.

Sukanya Samriddhi Yojana - Latest Updates

2023

Sukanya Samriddhi Yojana Interest Rate 8.20% per annum (w.e.f 1 January 2024) which is calculated on yearly basis and then compounded yearly. People can check sukanya samriddhi yojana chart and calculate their interest earned through sukanya samriddhi yojana calculator. People can Compare All Post Office Schemes 2024 before making investment.

How to Open the Sukanya Samriddhi Account?

- Parents or the legal guardian can open an account for up to two girl child. In case of the twins or the triples, an exemption will be made on production of a certificate from authorized medical institutions.

- The account can be opened by the parents until the girl child attain the age of 10 years.

- The account can only be opened on the name of the girl child, the guardian will only be able to deposit the amount on behalf of the girl child.

- The account can be opened in Post office across India or the designate bank branches.

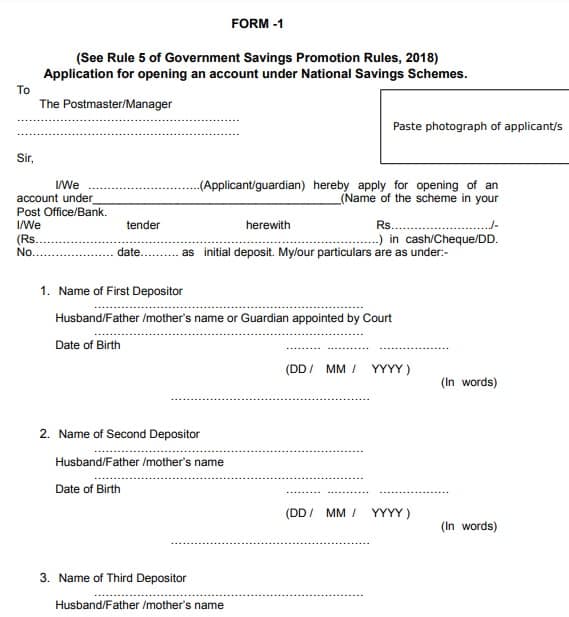

Sukanya Samriddhi Yojana Account Online Forms 2024

Here we are providing you the links of SSY Account Online forms which can be downloaded to open Sukanya Samriddhi Yojana Account.

- SSY Account Opening Form (FORM I) – Sukanya Samriddhi Yojana Account Opening Form Online

- SSY Application for Loan / Withdrawal (FORM 3) – Sukanya Samriddhi Yojana Application Loan / Withdrawal

- Application for Transfer of SSY Account (FORM 5) – Sukanya Samriddhi Account Transfer Form

- Application for premature closure of SSY Account (FORM 8) – Sukanya Samriddhi Account Premature Closure Form

- Application for Closure of SSY Account (FORM 9) – Sukanya Samriddhi Yojana Account Closure Form

Changes in SSY Guidelines 2024

1. Higher interest rate for default accounts

If people does not deposit even the minimum amount i.e. Rs. 250 in a financial year in the Sukanya Samriddhi Yojana account, it will be considered as an account in default. As per the newly notified rules, such “default accounts” will earn the interest rate applicable to the scheme, till the maturity date of the account, if not regularized till then. Previously, such default accounts earned only the post office savings bank interest rate. Default accounts due to death of guardian continue to be eligible for interest as per the scheme’s new rules.

2. Changes in rules for premature closure of account

As per the new scheme rules, the premature closure of a Sukanya Samriddhi account is allowed in case of death of the girl child or on compassionate grounds. The phrase “Compassionate grounds” would include situations such as medical treatment of the account holder for life threatening diseases or death of guardian. The old rules of the scheme allowed closure of the account in two cases i.e due to death of girl child and in case of change in residency status of girl child.

3. Operation of SSY account

According to the newly notified rules of SSY Scheme, the account cannot be operated by the girl child till she attains the age of 18 years as against 10 years as per old rules. As per the new rules, the account will be operated by the guardian till the account holder (i.e., the girl child) attains the age of 18 years. On attaining the age of 18 years, then necessary documents are required to be submitted to the bank/post office where the account is being held.

