Subsidy on Home Loans for Families Not Covered in Pradhan Mantri Awas Yojana Gramin (PMAY-G): Ministry of Rural Department, Central govt. has launched Rural Housing Interest Subsidy Scheme (RHISS) 2024. Subsequently, this Rural Housing Interest Subsidy Scheme (RHISS) will provide necessary resources to the families which are not covered under PMAY-G. Accordingly, PMAY-G Home Loan Interest Subsidy Scheme will provide easy and cheap access for institutional loans at the subsidized interest rates for the construction or modification of their houses. In this article, you can know how to check eligibility, rate, tenure, discount, fillup claim form and complete details here.

Central Nodal Agency – Ies is responsible to implement this Interest Subsidy scheme. All the rural families whose name is not on the wait-list for PMAY-G can apply for this scheme. Central Nodal Agency (CNA) will approve Primary Lending Institutions (PLIs) to simplify the loan process. This scheme will provide coverage to all the Indians except the towns under Census 2011 and towns under PMAY (Urban).

RHISS will provide this loan to construct a new house or to modify a Kuccha house into a Pucca House. Moreover, these pucca houses should comply with the standards and can withstand normal wear and tear, natural disasters for at-least 30 years.

What is Rural Housing Interest Subsidy Scheme (RHISS)

To ensure housing for all by 2022, central government launched Pradhan Mantri Awas Yojana Gramin (PMAY-G) which came into effect from 1st April 2016. The PMAY Gramin scheme provides financial assistance to households living in rural areas who are houseless or living in zero, one or two room kutcha houses as per Socio Economic Caste Census (SECC) 2011 data and verified by Gram Sabha. PMAY G covers most vulnerable section of rural population deprived of housing and gives them housing assistance.

Since the objective of govt. is to provide housing for all by 2022, it is pertinent to ensure that adequate resources are made available to such households who are not covered under PMAY-G. In this direction, Ministry of Rural Development has come up with Rural Housing Interest Subsidy Scheme. RHISS would provide cheap and easy access to institutional loan to households living in rural areas and not covered under PMAY-G for construction / modification of their dwelling unit.

RHISS envisages providing loan to rural household at subsidized interest rate to enable them to construct / modify dwelling unit.

Scope of Rural Housing Interest Subsidy Scheme (RHISS)

PMAY Gramin for rural areas has been launched with an objective to provide pucca house with basic amenities to all houseless and households living in kutcha houses by 2022. To achieve the objective of Housing for All, around 2.95 crore houses would be constructed by the year 2022. PMAY-G covers those families of rural areas who are homeless or living in 0, 1 or 2 room kutcha houses as per SECC 2011 data.

But there are large number of rural families who lives in kutcha house with more than 2 rooms or pucca house with one or two rooms. These households also require support to construct a pucca house or modify / enlarge their dwelling units. To provide adequate resources to those families who are not covered under PMAY-G, a new RHISS has been launched. Rural Housing Interest Subsidy Scheme will provide easy access to institutional loan to all such needy households for construction / modification of their dwelling units.

The universe of beneficiaries, eligible to receive central assistance under RHISS scheme, will include any rural household which does not appear / figure on permanent waitlist for Pradhan Mantri Awas Yojana Gramin (PMAY-G). The RHISS has been effective and operationalised and aims to provide assistance to households in rural areas to construct houses or modify their existing dwelling units.

Beneficiaries / Coverage of Rural Housing Interest Subsidy Scheme (RHISS)

- Beneficiaries – All the rural households whose name does not appears in the permanent wait list of Pradhan Mantri Awas Yojana – Gramin are eligible to apply.

- Exclusion – RHISS will cover all the citizens of the country but will exclude those who belongs to the statutory towns of Census 2011 and towns which are covered under PMAY-Urban.

- RHISS will provide support for modification of existing dwelling units and construction of pucca houses as per eligibility criteria defined here with basic civic infrastructure like water, sanitation, electricity etc.

Definition of Pucca House under PMAY Gramin Home Loan Interest Subsidy Scheme

The pucca houses constructed / modified under RHISS should conform to norms and standards provided in extant guidelines on construction and structural safety in the country. A pucca house is one which is able to withstand normal wear and tear due to usage and natural forces including climatic conditions, with reasonable maintenance for at-least 30 years. The roof and wall of the house should be strong enough to be able to withstand the climatic conditions of the place in which the beneficiary resides and incorporate disaster resilient features, wherever needed, to be able to withstand earthquakes, cyclone, floods etc.

