Pradhan Mantri Mudra Yojana (PMMY) 2024 Online Application Form

Published on sarkariyojana.com

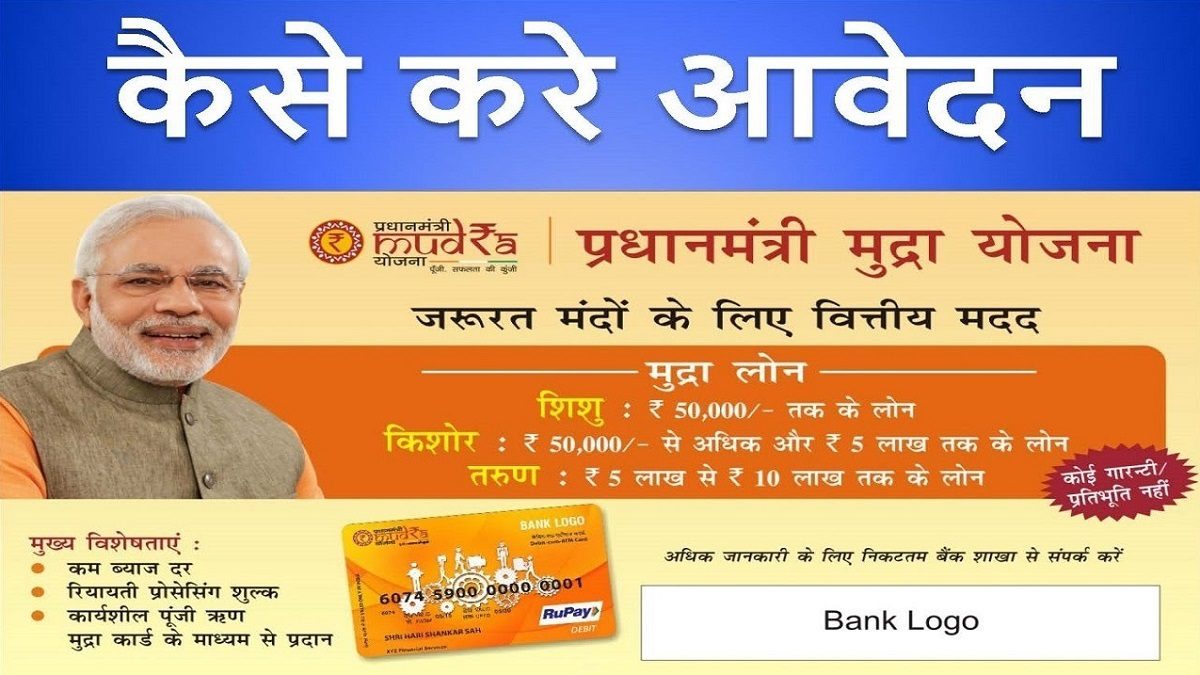

Prime Minister Mudra Yojana Application Form PDF: Pradhan Mantri Mudra Yojana (PMMY) is a special scheme by central govt. of India through MUDRA (a subsidiary of SIDBI). MUDRA supports institution to extend loans to the non-corporate non-farm sector income generating activities of micro and small entities. It is subject to those enterprises with credit needs below Rs. 10 lakhs. Both udyamitra.in and mudra.org.in are the official website of Pradhan Mantri Mudra Yojana.

PM Mudra Loan Yojana 2024 will also help in creating an ecosystem of growth for micro enterprises sector. The interventions have been named “Shishu”, “Kishor” and “Tarun” to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur. Basically, MUDRA Yojana is an initiative to fund the small business in India.

All those people who wants to get loans under PM Mudra Yojana can apply online by filling PMMY application form at www.udyamimitra.in. Moreover, people can also download PM Mudra Loan Yojana application forms in PDF format through www.mudra.org.in.