4. Opening of accounts for more than two girl children

There has been change in the additional documentation required for opening of account in case of more than two girl children. According to the newly notified rules, if accounts are to be opened in case of more than two girl children, then along with the birth certificates, an individual is required to submit an affidavit. The old rules required the guardian to submit medical certificate.

5. Other changes

Along with these changes, in the new rules of Sukanya Samriddhi Yojana, certain provisions have been removed and others have been clarified.The new rules have removed the provision of reversing wrongly credited interest in the account considering that as per the new rules the scheme interest now applies in case of all default accounts (and not the Post Office account saving interest rate). Also, under the new rules interest will be credited to the account at the end of the financial year.

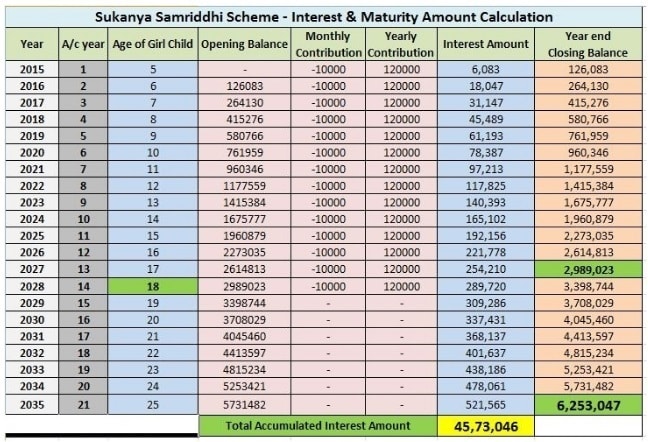

Sukanya Samriddhi Yojana Interest Rate Calculator Chart

Here is the complete chart for calculating interest rate of Sukanya Samriddhi Yojana:-

Salient Features of Sukanya Samriddhi Yojana Account

- Sukanya Samriddhi Account has an attractive interest rate of 8.20% (1 October 2024 to 31 December 2024) which is regulated by Ministry of Finance from time to time (on quarterly basis)

- The account can be opened in the name of girl child till she attain the age of 10 years.

- Only one account can be opened in the name of a girl child.

- Account can be opened in the Post Offices or notified branches of the commercial banks like HDFC Bank, ICICI Bank, PNB Bank, SBI Bank or any other bank across the country.

- Birth certificate of the girl child in whose name the account is opened must be produced and submitted.

- Account can be opened with a minimum amount of Rs. 250 and thereafter any amount can be deposited in multiples of Rs. 50/-.

- Deposits in an account can be made till completion of 14 years, from the date of opening of the account.

- A minimum of Rs. 250/- has to be deposited in a financial year.

- Interest @ as may be notified by the government from time to time will be calculated on yearly compounded basis and credited to the account.

- Maximum Rs. 1,50,000/- can be deposited in one financial year.

- One withdrawal shall be allowed on attaining the age of 18 years of account holder to meet education/marriage expenses at the rate of 50% of the balance at the credit of preceding financial year.

- The account can be transferred anywhere in India to any post office/bank.

- The account shall mature on the completion of 21 years from the date of opening of the account.

More information about Sukanya Samriddhi Yojana Account

- A penalty of Rs. 50 will be imposed if the account is not credited with the minimum amount.

- The guardians have to deposit amount for 14 years, no deposit is required after that till the maturity.

- A premature withdrawal (at the end of the previous financial year) of 50% of the accumulated amount is allowed after the girl child turns 18.

- The account can be closed after the completion of 21 years and the money can be withdrawn. If the amount is not withdrawn, it will continue to earn interest.

- As per Section 80C of Income Tax Act, the investment of Rs. 1.5 lakh per year including the earned interest will be completely exempted from the income tax.

Investment in Sukanya Samriddhi Yojana scheme is exempted from Income Tax under section 80C. The scheme offers Tax Benefit under TripleE regimen ie. Principal, interest and outflow all are tax exempted.

Documents Required for Opening an Account?

- Birth certificate of the girl child.

- Address and photo identity proof (PAN Card, Voter ID, Aadhar Card) of the guardian.

Sukanya Samriddhi Yojana primarily focuses on the girl child and is flagship scheme of the Indian Post Office and of the Modi Govt.

Moreover, this interest earned is better than than the other Post Office Savings Scheme like Public Provident Fund, Kisan Vikas Patra, National Savings Certificate Scheme etc.