Primary Lending Institutions (PLIs) for RHISS Scheme

Central Nodal Agency (CNA), identified by the Ministry for purpose of implementation of Interest Subsidy Scheme for Rural Housing, would successfully implement this scheme. CNA will provide subsidy to the Primary Lending institutions (PLIs) and will also monitor the progress. Accordingly some of the PLIs are as follows:-

- Scheduled Commercial banks

- Housing Finance Companies

- Urban Co-operative banks

- State Co-operative banks

- Regional Rural banks (RRB)

- Small Finance banks

- NBFC-Micro Finance Institutions

- Other Institution identified by CNA

- Any other Institutions as identified by Central Nodal Agency and approved by Ministry of Rural Development

CNA will provide reports to the Ministry of Rural Development on monthly or quarterly. All the beneficiaries who are taking the benefits of other govt. schemes cannot apply under this scheme.

Interest Subsidy Features under Rural Housing Interest Subsidy Scheme

Beneficiaries seeking housing loans from Banks, Housing Finance Companies and other such notified institutions, for modification / construction of pucca houses in rural areas would be eligible for interest subsidy with following features:-

| Features | Rural Housing Interest Subsidy Scheme (RHISS) |

|---|---|

| Rate of Interest Subsidy | 3% |

| Maximum Housing Loan Tenure (Duration) | 20 years |

| Minimum eligible Loan Amount for Interest Subsidy | Rs. 2 lakh |

| Rate of Discount for Interest subsidy to calculate NPV | 9% |

The interest subsidy will be at the rate of 3% on principal amount of the loan for beneficiary. Subsidy shall be admissible for a maximum loan amount of first Rs. 2 lakh, irrespective of quantum of housing loan, for 20 years or full period of loan, whichever is less. If quantum of housing loan, however, is less than Rs. 2 lakh, the subsidy will be calculated on actual loan amount.

The Net Present Value (NPV) of Subsidy will be calculated based on notional discount rate of 9% for the period of loan and interest chargeable at the time the loan is contracted, upfront subsidy shall be released to Primary Lending Institution (PLI).

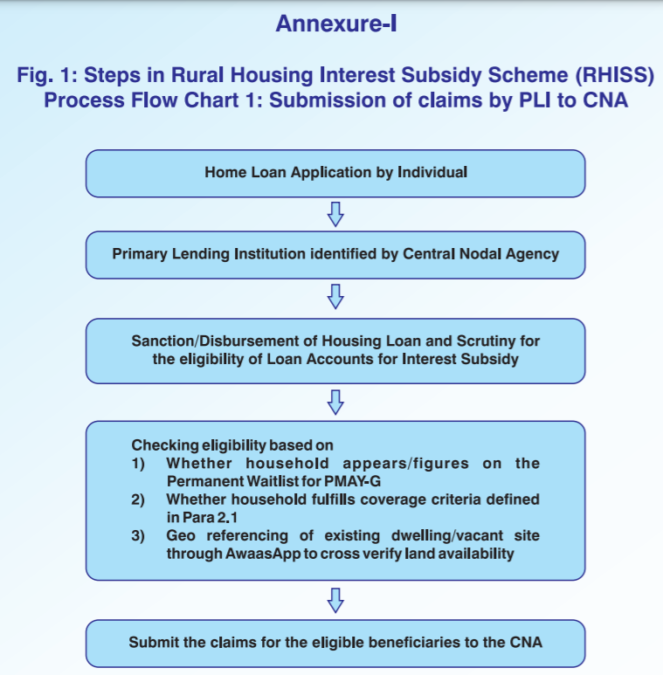

The NPV of interest subsidy given to PLI will be deducted from principal loan amount of the beneficiary, who will then have to pay interest to PLI at an agreed documented rate. fixed or floating on effectively reduced housing loan for the whole duration of the loan. The agreed documented rate which the beneficiary will have to pay may vary from bank to bank. The process flow diagram for the scheme is given here:-

Implementation Methodology of Rural Housing Interest Subsidy Scheme

- The interest subsidy will be available only for housing loan amounts indicated above and additional amount of housing loan beyond the above specified limit, if any, will be at non-subsidized rate.