PM Mudra Yojana (PMMY) 2024 Apply Online

Mudra Loan Scheme aims to attain development in an inclusive and sustainable manner by supporting and promoting partner institutions. Below is the complete process to apply online by filling Pradhan Mantri Mudra Yojana Application Form 2024:-

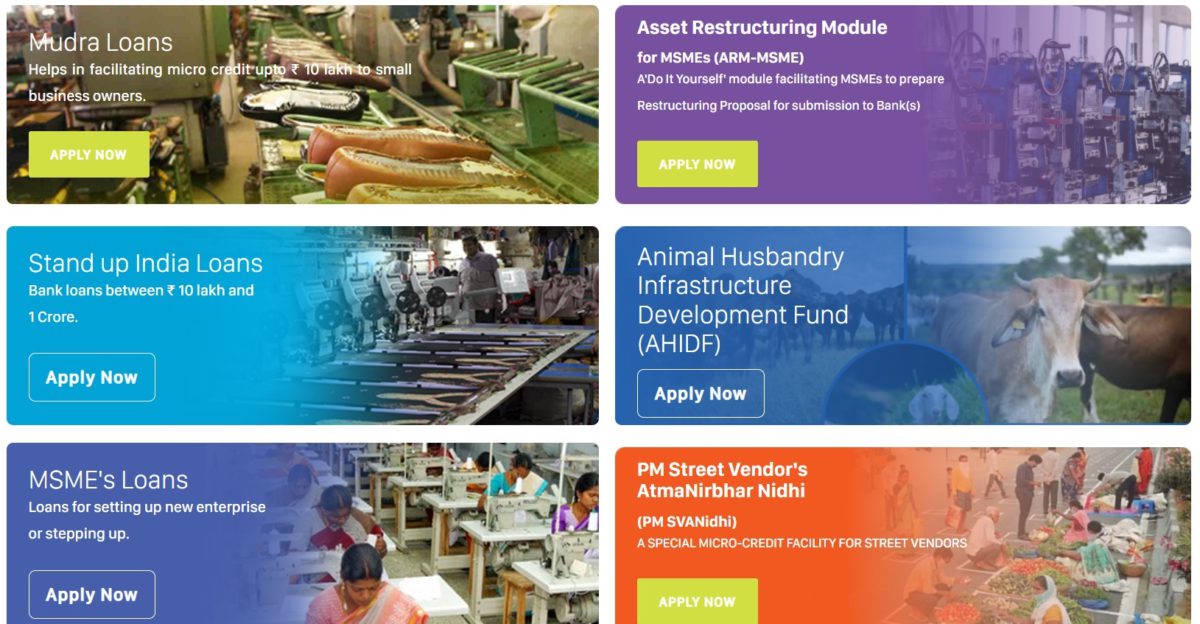

STEP 1: Firstly visit the official PMMY website at https://www.udyamimitra.in/

STEP 2: Applicant can scroll down the home page and click at “Apply Now” link under “Mudra loans” tab.