Summary of Sukanya Samriddhi Yojana Account

Here is the summary of the Sukanya Samriddhi Yojana Account as follows:-

Who can open account

-> By the guardian in the name of girl child below the age of 10 years.

-> Only one account can be opened in India either in Post Office or in any bank in the name of a girl child.

-> This account can be opened for maximum of two girls in a family. Provided in case of twins/triplets girls birth more than two accounts can be opened.

Deposits

(i) Account can be opened with minimum initial deposit Rs. 250.

(ii) Minimum deposit in a FY is Rs. 250 and maximum deposit can be made up to Rs. 1.50 lakh (in multiple of Rs. 50) in a FY in lumpsum or in multiple installments.

(iii) Deposit can be made maximum up to completion of 15 years from the date of opening.

(iv) If minimum deposit Rs. 250 is not deposited in a account in a FY , the account shall be treated at defaulted account.

(v) Defaulted account can be revived before completion of 15 years from the date of opening of account by paying minimum Rs. 250 + Rs. 50 default for each defaulted year.

(vi) Deposits qualify for deduction under section 80C of Income Tax Act.

Interest

(i) The account will earn on the prescribed rate notified by Ministry of Finance on quarterly basis.

(ii) The interest shall be calculated for the calendar month on the lowest balance in the account between the close of the fifth day and the end of the month.

(iii) Interest shall be credited to the account at the end of each FY where account stands at the end of FY. (i.e. in case of transfer of account from Bank to PO or vice versa)

(iv) Interest earned is tax free under Income Tax Act.

Operation of Account

-> Account will be operated by the guardian till the girl child attains the age of majority (i.e. 18 years).

Withdrawal

(i) Withdrawal may be taken from account after girl child attains age of 18 or passed 10th standard.

(ii) withdrawal may be taken up to 50% of balance available at the end of preceding F.Y.

(iii) withdrawal may be made in one lump sum or in installments, not exceeding one per year, for a maximum of five years, subject to the ceiling specified and subject to actual requirement of fee/other charges.

Premature closure

(i) Account may be prematurely closed after 5 years of account opening on the following conditions : –

-> On the death of account holder. (from date of death to date of payment PO Savings Account interest rate will be applicable).

-> On extreme compassionate grounds

(a) Life threatening decease of a/c holder.

(b) Death of the guardian by whom account operated.

(c) Complete documentation and application required for such closure.

(d) For premature closure of account submit prescribed application form along with pass book at concerned Post Office.

Closure on maturity

(i) After 21 years from the date of account opening.

(ii) Or at the time of marriage of girl child after attaining age of 18 years. (1 month before or 3 month after date of marriage).

Sukanya Samriddhi Yojana Account Rules – Click Here

Sukanya Samriddhi Account Forms – Click Here

Compare All Post Office Saving Schemes 2024

Before making investment, people can also compare SSY to other Post Office Schemes like Public Provident Fund, National Saving Certificate, Kisan Vikas Patra, Post Office Savings Account, Senior Citizen Saving Scheme, Recurring Deposit – RD Account, Time Deposit (TD) Account, Monthly Income Scheme (MIS) – SSY vs PPF vs NSC vs KVP vs vs SCSS vs RD vs MIS vs TD vs Post Office Savings Account. Furthermore for details of all Post Office Savings Scheme, please visit – indiapost.gov.in

Sukanya Samriddhi Yojana Account – Highlights at a Glance

The important features and highlights of Sukanya Samriddhi Accounts are as follows:-

| Sukanya Samriddhi Yojana Interest Rate & Calculator | Minimum SSY Account Balance & Maintaining Balance |

|---|---|

| As the sukanya samriddhi yojana chart from 1 October 2024, SSY rate of interest is 8.20% calculated on yearly basis and compounded annually | Minimum amount is Rs. 250 and maximum ssy account is Rs. 1.5 lakh per year. Accordingly candidates can make investment in multiples of Rs. 50 in Lump Sump amount or in installments. Moreover, there is no limit on the number of deposits either in month or in FY. |

| Salient Features & SSY Tax Benefits | |

| |

Regional Offices for more information about Sukanya Samriddhi Account

References

More information about the scheme can be obtained from the official website of National Saving Institute at www.nsiindia.gov.in or indiapost.gov.in

how & where we can apply ?

