Agriculture Infrastructure Fund Scheme 2024 Registration / Login at agriinfra.dac.gov.in Portal Online

Published on sarkariyojana.com

Central government is inviting Agriculture Infrastructure Fund Scheme 2024 Registration / Login at agriinfra.dac.gov.in. Farmers can now apply online for loan at the official Agriculture Infrastructure Fund Portal. AIF is a part of India’s Aatmanirbhar Bharat Package which was launched by PM Narendra Modi with a finance facility of Rs. 1 Lakh Crore for the next 4 years. Under the Agriculture Infrastructure Fund, the central government would bear about 3% interest subsidy per annum on the loans provided. In this article, we will tell you about the scheme registration, loan amount, interest subsidy, how to apply, who can make registration and complete details.

What is Agriculture Infrastructure Fund Scheme 2024

The Agriculture Infrastructure Fund scheme is aimed at enabling the farmers to get greater value for their produce as they will be able to store and sell at higher prices, reduce wastage, and increase processing and value addition. A loan of up to Rs. 2 Crore will be provided under the Agriculture Infrastructure Fund.

Announcement of Agriculture Infrastructure Fund Scheme

Hon’ble Finance Minister on 15 May 2020 announced Rs. 1 lakh crore Agri Infrastructure Fund for farm-gate infrastructure for farmers. Financing facility of Rs. 1,00,000 crore will be provided for funding Agriculture Infrastructure Projects at farm-gate & aggregation points (Primary Agricultural Cooperative Societies, Farmers Producer Organizations, Agriculture entrepreneurs, Start-ups, etc.). Impetus for development of farmgate& aggregation point, affordable and financially viable Post Harvest Management infrastructure.

Accordingly, DAC&FW has formulated the Central Sector Scheme to mobilize a medium – long term debt financing facility for investment in viable projects relating to postharvest management Infrastructure and community farming assets through incentives and financial support.

Credit Guarantee Coverage in Agri Infrastructure Fund Scheme

Credit guarantee coverage will be available for eligible borrowers from this financing facility under Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme for a loan up to Rs. 2 crore. The fee for this coverage will be paid by the Government. In case of FPOs the credit guarantee may be availed from the facility created under FPO promotion scheme of DACFW.

All loans under this financing facility will have interest subvention of 3% per annum up to a limit of Rs. 2 crore. This subvention will be available for a maximum period of 7 years. In case of loans beyond Rs.2 crore, then interest subvention will be limited up to 2 crore. The extent and percentage of funding to private entrepreneurs out of the total financing facility may be fixed by the National Monitoring Committee.

Objectives of Agriculture Infrastructure Fund Scheme

This financing facility will have numerous objective for all the stakeholders in the agriculture eco-system.

Farmers (including FPOs, PACS, Marketing Cooperative Societies, Multipurpose cooperative societies)

- Improved marketing infrastructure to allow farmers to sell directly to a larger base of consumers and hence, increase value realization for the farmers. This will improve the overall income of farmers.

- With investments in logistics infrastructure, farmers will be able to sell in the market with reduced post-harvest losses and a smaller number of intermediaries. This further will make farmers independent and improve access to market.

- With modern packaging and cold storage system access, farmers will be able to further decide when to sell in the market and improve realization.

- Community farming assets for improved productivity and optimization of inputs will result in substantial savings to farmers.

Government

- Government will be able to direct priority sector lending in the currently unviable projects by supporting through interest subvention, incentive and credit guarantee. This will initiate the cycle of innovation and private sector investment in agriculture.

- Due to improvements in post-harvest infrastructure, government will further be able to reduce national food wastage percentage thereby enable agriculture sector to become competitive with current global levels.

- Central/State Government Agencies or local bodies will be able to structure viable PPP projects for attracting investment in agriculture infrastructure.

Agri entrepreneurs and startups

- With a dedicated source of funding, entrepreneurs will push for innovation in agriculture sector by leveraging new age technologies including IoT, AI.

- It will also connect the players in ecosystem and hence, improve avenues for collaboration between entrepreneurs and farmers.

Banking ecosystem

- With Credit Guarantee, incentive and interest subvention lending institutions will be able to lend with a lower risk. This scheme will help to enlarge their customer base and diversification of portfolio.

- Refinance facility will enable larger role for cooperative banks and RRBs.

Consumers

- With reduced inefficiencies in post-harvest ecosystem, key benefit for consumers will be a larger share of produce reaching the market and hence, better quality and prices. Overall, the investment via the financing facility in agriculture infrastructure will benefit all the eco-system players.

Salient Features of Agriculture Infrastructure Fund Loan Scheme

- Size of the financing facility – Rs. 1 lakh Cr.