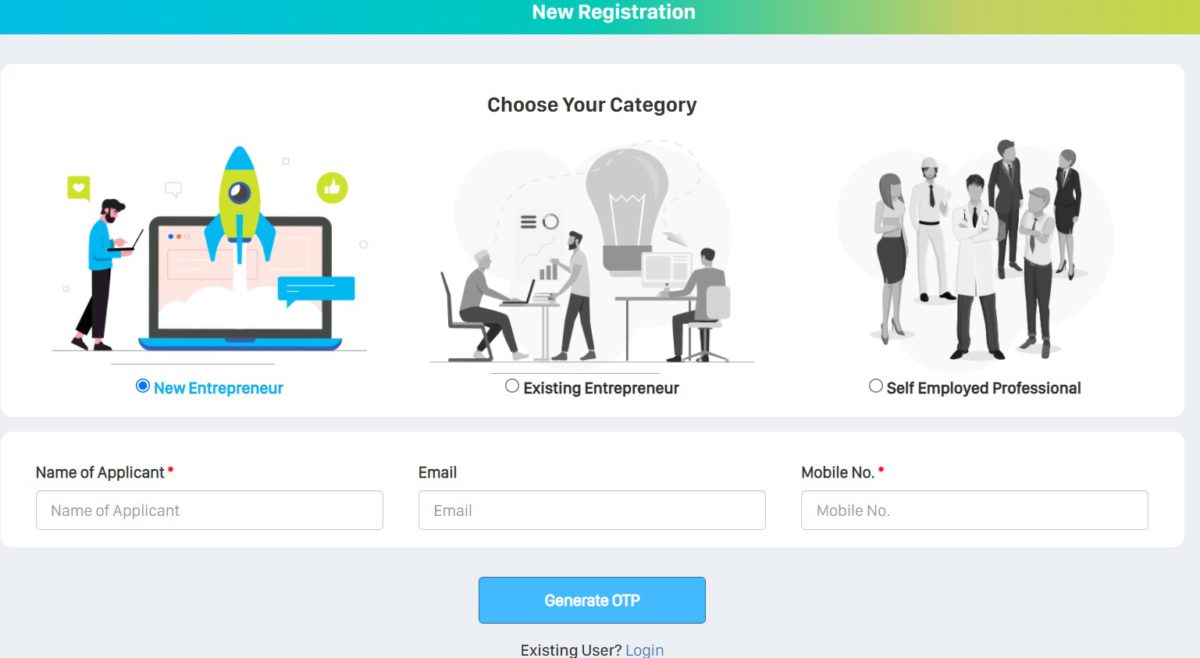

STEP 3: Upon clicking the link, PM Mudra Yojana online registration form 2024 will appear as shown below:-

STEP 4: Here enter name of applicant, e-mail ID, mobile number and click at “Generate OTP” button. Next Verify OTP to complete the registration process.

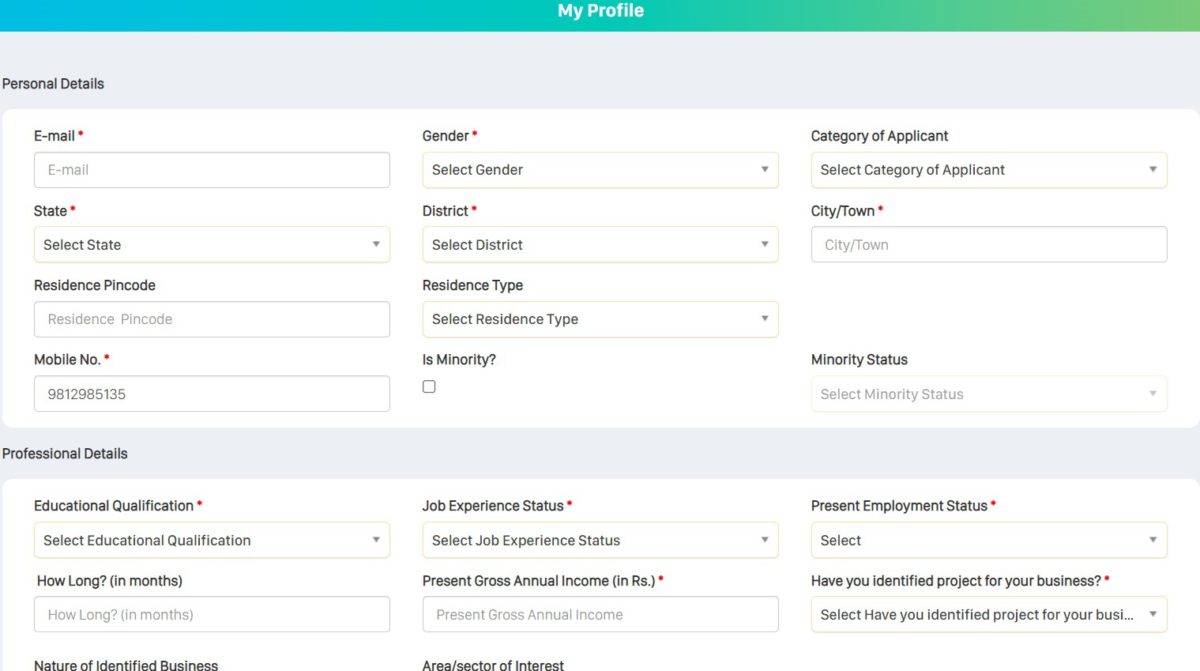

STEP 5: In the next step, applicants can complete their profile to fill PM Mudra Loan Yojana online application form.