Ability for all type of such yajana are not clear.

It is difficult to take benefit for common man.

wha is the benifit of sukanya yojna

Dear Sir i want This facility’s

thanks

Dear ser mere ladki ki age 8 ki k kya m sukanyan yojna kya labh l Santa hu please ser

dear ser mere ladki ki 01 ki hai mai sukanya yojana kara sakata ho

Mere ladaki ki age 8 sal hai

You can open an account in her name

हम बहुत गरीब हैं

ham bahut poor femily se hu mera a/c 728210110006466

sir me garib hu

please help

Me bahut garib hu mere 2betiya he kese kya hoga

Please help me

Mujhe salah chahiye mere do ladaki hai

Bahut garib hai ham log

Mai bahut garib hu mere do betiya hai

Maine apni beti ko achhi siksha Dena Carta hi par nahi de sakua 4000rs month salary hai meri

सर मेरी वेटी 4 वर्ष की है तथा वह पैरों से पूर्णतः विकलांग है क्या कोई सरकारी मदद मिल सकती है जिससे मैं उसका ईलाज करवा सकूं धन्यवाद

सर जी मेरी २ लडकिया है ४ साल की १ साल की क्या मेरी दोनो लडकियो को सुकन्या योजना का लाभ मिल सकता है मै उतरांचल से ह्ं

sir

mere do betiyanh 8y and 10y delhi se hun me es scheme (sukanya samrdhi) ki aur jankari ke liye kaha sampar karu taki hindi me details mile.

Sir mai ak garib kisan hoo meri do betiya hai Abhi unki shadi karne ke yogya ho chuki hai sir plz help me mo.8957229792

Sir maine 18mahine pahle suknya yojna ka form bhara muze abhi tak kuch reply nahi mila please help me

Sir meri beti 3 sales ki hai uske life keep liye kaon so yojna sahi rahe gi..

i need this yojana how to apply and which bank / post office

Sir me garib hu please meri help karna ji

Sir i help you my girl is 4

I am ramkumar verma sir dauther is jothi verma read in 8th class so help my dauther saving account open post office ho seke

सर मेरी वेटी 4 वर्ष की है तथा वह पैरों से पूर्णतः विकलांग है क्या कोई सरकारी मदद मिल सकती है

धन्यवाद

Mananiya pradhan mantriji mai ek kutchh she hu hamare pass apna ghar nahi hay Bhuj me awash yojna she ghar dilaie

sir meri sister 16year ki hai or pita ji privet job karte hai jisase ghar ka sirf kharcha hi chal pata hai or ham bahut garib hai kya yojana ka labh utha sakte hai plese es hamare mobail par coll kar ke bataiye mo-nu…,7518964920 plese

sir ji meri sister ki umar 16year hai or ham bahut garib hai kya es yojana ka labh utha sakte hai mo nu…-7518964920

plese bataiyega jarur sir ji

Jo bhi yojana hai bank wale batate nahi ..please bank me sudhar kijeeye…

सर मेरी तीन बेटी हैं 8,7,4, मै बहुत गरीब हूँ मुझे सरकार से कुछ मदद मिल सकती है

My daughter is three 8,7,4, iam very poor .

सर, मेरी बेटी 6 साल की हे मगर बैंक में उसका अकॉउंट नहीं खोल रहे कहते हे मार्च में आना और यहाँ सरकारी स्कूल भी 1.50km पर हे मज़बूरी में प्राइवेट स्कूल में पढ़ना पड़ रहा है मेरी तनखा भी कम है में बहुत परेशान हु

यह है योजना :इस अकाउंट में एक फाइनेंशियल ईयर में कम से कम 1 हजार और अधिक से अधिक डेढ़ लाख रुपया या इसके बीच की कितनी भी रकम जमा कर सकते हैं। यह पैसा अकाउंट खुलने के 14 साल तक ही जमा करवाना पड़ेगा। मगर, खाता बेटी के 21 साल की होने पर ही मैच्योर होगा। बेटी के 18 साल के होने पर आधा पैसा निकलवा सकते हैं।