- Credit Guarantee for a loan up to INR 2 crore.

- Interest subvention of 3% p.a., limited to INR 2 crore, though loan amount can be higher.

- Cap on lending rate, so that benefit of interest subsidy reaches the beneficiary and services to farmers remain affordable.

- Project Management Unit to provide handholding support for projects including project preparation.

- Multiple lending institutions including Commercial Banks, Cooperative Banks, NCDC, NBFCs etc.

- Online single window facility in collaboration with participating lending institutions.

- Convergence with all schemes of central or state government.

- Disbursement in four years starting with sanction of Rs. 10,000 crore in the first year and Rs. 30,000 crore each in next three financial years.

- Moratorium for repayment under this financing facility may vary subject to minimum of 6 months and maximum of 2 years.

- Need based refinance support will be made available by NABARD to all eligible lending entities including cooperative banks and RRBs as per its policy.

Who can Apply for Agriculture Infrastructure Fund Scheme

- Primary Agricultural Credit Societies (PACS).

- Marketing Cooperative Societies.

- Farmer Producers Organizations(FPOs).

- Farmers.

- Self Help Group (SHG)

- Joint Liability Groups (JLG).

- Multipurpose Cooperative Societies.

- Agri-entrepreneurs, Startups.

- Central/State agency or Local Body sponsored Public-Private Partnership Projects.

Eligible Projects under Agriculture Infrastructure Fund Scheme

Viable projects for building community farming assets including

- Organic inputs production

- Bio stimulant production units

- Infrastructure for smart and precision agriculture

Projects on hub and spoke model

- Projects identified for providing supply chain infrastructure for clusters of crops including export clusters.

- PPP projects promoted by Central/State/Local Govts. or their agencies.

Post-Harvest Management Projects like

- Supply chain services including e-marketing platforms

- Warehouses

- Silos

- Packaging units

- Assaying units

- Sorting & Grading units

- Cold Stores and Cold Chain

- Logistics facilities

- Primary processing centers

- Ripening Chambers

- Waxing plants

Crop-wise eligible PHM & Primary Processing Activities

| Crops | Eligible PHM & Primary Processing Activities | Not eligible under AIF |

|---|---|---|

| Cereals (Wheat, Paddy, etc.) | Cleaning De-stoning Sorting&grading Hulling Milling Pounding Grinding Tempering Parboiling Soaking Drying Sieving Irradiation | Fermentation Baking Puffing Flaking Frying Extrusion Blending Roasting |

| Fruits and vegetables | Washing Cleaning Drying Sorting Grading Blanching for primary processing Cooling Waxing Conditioning | Dehydration Concentrated products Canning Juice extraction Sterilization |

| Oilseeds | Cleaning De-stoning De-husking (decorticating machines) Winnowing Oil extraction (ghani, hydraulic press etc.) | By-product utilization Refining Neutralization Bleaching |

| Pulses | Cleaning De-stoning Drying Sorting & grading De-husking Splitting De-hulling Milling Irradiation | Canning Besan Papads Pulse based foods Puffed chickpea Pulse polishing |

| Cotton | Cleaning Drying Ginning Pressing & Bailing Lintering | Fibre finishing Scouring Purifying Spinning Weaving |

| Sugarcane | Cane unloading Cleaning Cane breaking Cane milling Straining Evaporators Centrifugation Storage tanks Dryers | |

| Spices | Cleaning Drying Sorting Boiling Polishing Grinding Packaging Storage Irradiation | Roasting Sterilizing Thermal treatment |

| Cocoa | Cleaning Gathering of pods Sorting Breaking of pods Fermentation of cocoa Drying Storage | Roasting Winnowing Alkalization |

| Coffee | Cleaning Drying of cherries Washing Hulling Pulping | Roasting Grinding Extraction |

| Jute | Cutting Retting Stripping Washing Drying Bailing Packing Storage | |

| Cashew | Cleaning Streaming in boiler Shell cutting Drying Peeling Grading Packaging | |

| Moringa | Washing Drying Milling Storage Packaging | |

| Tea | Cleaning Withering Rolling Fermentation Drying Sorting | |

| Rubber | Mastication Mixing Shaping Curing Irradiation | |

| Herbal and Medicinal Crops | Cleaning Sorting Drying | Syrup Pills Cream Roasting Frying Distillation Concentration |