STEP 6: Accordingly, enter all the personal and professional details and click at the “Submit” button to complete the Pradhan Mantri Mudra Yojana online apply process.

Before applying for a loan, view the checklist which can help you to fill up your application faster.

PM Mudra Loan Application Form PDF Download

Pradhan Mantri Mudra Yojana (PMMY) is open and is available from all Bank branches across the country. All the applicants can even download the Prime Minister Mudra Yojana application forms in PDF format through the link given here – https://www.mudra.org.in/Home/PMMYBankersKit

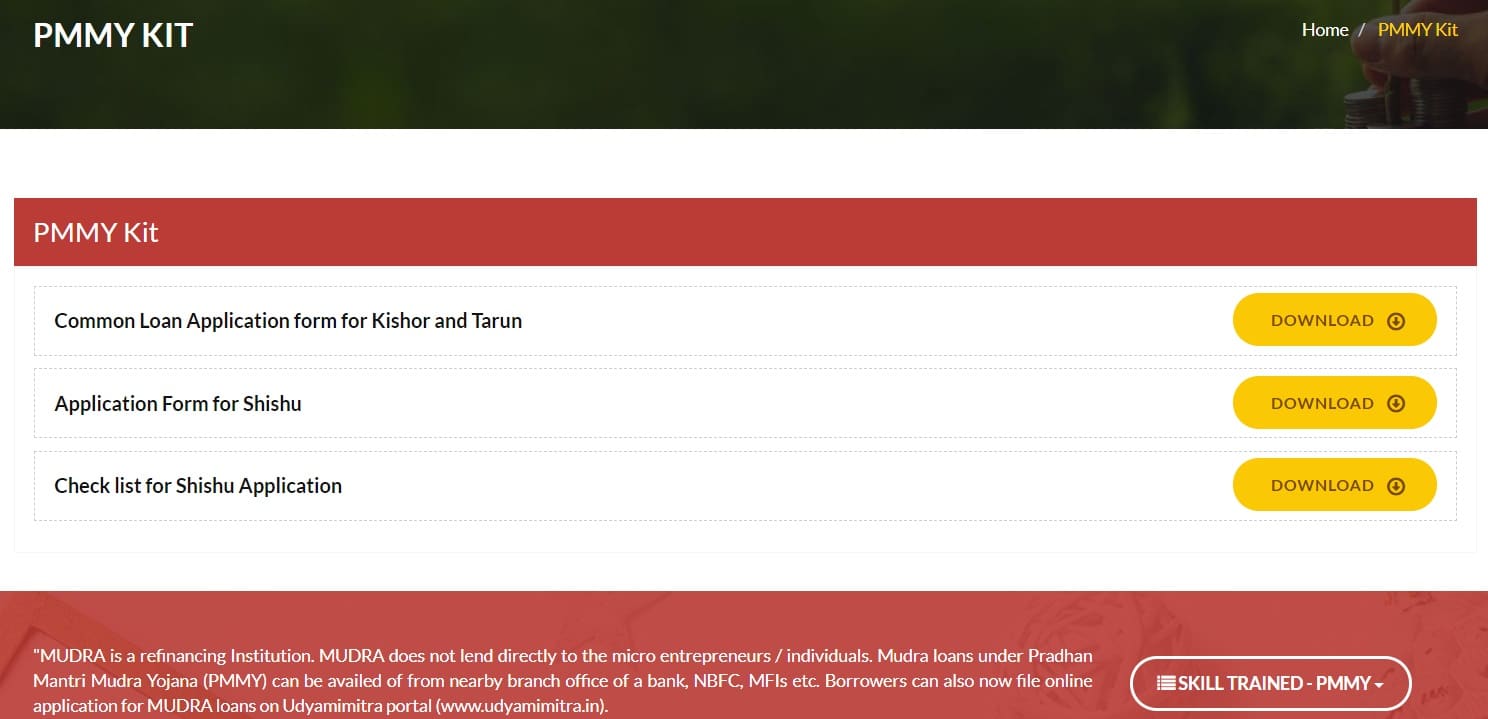

The PMMY bankers kit to download application forms for Shishu, Tarun & Kishor component under Pradhan Mantri Mudra Yojana will appear as below:-