21 साल के बाद खाता बंद हो जाएगा और पैसा गार्जियन को मिल जाएगा। अगर बेटी की 18 से 21 साल के बीच मैरिज हो जाती है तो अकांउट उसी वक्त बंद हो जाएगा। अगर पेमेंट लेट हुई तो सिर्फ 50 रुपए की पैनल्टी लगेगी। गार्जियन अपनी दो बेटियों के लिए दो अकाउंट खोल सकते हैं। जुड़वां होने पर उसका प्रूफ देकर ही तीसरा खाता खोल सकेंगे। खाते को आप कहीं भी ट्रांसफर करा सकेंगे।

ऐसे समझें फायदे को:यदि 2015 में कोई व्यक्ति 1,000 रुपए महीने से अकाउंट खोलता है तो उसे 14 साल तक यानी 2028 तक हर साल 12 हजार रुपए डालने होंगे। मौजूदा हिसाब से उसे हर साल 9.1 फीसदी ब्याज मिलता रहेगा तो जब बच्ची 21 साल की होगी तो उसे 6,07,128 रुपए मिलेंगे। यहां आपको बता दें कि 14 सालों में इस व्यक्ति को अकाउंट में कुल 1.68 लाख रुपए ही जमा करने पड़े। इसके अलावा बाकी के 4,39,128 रुपए ब्याज के हैं।

NOTE NAJDIKI POST OFFICE SE KHATA KULWANE KE BARE ME PATA KAREN.

सर मेए बिहार से हु मेरी दो लड़की है

yes sukanya samriddhi yojana

Sir

Mai ek vidhva hu or meri do betiya h jinhe me badi mehnat karke padha rahi hu par me kam padi likhi hone ke karan jada nhi kama pati aapse gujarish h ki meri betiyo ke liye or mere liye agar aap kuchh madad kar sakte ho to badi mehrbani hogi mujhe aapse peso ki madad nhi keval ek sarkari nokrib ka parbandh karva sake to badi mehrbani hogi

SUKANYA SAMRIDDHI YOJNA IS A COMMON FARMER

sir is yojana ko kha se samjna hoga

सर, मेरी बेटी 6 साल की हे मगर बैंक में उसका अकॉउंट नहीं खोल रहे कहते हे मार्च में आना और मज़बूरी में प्राइवेट स्कूल में पढ़ना पड़ रहा है मेरी तनखा भी कम है mere husband ne bhi mujhe chod rakha he में बहुत परेशान हु

सर, मेरी बेटी 6 साल की हे और मज़बूरी में प्राइवेट स्कूल में पढ़ना पड़ रहा है मेरी तनखा भी कम है mere husband ne bhi mujhe chod rakha he में बहुत परेशान हु

sir mai yogesh rinhayat mai berojgar

hun.mai koi business dalna chahta hun. lekin merepas paise nahi ho se mai sarkari madst lena chahta hun .

kya mujhe serkari mdat milsati hai.

agar yes hai to . madat lene ki prakriya bataye.

thenks.

I am ankita mishra. I want make singer but I have not family support and money but I know that l am talented girl please believe me and help me l am talented girl please believe me and help me i want platform where i achieve my dream

Sir

मै जलगाँव जिल्हा से शांताराम बडगुजर हु जैसे कि आपने कहा था बेटी के जन्म पर आप माता को 6000/-कि राशी देने का निर्णय लिया था मगर यहा कोई भी आशा बाई ठिक तराह से नही बता पाते कहते है घोषना तो हुई है पर हमे कोई जानकारी नही है कुपया आप सायता करे

धन्यवाद!

Sir jii plsszzz help me

Mere papa nhi h or meri 1 hi sister h or mere pass koi job werk nhi h jisse kuchh help ho sake ..

Aapse vinamr nivedan h ki meri kuchh help kare jiiiiiii thanxxx

dear sir,

meri ek beti h , uski age 5 years ki h to plesae aap mujhe ye bataiye ki mai uska a/c bank me bhi khulwa sakta hu ya nahi, agar haa to kon si bank me

please reply me

thanks

Sir maire ladki ki age 13year hai kya mai es yojana ka lakh le skta hu please help

hello sir.

mai local class ki family se hun pr mai ek baat puchna chahta hun .

pta nhi jawab milega ya nhi pr puchunga jarur ……….

mere sawal hai ki jo yojna humari behno ke liye hai wo humari behno tak nhi pahuchai jati iska karn ….Kya kisi yojna ke liye hume ye proof krna padega ke hum Indian hai ya fhir ye btana padega ke hum jis gao me rhte hai wha hume koi janta nhi …bs yhi hai……

……..

kai yojna hai…..