Agriculture Infrastructure Fund – State Wise Allocation

Tentative state / UT wise allocation of Agriculture Infrastructure Fund

| State/UT | Tentative Fund Allocation (Rs. Cr) |

|---|---|

| Uttar Pradesh | 12831 |

| Rajasthan | 9015 |

| Maharashtra | 8460 |

| Madhya Pradesh | 7440 |

| Gujarat | 7282 |

| West Bengal | 7260 |

| Andhra Pradesh | 6540 |

| Tamil Nadu | 5990 |

| Punjab | 4713 |

| Karnataka | 4525 |

| Bihar | 3980 |

| Haryana | 3900 |

| Telangana | 3075 |

| Kerala | 2520 |

| Odisha | 2500 |

| Assam | 2050 |

| Chhattisgarh | 1990 |

| Jharkhand | 1445 |

| Himachal Pradesh | 925 |

| Jammu & Kashmir &Ladakh | 900 |

| Uttarakhand | 785 |

| Tripura | 360 |

| Arunachal Pradesh | 290 |

| Nagaland | 230 |

| Manipur | 200 |

| Mizoram | 196 |

| Meghalaya | 190 |

| Goa | 110 |

| Delhi | 102 |

| Sikkim | 56 |

| Puducherry | 48 |

| A & N Islands | 40 |

| Daman & Diu | 22 |

| Lakshadweep | 11 |

| Dadra & Nagar Haveli | 10 |

| Chandigarh | 9 |

| Total | 1,00,000 |

Eligible Lending Institutions for Loan under AIF Scheme

After signing of Memorandum of Understanding (MoU) with National Bank for Agriculture & Rural Development (NABARD)/DAC&FW, all following eligible lending institutions may participate to provide this financing facility.

- All scheduled Commercial Banks.

- Scheduled Cooperative Banks.

- Regional Rural Banks (RRBs).

- Small Finance Banks.

- Non-Banking Financial Companies (NBFCs).

- National Cooperative Development Corporation (NCDC).

- DCCBs with PACS affilation.

Eligible beneficiaries can also apply directly for availing financing facility under this scheme. There is no requirement of prior scrutiny at any level. Such applications may be considered by the banks at their level. Timely MIS for such applications shall be made available by respective banks to DLMC (District Level Monitoring Committee) and SLMC (State Level Monitoring Committee).

Scheme Monitoring

The National, State and District Level Monitoring Committees to ensure real-time monitoring and effective feed-back about the implementation of the proposed scheme.

National Level Monitoring Committees

- National level Monitoring Committee (NLMC) will guide and steer the implementation of the project. It will approve the guidelines for implementation of the project.

- National level Implementation Committee (NLIC) will examine and recommend the guidelines for implementation of the project. It also will ensure and review the implementation of the scheme as per approved guidelines by the National level Monitoring Committee (NLMC).

State Level Monitoring Committees

- State level Monitoring Committee (SLMC) will implement the NIMC guidelines at the state level and provide feedback to NIMC.

- It will also guide and steer the implementation of the scheme in the state.

- It will also examine and approve the selected list of beneficiaries/ projects for inclusion in the scheme in consultation with DLMC.

- It will set the targets as per OOMF format and review the progress regularly.

District Level Monitoring Committees

- District level Monitoring Committee (DLMC) The DLMC will be the first line of implementation and monitoring system within the overall framework.

- It will identify the beneficiaries, to ensure viability of the project and prepare viable project reports to support the beneficiaries in collaboration with PMU.

- It will also examine the proposal and recommend to SLMC for consideration.

- DLMC will set targets in consultation with SLMC as per OOMF format and monitor the progress closely with the support of PMU.

- DLMC will maintain the Dashboard in collaboration with PMU.

- It will be responsible for the smooth implementation of the scheme and resolve any issues at the district level. In the process of sorting out implementation issues the Committee would be supported by the district administration wherever required.

Project Management Units

- Farmers Welfare Programme Implementation Society under DACFW will provide PMU

- Support to the scheme at the central level and state PMUs of PM KISAN at state level.

- Services of knowledge partners will be engaged to identify clusters including export.

- Clusters and gaps in supply chains to target projects and prepare viable project reports to.

- Support the beneficiaries.

- PMUs will provide handholding support for implementation of the scheme

- It will also monitor the progress closely with the support of DLMC.

- PMU will maintain the Dashboard in collaboration with DLMC.