MUDRA Loan Application Form for Shishu Loan

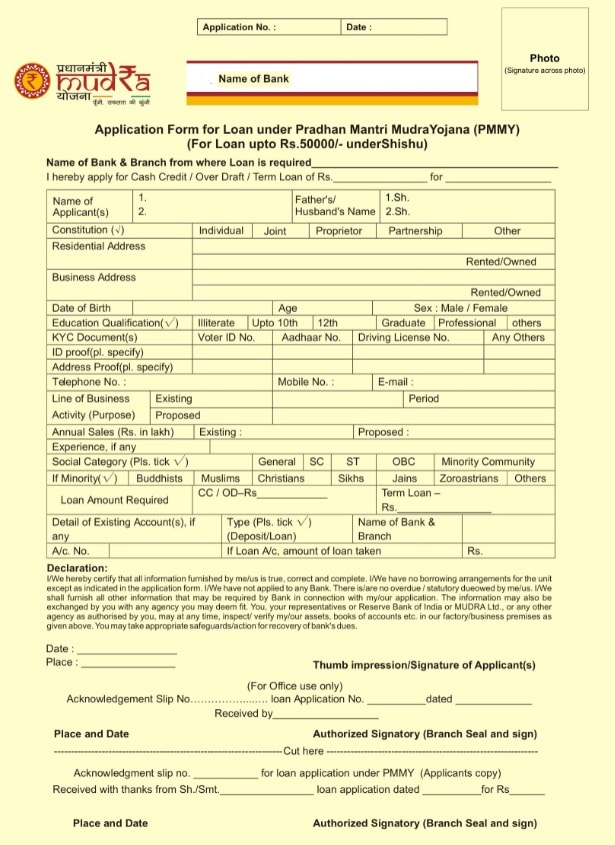

Click at the download option in front of “Application Form for Shishu” in PMMY Bankers Kit to open Shishu Loan Apply Offline Form PDF:-

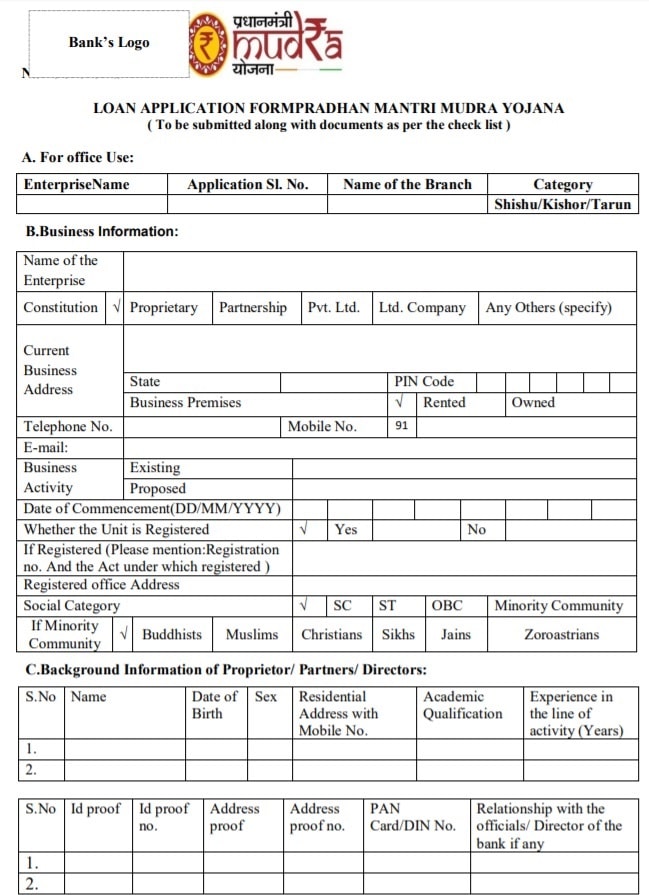

MUDRA Loan Application Form for Tarun / Kishor Loans

Click at the download option in front of “Common Loan Application form for Kishor and Tarun” in PMMY Bankers Kit to open Kishor / Tarun Loan Apply Offline Form PDF:-

Also view the checklist for filling PMMY Shishu Loan application form in the PMMY bankers kit.