1- Ladli yojna.

2- awas yojna.

3- kanya Daan yojna.

(Pta nhi ke aap iis baat pr dyaan de ke na de ..woo aap ke upr hai. Namskar?)

??

☆Mara sawal kanya Daan yojna . ke taht hai pichle 18 month se mai iis yojna ke bare me sunte aa rha hun .pr abhi tak maine ye nhi suna ke kisi ladki ki shadi me use iis yojna ka labh huaa hai..

…kyu sir Kya ye yojna village ke bade ghar ki betiyo ke liye hai ya fhir kuch garib logo ke liye bhi hai….

ek baar maine ek village ke AAdmi ko btaya ke aap ki beti ki shadi me sarkar se thodi madad lelijiye too unho ne kha humare liye nhi hai …

hum too bahut bade AAdmi hai..hum dusro ghar me kaam krte hai dusro ke kheto me anaaj ugate hai .hum garib nhi..hai….

….garib wo hai jo har saal gadi badlte hai ..her baar pardhan bante hai..garib too wo hai….Sun ke acha lga….Maine kha Aapne form bhraa hai too unho ne kha kosis too ki thi pr form hi nhi dekhne ko mila …

Meri AApse viniti hai ke aap iis yojna me lagne wali sb I’D ke naam mujhe btaye ager ..Aap garib bhaiyo ke bare me sochte hai too..

Mujhe jawab 5 din ke andar milna chahiye .

AAp ki kirpa hogi..mujhe mere whatsup no.pr bhi bhej sakte hai..

Mobail. no-07080057180

…………. DHANYAWAD.

21/03/2017

मै आपलोगों का मदद करा सकता हूँ लेकिन आप संपर्क करे 9120381113

sonam khan ji —-

सोनम जी आपका मदद जरुर होगी संपर्क करे 9120381113

mari sister 18 saal ki hai aur B.A.1st year ki student hai kya use Sukanya Samriddhi yojana ka labh mil sakta hai……..plz

AB nahi mil sakta, keval 10 saal ki age tak

madad krdo meri

I have four girls 1, 8, 10, 14 year old. What you help me

Mere three Beti he 1. 9year. 2.4year. 3. 1manth ki he

Me rajasthan se hu privet job me hu Hume koi ase jankari nhi he

Beti to Beti he dekte he keya hota he

Sar hum baut Persaan hai mari bahan ki sadi hai 28 4 2017 ki sadi baut peresaan ho plz help me 8923102172

Sar plz halpern me

sir

i want to sarkari job please help me.

sir,

i want to sarkari job please help me.

my watsaap number 8340694056

Sir main bahut garib hu aur B A. 2016 me ho gaya tha aur ab mujhe koi job nhi mil pa rhi… Aap hamari help kijiye sir

Sir,meri do betiya 21,18 year ki h m bahut garib hu mujhe bhi kiya samridhi yojna ka labh mil sakta h

Sat Mari 2 Grals ha jasma 1grals 7 year or ha or 1 Grals 5 year me ha Jo bade Grals ha Uska miend ka 1 saide ka is ishaa kame Na karta to Sar muja koi sarkary halo male Sakti ha mare mob 9138238611 par coll Kare place help

Sar me sanjeev singh apni garivi me bhut paresan hou ,meri bhan ki sadi agle do mahene baat hai aue meri theen bhan aur hai to plase sar meri kuch madat karo aapka bhut aabari rauga

Sar

Me sanjeev singh me bhut garib hou meri theen bhan hai unme se do ki sadi karni hai meri kuch madat karte to me aap ka bhut aabari rahuga .hum aapke upar bira bisbaas banaye hoye hai plasse aap muj par thoda dhyan de de to meri paresani khatam ho jaye .sadi me dhula bhuy saara saman mag raha hai aap to jante hai ki ham garib log otna khan se karege .plase halp me sar .aap ka garib sanjeev singh.