Output Outcome Monitory Framework

| Outcome statement | Outcome Indicators |

|---|---|

| Improvement in resource provision for agriculture infrastructure | Percentage of fund utilized for completed projects. Additional investments leveraged due to agriculture infrastructure fund interventions (Rs. Crore) |

| Enhancement in agriculture infrastructure capacity | Total capacity addition in agriculture sector due to infrastructure activities funded (MT). Reduction in post-harvest losses and food wastages (%) |

| Promoting creation and modernization of agriculture infrastructure | No. of projects submitted by eligible entities. Disbursement of funds for eligible projects/investments (Rs. Crores) |

| Increase in amount of interest subvention and credit guarantee support provided | Amount outgo on account of interest subvention (Rs. Crore) No. of projects receiving interest subvention Percent projects receiving interest subvention (of the total projects offered loan under the scheme) Amount outgo on credit guarantee coverage (Rs. Crore) Average percent credit guarantee coverage of the total credit extension under the scheme. |

How to Apply for Loan Under Agriculture Infrastructure Fund Scheme

Farmers and the entities listed above will be able to avail the loan of up to Rs. 2 Crore from the nationalized banks, commercial banks or any other financial institutions as empanelled by the government for the scheme.

Agriculture Infrastructure Fund Scheme Online Registration / Login for Beneficiaries

Here is the complete process to make beneficiary registration for Agriculture Infrastructure Fund Scheme:-

STEP 1: Firstly visit the official website at https://agriinfra.dac.gov.in/

STEP 2: At the homepage, scroll over the “Beneficiary” tab present in the main menu and then click at “Registration” link as here:-

STEP 3: Also you can click at the “Beneficiary Registration” under ‘Beneficiary Corner‘ section or directly click at https://agriinfra.dac.gov.in/Home/BeneficiaryRegistration link