What is Pradhan Mantri MUDRA Loan Yojana

Micro Units Development & Refinance Agency Ltd. (MUDRA) is an institution for development and refinancing micro finance institutions such as banks, NBFCs, MFIs and Other financial intermediaries, which are in the business of lending to manufacturing, processing, trading and service sector activities whose credit needs is less than Rs. 10 lakh.

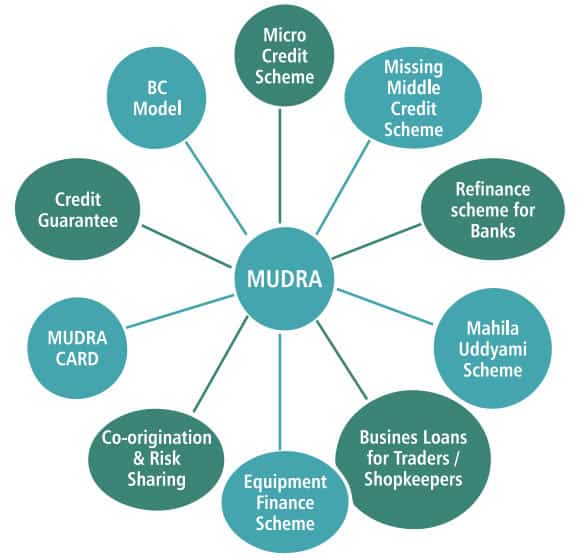

MUDRA provides refinance Support to banks, NBFCs / MFIs for PMMY. Other than the refinance product, MUDRA will also provide development support to the sector through other products. The other product offerings as depicted in the diagram below will be targeted across the spectrum of beneficiary segments.

Who can avail the MUDRA loan under PMMY

All non-farm sector income generating activities such as manufacturing, trading and services whose credit needs below Rs. 10 lakh are known as MUDRA Loans under Pradhan Mantri Mudra Yojana (PMMY).

Types of Loans under Pradhan Mantri Mudra Yojana (PMMY)

However there is certain eligibility criteria to get a loan under MUDRA Yojana. Any individual including women, proprietary concern, partnership firm, private limited company or any other entity are eligible applicant under PMMY loans. Under the aegis of Pradhan Mantri MUDRA Yojana (PMMY), MUDRA has formulated three Schemes to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur:-

- Shishu: Loans upto Rs. 50,000. This stage would cater to entrepreneurs who are either in their primitive stage or require lesser funds in order to get their businesses started.

- Kishor: Loans above Rs. 50,000/- and up to Rs. 5 lakh. This section of entrepreneurs would belong to either those who have already started their business and want additional funds to mobilize their business.

- Tarun: Loans above Rs. 5 lakh and up to Rs.10 lakh. If an entrepreneur meets the required eligibility conditions, he/she could apply loan for upto Rs.10 lakhs. This would be the highest level of amount that an entrepreneur could apply for a startup loan.

The MUDRA loans under the PMMY can be taken from the approved Non Banking Finance Companies (NBFCs), Micro Finance Institutions (MFIs), Public/Private Sector commercial banks and Regional Rural Banks (RRBs) across India. The loans will be sanctioned by the lending institutions as per the eligibility.

Eligibility Criteria for PM Mudra Loan Scheme 2024

All the applicants must fulfill the basic eligibility criterion to become eligible for bank loans under PM Mudra Yojana 2024. The business should be either one of the following:-

- Small manufacturing enterprise

- Shopkeepers

- Fruit and Vegetable vendors

- Artisans

- ‘Activities allied to agriculture’, e.g. pisciculture, bee keeping, poultry, livestock, rearing, grading, sorting, aggregation agro industries, diary, fishery, agriclinics and agribusiness centres, food & agro-processing, etc.(excluding crop loans, land improvement such as canal, irrigation and wells).