- Net present value of the interest subsidy will be credited upfront to the housing loan account of beneficiaries through PLIs resulting in reduced effective housing loan and Equated Monthly Installment (EMI).

- National Housing Bank (NHB) has been identified as Central Nodal Agency (CNA) to channelize this subsidy to lending institutions and for monitoring the progress. Ministry may notify other institutions as CNA in future.

- Primary Lending Institutions (PLIs) identified as Scheduled Commercial Banks, Housing Finance Companies, Regional Rural Banks, NBFC MFIs, or any other institution may be identified by the Ministry, can register only with one CNA by signing MoU as per Annexure 2 of RHISS guidelines (download Guidelines through the link at the bottom of the article).

- CNA will be responsible for ensuring proper implementation and monitoring of the scheme and will put in place appropriate mechanisms for the purpose. CMA will provide periodic monitoring inputs of MoRD through regular quarterly and monthly reports or as required by the Ministry.

In case a borrower who has taken a housing loan and availed of interest subsidy under any other scheme of Govt. of India but later switches to another PLI for balance transfer, such beneficiary will not be eligible to claim the benefit of interest subsidy again.

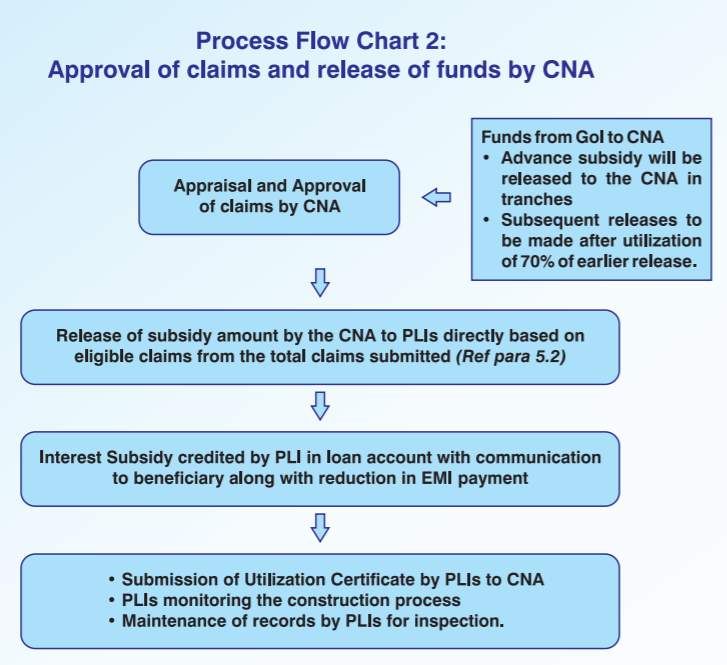

Mechanism for Release of Central Subsidy

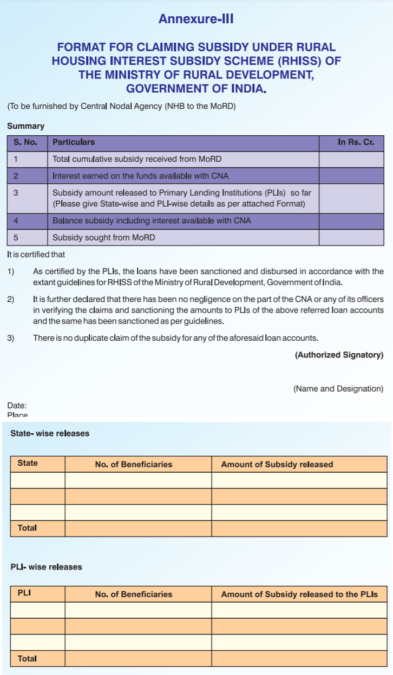

- An advance for Subsidy payment will be released to CNA(s) at the start of the scheme. Subsequent amounts of interest subsidy will be released to CNA(s) after 70% utilization of earlier amounts, on quarterly basis, and based on utilization / end use certificates submitted by PLIs to CNAs, as per prescribed format at Annexure 3.

- Based on the loan disbursed by a PLI to RHISS beneficiaries, the CNA will release the subsidy amount to PLIs directly based on claims submitted on total loans disbursed.

- NPV of interest subsidy will be credited by the PLI to the beneficiary’s account upfront by deducting it from principal loan amount of the beneficiary. The beneficiary will pay EMI as per lending rates on the remainder of principal loan amount.

- 0.25% of the total fund disbursement by the CNA to the PLIs will be paid to the CNA for their administrative expenses.