Sir

Mera nam Sk Habibulla.mera 2 ladki.nam Taniya parvin age-9 years and Tanjila Parvin age-7 years.

Meine Bohut gorib admi.

Vill -Goran Khali P,O-Barbasudev pur P,s-Sutahata Dist -Purba Medinipur Pin-721645

STATE-WEST BENGAL

MOB-9679835235 -8921925614

Vinodbhai nandniben majethiya

Me bhut hi garib abami hu me meri 2 bachi he to sukniya sanriddhi me labh milsakta he pls muje bataye

Hello sir ,meri AK beti 21year old hai.mujhe Sukanya samriddhi yojna se labh mil Sakta hai to mujhe es no.9983653821 pr suchna de

Sir mai apni Behen ke liye iss yojna ka labh kaise le sakta hu sir please help me…

Sir Maine post office me sukanya dhan yojana ke tahat accaunt khola hai. Sir hame kitana jama karane par kitana Paisa milega. Kripaya batane ki kripa kare

Sir

जैसे कि आपने कहा था बेटी के जन्म पर आप माता को 6000/-कि राशी देने का निर्णय लिया था मगर यहा कोई भी आशा बाई ठिक तराह से नही बता पाते कहते है घोषना तो हुई है पर हमे कोई जानकारी नही है कुपया आप सायता करे

धन्यवाद!

hello sir

Mai ek gareeb parivar se hu mai ek sarkari job pana chahata hu plz meri help karo

hello sir

Mai ek gareeb parivar se hu mai ek sarkari job pana chahata hu plz meri help karo my contact no 8564831204

RAJNI MAHAWAR

RESPECT SIR

SUKANYA YOJNA -KYA IS YOJNA KA LABH MERI CHOTI SISTER ,JO KI 4 SAAL KI HAI USKO IS YOJNA KA LABHA MIL SATA HAI .

PLEASE SIR

RAJNI MAHAWAR

SIR/MAM

MERI 4 SAAL KI SISTER HAI KYA USE IS YOJNA KA LABH MIL SAKTA HAI

Hello sir mai ek gariv ghar se hun mai koi job karna chahta hun mere pas paise bhi nahi hai please sir my halp my contect no:8393872316

sir meri beti 5 sal ki hi. mai apani beti ka name school me nahi likhava paya hu

sir mai bahut garib hoon

pleas help sir

Jise bhi kam chahia o is no par call Kate

8319708695

jitendra sonwani

Sir mai 20saal ki hu kya mujhe ab kanya yojna kaa labh mill skta h mai bhut hi grib ghr se hu ur mai age ki pdhai puri krna chahti hu to kya koi aose yojna h ki mai apni pdhai v puri kru ur kuch kaam v kr lu apni pdhai ko puri krne ke liye,,,,,,,,,agr aise koi yojna h to plzzz sir mujhe ish no pr call yaa fir msg kr ke jankari de…….9140704340

pm ji prenam hmari delhi main bahut gunda gardi or bahut bherta char ho rha hain or ladkiyo ke saat raip muder kidnup bahut ho rhe hain delhi main hi kiya over india ye sub ho rha hain aap to pm ho ye apke haat ke haat main rokna hain pls sir sub rokdo tbhi hmara desh aage berd sakta hain thank;s [sir meri wife prengnet hain or mere do ladki hain or main bahut garib hu or salry meri 7500 rupee or rent per rhata hu meri famly histri my aadhaar no 860328816753 my doter no 10472997820360 meri wife ka or choti doter ka abhi aadhaar bna nhi hain mobile no 9871773421

Sir agar ham 1000 se niche ka bima krana chahe to kya ho sakta hai

Sir me

Barwani.jile…ka ek nagrik hu sir me 4 hajar rupey mahine.ki majduri karta hu.meri.4 saal ki ladki he or.1 saal ka ladka he….sir agar apki koi madad mil jay to .bhut mehrbani ……..thanks

Sir me

Barwani.jile…ka ek nagrik hu sir me 4 hajar rupey mahine.ki majduri karta hu.meri.4 saal ki ladki he or.1 saal ka ladka he….sir agar apki koi madad mil jay to .bhut mehrbani ……..thanks

Sir, mai 49year old lady.sir.mai apnay dhar say khana bana kay ek dukan may jakar bechti hun .par sir ussy mare family nahi chal pa rahi hai muskil may hai.agar apkey dafter say kuch help milta hai to mare family bach jayga.