List of Documents Required for Mudra Yojana Bank Loan

- Self certified copy of identity proof such as Voter ID card / PAN Card / Aadhar Card / Passport / Driving License.

- Residence proof which may contain recent telephone or electricity bill, property tax receipt (not older than 2 months). Voter’s ID card, Aadhar Card & Passport of the borrower can also act as proof of residence.

- Proof of SC/ST/OBC/Minority.

- Copies of relevant licenses/registration certificates/other documents pertaining to the ownership, identity and address of business unit.

- The applicant should not be a defaulter in any Bank/Financial institution.

- Statement of accounts (for the last six months), from the existing banker, if any.

- Balance sheets of the units along with income tax/sales tax return etc of the last 2 years. (Applicable for all cases from Rs. 2 Lacs and above).

- Projected balance sheets for one year in case of working capital limits and for the period of the loan in case of term loan (Applicable for all cases from Rs. 2 Lacs and above).

- Project report (for the proposed project) containing details of technical & economic viability.

- Sales achieved during the current financial year up to the date of submission of application.

- Memorandum and articles of association of the company/Partnership Deed of Partners etc.

- Asset & Liability statement from the borrower including Directors & Partners may be sought to know the net-worth in the absence of third party guarantee.

- 2 copies of Photographs of each Proprietor/ Partners/ Directors.

PM Mudra Loan Yojana Helpline Number (Contact)

The borrowers who wish to avail MUDRA loan assistance under PMMY can contact directly to the banks, partnered financial institutions and non banking finance companies or the MUDRA nodal officers. MUDRA has identified a total of 97 Nodal Officers across the country at various SIDBI regional/branch offices to act as “First Contact Person” for MUDRA. Below are the links to access the Toll free helpline numbers, list of Nodal officers, banks nodal officers, PMMY mission office contact details and PMMY offices in Mumbai.

PMMY Toll Free Numbers

Bank’s Nodal Officer – PMMY

MUDRA Nodal Officers

MUDRA Officers – Mumbai

PMMY Mission office Contact Details

Progress of PM Mudra Loan Scheme

Here is the year wise progress of PM Mudra Loan Scheme which is defined here:-

Financial Year 2015-2016

- Number of PMMY Loans Sanctioned: 3,48,80,924

- Amount Sanctioned : 137449.27 crore

- Amount Disbursed : 132954.73 crore

Financial Year 2016-2017

- Number of PMMY Loans Sanctioned: 3,97,01,047

- Amount Sanctioned : 180528.54 crore

- Amount Disbursed : 175312.13 crore

Financial Year 2017-2018

- Number of PMMY Loans Sanctioned: 4,81,30,593

- Amount Sanctioned : 253677.10 crore

- Amount Disbursed : 246437.40 crore

Financial Year 2018-2019

- Number of PMMY Loans Sanctioned: 5,98,70,318

- Amount Sanctioned : 321722.79 crore

- Amount Disbursed : 311811.38 crore

Financial Year 2019-2020

- Number of PMMY Loans Sanctioned: 6,22,47,606

- Amount Sanctioned : 337495.53 crore

- Amount Disbursed : 329715.03 crore

Financial Year 2020-2021

- Number of PMMY Loans Sanctioned: 5,07,35,046

- Amount Sanctioned : 321759.25 crore

- Amount Disbursed : 311754.47 crore

Financial Year 2021-2022

- Number of PMMY Loans Sanctioned: 5,37,95,526

- Amount Sanctioned : 339110.35 Crore

- Amount Disbursed : 331402.20 Crore

Financial Year 2022-2023

- Number of PMMY Loans Sanctioned: 6,23,10,598

- Amount Sanctioned : 456537.98 Crore

- Amount Disbursed : 450423.66 Crore

Financial Year 2023-2024

- Number of PMMY Loans Sanctioned: 2,58,32,099

- Amount Sanctioned : 203659.87 Crore

- Amount Disbursed : 197566.76 Crore

The state wise details of loans/money sanctioned under the PM MUDRA Yojana can be found at https://www.mudra.org.in/