- In lieu of the processing fee for housing loan for the borrower under the scheme, PLI will be given a lump sum amount of Rs. 2000 per sanctioned application. PLIs will not take any processing charge from the beneficiary under the scheme.

Monitoring and Implementation of the Scheme

- RHISS will be implemented and monitored by the Ministry of Rural Development, Government of India through Central Nodal Agency.

- In addition to the state government, the State Level Bankers Committee (SLBC) will monitor the Scheme in the state through its prevalent institutional mechanism.

- In case any false declaration by the beneficiary under the scheme, she / he would be able for legal proceedings under relevant laws.

- All constructions / modification would be geo-referenced, time and date stamped and captured on AwaasSoft through AwaasApp.

- The decision of MoRD shall be final under the scheme.

Overview of PMAY-G Home Loan Interest Subsidy Scheme – RHISS

The highlights and details of PMAY-G Home Loan Interest Subsidy Scheme – RHISS are as follows:-

- Beneficiaries will get home loans for construction/ modification of the houses at an interest subsidy of 3 per cent.

- RHISS will provide a maximum loan amount of Rs 2,00,000 for a tenure of 20 years or full duration of the loan.

- However, if loan amount is less than Rs 2 lakh, then subsidy is calculated on the actual amount of the loan.

- Accordingly, Govt. will calculate Net Present Value (NPV) of subsidy at a discount rate of 9% for the duration of loan in addition to the interest charged at the time of loan.

- Subsequently, RHISS will release the subsidy to the Primary Lending Institution (PLIs).

- The process flow of this scheme is shown in the figure given below:-

References

For any further query, candidates can see the details of Rural Housing Interest Subsidy Scheme (RHISS) using the link given here – https://iay.nic.in/netiay/PMAY-G%20BOOK%20English.pdf

Please contact number

Good work

Kis ko mile jha ye loan aur kya jo rent pe raha rahe hi usko mile gha call me 9608750478

Mere maa papa jitna bhi kamata hai o sab rashan me hi kharch ho jata aagar mujhe pradhan mantri aawasa yojana se help mil jaye to mai aapni maa papa ko ek chhota ghar bana kar deta thankyou

mere ko chahiye kya karna hoga

I get to a home?

Me apni maa or bhan ke liye ak ghar ki vayvastha karna chahti hu taki unhe khi bhatakna n pade . Mene bhuat logo se is yojna ke labh uthana chaha pr kisi ne shi jankari nhi di . Sab pese hi mangte h kam karne ke liye . Or kuch log kahte h ki is yojna ka kuch nhi hoga . Pr mujhe lagta h ki is prdhan mantri yojna ka laabh hum jese be sahara logo ko jarur milna chahiye . Thank you?prdhan mantri awas yojna sab ka ghar ho apna ?

Kis ko mile jha ye loan aur kya jo rent pe raha rahe hi usko mile gha call me 9448338585

House lone how to apply loan to pmy lone

T rajkot.j rajkot Mohan Bhai vaghela

Ametkar nagar seri N.13

Mohan vaghela

Ham do miya bibi ordo bchay hai or ham share mai keray per rahety hami Ghar kharidny ki liay hami Lon chahiay. Dhanibadh.Jai hind,BJP Samerthak

sir mujhko Laon chahiye plz sir my no coll me 7355776298

sir mujhko laon chahiye plz sir my no call me 9954893267

I applied for homelone by pmay.But no amy response.

Mara ko bhi loan chahiye

Siri modi g ham bhut HI garib ghar age h hamari jamin mere papa ke chacha Tay ne harap rakhi he or hmare pass sar chupane ki bhi jgah nhi h kirpya aap hmari madatt kre.. Jai hind

Sir mujhe bhi ghar chahiye mera naam sonu nishad hai mai apki pmkvy yojna ka laabh utha raha hu Mai hardware se hu

Respected Sir,

Hamare ek chotta sa larka hei, or ham log join familu hei, but ham logo ka ghar bonane ke liye financial problem hei, baris hone se ghor ke ander pani vor jata hei, bhut problem face karne porta hei, so please sir, pradhan mantri awas yojana se hamko help kijiye,ham apke avari rehenge.

Sir ji mujhe bhi 1 lakh ka lone chaiye

Sir ,

I want to build shop at my village in Maharashtra , can i benefited to get loan on lower interest from national banks under prime minister scheme if yes please direct me.