Hi u can send me u r full dettail

i like it

Jai sadguru.. Sir..

Sir me… Hamare ganho ki logonko batana chatahu Hamare deska paradha mantri Sir ka tarap se he suvedha Diya jarahahe he. Kui ke Hamare ganho me koi padlika nai sir..

मैं आपका अच्छा फ्रेंड हूं

sir meri bahan ki shadi ke liye thodi madat mil jaye to me aapaka aabharri rahunga mere papa hat majuri karte he vo paisa kaha se layenge agar aap mujhe thodi madat kar denge to me aapko nokri lagjaunga tab lauta dunga yakin kariye sir

Susanya Sam ridding yojana

Sir mera name sounu Kumar hai sir m bahut garib hu sir meri ek beti hui hai 6/11/2017 ko block tundla m sir meri bi sukanya samriddhi yojna m meri beti ka name bi likh lo sir apki ati kirpa hogi village mohablli post bhoudela dist firozabad Uttar Pradesh 283204

गोरखपुर हरिभानपुर नाम गौरव कुमार

गोरखपुर हरिभानपुर नाम गौरव कुमार 9793031622

sir may bohut gorib poribar ka hoon mera koi pise suport karne wala nhi hai mere ghore me mera maa aur budda baba hai may kama ke poribar ko bachata hoon muskil vhi hota hai lekin kha karu baas thora sa

sarkar tarap se help mile assa hai,,,,,,,,, jai hind

sir ,,,,nomoskar sobko ghore mil raha hai lekin mera papa ko nhi mil raha sir exsuali haam log bohut gorib hoon koi sarkari subiday nhi milta hai sir ,,,,mera papa ka naam,,,madan das

villeg,,choto kolia

dist-dhubri(assam)

post office- fakirganj

police station- fakirganj

pin no.783330

house no.47

pls pls pls help sir

Nice Excellent

Hello

I’m ajaypal singh from Rajsthan.

sir,Yadi mai 1.50rupess pr year jaam krvata hu to mujhe tax pay krna hoga kya..???

I am Suresh Tilakchand Choudhari At-Chulod Post-Dattora Th+Dist -Gondia Maharashtra 441614

Mai Computer Operater hoo {Digital India } income ke baare pucho hi mat ji grampanchayat se chaq bhejte hai csc, aaple sarkaar ko lekin pyement atta paata nahi rahata 9 month ho chuke payement nahi hai.ab our kya bole aap sabhi kuch malum hai .Meri beti hai Manasvi Choudhari. Date of Birth 14/08/2015 kirpa karke ye name plz accept karo ji .Mob.9765989305

Latest yojna

Please Full Detail Provide in this Scheme

dir sir

My daughter date of birth is 21-5-2019,can I open the ssy account.

Good

This post is really nice and providing the better information.Thanks for sharing this information with us.

good

sar mjhe bhi yojna ka labh chahiye

riya singh (9598222553)

sir mera nam shruti h kya aap mjhe iske bare me aur jankari de denge.

9820119919

I have opened Sukanya Samriddhi yojana account in post office before 5 days. PO provided me passbook with entry of first installment deposit. I requested for receipt for the deposit amount. They didn’t provide the same and explain that, You can show by the passbook.

When I send the passbook photo copy for investment proof to Payroll department. they replied me “for benefit under Sukanya Samriddhi Yojana (for Girl Child), Photocopy of Receipts is required from your side.”

I am trying to call the help line but all the provided numbers are not in working condition. I tried on “18002666868” and “01126862526”.

How I can get the benefit on income tax. request you to please reply here.

My contact number is 9806828552.

(Er. Anil) can i know how to apply?

6306178953

last 5 years iam paying on Sukanya samridi yojana , but recently post office officials saying that there was a circular from government, saying that other than parents , legal guardian name recorded on child pass book will be no more allowed to pay further in this scheme

kindly advice for the rectification 7356687209

Sir Yadi Apko Contant Writer Ki Jarurt Ho To Kripya Muje Batye Me Contant Write Kar Sakta Hu