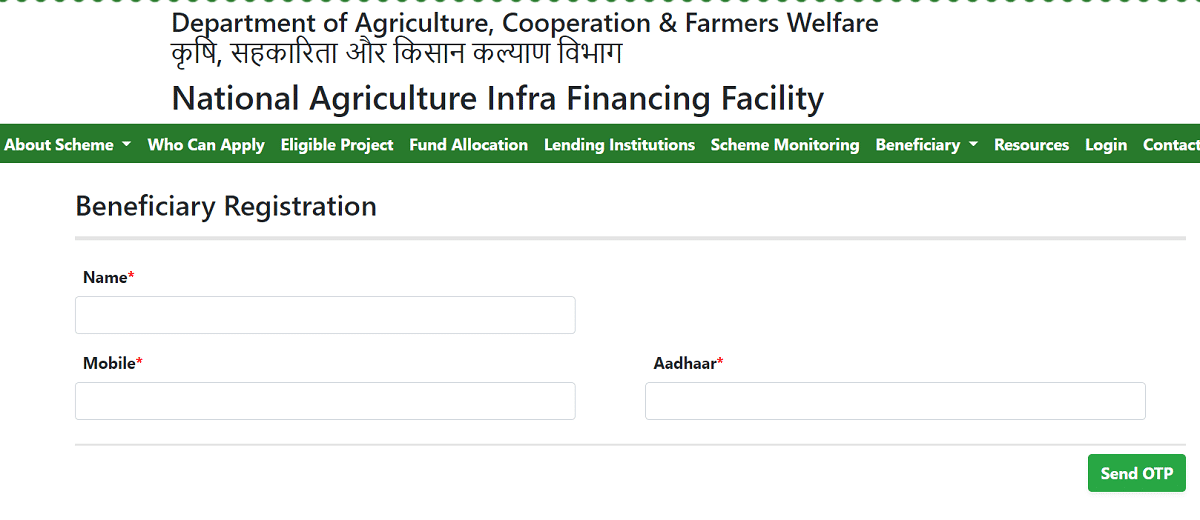

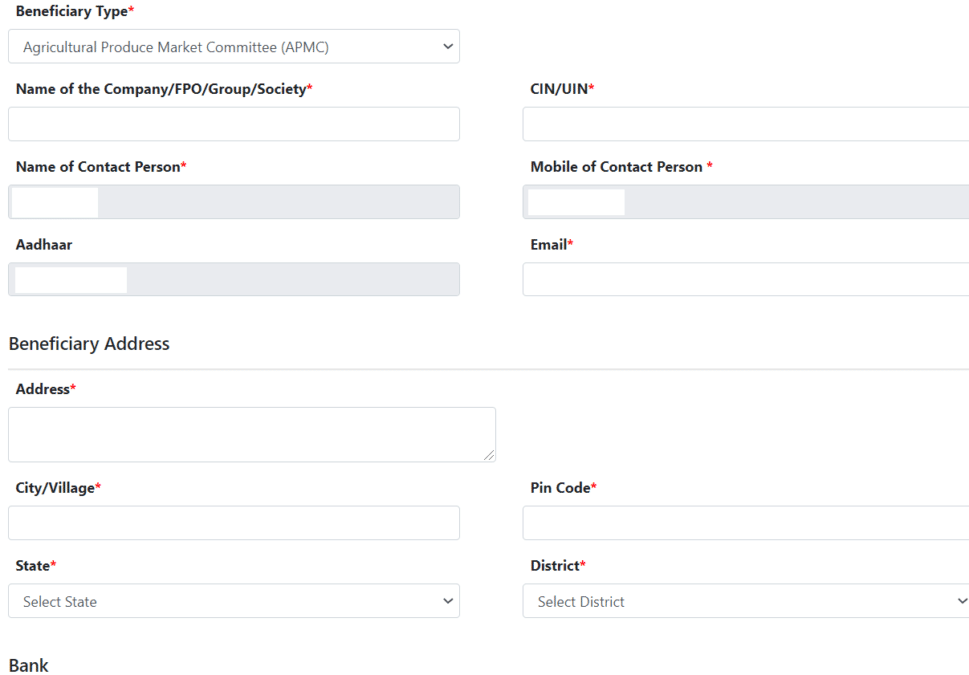

STEP 4: Then the Agriculture Infrastructure Fund Scheme online registration form for beneficiaries will appear as shown below:-

STEP 5: Here enter the name, mobile number, aadhar number of beneficiary and hit at “Send OTP” button. Verify the OTP to open the complete Agriculture Infrastructure Fund Online Application Form

STEP 6: Afterwards, applicants can apply online by making Agriculture Infrastructure Fund Scheme login using the link – https://agriinfra.dac.gov.in/Home/Login. The page to make login will appear as shown below:-

STEP 7: Here applicants can enter the e-mail ID or beneficiary ID and password and then click at “Login” button to proceed to complete the Agriculture Infrastructure Fund Scheme apply online process.

Need for National Agriculture Infra Financing Facility

The role of infrastructure is crucial for agriculture development and for taking the production dynamics to the next level. It is only through the development of infrastructure, especially at the post harvest stage that the produce can be optimally utilized with opportunity for value addition and fair deal for the farmers. Development of such infrastructure shall also address the vagaries of nature, the regional disparities, development of human resource and realization of full potential of our limited land resource.

Agriculture Infrastructure Fund – Guidelines

The complete guidelines of Agriculture Infrastructure Fund Scheme can be downloaded in PDF format from the official website of Ministry of Agriculture and Farmer’s Welfare using the below given link.

https://agricoop.nic.in/sites/default/files/FINAL%20Scheme%20Guidelines%20AIF.pdf or

https://agriinfra.dac.gov.in/Content/DocAttachment/FINALSchemeGuidelinesAIF.pdf

Implementation Period of AIF Scheme

The Scheme will be operational from 2020-21 to 2029-30. Disbursement in four years starting with sanction of Rs. 10,000 crore in the first year and Rs. 30,000 crore each in next three financial years. Moratorium for repayment under this financing facility may vary subject to minimum of 6 months and maximum of 2 years.

Agriculture Infrastructure Fund Loan Benefits

There are always some benefits of availing loan under any government schemes, and that’s why there are loan schemes by the government. Hence, below are some of the main benefits to be provided under the Agriculture Infrastructure Fund loan scheme

- The maximum loan tenure under the scheme will be 7 years.

- Interest subvention of 3% per annum on the loan availed under this scheme.

- Credit guarantee coverage under CGTMSE scheme for loans up to Rs. 2 Crore.

- The fee for this coverage will be paid by the Government. In case of FPOs the credit guarantee may be availed from the facility created under FPO promotion scheme of DACFW.

The Agriculture Infrastructure Fund Loan Scheme will support farmers, PACS, FPOs, Agri-entrepreneurs, etc. in building community farming assets and post-harvest agriculture infrastructure.

Frequently Asked Questions

How to apply for Agriculture Infrastructure Fund loan

Any eligible farmer or entity can apply for AIF loan through the banks and financial institutions empaneled by the government.

What is the loan amount under AIF loan scheme

Up to Rs. 2 Crore

What is the Interest Subsidy on Loan

3% per annum

Who can apply for Agriculture Infrastructure Fund loan

Farmers, Primary Agriculture Credit Societies (PACS), Marketing Cooperative Societies, Self Help Groups (SHG’s), Farmer Producer Organizations (FPO’s), Join Liability Groups (JLG), Multipurpose Cooperative Societies, Agri – Entrepreneurs, Agriculture Startups and PPP Agriculture Projects sponsored by central / state agency or urban local body can apply for this scheme.

What is the maximum loan tenure under AIF scheme

7 Years

For more details, please read other Frequently Asked Questions at https://agriinfra.dac.gov.in/Home/FAQs