I Want to some Information about shali palan

I want the loan for house plz contact this no 9731461258

I want the home loan plz help me contact no 9731461258

All schemes benefit should get olny private sector not a govt sector as much possible to reach in village town. I am waiting for this scheme & i hope that procedure of scheme will make in easy way. also other schemes also.

Sir I want home loan please help me

Sir

mane es yojna ke under from 6mth se apply kiya hua h. But abi tak no responce.

pls infrmation &help me

Sir please i want home loan

I am alone my mom and dad will be dead

Can u help me sir i am poor man

I want house please help me

I WANT TO HOME LOAN PLEASE HELP

Sir pls is time hame loan ki bhut jrurt h barsat me bhut preshani hoti hai Pls help me mob 7876748001

To

The P M Modi ji

Of India

Sir

With respectfully i bag to say that

I am poor.please give me lone 100000

Thanks you

Vijay kumar

as all we know pm modi ji is doing too much for people but it is not enough because they should also be concern about the transfer of funds because their are still too many loopholes in the procedure because too much people are taking advantage of it

so that is the real problem

sir,

i was already got loan from Mudra scheme and i pay the emi every month if complete the amount may i get the loan again

Ye sab Pese Khane wAle log bethe hain beech me..aj hi mene pmkvy k loan ka pata kiya toh muje bataya gaya ki 7 lac me se sirf 5 lac loan milega or baki ka beech wale log khayenge..or koi subscidy ni hai 5 lacs k 6 lacs chukane hain..ye hai pradhan mantri ki yojna..ese mitra hai corruption.

10 lakhs rupees dene ki kirpaya kren

There are houseless families in thousands in our District Bandipora especially in Block Nowgam.

The scheme hasn’t been started yet.

Subsidy not credit lone accout home lone amount 8.5 6 emi dabit lone account no.LBBRD00003635669 pmay Neha ayuah singh

No scheme advertising in our district medchal and sir,i asked loan in bank but,they need 3 lakh income certificate but my father is Auto Driver i think this scheme only for people who are monthly salary Rs: 30,000/ what about Labours,Drivers,shopkeepers,vegetable seller etc

I can not repair my house even my house damage & ruins so please help me

Home Loan For BPL Holder

M rohtak Haryana se hu, m kb se is scheme k ly chakkar kat rha hu lkn mujhe koi loan nhi mila h… My contanct no. 9996327327

I have purchased a flat in rural area near Wani city Dist- Yavatmalon Jnauary-2016 which is under construction till December 2017 for that I have taken a home loan from HDFC Chandrapur. My anuual income is 5.5 lacs per annum. This is my first home as my wife is housewife the loan is given on my name so the owner of flat is me because HDFC tells me to be the owner of flat if I want loan. When I asked HDFC to give me benefit of PMAY-G scheme they refuses by saying that home is not on your wife name. Tell me how can I get benefits under PMAY scheme & to whom I contact in City-Wani,Dist- Yavatmal (Maharashtra).

Dear sir,

Please tell me that how we get loan through PMAY -G Home lone.

Sir good evening pl. Update pmay gramin housing loan where is pmay g or double bed room

myname ashwini prakash joshi mane mumbai thana me room liya hai mujhe batayagaya gaya ki six mahine me subsidy mil jayegi iekin 12 mahina ho gaya hai phir bhi abhi tak subsidy nahi milekrupya karke subsidy dilaneke kosis kare mananiya pradhan ntri ji

how to apply sir

how to apply

I went to Allahabad bank for home loan according to pmay subsidy. Bank manager told me I can’t give loan in rular area.

Please tell me that how I get loan through PMAY-G Home loan.

Mobile No is 8006780044

very useful

mere nam pe koi ghar nahi mai kheti me gar bananneka. maine tahsil ki permition bhi le li hai. aur national bank ka loan le raha hu muze pmay-g antargat kuch subsidy milegi kya.

R/Sir.

We 4 person taken loan from indiabulls houshing p.ltd. vapi branch same building 3 person get the PMAY benifit and why should i do note get the same.and not fillip (PMAY)subsidy forn. The bulider

is same / bulding is same / housing finance company is same.

Pls do the need full at urgent.

(PMY subsidy benifit person.

Example Loan No. HHLVAI00396031/HHLVAI395141 etc.)

Sir please help me

Go home